5.1 Complete the IBC Information Guide

advertisement

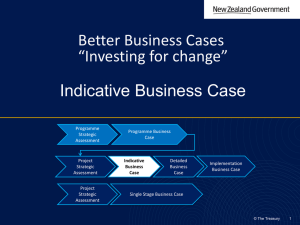

5.10 Indicative Business Case Executive summary The executive summary should be written in a way that is simple, concise and accessible to many different audiences including stakeholders and members of the community. The executive summary can be used as the basis for subsequent papers to decision-makers and refocused to meet the information needs of different target audiences. Someone reading the summary should be able to understand: That the strategic case is still sound How the short-listed options for the activity were selected The evidence behind the key problems, opportunities and constraints, and Why the preferred activity has been selected. This indicative business case seeks formal approval to … Produced by The Integral Group Ltd 1 of 7 5.10 PART 1 – THE INDICATIVE BUSINESS CASE 1 Strategic Case (Strategy) The business case approach progressively builds on previous stages of development, reconfirming rather than recreating. This Indicative Business Case (IBC) therefore revisits and reconfirms the Strategy Strategic Case and strategic context for the investment proposal. This IBC: Reconfirms or updates the strategic context and anticipated assessment profile for the proposed investment Re-examines and/or updates the evidence base for the key problem or rationale for investing; Demonstrates how the potential benefits of investing may be measured using SMART transport KPIs Include a copy of the reconfirmed or updated strategy strategic case as an appendix to the IBC document. 2 Strategic Case (Activity) The IBC revisits and reconfirms the Activity Strategic Case, including the Strategic Assessment. In this section summarise: The agreed problem statements arising from the Problem and Consequence Definition workshops, together with an outline of the status of the evidence base; The agreed benefits of successfully responding to the problem (or opportunity); The alignment of the activity to the programme goals and outcomes Include a copy of the reconfirmed or updated activity strategic case as an appendix to the IBC document. 2.1 Status of the Evidence Base Outline the status of the evidence which supported the analysis. In which areas is there a good evidence base? Where are there gaps in the evidence, how will they be addressed and what areas were identified for further analysis to support the investment story? 2.2 Changes/updates since the strategic case was undertaken For example, as the wider political environment has changed Outcome 2 is no longer considered to be a priority, and the associated benefits have changed. 2.3 Stakeholders’ Agreement Show that the stakeholders have agreed with the strategic case. Produced by The Integral Group Ltd 2 of 7 5.10 3 Activity development This section provides an overview of the process used to select the investment option that optimises value for money (the economic case), as well as outlining the indicative commercial, financial and management cases for the preferred way forward. 3.1 Activity Context Outline the geographic, economic, social and environmental context of the activity, as follows: Describe the geographic & environmental area likely to be affected by the preferred option, including a description of the built and natural environment (baseline information) as well as a description of the existing transport infrastructure. Describe the social makeup of the area likely to be affected if the short-listed/preferred options are implemented. Areas of deprivation and social exclusion should be identified as well as noting any relevant policy designations. Describe the principal sectors and industries likely to be affected if the short-listed/preferred options are implemented, as well as a summary of factors affecting performance. Include the IBC assessment of options summary table <link to 5.03> as an appendix 3.2 Options Assessment (including Economic Case) The purpose of this section is to show how a wide range of options were identified and assessed against the investment objectives and service requirements in order to select a preferred way forward. Include the completed options and preferred option workshop templates to show that the process was comprehensive and evaluated, as far as possible, the costs, time frames, risks and disbenefits of each of the activity options considered. It is also useful to state what was excluded from the long list of options and why. Options identification Briefly describe the process used to select options considered during the options workshop. The status quo and/or do nothing option A base case option must be included and is used as a baseline for comparing marginal costs and benefits of alternative activities. It provides the benchmark for determining the relative marginal value for money added by other options under consideration. In some cases, maintaining the current state is not a viable option going forward. In the case of significant change or service delivery failure, some restorative action may be need to be taken and the baseline costs and benefits adjusted accordingly. Long-List options assessment The assessment of the long-list identified the economic, environmental, social and distributional impacts of each option. In assessing value for money, all of these are consolidated to determine the extent to which a proposal’s benefits outweigh its costs. The assessment should be able to answer the following: How do the recommended options contribute to key objectives, including wider transport and government objectives? What is the overall level of impact in combination with other connected schemes? What will constitute success for the activity, and how will it be measured? What wider impacts will the project have? This section assesses the performance of the preferred option against four key criteria: Produced by The Integral Group Ltd 3 of 7 5.10 project outcomes implementation wider project impacts cost optimisation. The summary assessment of each of the long-list options is set out in the table below. A more detailed analysis may be included in the appendix. Description Advantages Disadvantages Long list option 1 Comments This option would…. Long list option 2 Long list option 3 Short-listed options Analysis of the long-list options and scoring against the outcomes and assessment criteria was used to determine a short-list of options for further assessment in the detailed business case. The short-list consists of the following (three to five) options, including the status quo or do nothing option, the preferred way forward and the less and more ambitious options. On the basis of this analysis, the short-list for further assessment is as follows: Options 1: Status quo or do minimum option (retained as a baseline comparator) Options 2: Option 3: (the preferred way forward) Option 4: Option 5: (the more ambitious option). Produced by The Integral Group Ltd 4 of 7 5.10 4 Commercial Case The commercial case discusses the commercial viability of the proposal and the consenting and procurement strategy that will be used to engage the market. It presents evidence on risk allocation and transfers as well as details of responsibilities for delivering different aspects of the programme. The detailed consideration of the commercial case takes place at the detailed business case stage. An initial outline of the commercial case should be provided now to decision makers to provide some assurance on the likely commercial viability of the proposal, potential suppliers, and where those suppliers may be utilised. This is particularly relevant for innovative or more complex services where there may be little market depth and experience. Issues with the commercial case should inform the scoping plan for the detailed business case. This section outlines the proposed deal in relation to the preferred way forward…… 5 Financial Case This section outlines the financial viability of the programme and outlines possible funding sources. An outline is provided as to the process which a project must follow in order to gain funding. Resources available between project partners have been discussed at a high level. Note that detailed analysis of the financial case including affordability takes place at the detailed business case stage. This part of the financial case provides assurance that the short-listed options, with particular focus on the preferred way forward, are affordable to the organisation. The purpose of this section is to set out the indicative financial implications of the preferred way forward….. Impact on the financial statements The financial costing needs to be updated as the impacts on the financial statements of the organisation are known with greater accuracy. To allow for uncertainty in the initial estimates, optimism bias should be included and range-based estimates are preferred. Timing of the intervention should be considered as part of affordability. Based on current estimates, the anticipated cash flows for the investment proposal over its intended life span are set out in the table below. Summary of estimated financial costs Construction/implementation cost $ Total capital construction costs $ Total property value (market value) $ Total implementation costs $ Total operating costs including increases in normal asset maintenance $ Total cost $ 95th percentile total cost $ 5th percentile total cost $ Comment on funding plan xxxx Produced by The Integral Group Ltd 5 of 7 5.10 The following assumptions have been made in determining these initial estimates…… Overall affordability The proposed whole of life cost of the project is ….over the …. years of the expected lifetime of the contract. Funding Sources It is proposed that funding for … is provided from the following sources: …….. 6 Management Case The management case addresses the achievability of the proposal and planning arrangements required to both ensure successful delivery and to manage project risks….. Project management strategy and framework For this section, outline the: History of the project to date including relationships with wider programmes of work and other related projects Project methodology adopted Project structure Project reporting arrangements Key roles and responsibilities, including the project executive, senior responsible roles and other key project team members Project management strategy and framework The key aspects of the project plan are…..Include key milestones for project delivery and benefits realisation. Risk management Ensure responsibility is also covered for the management of risk. The risk register is intended to be continuously updated and reviewed throughout the course of the project. Governance and Reporting Stakeholder Engagement and Communications Plan 7 Assessment Profile The short listed options and the preferred option were assessed using the NZTA Assessment Framework. The short listed options had a range of assessment profile from xxx to xxx. Strategic fit of the problem, issue or opportunity that is being addressed: H/M/L Explain Rationale …. Effectiveness of the proposed option: H/M/L Explain Rationale… Economic efficiency of the proposed option: H/M/L Rationale… Does the programme/preferred option have independent assurance in place? Produced by The Integral Group Ltd 6 of 7 5.10 PART 2 –FUNDING REQUIREMENTS TO PROCEED TO THE DETAILED BUSINESS CASE Right sizing the capacity/capability of the team Outline the key dates for developing the detailed business case Set out the estimated cost of developing the detailed business case and the basis for its development. Outline the composition of the project team, i.e. its size, key skill sets, in-house or consultants etc. Right sizing the effort Outline the key challenges you expect to face in undertaking development of the detailed business case, including gaps identified in part one of this document, and how you plan to mitigate these. Right sizing the engagement Who are the key stakeholders and how will they be engaged? What public engagement is proposed to understand further the key opportunities, constraints and wider objectives of the community to inform the indicative business case? Risk Management Highlight any risk management issues associated with developing the detailed business case. Estimated investment required Set out the estimated funding required to develop the detailed business case, together with a breakdown of how this figure has been arrived at. Project plan Produced by The Integral Group Ltd 7 of 7