a comprehensive listing of budget amendments of

advertisement

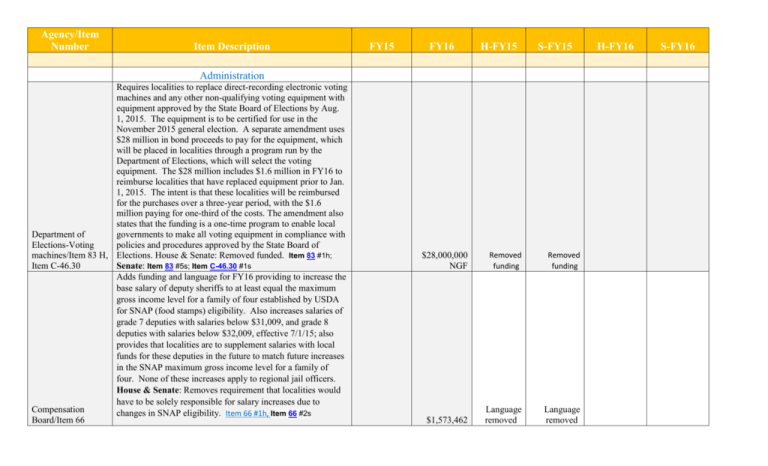

Agency/Item Number Item Description FY15 FY16 H-FY15 S-FY15 Administration Requires localities to replace direct-recording electronic voting machines and any other non-qualifying voting equipment with equipment approved by the State Board of Elections by Aug. 1, 2015. The equipment is to be certified for use in the November 2015 general election. A separate amendment uses $28 million in bond proceeds to pay for the equipment, which will be placed in localities through a program run by the Department of Elections, which will select the voting equipment. The $28 million includes $1.6 million in FY16 to reimburse localities that have replaced equipment prior to Jan. 1, 2015. The intent is that these localities will be reimbursed for the purchases over a three-year period, with the $1.6 million paying for one-third of the costs. The amendment also states that the funding is a one-time program to enable local Department of governments to make all voting equipment in compliance with Elections-Voting policies and procedures approved by the State Board of machines/Item 83 H, Elections. House & Senate: Removed funded. Item 83 #1h; Item C-46.30 Senate: Item 83 #5s; Item C-46.30 #1s Adds funding and language for FY16 providing to increase the base salary of deputy sheriffs to at least equal the maximum gross income level for a family of four established by USDA for SNAP (food stamps) eligibility. Also increases salaries of grade 7 deputies with salaries below $31,009, and grade 8 deputies with salaries below $32,009, effective 7/1/15; also provides that localities are to supplement salaries with local funds for these deputies in the future to match future increases in the SNAP maximum gross income level for a family of four. None of these increases apply to regional jail officers. House & Senate: Removes requirement that localities would have to be solely responsible for salary increases due to Compensation changes in SNAP eligibility. Item 66 #1h, Item 66 #2s Board/Item 66 $28,000,000 NGF Removed funding Removed funding $1,573,462 Language removed Language removed H-FY16 S-FY16 Agency/Item Number Compensation Board/Item 66 Compensation Board/Item 66 Compensation Board/Item 67 Compensation Board/Item 70 Salary increases for State supported local employees Item Description Adds funding and 11 new positons to support staffing of the first phase of a jail expansion at the Central Virginia Regional Jail scheduled for opening on 11/1/15. Revises the Sheriffs' career development plan to eliminate any in-house certification alternatives to accreditation by accrediting agencies, grandfathering the one office that currently qualifies until the end of FY16; transfers certification program administered by UVA to VCU. Adds funds for the state share of jail per diem costs to house local and state responsible inmates for the current fiscal year; the Comp Board will soon update its forecast for this year. No additional per diem funds are included for FY16. House (Item 67 #1h) and Senate (Item 67#2s) add funds in FY15 to cover anticipated state shortfall. Removes language from the 2014-approved budget that limited treasurers and other local government entities from collecting a contingent collection fee on delinquent court fines and costs (including in-house commonwealth's attorney collections), beginning 1/1/16. House (Item 70 #1h) and Senate (Item 70 #1s) restores the language from 2014. House & Senate set up contingency funds for salary increases for state supported employees and constitutional officers. House: Require a base salary increase of 2% effective Aug. 1, 2015. It is not clear if the language requires that the salary increase be given even if a locality supplements salaries beyond what they would be with the 2% increase. Item 467 #2h. Senate: Support the general fund portion of costs associated with a 3% salary increase for state-supported local employees and constitutional officers effective Sept. 1, 2015. This language appears to give flexibility to localities who are supplementing salaries beyond what they would be with the 2% increase. Item 467 #1s FY15 FY16 H-FY15 S-FY15 $2,498,446 H-FY16 S-FY16 $34,660,271 $22,100,000 $206,723 language language $11,310,001 $0 $2,498,446 language language language language Agency/Item Number Item Description FY15 FY16 H-FY15 S-FY15 H-FY16 S-FY16 Economic Development Economic Development Incentives/Item 101 Economic Development Incentives/Item 101 Increase funding for Governor's Opportunity Fund Item 101 #4s Capitalize VA Tourism Growth Incentive Fund to attract tourism, retail and lodging projects. Item 101 #2h and Item 101 #5s $9,916,000 $10,750,000 No change ($4,419,000) No change No change $0 $500,000 No change No change ($500,000) ($250,000) $500,000 $1,000,000 ($500,000) ($500,000) ($1,000,000) No change Brownfields Restoration Housing & Community Development/Item 103 Building Entrepreneurs Economies Housing & Community Development/Item 104 Housing & Community Development/Item 105 Provides loans or grants for site remediation Item 104 #2h Item 101 #2s Ft. Monroe Authority/Item 119 Increase payments in lieu of taxes to City of Hampton Item 119 #1h Item 119 #1s Research Entrepreneurs Center for Advanced Manufacturing Center Provides funding to link national security agency R&D with entrepreneurs in Northern Virginia Item 120 #2h -- -- -- -- Restore past spending reductions Item 120 #3h -- -- $1,500,000 -- -- Promote rapid re-housing efforts to reduce homelessness Item 103 #1h Item 103 #1s Defunds an expansion of a pilot project to build entrepreneurs economies Item 104 #3h Permit up to 2% of certain state agency grants for administration Reduce enterprise zone grants Item 471.10 #4s -- $0 -- -- -- $1,000,000 and 1 FTE -- -- -- language language No change No change No change No change ($250,000) ($400,000) No change $250,000 No change $400,000 $345,663 $345,663 ($345,663) ($345,663) ($345,663) ($345,663) $350,000 -- -- -- Agency/Item Number VA Economic Development Partnership/Item 120 Item Description Provide state support for VA Coalfield Economic Development Authority. This is tied to governor's tax preferences legislation. Item 120 #1h Item 120 #3s FY15 FY16 $0 $1,200,000 H-FY15 No change S-FY15 No change H-FY16 S-FY16 ($1,200,000) ($1,200,000) $55,017,912 $50,409,472 Public Education Teacher salary increases Teacher salaries. House: provides state share of a 1.5% salary increase for funded SOQ instructional and support positions in FY16. Funding is based on a 1.5% increase effective Aug. 1, 2015 (11 months) but the required local match is based on 1.5% increase as of Jan. 1, 2016. Local match required. Divisions must certify that the minimum 1.5 % raise will be provided to employees by 1/1/16 to receive the state funding. Item 136 #4h. Item 467 #2h Senate: State share of a 1.5% salary increase for funded SOQ instructional and support positions, calculated based on ten months, in either FY15 or FY16. School divisions have the flexibility to determine the specific effective date, no later than Jan. 1, 2016. Local match required. School divisions must certify that salary increases of at least 1.5% were given in either FY15 or FY16 by Jan. 1, 2016. Item 136 #1s Public EducationVDOE Central Office House: establish High School Program Innovation grant program (5 grants of $40,000 each) for planning implementation of innovations. Item 128 #2h Public EducationVDOE Central Office House: Assist local school divisions with establishing criteria for the professional development of teachers and principals on the subject of high-needs students. Item 128 #3h Strengthen department staffing capacity in order to increase service capacity for academically struggling schools, primarily for School Improvement and Curricular Specialists. Senate: encourages more options for lead turnaround partners. Public EducationVDOE Central Office/ Items 131, 134 Item 131 #1s $200,000 $366,000 Language $572,976 Agency/Item Number Public EducationVDOE Central Office/Item 128 H Public education Extended school year Public education teacher residency program Public EducationDirect Aid-Teacher retirement payment/Item 136 2 c Item Description Provide program for training of principals in low-performing schools; funding covers training for 40 principals in schools that have not met accreditation standards. Provides additional funding in FY16 for an extended school year incentive and to establish a predictable funding formula to encourage those school divisions that may most benefit from adding additional instructional days distributed throughout the year to do so. Funding is based on start-up grants of $300,000 per school for a three-year period to establish extended school year programs in certain eligible schools and the state's share of on-going funding beyond the three-year initial period. The per school amounts may be up to $400,000 in the case of schools that were Denied Accreditation at the time of initial implementation as an additional incentive amount. Item 135 #5s Provides funding for planning grants to expand the teacher residency partnership model between Virginia Commonwealth University's School of Education and Richmond City Schools to other Virginia universities' education schools and hard-tostaff urban school divisions, and to expand and enhance the existing program. Item 135 #1s Makes a one-time payment toward the ten-year deferred contribution balance ($506.1 million) in the teacher retirement fund. The lowered deferred contribution balance is reamortized over a six-year period. Reduces teacher retirement rate from 14.50% to 14.15%. Funds are generated from the sale of unclaimed stocks and bonds in the Literary Fund. House: Increases payment by $40,000,000, which results in lower teacher retirement contribution rate of 14.07%, saving the state $2.4 million and saving localities about $5 million. Senate: Increases payments by $37.2 million which results in FY15 FY16 H-FY15 S-FY15 H-FY16 S-FY16 $713,000 $7,700,000 $1,000,000 $150,000,000 (NGF) $40,000,000 NGF (2,422,087) $37,200,000 NGF (2,422,083) Agency/Item Number Item Description FY15 FY16 H-FY15 S-FY15 H-FY16 state savings of an additional $2.4 million (and savings to localities of about $5 million). Item 136 #10s Authorizes the Department of Education to offer up to $50 million in FY16 for school construction loans from the Literary Fund; also provides up to $25 million in FY16 for an interest rate subsidy program for projects on the First Priority Public EducationWaiting List (39 projects totaling $192.5 million). Projects on Direct Aid-School the Second Priority Waiting List (three totaling $22.5 million) Construction may participate if moneys are available. House: Uses $25 Loans/Interest Rate Subsidies/ Item 136, C million funding that governor intended for interest rate subsidy 11 b & c program for teacher retirement instead. Item 136 #5h. Authorizes the transfer of allocated preschool slots that have not been used by school divisions to other divisions that have fully used their state allocated slots. This would allow school divisions that with full participation in VPI to offer preschool programs to children who are on waiting lists. House: Eliminates funding for hold harmless slots. Item 136 #9h. Public EducationSenate: requires DOE to offer any unobligated balances for Direct Aid-Virginia one-time grants, with priority to proposals to expand the use of Preschool Initiative/ partnerships with either non-profit or for-profit providers; Item Item 136 C 14 4 a 136 #5s Senate: directs the Department to update the per pupil amount for the Virginia Preschool Initiative in the next biennial reUpdating VPI benchmarking. For this program, the per-pupil amount has amount been set out as a fixed amount, currently $6,000. Item 136 #9s House: Limits eligibility for participation in VPI to eligibility for a free lunch. Currently school divisions have the authority to determine the criteria for the definition of at-risk and many use a matrix of factors such as income, homelessness, VPI eligibility developmental delay, ESL and other factors. This would limit $75,000,000 NGF Language Language ($3,500,893) Language ($2,861,834) S-FY16 Agency/Item Number Item Description FY15 FY16 H-FY15 S-FY15 H-FY16 S-FY16 the amount of children eligible for state funding. Item 136 #2h. Updates kindergarten enrollment from 9/30/2013 to the projected 9/3/2015 membership Item 136 #8h; the decrease in funding shown is related to this change. VPI Study Subcommittee House & Senate: Establish joint subcommittee to study VPI. Language is similar but not identical. House: Item 1 #1h, Senate: Item 1 #1s; Language Language Finance Dept of Accounts/Item 261 Fund localities with qualifying tourism zone projects at an amount equal to a 1% sales tax on purchases made in the zone in order to pay the debt service financing a project. $125,000 $125,000 No change No change No change No change Department of Accounts Transfer Payments/Item 261 No changes to distribution of rolling stock, recordation, rental vehicle tax, sales tax, TVA payments; adds funds each year for distribution of sales tax revenues from certain tourism projects $125,000 $125,000 No change No change No change No change $99,500,000 $134,000,000 No change No change No change $150,000 Rainy Day Fund Planning & Budget/Item 268 Taxation Reserve revenue for projected deposit in FY 2017 Item 262 #1h Item 471.50 #1s Eliminate funding for local school efficiency reviews. Senate: Provides funding through direct aid to education as assistance for school divisions to pay costs of school efficiency review program Item 135 #4s Taxation/Item 270 Transfer of cigarette enforcement funds to ABC Item 270 #2s Allows taxpayers to file (through electronic transmission) estimated income tax returns directly with the Dept. of Taxation instead of local constitutional officers. Central Appropriations/Item 471.30 Reduces the amount of "local aid to the commonwealth" in FY16 to $29.8 million. Item 471.30 #4s -- -- $0 -- ($200,000) -- No change -- No change -- -- ($361,000) language language No change No change No change No change $0 ($159,262) No change No change No change $29,840,738 Agency/Item Number Item Description FY15 FY16 H-FY15 S-FY15 ($150,000) ($150,000) H-FY16 S-FY16 Health and Human Resources State Inspector General/Item 63 Comprehensive Services for At-Risk Youth & Families/Item 279 Comprehensive Services for At-Risk Youth & Families/Item 281 Funds a study of Catawba Hospital and Piedmont Geriatric Hospital to focus on best options for future use (healthcare related or not), along with estimated costs associated with each option. Study shall take into account future options for serving geriatric individuals in need of behavioral health services in state facilities and community settings. Final report with recommendations due 3/1/16. Senate (Item 63 #1s) and House (Item 63 #1h) remove the funding and request. Senate (Item 307#8s) requests the Department of Behavioral Health and Developmental Services to review and evaluate these operations, future needs, and optional care models. Reduces state general funds to overall program in FY16 to account for decrease in forecast costs for foster care costs covering youth to 21 years of age. House rejects the expansion of foster care to youth from 19-21 years of age (Item 334 #1h) and restores funding to CSA as a result (Item 279 #1h) Adds funding each year to pay for the relocation of the office to the same building as VDSS; rent will be higher at the new location. Comprehensive Services for At-Risk Youth & Families/Item 281 Senate (Item 281 #1s) adds funds and one position to allow OCS to comply with the Administrative Process Act (APA) contingent upon passage of SB1054. Department of Medical Assistance Services (DMAS)/Item 298 Increases funding for medical services related to medical screening and assessment services provided to persons with mental illness while in emergency custody and other costs related to involuntary mental commitments. Increases are due mostly to policy changes extending the length of temporary detention orders by an additional 24 hours. $150,000 ($3,023,836) $11,279 $7,342,465 $22,673 $77,409 $3,126,498 $1,498,988 Agency/Item Number Department of Medical Assistance Services (DMAS)/Item 300 DMAS/Item 301, LLLL.1.-2. DMAS/Item 301, OOOO.1. Item Description Decreases funding for the Family Access to Medical Insurance Security Program (FAMIS) to reflect the latest cost forecast. Lower costs in FY15 were partially due to a delay in reinstating the FAMIS MOMS program (pregnant women); managed care rates are expected to be lower as well. Actual enrollment of children in the program shows a slight decrease in FY15 (-$400,831 GF) and increase in FY16 (+$315,943 GF). House (Item 300 #1h) further decreases funding but provides authority in Item 301 to extend dental services to pregnant women enrolled in FAMIS MOMS and extend FAMIS to children of low-income state employees who otherwise would be eligible. Provides authority & funding to re-design and re-name the Day Support waiver for persons with intellectual and developmental disabilities. The new name is the "Building Independence" waiver. The redesigned waiver would add supported employment, integrated day services, shared living, and independent living (to be complemented by non-waiver funded rental assistance; see DBHDS Item 308 below). The number of waivers would be increased from 300 to 500 slots. House (Item 301 #3h) removes the funding and language authorizing submission of amendments to the waiver. Language added to Item 307 requires DMAS to report on its plans to redesign the waivers prior to submitting a request to CMS. House (Item 301 #6h) adds funds to provide behavioral health services and prescription drugs to 29,200 adults with serious mental illness with incomes at or below 80 percent federal poverty level; provide dental services to pregnant women in FAMIS MOMS and extend FAMIS to children of low-income state employees who otherwise would be eligible. FY15 FY16 ($44,798,514) ($33,255,812) H-FY15 ($339,872 GF) ($683,513 NGF) S-FY15 H-FY16 ($,672,801 GF) ($17,019,037 NGF) ($1,200,000 GF) ($1,200,000 NGF) 1,200,000 GF 1,200,000 NGF $14,944,222 $15,988,267 NGF $98,239,322 $114,717,276 NGF) S-FY16 Agency/Item Number Item Description Authorizes expansion of Medicaid on 1/1/16 to non-elderly adults with incomes up to 133 percent of federal poverty level, resulting in 400,000 Virginians gaining health insurance paid for with 100 federal funds ($482 million) in FY16. Savings would accrue as federal funds supplanted state-supported indigent care costs, mental health services provided by CSBs, and inpatient hospital care for state correctional inmates. Net savings would be about $105 million in FY16. Savings would be deposited in special fund for future Medicaid costs or deposits to the state rainy day fund. House (Item 301 #11h) and Senate (Item 301 #11s) eliminate expansion overall; but while the Senate (Item 301 #7s) reduces funding to reflect lower estimate related to behavioral health homes in the DMAS/Item 301 3b. introduced budget, it still includes $5 million for the Healthy -10b. Virginia initiative for adults with serious mental illness. Authorizes emergency amendment to the State Medicaid Plan to implement supplemental Medicaid payment of $300,000 annually ($150,000 NGF, $150,000 intergovt transfer from DMAS/Item 301 VDH) for clinic services furnished by the VA Dept. of Health DDDD.4. beginning 7/1/15. Establishes licensing fees for all adult behavioral health and Behavioral Health & developmental services licensed by the department, including Developmental day support and residential. Application fee of $750 per Services service and renewal fee of $500 per service. All revenues (DBHDS)/Item would go into the state general fund. House (Item 305 #1h) 305B. and Senate (Item 305 #1s) eliminate the language. DBHDS/Item 307 Adds a position and funding for it in the central office to assist in coordination and management of crisis intervention team training centers, programs of assertive community treatment (PACT), and emerging adult programs. FY15 language FY16 language H-FY15 S-FY15 language language language language language language language $86,024 H-FY16 S-FY16 Agency/Item Number DBHDS/Item 308, 2. DBHDS/Item 307 DBHDS/Item C21.05 DBHDS/Item 308 DBHDS/Item 308 Item Description Changes the deadline from Oct. 1 to Nov. 1 for the department to report on the revenues and costs of the Part C early intervention for infants and toddlers program to account for the availability of information from localities. No revenue impact, just a reality check. Provides partial year funding for rental subsidies for up to 250 individuals who will transition to the planned Building Independence Medicaid waiver. Rental subsidies are not covered by Medicaid and would not be eligible for federal reimbursement. House (Item 307 #3h) eliminates this funding; a related item (Item 307 #2h) requires DBHDS to report on plans to redesign the comprehensive waiver programs. This item, under Part 2, Capital Budgets, authorizes use of the $4.7 million remaining VPBA bond proceeds (2009 Act of Assembly) to be used by the department to make grants to localities, CSBs, or private sponsors for the construction, rehabilitation, or acquisition of single-family or multi-family housing for individuals with intellectual or developmental disabilities. Contracts would only be allowed where any continuing assistance results in an affordable cost to individuals, without Commonwealth housing assistance unless the General Assembly approves additional funds to support such housing assistance. DBHDS may enter into agreements with other state agencies and authorities to administer these grants. House (Item C-21.05 #1h) eliminates this item. House (Item 308 #1h) and Senate (Item 308 #4s) add funds to expand child psychiatry and children’s crisis response services. House (Item 308#2h) and Senate (Item 308#5s) add funds to the Part C Early Intervention Services for infants and toddlers with disabilities from birth to three years of age To meet the increase in number of referrals and prevent wait lists. FY15 FY16 H-FY15 S-FY15 H-FY16 S-FY16 language $675,000 language language ($675,000) language $2,500,000 $1,000,000 $1,000,000 $602,222 Agency/Item Number DBHDS/Item 308 DBHDS/Item 308 DBHDS/Item 312 Item Description FY15 FY16 House (Item 308#4h) adds funding for five new therapeutic assessment or “drop off” centers where law enforcement can transfer custody of an individual in crisis for assessment and treatment. Senate (Item 308 #2s) adds funds to support 300 rental subsidies and supports to be administered by CSBs or private entities to provide stable, supportive housing for individuals with serious mental illness, along with outreach and in-home clinical services and supports to avoid hospitalizations, incarceration or homelessness. This would provide an average of $714 per month to support rental subsidies. Funds six additional direct service staff for the Commonwealth Center for Children and Adolescents, which has seen an increase in admissions following changes in state mental health law. The positions are for patient care and transport to outside appointments. Western State also gets $454,532 in additional funds in FY16 to fund eight patient care positions because of increased admissions and acuity of the individuals being admitted. Senate (Item 312 #1s) adds five more positions and funding for this purpose. H-FY15 S-FY15 H-FY16 S-FY16 $1,600,000 $4,255,200 $268,260 $281,894 Natural Resources Agricultural & Consumer Services/Item 88 DEQ/Item C-43#1s Decrease in VA Farmland Preservation grants to localities Provides for $10 million in bond authorization in FY 16 for 50% matching grants to localities to reduce stormwater runoff pollution. Public Safety $0 ($250,000) $0 $0 $750,000 ($250,000) $10,000,000 Agency/Item Number Dept. of Correctionsconstruction of regional jails/Item 382 Dept. of Criminal Justice Services Dept. of Veterans Services, Veterans Benefit Services, Item 461 Dept. of Veterans Services, Veterans Benefit Services, Item 461 Dept. of Veterans Services, Veterans Benefit Services, Item 461 Item Description Lowers state reimbursement for construction, expansion or renovation of a regional jail from 50 percent to 25 percent. Senate (Item 382 #1s) restores the 50 percent for approved expansion or renovation of existing regional jails, contingent upon passage of SB1049. No increase in State Aid to Localities Operating Police Departments (HB599). Senate (Item 390 #1s) reinserts language from previous budgets clarifying that the amounts distributed to each locality in FY15 and FY16 shall be equal to the amounts distributed in FY14. Provide funding for support for 3 local housing resource specialists for the Virginia Wounded Warrior Program Support promotion of hiring of veterans by Virginia Values Veterans Program companies. Several local governments participate in the program. Provide additional funding for case management services for veterans benefits and to assist veterans seeking healthcare and other services. Funding for two positions (claims agent and an administrator) is including for a potential partnership/funding through local government. FY15 FY16 $0 H-FY15 S-FY15 Language Language $0 Language H-FY16 S-FY16 $180,000 $474,000 GF; $100,000 NGF $1,750,201 Transportation DRPT/Item 439#1s DRPT/Item 439#5s Allocates $1.9 million in the FY 16 from the Mass Transit Fund assess and plan for future light rail between areas of high density commercial and residential populations in Hampton Roads and Newport News Directs the Department of Rail and Public Transportation to analyze the potential opportunities for providing paratransit services through private operators and contractors (including transportation network companies like Uber & Lyft) language language language Agency/Item Number Item Description VDOT/Item 445#1h Directs the Commonwealth Transportation Board (CTB) to include municipally-owned structurally deficient bridges in its selection of projects being funded with the portion of the "CTB formula" funds dedicated to structurally deficient bridges. The Code provisions include municipally-owned primary extensions but failed to reference bridges on the same roadway sections. Requires that state transportation dollars allocated for soil retention for projects can only be spent on U.S. manufactured geotextiles (i.e. silt fences) VDOT/Item 447 Reduces the FY 2016 distribution to the Hampton Roads Transportation Fund to $159.1 million. VDOT/Item 427#1h FY15 FY16 $0 ($24,524,680) H-FY15 S-FY15 H-FY16 language language language language $0 $0 ($24,524,680) S-FY16 ($24,524,680)