x

x

x

x

x

x

x

x

x

x

x

x

x

x

x

x

x

x

x

x

x

x

x

x

x

x

x

x

x

x

x

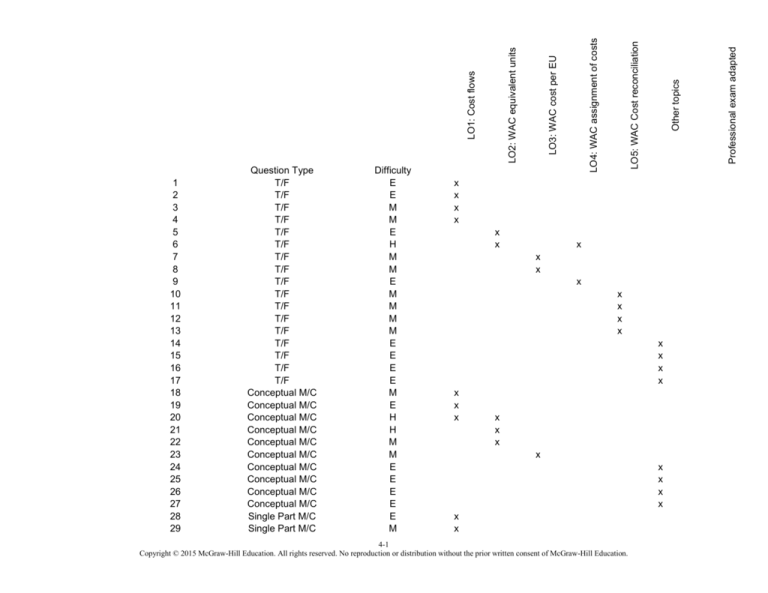

4-1

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education.

Professional exam adapted

Other topics

LO5: WAC Cost reconciliation

LO4: WAC assignment of costs

Difficulty

E

E

M

M

E

H

M

M

E

M

M

M

M

E

E

E

E

M

E

H

H

M

M

E

E

E

E

E

M

LO3: WAC cost per EU

LO2: WAC equivalent units

LO1: Cost flows

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

Question Type

T/F

T/F

T/F

T/F

T/F

T/F

T/F

T/F

T/F

T/F

T/F

T/F

T/F

T/F

T/F

T/F

T/F

Conceptual M/C

Conceptual M/C

Conceptual M/C

Conceptual M/C

Conceptual M/C

Conceptual M/C

Conceptual M/C

Conceptual M/C

Conceptual M/C

Conceptual M/C

Single Part M/C

Single Part M/C

CH04-Ref1

CH04-Ref2

CH04-Ref3

CH04-Ref4

CH04-Ref5

CH04-Ref6

CH04-Ref7

CH04-Ref8

CH04-Ref9

CH04-Ref10

CH04-Ref11

CH04-Ref12

CH04-Ref13

CH04-Ref14

CH04-Ref15

CH04-Ref16

CH04-Ref17

CH04-Ref18

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48-50

51-52

53-54

55-57

58-59

60-62

63-67

68-70

71-73

74-80

81-82

83-88

89-92

93-98

99-100

101-102

103-104

105-106

107

108

109

110

Single Part M/C

Single Part M/C

Single Part M/C

Single Part M/C

Single Part M/C

Single Part M/C

Single Part M/C

Single Part M/C

Single Part M/C

Single Part M/C

Single Part M/C

Single Part M/C

Single Part M/C

Single Part M/C

Single Part M/C

Single Part M/C

Single Part M/C

Single Part M/C

Multipart M/C

Multipart M/C

Multipart M/C

Multipart M/C

Multipart M/C

Multipart M/C

Multipart M/C

Multipart M/C

Multipart M/C

Multipart M/C

Multipart M/C

Multipart M/C

Multipart M/C

Multipart M/C

Multipart M/C

Multipart M/C

Multipart M/C

Multipart M/C

Problem

Problem

Problem

Problem

E

M

E

M

M

M

M

M

M

M

H

M

E

M

M

E

E

E

M

M

M

E-M

M

M

M

M

M

E-M

M

M

E-M

E-M

M

M

E-M

E-M

E

E

E

M

x

x

x

x

x

x

x

x

x

x

x

x

x

x

x

x

x

x

x

x

x

x

x

x

x

x

x

x

x

x

x

x

x

x

x

x

x

x

x

x

x

x

x

x

x

x

x

x

x

x

x

x

x

x

x

x

x

x

x

x

x

x

x

x

x

x

x

x

x

x

x

x

4-2

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education.

111

112

113

114

115

116

117

118

119

120

121

122

123

124

125

126

Problem

Problem

Problem

Problem

Problem

Problem

Problem

Problem

Problem

Problem

Problem

Problem

Problem

Problem

Problem

Problem

E

E

E

M

M

M

E

E

M

M

M

M

E

E

E

E

x

x

x

x

x

x

x

x

x

x

x

x

x

x

x

x

x

x

x

4-3

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education.

x

x

x

Chapter 04

Process Costing

True / False Questions

1. When materials are purchased in a process costing system, a materials account is debited with

the cost of the materials.

True

False

2. Costs are accumulated by department in a process costing system.

True

False

3. The following journal entry would be made in a processing costing system when units that have

been completed with respect to the work done in Processing Department Z are transferred from

Processing Department Z to Processing Department Y:

True

False

4-4

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of

McGraw-Hill Education.

4. The units in beginning work in process inventory plus the units in ending work in process

inventory must equal the units transferred out of the department plus the units started into

production.

True

False

5. In order to equitably allocate costs in a process costing system, dissimilar products are restated

in terms of equivalent units by weighting the number of units produced by their market values.

True

False

6. Under the weighted-average method, the equivalent units used to compute the unit costs of

ending inventories relate only to work done during the current period.

True

False

7. In calculating cost per equivalent unit under the weighted-average method, prior period costs are

not combined with current period costs.

True

False

8. Under the weighted-average method of process costing, costs from the prior period are averaged

with those of the current period in computing unit costs.

True

False

9. Using process costing, it is necessary to consider the stage of completion of the units when

assigning conversion cost to partially completed units in the ending work in process inventory.

True

False

4-5

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of

McGraw-Hill Education.

10. The "costs accounted for" portion of the cost reconciliation report includes the cost of beginning

work in process inventory and the cost of units transferred out.

True

False

11. The "costs to be accounted for" portion of the cost reconciliation report includes the cost of

ending work in process inventory and the costs added during the period.

True

False

12. The "costs accounted for" portion of the cost reconciliation report includes the cost of beginning

work in process inventory and the costs added to production during the period.

True

False

13. The "costs to be accounted for" portion of the cost reconciliation report includes the cost of

beginning work in process inventory and the costs added during the period.

True

False

14. Process costing is used in those situations where many different products or services are

produced each period to customer specifications.

True

False

15. A job-order cost system would be used to account for the cost of building an oil tanker.

True

False

4-6

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of

McGraw-Hill Education.

16. Operation costing is a hybrid system that employs certain aspects of both job-order and process

costing.

True

False

17. Both job-order and process costing systems use averaging to compute unit product costs.

True

False

Multiple Choice Questions

18. Pulo Corporation uses a weighted-average process costing system. The company has two

processing departments. Production starts in the Assembly Department and is completed in the

Finishing Department. The units completed and transferred out of the Assembly department

during April will become the:

A. units in April's ending work in process in Finishing.

B. units in May's beginning work in process in Finishing.

C. units started in production in Finishing for April.

D. units started in production in Finishing for May.

4-7

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of

McGraw-Hill Education.

19. Which of the following journal entries would be used to record application of manufacturing

overhead to work in process in a process costing system with two processing departments,

department A and department B?

A. Option A

B. Option B

C. Option C

D. Option D

20. Which of the following statements about a process costing system is incorrect?

A. In a process costing system, each processing department has a work in process account.

B. In a process costing system, equivalent units are separately computed for materials and for

conversion costs.

C. In a process costing system, overhead can be underapplied or overapplied just as in job-order

costing.

D. In a process costing system, materials costs are traced to units of products.

4-8

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of

McGraw-Hill Education.

21. Barraza Corporation uses a weighted-average process costing system. Barraza has two direct

materials. One of these materials is added at the beginning of the production process. The other

material is added when processing is 50% complete. When will the equivalent units of production

for these two materials be equal?

A. when processing on beginning work in process is less than 50% complete at the start of the

period.

B. when processing on beginning work in process is more than 50% complete at the start of the

period.

C. when processing on ending work in process is over 50% complete.

D. when processing on ending work in process is less than 50% complete.

22. When the weighted-average method of process costing is used, a department's equivalent units

are computed by:

A. subtracting the equivalent units in beginning inventory from the equivalent units in ending

inventory.

B. subtracting the equivalent units in beginning inventory from the equivalent units for work

performed during the period.

C. adding the units transferred out to the equivalent units in ending inventory.

D. subtracting the equivalent units in beginning inventory from the sum of the units transferred out

and the equivalent units in ending inventory.

4-9

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of

McGraw-Hill Education.

23. Which of the following are needed to compute the cost per equivalent unit for materials under the

weighted-average method of process costing?

A. Option A

B. Option B

C. Option C

D. Option D

24. For which situation(s) below would an organization be more likely to use a process costing

system of rather than a job-order costing system?

A. a paper mill that processes wood pulp into large rolls of paper

B. a shop that restores old cars to "showroom" quality

C. a framing shop that builds picture frames to order for individual customers

D. a masonry company that builds brick walls, bulkheads, and walkways designed by architects

25. Costs in an operation costing system are accumulated by:

A. department.

B. by individual job.

C. by both job and departments.

D. by neither job nor department.

4-10

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of

McGraw-Hill Education.

26. Which of the following companies would be most likely to use a process costing system?

A. a shipbuilder

B. a furniture manufacturer

C. a law firm

D. a utility producing natural gas

27. Which of the following companies would be most likely to use a process costing system?

A. Ship builder.

B. Movie studio.

C. Oil refinery.

D. Hospital.

28. The Assembly Department started the month with 35,000 units in its beginning work in process

inventory. An additional 472,000 units were transferred in from the prior department during the

month to begin processing in the Assembly Department. There were 34,000 units in the ending

work in process inventory of the Assembly Department. How many units were transferred to the

next processing department during the month?

A. 507,000

B. 473,000

C. 471,000

D. 541,000

4-11

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of

McGraw-Hill Education.

29. Health Beverage Corporation uses a process costing system to collect costs related to the

production of its celery flavored cola. The cola is first processed in a Mixing Department at Health

and is then transferred out and finished up in the Bottling Department. The finished cases of cola

are then transferred to Finished Goods Inventory. The following information relates to Health's

two departments for the month of January:

How many cases of cola were completed and transferred to Finished Goods Inventory during

January?

A. 66,000

B. 71,000

C. 72,000

D. 74,000

4-12

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of

McGraw-Hill Education.

30. Fabian Corporation uses the weighted-average method in its process costing system. The

Assembly Department started the month with 9,000 units in its beginning work in process

inventory that were 70% complete with respect to conversion costs. An additional 90,000 units

were transferred in from the prior department during the month to begin processing in the

Assembly Department. During the month 87,000 units were completed in the Assembly

Department and transferred to the next processing department. There were 12,000 units in the

ending work in process inventory of the Assembly Department that were 20% complete with

respect to conversion costs.

What were the equivalent units for conversion costs in the Assembly Department for the month?

A. 93,000

B. 83,100

C. 87,000

D. 89,400

31. Jawson Corporation uses the weighted-average method in its process costing system. Operating

data for the Painting Department for the month of April appear below:

What were the equivalent units for conversion costs in the Painting Department for April?

A. 67,300

B. 68,820

C. 70,520

D. 63,900

4-13

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of

McGraw-Hill Education.

32. Narver Corporation uses the weighted-average method in its process costing system. Operating

data for the Lubricating Department for the month of October appear below:

What were the equivalent units for conversion costs in the Lubricating Department for October?

A. 43,100

B. 37,100

C. 44,780

D. 47,780

33. Baker Corporation uses the weighted-average method in its process costing system. The

Assembly Department started the month with 8,000 units in its beginning work in process

inventory that were 90% complete with respect to conversion costs. An additional 95,000 units

were transferred in from the prior department during the month to begin processing in the

Assembly Department. There were 11,000 units in the ending work in process inventory of the

Assembly Department that were 90% complete with respect to conversion costs.

What were the equivalent units for conversion costs in the Assembly Department for the month?

A. 94,700

B. 101,900

C. 98,000

D. 92,000

4-14

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of

McGraw-Hill Education.

34. Larner Corporation uses the weighted-average method in its process costing system. Operating

data for the first processing department for the month of June appear below:

According to the company's records, the conversion cost in beginning work in process inventory

was $68,064 at the beginning of June. Additional conversion costs of $585,324 were incurred in

the department during the month.

What was the cost per equivalent unit for conversion costs for the month? (Round off to three

decimal places.)

A. $6.892

B. $6.806

C. $5.575

D. $7.090

4-15

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of

McGraw-Hill Education.

35. Harker Corporation uses the weighted-average method in its process costing system. The first

processing department, the Welding Department, started the month with 16,000 units in its

beginning work in process inventory that were 40% complete with respect to conversion costs.

The conversion cost in this beginning work in process inventory was $29,440. An additional

59,000 units were started into production during the month and 61,000 units were completed in

the Welding Department and transferred to the next processing department. There were 14,000

units in the ending work in process inventory of the Welding Department that were 10% complete

with respect to conversion costs. A total of $246,400 in conversion costs were incurred in the

department during the month.

What would be the cost per equivalent unit for conversion costs for the month? (Round off to

three decimal places.)

A. $4.176

B. $4.600

C. $3.375

D. $4.421

4-16

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of

McGraw-Hill Education.

36. Paxton Corporation uses the weighted-average method in its process costing system. The

Molding Department is the second department in its production process. The data below

summarize the department's operations in January.

The accounting records indicate that the conversion cost that had been assigned to beginning

work in process inventory was $10,973 and a total of $268,107 in conversion costs were incurred

in the department during January.

What was the cost per equivalent unit for conversion costs for January in the Molding

Department? (Round off to three decimal places.)

A. $5.348

B. $4.038

C. $5.080

D. $4.704

4-17

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of

McGraw-Hill Education.

37. Barnett Corporation uses the weighted-average method in its process costing system. The

company adds materials at the beginning of the process in Department M. Conversion costs were

75% complete with respect to the 4,000 units in work in process at May 1 and 50% complete with

respect to the 6,000 units in work in process at May 31. During May, 12,000 units were completed

and transferred to the next department. An analysis of the costs relating to work in process at

May 1 and to production activity for May follows:

The total cost per equivalent unit for May was:

A. $5.02

B. $5.10

C. $5.12

D. $5.25

4-18

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of

McGraw-Hill Education.

38. David Corporation uses the weighted-average method in its process costing system. The first

processing department, the Welding Department, started the month with 20,000 units in its

beginning work in process inventory that were 80% complete with respect to conversion costs.

The conversion cost in this beginning work in process inventory was $123,200. An additional

65,000 units were started into production during the month. There were 19,000 units in the ending

work in process inventory of the Welding Department that were 10% complete with respect to

conversion costs. A total of $389,250 in conversion costs were incurred in the department during

the month.

What would be the cost per equivalent unit for conversion costs for the month? (Round off to

three decimal places.)

A. $7.547

B. $7.700

C. $4.634

D. $5.988

39. Jimmy Corporation uses the weighted-average method in its process costing system. The ending

work in process inventory consists of 9,000 units. The ending work in process inventory is 100%

complete with respect to materials and 70% complete with respect to labor and overhead. If the

cost per equivalent unit for the period is $3.75 for material and $1.25 for labor and overhead,

what is the balance of the ending work in process inventory account?

A. $41,625

B. $33,750

C. $45,000

D. $31,500

4-19

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of

McGraw-Hill Education.

40. Stay Corporation uses the weighted-average method in its process costing system. The

company's ending work in process inventory consists of 8,000 units, 60% complete with respect

to materials and 80% complete with respect to conversion costs. If the total cost in this inventory

is $200,000 and if the cost for materials is $16 per equivalent unit for the period, the conversion

cost per equivalent unit of the production for the period must be:

A. $19.25

B. $16.00

C. $25.67

D. $31.25

41. Walborn Corporation uses the weighted-average method in its process costing system. The

beginning work in process inventory in a particular department consisted of 11,000 units, 100%

complete with respect to materials cost and 30% complete with respect to conversion costs. The

total cost in the beginning work in process inventory was $22,400. A total of 45,000 units were

transferred out of the department during the month. The costs per equivalent unit were computed

to be $1.20 for materials and $3.40 for conversion costs. The total cost of the units completed

and transferred out of the department was:

A. $207,000

B. $184,600

C. $204,980

D. $182,580

4-20

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of

McGraw-Hill Education.

42. Trapp Corporation uses the weighted-average method in its process costing system. The

beginning work in process inventory in its Painting Department consisted of 3,000 units that were

70% complete with respect to materials and 60% complete with respect to conversion costs. The

cost of the beginning work in process inventory in the department was recorded as $10,000.

During the period, 9,000 units were completed and transferred on to the next department. The

costs per equivalent unit for the period were $2.00 for material and $3.00 for conversion costs.

The cost of units transferred out during the month was:

A. $39,600

B. $45,000

C. $45,400

D. $35,400

43. Valley Manufacturing Corporation's beginning work in process inventory consisted of 10,000

units, 100% complete with respect to materials cost and 40% complete with respect to conversion

costs. The total cost in the beginning inventory was $30,000. During the month, 50,000 units were

transferred out. The equivalent unit cost was computed to be $2.00 for materials and $3.70 for

conversion costs under the weighted-average method. Given this information, the total cost of the

units completed and transferred out was:

A. $255,000

B. $270,000

C. $240,000

D. $285,000

4-21

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of

McGraw-Hill Education.

44. Sarver Corporation uses the weighted-average method in its process costing system. The Fitting

Department is the second department in its production process. The data below summarize the

department's operations in March.

The Fitting Department's cost per equivalent unit for conversion cost for March was $8.24.

How much conversion cost was assigned to the units transferred out of the Fitting Department

during March?

A. $482,287.20

B. $502,640.00

C. $523,240.00

D. $561,144.00

4-22

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of

McGraw-Hill Education.

45. Rariton Corporation uses the weighted-average method in its process costing system. The

Molding Department is the second department in its production process. The data below

summarize the department's operations in January.

The Molding Department's cost per equivalent unit for conversion cost for January was $5.37.

How much conversion cost was assigned to the ending work in process inventory in the Molding

Department for January?

A. $4,081.20

B. $10,203.00

C. $10,310.40

D. $6,121.80

46. In May, one of the processing departments at Stitzel Corporation had beginning work in process

inventory of $16,000 and ending work in process inventory of $27,000. During the month, the cost

of units transferred out from the department was $160,000. In the department's cost reconciliation

report for May, the total cost to be accounted for under the weighted-average method would be:

A. $358,000

B. $43,000

C. $374,000

D. $187,000

4-23

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of

McGraw-Hill Education.

47. In February, one of the processing departments at Manger Corporation had beginning work in

process inventory of $25,000 and ending work in process inventory of $34,000. During the month,

$290,000 of costs were added to production and the cost of units transferred out from the

department was $281,000. In the department's cost reconciliation report for February, the total

cost to be accounted for under the weighted-average method would be:

A. $59,000

B. $605,000

C. $630,000

D. $315,000

Arizaga Corporation manufactures canoes in two departments, Fabrication and Waterproofing. In

the Fabrication Department, fiberglass panels are attached to a canoe- shaped aluminum frame.

The canoes are then transferred to the Waterproofing department to be coated with sealant.

Arizaga uses a weighted-average process cost system to collect costs in both departments.

All materials in the Fabrication Department are added at the beginning of the production process.

On July 1, the Fabrication Department had 320 canoes in process that were 20% complete with

respect to conversion cost. On July 31, Fabrication had 540 canoes in process that were 30%

complete with respect to conversion cost. During July, the Fabrication Department completed

6,700 canoes and transferred them to the Waterproofing Department.

48. What are the Fabrication Department's equivalent units related to materials for July?

A. 6,160

B. 6,380

C. 6,920

D. 7,240

4-24

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of

McGraw-Hill Education.

49. What are the Fabrication Department's equivalent units related to conversion costs for July?

A. 6,542

B. 6,798

C. 6,862

D. 7,078

50. What journal entry should Arizaga make to record the completion of the production process by

the Waterproofing Department?

A. Option A

B. Option B

C. Option C

D. Option D

4-25

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of

McGraw-Hill Education.

The following information relates to the Blending Department of Kedakai Products Corporation for

the month of May. Kedakai uses a weighted-average process costing system.

51. What are the Blending Department's equivalent units related to materials for May?

A. 260,000

B. 277,000

C. 290,000

D. 307,000

52. What are the Blending Department's equivalent units related to conversion costs for May?

A. 266,400

B. 290,400

C. 293,400

D. 303,600

4-26

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of

McGraw-Hill Education.

Jublot Corporation uses the weighted-average method in its process costing system. Data

concerning the first processing department for the most recent month are listed below:

Note: Your answers may differ from those offered below due to rounding error. In all cases, select

the answer that is the closest to the answer you computed. To reduce rounding error, carry out all

computations to at least three decimal places.

53. The cost per equivalent unit for materials for the month in the first processing department is

closest to:

A. $16.31

B. $17.89

C. $14.48

D. $15.88

4-27

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of

McGraw-Hill Education.

54. The cost per equivalent unit for conversion costs for the first department for the month is closest

to:

A. $21.76

B. $19.45

C. $23.22

D. $24.38

Dodd Corporation uses the weighted-average method in its process costing system. This month,

the beginning inventory in the first processing department consisted of 400 units. The costs and

percentage completion of these units in beginning inventory were:

A total of 5,400 units were started and 4,700 units were transferred to the second processing

department during the month. The following costs were incurred in the first processing

department during the month:

The ending inventory was 85% complete with respect to materials and 30% complete with

respect to conversion costs.

Note: Your answers may differ from those offered below due to rounding error. In all cases, select

the answer that is the closest to the answer you computed. To reduce rounding error, carry out all

computations to at least three decimal places.

4-28

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of

McGraw-Hill Education.

55. How many units are in ending work in process inventory in the first processing department at the

end of the month?

A. 700

B. 5,000

C. 900

D. 1,100

56. What are the equivalent units for conversion costs for the month in the first processing

department?

A. 5,800

B. 5,030

C. 4,700

D. 330

57. The cost per equivalent unit for materials for the month in the first processing department is

closest to:

A. $21.37

B. $19.47

C. $20.04

D. $20.76

4-29

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of

McGraw-Hill Education.

Ibarra Corporation uses the weighted-average method in its process costing system. Data

concerning the first processing department for the most recent month are listed below:

Note: Your answers may differ from those offered below due to rounding error. In all cases, select

the answer that is the closest to the answer you computed. To reduce rounding error, carry out all

computations to at least three decimal places.

58. What are the equivalent units for conversion costs for the month in the first processing

department?

A. 7,070

B. 6,800

C. 8,600

D. 270

4-30

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of

McGraw-Hill Education.

59. The cost per equivalent unit for materials for the month in the first processing department is

closest to:

A. $11.76

B. $13.20

C. $12.65

D. $12.27

Evans Corporation uses the weighted-average method in its process costing system. This month,

the beginning inventory in the first processing department consisted of 900 units. The costs and

percentage completion of these units in beginning inventory were:

A total of 8,100 units were started and 6,800 units were transferred to the second processing

department during the month. The following costs were incurred in the first processing

department during the month:

The ending inventory was 60% complete with respect to materials and 10% complete with

respect to conversion costs.

Note: Your answers may differ from those offered below due to rounding error. In all cases, select

the answer that is the closest to the answer you computed. To reduce rounding error, carry out all

computations to at least three decimal places.

4-31

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of

McGraw-Hill Education.

60. What are the equivalent units for conversion costs for the month in the first processing

department?

A. 9,000

B. 7,020

C. 6,800

D. 220

61. The cost per equivalent unit for materials for the month in the first processing department is

closest to:

A. $10.09

B. $11.18

C. $9.85

D. $8.89

62. The total cost transferred from the first processing department to the next processing department

during the month is closest to:

A. $342,904

B. $453,843

C. $366,300

D. $327,400

4-32

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of

McGraw-Hill Education.

Acklac Corporation uses the weighted-average method in its process costing system. This month,

the beginning inventory in the first processing department consisted of 700 units. The costs and

percentage completion of these units in beginning inventory were:

A total of 9,200 units were started and 8,300 units were transferred to the second processing

department during the month. The following costs were incurred in the first processing

department during the month:

The ending inventory was 75% complete with respect to materials and 15% complete with

respect to conversion costs.

Note: Your answers may differ from those offered below due to rounding error. In all cases, select

the answer that is the closest to the answer you computed. To reduce rounding error, carry out all

computations to at least three decimal places.

63. What are the equivalent units for conversion costs for the month in the first processing

department?

A. 8,300

B. 240

C. 9,900

D. 8,540

4-33

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of

McGraw-Hill Education.

64. The cost per equivalent unit for materials for the month in the first processing department is

closest to:

A. $22.40

B. $20.28

C. $21.14

D. $21.49

65. The cost per equivalent unit for conversion costs for the first department for the month is closest

to:

A. $26.64

B. $26.41

C. $27.97

D. $22.98

66. The total cost transferred from the first processing department to the next processing department

during the month is closest to:

A. $485,486

B. $407,024

C. $426,300

D. $440,300

4-34

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of

McGraw-Hill Education.

67. The cost of ending work in process inventory in the first processing department according to the

company's cost system is closest to:

A. $33,273

B. $11,769

C. $78,462

D. $58,847

Lumb Corporation uses the weighted-average method in its process costing system. Data

concerning the first processing department for the most recent month are listed below:

Note: Your answers may differ from those offered below due to rounding error. In all cases, select

the answer that is the closest to the answer you computed. To reduce rounding error, carry out all

computations to at least three decimal places.

4-35

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of

McGraw-Hill Education.

68. What are the equivalent units for materials for the month in the first processing department?

A. 595

B. 7,995

C. 8,100

D. 7,400

69. The cost per equivalent unit for conversion costs for the first department for the month is closest

to:

A. $35.88

B. $32.54

C. $34.17

D. $33.83

70. The cost of ending work in process inventory in the first processing department according to the

company's cost system is closest to:

A. $32,892

B. $23,325

C. $17,413

D. $38,696

4-36

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of

McGraw-Hill Education.

Yoder Corporation uses the weighted-average method in its process costing system. The

following data pertain to operations in the first processing department for a recent month:

71. How many units were completed and transferred to the next department during the month?

A. 750,000 units

B. 790,000 units

C. 760,000 units

D. 740,000 units

72. What was the cost per equivalent unit for materials during the month?

A. $0.30

B. $0.25

C. $0.20

D. $0.15

4-37

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of

McGraw-Hill Education.

73. How much cost, in total, was assigned to the ending work in process inventory?

A. $2,600

B. $4,300

C. $15,000

D. $5,400

Guo Corporation uses the weighted-average method in its process costing system. This month,

the beginning inventory in the first processing department consisted of 500 units. The costs and

percentage completion of these units in beginning inventory were:

A total of 9,700 units were started and 9,100 units were transferred to the second processing

department during the month. The following costs were incurred in the first processing

department during the month:

The ending inventory was 85% complete with respect to materials and 75% complete with

respect to conversion costs.

Note: Your answers may differ from those offered below due to rounding error. In all cases, select

the answer that is the closest to the answer you computed. To reduce rounding error, carry out all

computations to at least three decimal places.

4-38

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of

McGraw-Hill Education.

74. How many units are in ending work in process inventory in the first processing department at the

end of the month?

A. 900

B. 1,100

C. 600

D. 9,200

75. What are the equivalent units for materials for the month in the first processing department?

A. 935

B. 9,100

C. 10,200

D. 10,035

76. What are the equivalent units for conversion costs for the month in the first processing

department?

A. 9,925

B. 10,200

C. 9,100

D. 825

4-39

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of

McGraw-Hill Education.

77. The cost per equivalent unit for materials for the month in the first processing department is

closest to:

A. $23.31

B. $23.70

C. $24.43

D. $24.03

78. The cost per equivalent unit for conversion costs for the first department for the month is closest

to:

A. $37.11

B. $38.14

C. $40.05

D. $37.92

79. The total cost transferred from the first processing department to the next processing department

during the month is closest to:

A. $623,600

B. $638,122

C. $614,200

D. $569,301

4-40

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of

McGraw-Hill Education.

80. The cost of ending work in process inventory in the first processing department according to the

company's cost system is closest to:

A. $54,299

B. $51,613

C. $58,495

D. $68,817

Kuzuck Corporation uses the weighted-average method in its process costing system. Data

concerning the first processing department for the most recent month are listed below:

Note: Your answers may differ from those offered below due to rounding error. In all cases, select

the answer that is the closest to the answer you computed. To reduce rounding error, carry out all

computations to at least three decimal places.

4-41

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of

McGraw-Hill Education.

81. The total cost transferred from the first processing department to the next processing department

during the month is closest to:

A. $562,368

B. $543,200

C. $527,219

D. $536,200

82. The cost of ending work in process inventory in the first processing department according to the

company's cost system is closest to:

A. $28,118

B. $15,981

C. $35,148

D. $5,272

4-42

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of

McGraw-Hill Education.

Hache Corporation uses the weighted-average method in its process costing system. Data

concerning the first processing department for the most recent month are listed below:

Note: Your answers may differ from those offered below due to rounding error. In all cases, select

the answer that is the closest to the answer you computed. To reduce rounding error, carry out all

computations to at least three decimal places.

83. What are the equivalent units for materials for the month in the first processing department?

A. 750

B. 5,900

C. 4,400

D. 5,150

4-43

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of

McGraw-Hill Education.

84. What are the equivalent units for conversion costs for the month in the first processing

department?

A. 5,900

B. 4,400

C. 4,850

D. 450

85. The cost per equivalent unit for materials for the month in the first processing department is

closest to:

A. $16.66

B. $15.31

C. $17.53

D. $19.09

86. The cost per equivalent unit for conversion costs for the first department for the month is closest

to:

A. $28.89

B. $22.61

C. $27.51

D. $25.90

4-44

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of

McGraw-Hill Education.

87. The total cost transferred from the first processing department to the next processing department

during the month is closest to:

A. $231,700

B. $274,893

C. $205,007

D. $215,900

88. The cost of ending work in process inventory in the first processing department according to the

company's cost system is closest to:

A. $26,693

B. $69,888

C. $34,944

D. $20,966

4-45

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of

McGraw-Hill Education.

Carmon Corporation uses the weighted-average method in its process costing system. This

month, the beginning inventory in the first processing department consisted of 700 units. The

costs and percentage completion of these units in beginning inventory were:

A total of 7,900 units were started and 6,900 units were transferred to the second processing

department during the month. The following costs were incurred in the first processing

department during the month:

The ending inventory was 70% complete with respect to materials and 35% complete with

respect to conversion costs.

Note: Your answers may differ from those offered below due to rounding error. In all cases, select

the answer that is the closest to the answer you computed. To reduce rounding error, carry out all

computations to at least three decimal places.

89. How many units are in ending work in process inventory in the first processing department at the

end of the month?

A. 900

B. 1,700

C. 1,000

D. 7,200

4-46

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of

McGraw-Hill Education.

90. What are the equivalent units for conversion costs for the month in the first processing

department?

A. 8,600

B. 7,495

C. 6,900

D. 595

91. The cost per equivalent unit for materials for the month in the first processing department is

closest to:

A. $23.23

B. $19.94

C. $21.85

D. $21.20

92. The total cost transferred from the first processing department to the next processing department

during the month is closest to:

A. $334,200

B. $367,616

C. $294,947

D. $308,600

4-47

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of

McGraw-Hill Education.

Barker Corporation uses the weighted-average method in its process costing system. This month,

the beginning inventory in the first processing department consisted of 300 units. The costs and

percentage completion of these units in beginning inventory were:

A total of 9,100 units were started and 8,700 units were transferred to the second processing

department during the month. The following costs were incurred in the first processing

department during the month:

The ending inventory was 85% complete with respect to materials and 20% complete with

respect to conversion costs.

Note: Your answers may differ from those offered below due to rounding error. In all cases, select

the answer that is the closest to the answer you computed. To reduce rounding error, carry out all

computations to at least three decimal places.

93. How many units are in ending work in process inventory in the first processing department at the

end of the month?

A. 8,800

B. 900

C. 400

D. 700

4-48

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of

McGraw-Hill Education.

94. What are the equivalent units for conversion costs for the month in the first processing

department?

A. 140

B. 8,840

C. 8,700

D. 9,400

95. The cost per equivalent unit for materials for the month in the first processing department is

closest to:

A. $26.35

B. $25.85

C. $26.65

D. $25.56

96. The cost per equivalent unit for conversion costs for the first department for the month is closest

to:

A. $26.31

B. $27.42

C. $29.38

D. $27.98

4-49

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of

McGraw-Hill Education.

97. The total cost transferred from the first processing department to the next processing department

during the month is closest to:

A. $482,700

B. $513,466

C. $495,000

D. $475,229

98. The cost of ending work in process inventory in the first processing department according to the

company's cost system is closest to:

A. $32,501

B. $7,647

C. $38,237

D. $19,773

4-50

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of

McGraw-Hill Education.

Fulton Corporation uses the weighted-average method in its process costing system. This month,

the beginning inventory in the first processing department consisted of 800 units. The costs and

percentage completion of these units in beginning inventory were:

A total of 9,900 units were started and 8,900 units were transferred to the second processing

department during the month. The following costs were incurred in the first processing

department during the month:

The ending inventory was 70% complete with respect to materials and 60% complete with

respect to conversion costs.

Note: Your answers may differ from those offered below due to rounding error. In all cases, select

the answer that is the closest to the answer you computed. To reduce rounding error, carry out all

computations to at least three decimal places.

99. The total cost transferred from the first processing department to the next processing department

during the month is closest to:

A. $323,168

B. $388,528

C. $349,400

D. $364,800

4-51

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of

McGraw-Hill Education.

100.The cost of ending work in process inventory in the first processing department according to the

company's cost system is closest to:

A. $39,216

B. $65,360

C. $45,752

D. $41,633

The following information relates to the Assembly Department of Jataca Corporation for the

month of November. Jataca uses a weighted-average process costing system. All materials at

Jataca are added at the beginning of the production process.

On November 1, the work in process inventory account contained $6,400 of material cost and

$4,400 of conversion cost. Cost per equivalent unit for November was $1.50 for materials and

$2.80 for conversion costs.

101.What total amount of cost should be assigned to the units transferred out during November?

A. $1,337,300

B. $1,348,100

C. $1,369,500

D. $1,380,300

4-52

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of

McGraw-Hill Education.

102.What total amount of cost should be assigned to the units in work in process on November 30?

A. $17,800

B. $38,700

C. $40,200

D. $43,000

In September, one of the processing departments at Wielgus Corporation had beginning work in

process inventory of $27,000 and ending work in process inventory of $10,000. During the month,

$296,000 of costs were added to production.

103.In the department's cost reconciliation report for September, the cost of units transferred out of

the department would be:

A. $313,000

B. $323,000

C. $303,000

D. $286,000

104.In the department's cost reconciliation report for September, the total cost to be accounted for

would be:

A. $37,000

B. $323,000

C. $619,000

D. $646,000

4-53

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of

McGraw-Hill Education.

In December, one of the processing departments at Rumsey Corporation had ending work in

process inventory of $21,000. During the month, $110,000 of costs were added to production and

the cost of units transferred out from the department was $99,000.

105.In the department's cost reconciliation report for January, the cost of beginning work in process

inventory for the department would be:

A. $32,000

B. $78,000

C. $89,000

D. $10,000

106.In the department's cost reconciliation report for December, the total cost accounted for would

be:

A. $230,000

B. $120,000

C. $31,000

D. $240,000

Essay Questions

4-54

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of

McGraw-Hill Education.

107.Zhang Corporation uses process costing. A number of transactions that occurred in June are

listed below.

(1) Raw materials that cost $41,700 are withdrawn from the storeroom for use in the Mixing

Department. All of these raw materials are classified as direct materials.

(2) Direct labor costs of $47,700 are incurred, but not yet paid, in the Mixing Department.

(3) Manufacturing overhead of $56,900 is applied in the Mixing Department using the

department's predetermined overhead rate.

(4) Units with a carrying cost of $128,300 finish processing in the Mixing Department and are

transferred to the Drying Department for further processing.

(5) Units with a carrying cost of $133,800 finish processing in the Drying Department, the final

step in the production process, and are transferred to the finished goods warehouse.

(6) Finished goods with a carrying cost of $129,200 are sold.

Required:

Prepare journal entries for each of the transactions listed above.

4-55

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of

McGraw-Hill Education.

108.During February, the following transactions were recorded at Cuenca Corporation. The company

uses process costing.

(1) Raw materials that cost $38,300 are withdrawn from the storeroom for use in the Assembly

Department. All of these raw materials are classified as direct materials.

(2) Direct labor costs of $21,700 are incurred, but not yet paid, in the Assembly Department.

(3) Manufacturing overhead of $45,200 is applied in the Assembly Department using the

department's predetermined overhead rate.

(4) Units with a carrying cost of $86,500 finish processing in the Assembly Department and are

transferred to the Painting Department for further processing.

(5) Units with a carrying cost of $109,100 finish processing in the Painting Department, the final

step in the production process, and are transferred to the finished goods warehouse.

(6) Finished goods with a carrying cost of $106,100 are sold.

Required:

Prepare journal entries for each of the transactions listed above.

4-56

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of

McGraw-Hill Education.

109.Lagana Corporation uses process costing. The following data pertain to its Assembly Department

for February.

Required:

Determine the equivalent units of production for the Assembly Department for February using the

weighted-average method.

4-57

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of

McGraw-Hill Education.

110.Carver Inc. uses the weighted-average method in its process costing system. The following data

concern the operations of the company's first processing department for a recent month.

Required:

Using the weighted-average method, determine the equivalent units of production for materials

and conversion costs.

4-58

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of

McGraw-Hill Education.

111.Jordon Corporation uses the weighted-average method in its process costing. The following data

pertain to its Materials Preparation Department for November.

Required:

Determine the equivalent units of production for the Materials Preparation Department for

November using the weighted-average method.

4-59

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of

McGraw-Hill Education.

112.Chargualaf Corporation uses the weighted-average method in its process costing. The following

data pertain to its Assembly Department for September.

Required:

Compute the equivalent units of production for both materials and conversion costs for the

Assembly Department for September using the weighted-average method.

4-60

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of

McGraw-Hill Education.

113.The following data have been provided by Allton Corporation, which uses the weighted-average

method in its process costing. The data are for the company's Shaping Department for October.

Required:

Compute the equivalent units of production for both materials and conversion costs for the

Shaping Department for October using the weighted-average method.

4-61

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of

McGraw-Hill Education.

114.Barker Inc. uses the weighted-average method in its process costing system. The following data

concern the operations of the company's first processing department for a recent month.

Required:

Using the weighted-average method:

a. Determine the equivalent units of production for materials and conversion costs.

b. Determine the cost per equivalent unit for materials and conversion costs.

c. Determine the cost of units transferred out of the department during the month.

d. Determine the cost of ending work in process inventory in the department.

4-62

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of

McGraw-Hill Education.

115.Able Inc. uses the weighted-average method in its process costing system. The following data

concern the operations of the company's first processing department for a recent month.

Required:

a. Determine the equivalent units of production.

b. Determine the costs per equivalent unit.

c. Determine the cost of ending work in process inventory.

d. Determine the cost of the units transferred to the next department.

4-63

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of

McGraw-Hill Education.

116.Kamp Company uses the weighted-average method in its process costing. Information about

units processed during a recent month in the Curing Department follow:

The beginning work in process inventory had $4,600 in conversion cost. During the month, the

Department incurred an additional $210,000 in conversion cost.

Required:

a. Determine the equivalent units of production for conversion for the month.

b. Determine the cost per equivalent unit of production for conversion for the month.

c. Determine the conversion cost assigned to the ending work in process inventory.

d. Determine the total conversion cost transferred out during the month.

4-64

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of

McGraw-Hill Education.

117.Gupta Inc. uses the weighted-average method in its process costing. The following data concern

the company's Mixing Department for the month of December.

Required:

Compute the cost per equivalent unit for materials and conversion for the Mixing Department in

December.

4-65

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of

McGraw-Hill Education.

118.Lafollette Inc. uses the weighted-average method in its process costing. The following data

concern the company's Assembly Department for the month of November.

Required:

Compute the costs per equivalent unit for the Assembly Department for November.

4-66

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of

McGraw-Hill Education.

119.Oleksy Corporation uses the weighted-average method in its process costing. The following data

concern the company's Assembly Department for the month of June.

During the month, 4,900 units were completed and transferred from the Assembly Department to

the next department.

Required:

Determine the cost of ending work in process inventory and the cost of units transferred out of

the department during June using the weighted-average method.

4-67

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of

McGraw-Hill Education.

120.Sydnor Inc. has provided the following data concerning the Assembly Department for the month

of April. The company uses the weighted-average method in its process costing.

During the month, 7,000 units were completed and transferred from the Assembly Department to

the next department.

Required:

Determine the cost of ending work in process inventory and the cost of units transferred out of

the department during April using the weighted-average method.

4-68

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of

McGraw-Hill Education.

121.In December, one of the processing departments at Weisz Corporation had beginning work in

process inventory of $20,000 and ending work in process inventory of $14,000. During the

month, the cost of units transferred out from the department was $244,000.

Required:

Construct a cost reconciliation report for the department for the month of December.

122.In September, one of the processing departments at Farquer Corporation had beginning work in

process inventory of $34,000. During the month, $342,000 of costs were added to production and

the cost of units transferred out from the department was $357,000.

Required:

Construct a cost reconciliation report for the department for the month of September.

4-69

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of

McGraw-Hill Education.

123.In July, one of the processing departments at Gulbranson Corporation had beginning work in

process inventory of $14,000 and ending work in process inventory of $18,000. During the

month, $165,000 of costs were added to production and the cost of units transferred out from the

department was $161,000.

Required:

Construct a cost reconciliation report for the department for the month of July.

4-70

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of

McGraw-Hill Education.

124.A number of companies in different industries are listed below:

1. Synthetic rubber manufacturer

2. Contract printer that produces posters, books, and pamphlets to order

3. Dress manufacturer that makes clothing on contract for department stores

4. Aluminum refiner that makes aluminum ingots from bauxite ore

5. Asparagus cannery

6. Winery that produces a number of varietal wines

Required:

For each company, indicate whether the company is most likely to use job-order costing or

process costing.

4-71

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of

McGraw-Hill Education.

125.Whether a company uses process costing or job-order costing depends on its industry. A number

of companies in different industries are listed below:

1. Contract printer that produces posters, books, and pamphlets to order

2. Asparagus cannery

3. Brick manufacturer

4. Contract oil drilling company

5. Custom boat builder

6. Flour mill

Required:

For each company, indicate whether the company is most likely to use job-order costing or

process costing.

4-72

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of

McGraw-Hill Education.

126.Some companies use process costing and some use job-order costing. Which method a

company uses depends on its industry. A number of companies in different industries are listed

below:

1. Contract printer that produces posters, books, and pamphlets to order

2. Corn meal mill

3. Cattle feedlot that fattens cattle prior to slaughter

4. Shirt manufacturer that makes clothing on contract for department stores

5. Commercial photographer

Required:

For each company, indicate whether the company is most likely to use job-order costing or

process costing.

4-73

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of

McGraw-Hill Education.

Chapter 04 Process Costing Answer Key

True / False Questions

1.

When materials are purchased in a process costing system, a materials account is debited

with the cost of the materials.

TRUE

AACSB: Reflective Thinking

AICPA BB: Critical Thinking

AICPA FN: Measurement

Blooms: Remember

Difficulty: 1 Easy

Learning Objective: 04-01 Record the flow of materials; labor; and overhead through a process costing system.

2.

Costs are accumulated by department in a process costing system.

TRUE

AACSB: Reflective Thinking

AICPA BB: Critical Thinking

AICPA FN: Measurement

Blooms: Remember

Difficulty: 1 Easy

Learning Objective: 04-01 Record the flow of materials; labor; and overhead through a process costing system.

4-74

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of

McGraw-Hill Education.

3.

The following journal entry would be made in a processing costing system when units that

have been completed with respect to the work done in Processing Department Z are

transferred from Processing Department Z to Processing Department Y:

FALSE

AACSB: Reflective Thinking

AICPA BB: Critical Thinking

AICPA FN: Measurement

Blooms: Remember

Difficulty: 2 Medium

Learning Objective: 04-01 Record the flow of materials; labor; and overhead through a process costing system.

4.

The units in beginning work in process inventory plus the units in ending work in process

inventory must equal the units transferred out of the department plus the units started into

production.

FALSE

AACSB: Reflective Thinking

AICPA BB: Critical Thinking

AICPA FN: Measurement

Blooms: Remember

Difficulty: 2 Medium

Learning Objective: 04-01 Record the flow of materials; labor; and overhead through a process costing system.

5.

In order to equitably allocate costs in a process costing system, dissimilar products are

restated in terms of equivalent units by weighting the number of units produced by their market

values.

FALSE

AACSB: Reflective Thinking

4-75

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of

McGraw-Hill Education.

AICPA BB: Critical Thinking

AICPA FN: Measurement

Blooms: Remember

Difficulty: 1 Easy

Learning Objective: 04-02 Compute the equivalent units of production using the weighted-average method.

6.

Under the weighted-average method, the equivalent units used to compute the unit costs of

ending inventories relate only to work done during the current period.

FALSE

AACSB: Reflective Thinking

AICPA BB: Critical Thinking

AICPA FN: Measurement

Blooms: Understand

Difficulty: 3 Hard

Learning Objective: 04-02 Compute the equivalent units of production using the weighted-average method.

7.

In calculating cost per equivalent unit under the weighted-average method, prior period costs

are not combined with current period costs.

FALSE

AACSB: Reflective Thinking

AICPA BB: Critical Thinking

AICPA FN: Measurement

Blooms: Remember

Difficulty: 2 Medium

Learning Objective: 04-03 Compute the cost per equivalent unit using the weighted-average method.

8.

Under the weighted-average method of process costing, costs from the prior period are

averaged with those of the current period in computing unit costs.

TRUE

AACSB: Reflective Thinking

4-76

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of

McGraw-Hill Education.

AICPA BB: Critical Thinking

AICPA FN: Measurement

Blooms: Understand

Difficulty: 2 Medium

Learning Objective: 04-03 Compute the cost per equivalent unit using the weighted-average method.

9.

Using process costing, it is necessary to consider the stage of completion of the units when

assigning conversion cost to partially completed units in the ending work in process inventory.

TRUE

AACSB: Reflective Thinking

AICPA BB: Critical Thinking

AICPA FN: Measurement

Blooms: Remember

Difficulty: 1 Easy

Learning Objective: 04-04 Assign costs to units using the weighted-average method.

10.

The "costs accounted for" portion of the cost reconciliation report includes the cost of

beginning work in process inventory and the cost of units transferred out.

FALSE

AACSB: Reflective Thinking

AICPA BB: Critical Thinking

AICPA FN: Measurement

Blooms: Understand

Difficulty: 2 Medium

Learning Objective: 04-05 Prepare a cost reconciliation report.

11.

The "costs to be accounted for" portion of the cost reconciliation report includes the cost of

ending work in process inventory and the costs added during the period.

FALSE

AACSB: Reflective Thinking

4-77

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of

McGraw-Hill Education.

AICPA BB: Critical Thinking

AICPA FN: Measurement

Blooms: Understand

Difficulty: 2 Medium

Learning Objective: 04-05 Prepare a cost reconciliation report.

12.

The "costs accounted for" portion of the cost reconciliation report includes the cost of

beginning work in process inventory and the costs added to production during the period.

FALSE

AACSB: Reflective Thinking

AICPA BB: Critical Thinking

AICPA FN: Measurement

Blooms: Understand

Difficulty: 2 Medium

Learning Objective: 04-05 Prepare a cost reconciliation report.

13.

The "costs to be accounted for" portion of the cost reconciliation report includes the cost of

beginning work in process inventory and the costs added during the period.

TRUE

AACSB: Reflective Thinking

AICPA BB: Critical Thinking

AICPA FN: Measurement

Blooms: Understand

Difficulty: 2 Medium

Learning Objective: 04-05 Prepare a cost reconciliation report.

14.

Process costing is used in those situations where many different products or services are

produced each period to customer specifications.

FALSE

AACSB: Reflective Thinking

4-78

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of

McGraw-Hill Education.

AICPA BB: Industry

AICPA FN: Measurement

Blooms: Remember

Difficulty: 1 Easy

Learning Objective: Other topics

15.

A job-order cost system would be used to account for the cost of building an oil tanker.

TRUE

AACSB: Reflective Thinking

AICPA BB: Industry

AICPA FN: Measurement

Blooms: Remember

Difficulty: 1 Easy

Learning Objective: Other topics

16.

Operation costing is a hybrid system that employs certain aspects of both job-order and

process costing.

TRUE

AACSB: Reflective Thinking

AICPA BB: Industry

AICPA FN: Measurement

Blooms: Remember

Difficulty: 1 Easy

Learning Objective: Other topics

17.

Both job-order and process costing systems use averaging to compute unit product costs.

TRUE

AACSB: Reflective Thinking

AICPA BB: Critical Thinking

AICPA FN: Measurement

Blooms: Remember

4-79

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of

McGraw-Hill Education.

Difficulty: 1 Easy

Learning Objective: Other topics

Multiple Choice Questions

18.

Pulo Corporation uses a weighted-average process costing system. The company has two

processing departments. Production starts in the Assembly Department and is completed in

the Finishing Department. The units completed and transferred out of the Assembly

department during April will become the:

A. units in April's ending work in process in Finishing.

B. units in May's beginning work in process in Finishing.

C. units started in production in Finishing for April.

D. units started in production in Finishing for May.

AACSB: Reflective Thinking

AICPA BB: Critical Thinking

AICPA FN: Measurement

Blooms: Understand

Difficulty: 2 Medium

Learning Objective: 04-01 Record the flow of materials; labor; and overhead through a process costing system.

4-80

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of

McGraw-Hill Education.

19.

Which of the following journal entries would be used to record application of manufacturing

overhead to work in process in a process costing system with two processing departments,

department A and department B?

A. Option A

B. Option B

C. Option C

D. Option D

AACSB: Reflective Thinking

AICPA BB: Critical Thinking

AICPA FN: Measurement

Blooms: Remember

Difficulty: 1 Easy

Learning Objective: 04-01 Record the flow of materials; labor; and overhead through a process costing system.

4-81

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of

McGraw-Hill Education.

20.