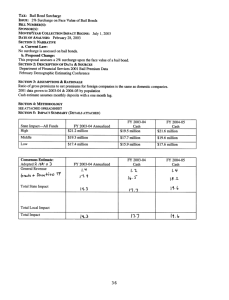

SOC ∙ Ms. Wiley ∙ Taxes—Price of Civilization?, D___ Name: Have

advertisement

SOC ∙ Ms. Wiley ∙ Taxes—Price of Civilization?, D___ Name: Have you ever heard someone say, “ I LOVE PAYING TAXES!!!!”???? Probably not. Though taxes are burdensome, they also make government possible. Most economists argue that without taxes, there would be no public institutions—no legislature, courts, or system of law enforcement. There would be no ordered society. “Taxation,” said Supreme Court justice Oliver Wendell Holmes Jr., “is the price we pay for civilization.” They’ve also existed for as long as societies have been organized. Adam Smith, a Scottish economist that informed economic policy in America, argued that: Taxes must be FAIR. In his view, wealthy citizens benefit most from government and can most afford to pay its costs. He wrote, “It is not very unreasonable that the rich should contribute to the public expense, not only in proportion to their revenue, but something more than in that proportion.” Smith also believed that economic costs of the tax system should be kept to a minimum. Smith believed that taxes should produce maximum gain for the government and society, while causing minimum loss for taxpayers. He argued that taxes should be used predominately for defense and the general welfare. One of the key difficulties in devising a fair tax system is figuring out who should pay what. Let’s see what you think: 1. What percentage of each individual’s income below should be taxed by the federal government for things such as education, military spending, health and human services, veterans affairs, subsidies to certain companies, social security, government salaries and offices, international assistance, science research, safety net programs (such as unemployment insurance), etc.? Consider they will also be taxed by their state and local governments for things such as schools and higher education, transportation (roads, bridges, etc.), corrections, public safety, state and local government salaries and offices, and economic development. [These taxes vary greatly depending on the state. Connecticut paid the highest in state and local taxes per person ($7,150 on average) while Mississippi paid the least ($2,620 on average) in 2014.] a. Married couple with 4 children in a great neighborhood with strong school districts. Father makes $75,000 teaching in a public school and mother makes $150,000 as a clinical psychologist. Paying expensive bills for childcare, mortgage, healthcare (daughter has epilepsy and has had several brain surgeries), and student loans from undergraduate and graduate school. Donates to their local library (approximately $2,000 per year) and father coaches the high school JV baseball team, which pays $1,300 per year (12-18 hours a week in season, not including prep for practices/games and off-season games and workouts). Manages to maintain their upper-middle class lifestyle but feels the pinch daily. ___________ % Explanation: b. ACTUAL: ___________ Young stockbroker. Makes $1,680,000 a year. No debt (school, early adult housing, car, etc. was paid for by parents and now makes enough money to cover his bills and invest). Cares deeply about the environment and donates $15,000 a year to the Sierra Club. Gives generously to politicians during campaign season who favor environmental protection. Currently going through the adoption process. ___________ % Explanation: c. $ ___________ $ ___________ ACTUAL: ___________ Single father of two in a run-down neighborhood with very little businesses and poor school districts. Makes $17,000 a year working two part-time jobs. Recovering alcoholic. Would like to go to college to improve skills and achieve a higherpaying job to better provide for his children but cannot afford to incur the debt and interest. He’s trying to save so that he can buy a home but needs strong credit to do so. Until he has enough, he’ll keep throwing too much money away on overpriced rent. Would love to collect food stamps so he could save a little bit of money on groceries, but he does not qualify for the program since his yearly pay is over $15,000 in a household of 3. Currently cannot afford to take his kids to the dentist or doctor’s office. ___________ % Explanation: d. $ ___________ ACTUAL: ___________ One of the wealthiest men in America, making about 10 billion a year on mostly returns on investments. Former CEO of a cigarette company. Married to a stay-at-home wife. Couple has 3 children, who were sent to the best schools in the country. Multiple properties both nationally and internationally. Inherited a multimillion dollar fortune from his parents. ___________ % Explanation: $ ___________ ACTUAL: ___________ 2. How did you determine the percentages? Was it all about income? Did the context matter (background, amount of kids, type of job)? Why or why not? 3. Should there be exceptions made for certain types of people? i.e. those with “good jobs” [surgeon vs. CEO of alcohol company], self-employed, disabled, philanthropists, those that “donate” their time by working with kids in their communities, etc. 4. How do you think these decisions should be determined in our society? Why? 5. How it actually works: If you don't like paying taxes . . ., from Understanding Society: An Introductory Reader in Sociology - Don't drive on paved streets or highways. - Don't call 911. - Don't flush your toilet. - Don't bring your garbage to the curb. - Don't use the court system. - Don't call the police when you get robbed. - Don't use the US Post Office. - Don't buy a sports franchise and ask the taxpayers to build your stadium. - Don't send your children to public schools. - Don't expect a social security payment. - Don't let Medicare pay your bills if you are over 65 or disabled. - Don't look for a government. - Don't run for political office where your salary is paid for by the taxpayers. - Don't accept government research findings that subsidize research for your industry. - Don't be an airline and expect the government to bail you out. - Don't be a car company and expect the government to bail you out. - Don't be a steel company and expect the government to bail you out. - Don't climb to the top of the Washington Monument, which is maintained at taxpayer expense. - Don't be rescued by fire department paramedic team. - Don't call the fire department. - Don't expect federal assistance if a natural disaster destroys your home or business. - Don't expect the military to defend your country. - Don't take any medications tested and approved by the FDA. - Don't drink, bath or otherwise use the water from municipal water systems. - Don't look at a NASA generated picture. - Don't expect an elevator to work correctly or not fall. - Don't accept government money to help develop a product which you then personally patent or copyright and sell for your own profit. - Don't expect research into medical problems such as cancer, heart disease, diabetes, aging, prostrate, menopause, etc. - Don't use the public library. - Don't go to a state university. - Don't watch state college sports. - Don't apply for government grants or loans for college. Good luck with the private loans that charge double or triple the interest! - Don't use currency printed by the US Treasury. - Don't get married, have children or die and expect the government to keep track of all the certificates. - Don't go to a beach kept clean by the state. - Don't use public transportation. - Don't visit public museums. - Don't use truckstops or public restrooms. - Don't expect there to be much wildlife left other than rats. - Don't expect highway signs. - Don't expect anyone to plow your roads when it snows or sweep them when they're dirty. - Don't expect convicted criminals to be in prison and off your street. - Don't expect to eat in restaurants that have been inspected to ensure cleanliness and the safe preparation of food. - Don't expect your children to be able to ride the bus to school. - Don't try to adopt a child through your county or state government. - Don't expect the state or county to pay foster parents to take care of the children left abandoned or orphaned. - Don't expect the court to appoint a taxpayer-paid attorney to represent you (or your child) when you are accused of a crime. - Don't call or go to the US Embassy in a foreign country when you get in trouble. - Don’t complain when your rivers and air are polluted. 6. What message were the authors trying to send to the public with this list? 7. How did this list impact your view of taxes in America? 8. Can/should any items on this list be sacrificed? If so, which ones? Why?

![Matt [] Fri 3/11/2005 4:16 PM](http://s2.studylib.net/store/data/015587593_1-ea2d7149f0993a47a22017ad088606cd-300x300.png)