CHAPTER

11

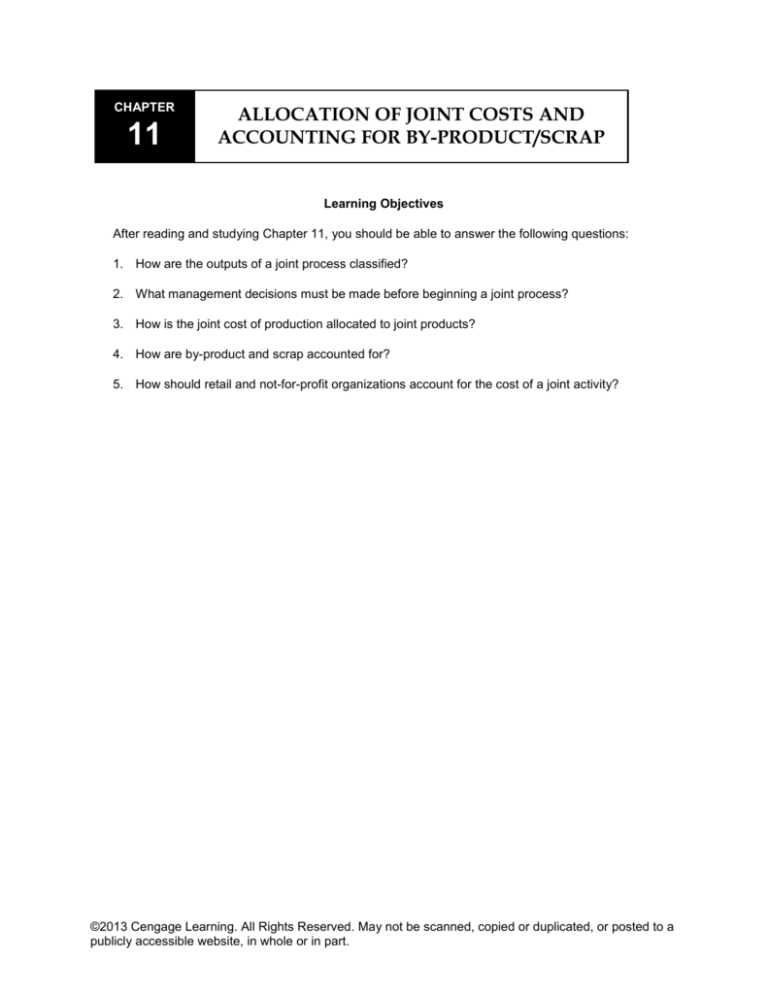

ALLOCATION OF JOINT COSTS AND

ACCOUNTING FOR BY-PRODUCT/SCRAP

Learning Objectives

After reading and studying Chapter 11, you should be able to answer the following questions:

1. How are the outputs of a joint process classified?

2. What management decisions must be made before beginning a joint process?

3. How is the joint cost of production allocated to joint products?

4. How are by-product and scrap accounted for?

5. How should retail and not-for-profit organizations account for the cost of a joint activity?

©2013 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a

publicly accessible website, in whole or in part.

Chapter 11: Allocation of Joint Costs and Accounting for By-Product/Scrap

IM 2

Terminology

Approximated net realizable value at split-off allocation: a method of allocating joint costs to joint

products using a simulated net realizable value at the split-off point; approximated value is computed as

final sales price minus incremental separate costs

By-product: an incidental output of a joint process; it is salable, but the sales value is not substantial

enough for management to justify undertaking the joint process; it is viewed as having a higher sales

value than scrap

Joint costs: costs incurred for material, labor, and overhead during a joint process up to the split-off point

Joint process: a process during which one product cannot be manufactured without producing others

Joint product: a primary output of a joint process; each joint product individually has substantial

revenue-generating ability

Net realizable value (NRV): an amount equal to the product’s sales revenue at split-off less preparation

and disposal costs

Net realizable value approach: a method of accounting for by-products or scrap that requires that the

net realizable value of these products be treated as a reduction in the cost of the primary products

Net realizable value at split-off allocation: a method of assigning joint costs to joint products based on

the sales value at split-off minus all costs necessary to prepare and dispose of the products; it requires

that all joint products be salable at the split-off point

Offset approach: (see net realizable value approach)

Other income approach: (see realized value approach)

Physical measure allocation: a method of allocating a joint cost to products that uses a common

physical characteristic as the proration base

Realized value approach: a method of accounting for by-products or scrap that does not recognize any

value for these products until they are sold; the value recognized upon sale can be treated as other

revenue or income

Sales value at split-off allocation: a method of assigning joint costs to joint products based on the

relative sales value of the products at the split-off point as the proration base; use of this method requires

that all joint products be salable at the split-off point

Scrap: an incidental output of a joint process; it is salable but the sales value from scrap is not enough for

management to justify undertaking the joint process; it is viewed as having a lower sales value than a byproduct; leftover material that has a minimal but distinguishable disposal value

Separate costs: costs incurred in later stages of production that are assignable to specific primary

products

Split-off point: the point at which the outputs of a joint process are first identifiable as individual products

Waste: a residual output of a production process that has no sales value

©2013 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a

publicly accessible website, in whole or in part.

Chapter 11: Allocation of Joint Costs and Accounting for By-Product/Scrap

IM 3

Lecture Outline

LO.1: How are the outputs of a joint process classified?

A. Introduction

1. Many companies produce and sell multiple products.

2. A joint process is a manufacturing process that simultaneously produces more than one product

line.

a. Classification of joint process output is based on management judgment about the relative

sales value of the outputs and can vary from company to company.

3. Joint cost refers to the costs incurred for material, labor, and overhead during a joint process up

to the split-off point.

a. Although joint costs must be allocated to the primary products to determine financial

statement valuations, such allocations should not be used in making internal decisions.

4. Separate costs are costs incurred in later stages of production that are assignable to specific

primary products.

5. This chapter discusses joint manufacturing processes, their related product outputs, and the

accounting treatment of the costs of those processes.

B. Outputs of a Joint Process

1. The products resulting from a joint process and having a sales value are classified as joint

products, by-products, or scrap.

2. Joint products are the primary outputs of a joint process, each of which has substantial revenuegenerating ability.

a. Joint products are also called primary products, main products, and co-products.

3. By-products are incidental outputs of a joint process; they are salable, but the sales value of byproducts is not substantial enough for management to justify undertaking the joint process; they

are viewed as having a higher sales value than scrap.

4. Scrap is an incidental output of a joint process; it is salable, but the sales value from scrap is not

enough for management to justify undertaking the joint process; it is viewed as having a lower

sales value than a by-product; leftover material that has a minimal but distinguishable disposal

value.

5. Waste is a residual output of a production process that must be disposed of because it has no

sales value.

6. Over time, a product classification may change because of technology advances, consumer

demand, or ecological factors.

©2013 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a

publicly accessible website, in whole or in part.

Chapter 11: Allocation of Joint Costs and Accounting for By-Product/Scrap

IM 4

a. New joint products may be developed from a product as illustrated in text Exhibit 11.1 (p.

435) for soybeans.

b. Joint process output is classified based on management’s judgment about the relative sales

values of outputs.

C. The Joint Process

1. Joint products are typically manufactured in companies using mass production processes and a

process costing accounting method.

a. Text Exhibit 11.2 (p. 436) describes the outputs produced from steer processing.

2. The split-off point is the point at which the outputs of a joint process are first identifiable as

individual products.

3. Financial reporting requires that all necessary and reasonable costs of production be attached to

products.

a. Joint costs must be allocated to the primary outputs of the production process for inventory

valuation purposes.

4. Costs incurred after split-off are assigned to the separate products for which those costs are

incurred.

a. Text Exhibit 11.3 (p. 437) illustrates a joint process with multiple split-off points and the

allocation of costs to products.

b. Allocated joint costs should not be used in making decisions about further processing of joint

products.

LO.2: What management decisions must be made before beginning a joint process?

D. The Joint Process Decision

1. Text Exhibit 11.4 (p. 439) presents the four management decision points in a joint production

process:

a. Management must decide whether the total expected revenues from the sale of the joint

process output are likely to exceed the total expected processing costs of the output. Other

potential costs must be considered in determining if the revenues are expected to exceed the

costs;

b. Managers must compare the net income from this use of resources to the net income that

would be provided by all other alternative uses of company resources if total anticipated

revenues from the “basket” of products exceed the anticipated joint and separate costs.

Management would then decide that this joint production process is the best use of capacity

and would begin production if joint process net income is greater than the net income that

would be provided by other uses;

c.

Management must decide how to classify joint process outputs; and

©2013 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a

publicly accessible website, in whole or in part.

Chapter 11: Allocation of Joint Costs and Accounting for By-Product/Scrap

i.

IM 5

Some will be primary; others will be by-product, scrap, or waste.

d. Management must then decide whether any (or all) of the joint process output will be sold (if

marketable) at split-off or whether it will be processed further.

i.

Such decisions should be made only after considering whether the expected additional

revenues from further processing are higher than the expected additional costs of further

processing.

2. Managers must have a reasonable estimate of each joint output’s selling price in order to make

decisions at any potential point of sale. Expected selling prices should be based on both cost and

market factors.

LO.3: How is the joint cost of production allocated to joint products?

E. Allocation of Joint Cost

1. Text Exhibit 11.5 (p. 440) provides data for Gobble Gobble, a company that manufactures three

primary products from a joint process. This case is used in the chapter to demonstrate alternative

methods of allocating joint processing costs.

2. Physical measure allocation

a. Physical measure allocation is a method of allocating common costs to products that uses

a common physical characteristic as the proration base.

b. Physical measurement allocation, unlike monetary measure allocation, provides an

unchanging yardstick of output.

c.

Physical measures are useful in allocating joint cost to products that have extremely unstable

selling prices.

d. A primary disadvantage of the method is that it ignores the revenue-generating ability of

individual joint products.

e. This allocation process treats each weight unit of output as equally desirable and assigns

each the same per unit cost.

f.

Text Exhibit 11.6 (p. 441) illustrates this method of allocation.

i.

Journal entries for incurring the joint processing cost, allocating it to the joint products,

and recognizing the separate processing cost are provided in the text immediately

following the exhibit.

3. Monetary measure allocation

a. General

i.

The primary benefit of monetary over physical measure allocations is that the monetary

measure approach recognizes the relative ability of each product to generate a profit at

sale.

ii.

A problem with monetary measure allocations is that the basis used is dynamic.

©2013 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a

publicly accessible website, in whole or in part.

Chapter 11: Allocation of Joint Costs and Accounting for By-Product/Scrap

IM 6

Accountants customarily ignore price-level fluctuations.

iii. Monetary measure allocation uses the following steps to prorate joint costs to joint

products:

Step 1: Choose a monetary allocation base;

Step 2: List each product’s base values;

Step 3: Sum the values in step 2 to obtain a total value for the list;

Step 4: Divide each individual value in step 2 by the total in step 3 to obtain a

numerical proportion for each product. (The sum of these proportions should total

100 percent);

Step 5: Multiply the joint cost by each proportion to obtain the amount to be allocated

to each product; and

Step 6: Divide each product’s prorated joint cost by the number of product units to

obtain a cost per unit for valuation purposes.

b. Sales value at split-off

i.

The sales value at split-off allocation is a method of assigning joint cost to joint

products based on the relative sales values of the products at the split-off point.

ii.

Use of this method requires that all joint products are marketable at split-off.

iii. Text Exhibit 11.7 (p. 442) illustrates this method of allocation.

c.

Journal entries are similar to those illustrated earlier.

Net realizable value at split-off

i.

The net realizable value at split-off allocation is a method of allocating joint cost to

joint products based on the sales value at split-off minus all costs necessary to prepare

and dispose of the products.

ii.

Use of this method requires that all joint products be salable at split-off.

iii. Text Exhibit 11.8 (p. 443) illustrates this method of allocation.

d. Approximated net realizable value at split-off

i.

The approximated net realizable value at split-off allocation is a method of allocating

joint cost to joint products that uses a simulated net realizable value at the split-off point.

ii.

Approximated value is computed as final sales price minus incremental separate costs.

Thus, decisions made about further processing affect the values used to allocate joint

cost under this method.

©2013 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a

publicly accessible website, in whole or in part.

Chapter 11: Allocation of Joint Costs and Accounting for By-Product/Scrap

IM 7

iii. An underlying assumption of this method is that the incremental revenue from further

processing is equal to or greater than the incremental costs of further processing.

iv. Text Exhibit 11.9 (p. 444) illustrates this method of allocation.

v.

Text Exhibit 11.10 (p 445) shows that the example company can process some joint

products further to create additional types of output. However, this further processing

does not change the allocation of joint cost previously made to the joint products.

4. In summary:

a. Each method discussed allocates a different amount of joint cost to the joint products and

results in a different per-unit cost for each product and, accordingly, has its own advantages

and disadvantages; and

b. For most companies, approximated NRV at split-off provides the most logical joint cost

assignment.

i.

This is because, for each joint product, approximated NRV captures the intended level of

separate processing, costs of separate processing, expected selling costs of each joint

product, and the expected selling price of each joint product. Thus, approximated NRV is

the best measure of the expected contribution of each product line to the coverage of

joint costs.

ii.

The method is, however, more complex than the other methods because estimations

must be made about additional processing costs and potential future sales values.

LO.4: How are by-product and scrap accounted for?

F. Accounting for By-Product and Scrap

1. General

a. Because the distinction between by-product and scrap is one of degree, these categories are

discussed together by presenting several of the treatments found in practice.

i.

The appropriate choice of method depends on the magnitude of the net realizable value

of the item and the need for additional processing beyond split-off.

b. As the sales value of the by-product increases, so does the need for inventory recognition.

i.

c.

Sales value of the by-product is generally recorded under either the NRV approach or

realized value approach.

Text Exhibit 11.11 (P. 446) provides data for a by-product that is produced by Gobble

Gobble.

2. Net realizable value (NRV) approach

a. The net realizable value approach (or offset approach) is a method of accounting for byproducts or scrap that requires the net realizable value of such products to be treated as a

reduction in the cost of the primary products.

©2013 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a

publicly accessible website, in whole or in part.

Chapter 11: Allocation of Joint Costs and Accounting for By-Product/Scrap

IM 8

b. The NRV is debited to inventory and one of two accounts may be credited: WIP Inventory –

Joint Products or Cost of Goods Sold.

c.

Although reducing joint cost by the NRV of the by-product/scrap is the traditional method

used to account for such goods, it is not necessarily the best method for internal decision

making or the management of by-products/scrap.

i.

The NRV method does not indicate the revenues, expenses, or profits from the byproduct and thus does not provide sufficient information for managerial decision making.

d. Text Exhibit 11.12 (p. 447) shows two comparative income statements using both NRV

methods of accounting for the by-product/scrap income for the example company.

3. Realized value approach

a. When management considers by-product/scrap to be a moderate source of income, the

accounting and reporting methods used should help managers monitor production and further

processing of the by-product/scrap.

b. The realized value approach (or other income approach) is a method of accounting for byproduct/scrap that does not recognize any value for these products until they are sold; the

value recognized at the time of sale can be treated as other revenue or as other income.

c.

The total sales price of the by-product/scrap is shown on the income statement as other

revenue under the “other revenue” method.

i.

Additional processing or disposal costs of the by-product/scrap are included with the cost

of producing the primary products, so little useful information is provided to management

since the cost of producing the by-product/scrap is not matched with the revenues

generated by those items.

d. The net by-product revenue is presented as an enhancement of net income in the period of

sale as “other income” under the “other income” method.

i.

By-product/scrap revenue is matched with related storage, further processing,

transportation, and disposal costs.

ii.

Since detailed information on financial responsibility and accountability is provided,

control and performance may be improved.

e. Text Exhibit 11.13 (p. 449) shows two comparative income statements using both realized

value methods of accounting for the by-product/scrap income for the example company.

4. With the trend toward more emphasis on cost and quality control, companies are becoming more

aware of the potential value of by-product, scrap, and waste and are devoting time and attention

to developing those innovative revenue sources.

G. By-Product and Scrap in Job Order Costing

1. Job order costing systems can have by-products or scrap even though joint products are not

normally associated with such systems.

©2013 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a

publicly accessible website, in whole or in part.

Chapter 11: Allocation of Joint Costs and Accounting for By-Product/Scrap

IM 9

2. The value of by-product/scrap in a job order costing system should be credited to manufacturing

overhead if the by-products/scrap value is created by a significant proportion of all jobs

undertaken.

3. The by-product/scrap value, in contrast, can be credited to the specific jobs in process if only a

few specific jobs generate a disproportionate share of the by-products/scrap.

LO.5: How should retail and not-for-profit organizations account for the cost of a joint activity?

H. Joint Costs in Retail Businesses and Not-for-Profit Organizations

1. Joint costs in retail businesses and not-for-profit (NFP) organizations often do not relate to

production processes but to marketing and promotion activities such as:

a. advertising multiple products;

b. printing multipurpose documents; or

c.

holding multipurpose events.

2. Retail businesses may allocate joint costs using either a physical or monetary base.

a. Joint costs for retail businesses usually relate to advertisements rather than to a process.

b. Retail businesses may decide it is not necessary to allocate joint costs.

3. Although retail businesses may decide that allocating joint cost is not necessary, financial

accounting requires that not-for-profit organizations allocate joint costs among the activities of

fund-raising, offering an organizational program (program activities), or conducting an

administrative function (management and general activities).

4. No specific allocation method is prescribed; only that the method used must be rational and

systematic, result in reasonable allocations, and be applied in the same manner under similar

situations.

a. A major purpose of this allocation process is to ensure that external users of financial

statements are able to determine clearly the amounts spent by the organization for various

activities—especially fundraising.

5. There are three tests that must be met for allocation; if all the tests are not met, all the costs

associated with the joint activity must be charged to fundraising:

a. The purpose test must demonstrate that the activity’s purpose includes accomplishing some

program or management/general function.

i.

A critical element under the purpose test is the compensation test. If a majority of

compensation or fees for anyone performing a part of the activity is tied to contributions

raised, the activity automatically fails the purpose criterion and all costs of the activity

must be charged to fundraising.

b. The audience test must demonstrate that the NFP chose the audience because it is suitable

for accomplishing the activity’s program or management/general functions.

©2013 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a

publicly accessible website, in whole or in part.

Chapter 11: Allocation of Joint Costs and Accounting for By-Product/Scrap

c.

IM 10

The content test must demonstrate that the activity’s content supports program or

management/general functions.

©2013 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a

publicly accessible website, in whole or in part.

Chapter 11: Allocation of Joint Costs and Accounting for By-Product/Scrap

IM 11

Multiple Choice Questions

1. (LO.1) A product that results from a joint process may be classified as

a. a joint product.

b. a by-product.

c. scrap.

d. All of the above.

2. (LO.1) Select the incorrect statement from the following.

a. Producing first-quality merchandise and factory seconds in a single operation can be viewed

as a joint process.

b. Waste is a residual output from many production processes whose sales value is comparable

to that of by-products.

c. By-products are distinguished from scrap by their higher sales value.

d. While joint cost allocations are necessary to determine financial statement valuations, such

allocations should not be used in making internal decisions.

3. (LO.1) Select the incorrect statement concerning the split-off point.

a. The split-off point is the point at which joint process outputs are first identifiable as individual

products.

b. If joint output is processed beyond the split-off point, additional costs will be incurred and

must be assigned to the specific products for which those costs were incurred.

c. A single joint process cannot have multiple spit-off points.

d. Output may be sold at the split-off point or processed further and then sold.

4. (LO.2) In joint product costing and analysis, which one of the following costs is relevant when

deciding the point at which a product should be sold in order to maximize profits?

a. Purchase costs of the materials required for the joint products

b. Separable costs after the split-off point

c. Joint costs to the split-off point

d. Sales salaries for the period when the units were produced

5. (LO.2) Before committing resources to a joint process, management must first decide whether

total expected revenue from selling the joint output ‘basket’ of products is likely to exceed the:

a. selling expenses for the goods.

b. joint costs and separate processing costs after split-off.

c. disposal costs for any waste generated.

d. All of the above.

6. (LO.2) When estimating unit selling prices for use in allocating joint production costs, which of the

following should be considered?

a. Competitor prices

b. Consumers’ sensitivity to price changes

c. Costs

d. All of the above

7. (LO.3) All of the following are common monetary measures for allocating joint costs to joint

products except:

a. approximated net realizable value at split-off.

b. gross margin at split-off.

c. net realizable value at split-off.

d. sales value at split-off.

©2013 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a

publicly accessible website, in whole or in part.

Chapter 11: Allocation of Joint Costs and Accounting for By-Product/Scrap

IM 12

8. (LO.3) LS Company manufactures two products, Product L and Product S in a joint process. The

joint (common) costs incurred are $420,000 for a standard production run that generates 180,000

units of L and 120,000 units of S. Product L sells for $2.40 per unit while Product S sells for $3.90

per unit. Assuming both products are sold at the split-off point, the amount of joint cost of each

production run allocated to Product L on a net realizable value (NRV) basis is:

a. $252,000.

b. $218,400.

c. $201,600.

d. $168,000.

9. (LO.3) Products A and B are manufactured in a joint process. The joint (common) costs incurred

are $252,000 for a standard production run that generates 108,000 gallons of Product A which

sells for $2.40 per gallon and 72,000 gallons of Product B which sells for $3.90 per gallon. If no

additional costs are incurred after the split-off point, the amount of joint cost of each production

run allocated to Product B on a physical measure basis is:

a. $100,800.

b. $140,000.

c. $151,200.

d. $280,800.

10. (LO.3) Products X and Y are manufactured in a joint process. The joint (common) costs incurred

are $420,000 for a standard production run that generates 180,000 gallons of Product X which

sells for $2.40 per gallon and 120,000 gallons of Product Y which sells for $3.90 per gallon. If

additional processing costs beyond the split-off point are $1.40 per gallon for Product X and $0.90

per gallon for Product Y, the amount of joint cost allocated to Product Y on a net realizable value

basis is:

a. $280,000.

b. $252,000.

c. $168,000.

d. $140,000.

11. (LO.3) M Company incurs $10,000,000 in joint costs for its three products. The company

estimates the products’ production, final selling price, and separate costs after split-off as follows:

Product

Product A

Product B

Product C

Production

3,000

2,400

1,200

Estimated

Selling Price

$2,000

$3,000

$1,500

Estimated

Separate Cost

$200

$500

$100

How much of the joint costs should be allocated to Product A under the approximated net

realizable value at split-off? (Note: round percentages to zero decimal places.)

a. $4,600,000

b. $4,100,000

c. $1,300,000

d. None of the above

©2013 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a

publicly accessible website, in whole or in part.

Chapter 11: Allocation of Joint Costs and Accounting for By-Product/Scrap

IM 13

12. (LO.4) P Inc. always generates a certain amount of waste due to the nature of its production

activities regardless of which products it is producing at the time. After production in a recent

month, the company sold $200 of scrap. Which of the following is the correct entry to record the

sale of the scrap using the realized value approach?

a. Cash

200

Manufacturing Overhead

200

b. Cash

200

Finished Goods

200

c. Cash

200

Scrap Inventory

200

d. Cash

200

Work in Process

200

13. (LO.4) Select the incorrect statement concerning the accounting for by-product and scrap.

a. Reducing joint cost by the NRV of the by-product/scrap is the traditional method used to

account for such goods.

b. Regardless of whether a company uses the NRV or the realized value approach, the specific

method used to account for by-product should be established before the joint cost is allocated

to the joint products.

c. Two common methods used to account for by-products are the NRV approach and the

realized value approach.

d. Under the realized value approach, the estimated selling price of the by-product is recognized

prior its actual sale.

14. (LO.5) Not-for-profit organizations may charge the entire cost of a joint activity to fund-raising if all

of the following criteria are met except:

a. amount.

b. audience.

c. content.

d. purpose.

15. (LO.5) If a majority of compensation or fees for anyone performing a part of an activity is tied to

contributions raised, the activity automatically fails the

a. purpose criterion and all costs of the activity must be charged to program activities.

b. content criterion and all costs of the activity must be charged to fund-raising.

c. purpose criterion and all costs of the activity must be charged to fund-raising.

d. audience criterion and all costs of the activity must be charged to administrative activities.

©2013 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a

publicly accessible website, in whole or in part.

Chapter 11: Allocation of Joint Costs and Accounting for By-Product/Scrap

IM 14

Multiple Choice Solutions

1.

d

2.

b

3.

c

4.

b (CMA Adapted)

5.

d

6.

d

7.

b

8.

c (CMA Adapted)

Product

Product L

Product S

9.

Joint Costs

Total

Unit

$151,200

$1.40

100,800

1.40

$252,000

Final Net

Sales

Value

$432,000

468,000

$900,000

Net

Separable

Costs

$252,000

108,000

$360,000

Realizable

Value

$180,000

360,000

$540,000

Joint Costs

$140,000

280,000

$420,000

Proportion

41%

46%

13%

Joint Costs

$4,100,000

$4,600,000

$1,300,000

b (CMA adapted)

Product

Product A

Product B

Product C

12.

Gallons

108,000

72,000

180,000

Joint Costs

$201,600

218,400

$420,000

a (CMA Adapted)

Product

Product X

Product Y

11.

Final Sales Value

Unit

Total

$2.40

$432,000

3.90

468,000

$900,000

a (CMA Adapted)

Product

Product A

Product B

10.

Units

180,000

120,000

300,000

Approximated

Units

Approx

Total

Produced NRV

NRV

3,000

($2,000 - $200) $5,400, 000

2,400

($3,000 - $500) $6,000,000

1,200

($1,500 - $100) $1,680,000

a

©2013 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a

publicly accessible website, in whole or in part.

Chapter 11: Allocation of Joint Costs and Accounting for By-Product/Scrap

13.

d

14.

a

15.

c

IM 15

©2013 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a

publicly accessible website, in whole or in part.