Simple and Compound Interest

advertisement

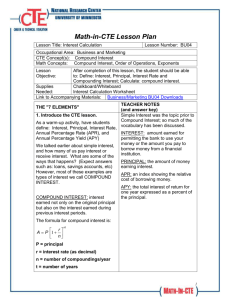

Simple and Compound Interest Interest can be defined as the cost of borrowing money. It is also the amount of money earned on investments. Here I will discuss two types of interest, Simple Interest and Compound Interest. Simple interest is usually used for borrowing and compound interest is used on both borrowing and investing money. Simple interest is a quick method of calculating interest on a loan. It is usually used on loans that are 1 year or less. It is only calculated on the original principal (amount borrowed). Simple interest is a percentage of the amount borrowed. The formula for calculating simple interest is as Follows: Simple Interest (I) = Principal (P) x Rate (R) x Time (T). One method that can be used for calculating simple interest is called Exact Interest. The Federal Reserve banks and the federal government use this method. The exact interest method uses a 365-day year for time. The time is calculated by using the exact number of days in each month the borrower has the loan. The day the money is borrowed does not count, but the day it is repaid does. After determining the number of days, they are then divided by 365. Example: Interest on a $2,000 loan with an interest rate of 12% from March 1, 2015 to May 30, 2015 would be $59.18. $2,000 x .12 x 90/365 = $59.18 Another method that is used to calculate simple interest is called Ordinary Interest. This method is known as the Bankers Rule, as it is commonly used by banks. The ordinary interest method uses a 360-day year for time. This method benefits the banks not borrowers, because the interest is slightly higher. This method is calculated the same as exact interest, except for, instead of dividing the number of days by 365 we divide by 360. What is compound interest? It can be thought of as interest earned on interest. Compound interest is calculated periodically over the life of an investment or loan, and then the interest is added to the principal each time it is compounded. Each time interest is calculated it is calculated on the adjusted principal. While compound interest can benefit an investor it can work against a borrower, especially if the interest rate is high. Interest can be compounded annually, semi-annually, quarterly, monthly, or daily. The amount of interest earned or the amount of interest you pay depends on how often the interest is compounded. The more frequent the interest is compounded the greater the interest. Compound interest can be calculated manually, but is can be time consuming. Financial calculators and rate tables can simplify the process. The magic of compounding (as some refer) can significantly increase your rate of return on investments over the long term. When interest is compounded, it results in a higher amount than that of simple interest. For instance, compare compound interest to simple interest. With simple interest a $10,000 deposit with an interest rate of 5%, over 10 years would earn you $5,000 in interest. With compound interest a $10,000 deposit compounded annually at 5% over the same time period would earn you $6,289 in interest. As you can see, there is a significant difference between the two concepts. Reflection I choose to write about these two concepts, because I believe they are very important. Not only can they greatly benefit me in my personal life, they could play an important role in my career as well. Understanding simple interest and compound interest, as well as how to calculate it, can be a very powerful tool for individuals and businesses. Knowing how to use these tools will help me to make sound financial decisions.