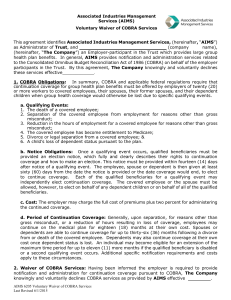

Sample Initial Notice Of COBRA Continuation Coverage Rights

advertisement