Job description Manager – Start-up Loans

advertisement

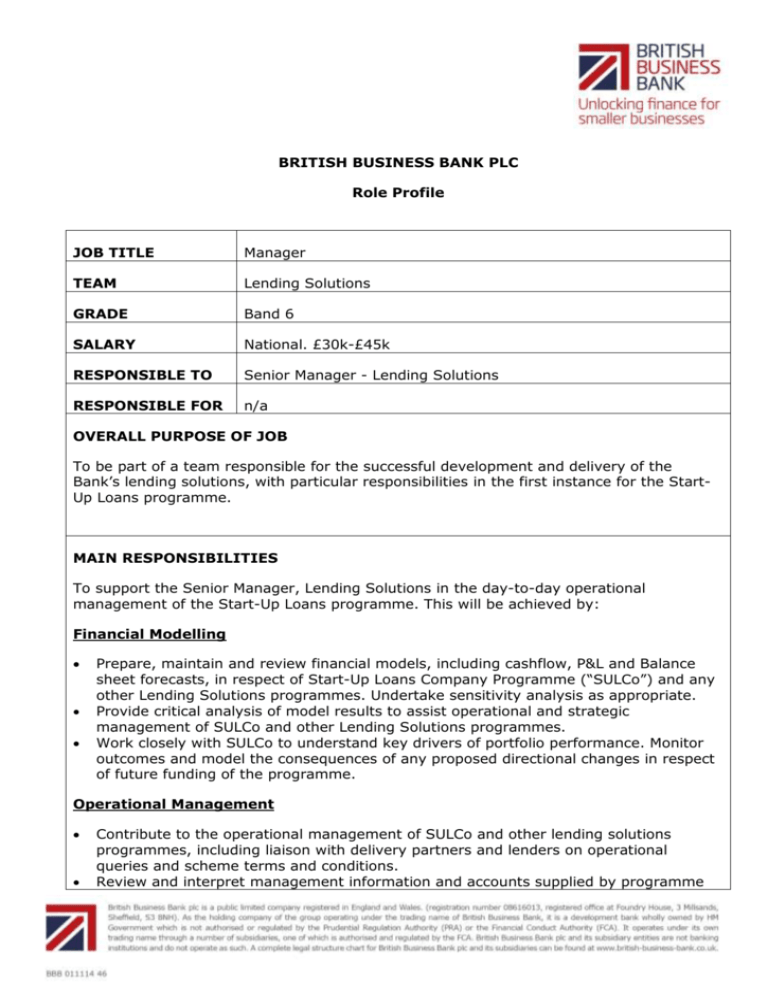

BRITISH BUSINESS BANK PLC Role Profile JOB TITLE Manager TEAM Lending Solutions GRADE Band 6 SALARY National. £30k-£45k RESPONSIBLE TO Senior Manager - Lending Solutions RESPONSIBLE FOR n/a OVERALL PURPOSE OF JOB To be part of a team responsible for the successful development and delivery of the Bank’s lending solutions, with particular responsibilities in the first instance for the StartUp Loans programme. MAIN RESPONSIBILITIES To support the Senior Manager, Lending Solutions in the day-to-day operational management of the Start-Up Loans programme. This will be achieved by: Financial Modelling Prepare, maintain and review financial models, including cashflow, P&L and Balance sheet forecasts, in respect of Start-Up Loans Company Programme (“SULCo”) and any other Lending Solutions programmes. Undertake sensitivity analysis as appropriate. Provide critical analysis of model results to assist operational and strategic management of SULCo and other Lending Solutions programmes. Work closely with SULCo to understand key drivers of portfolio performance. Monitor outcomes and model the consequences of any proposed directional changes in respect of future funding of the programme. Operational Management Contribute to the operational management of SULCo and other lending solutions programmes, including liaison with delivery partners and lenders on operational queries and scheme terms and conditions. Review and interpret management information and accounts supplied by programme delivery partners. Monitor performance against covenants. Liaise with third party contractors engaged to aide delivery of specific programmes. Develop and refine internal processes to support effective programme management. Cash Management Process and track requests for drawdowns, maintain records of committed, allocated and drawn funds by programme and liaise extensively with both BBB’s finance team and external BBB’s shareholder to ensure appropriate reconciliation and control. Prepare forecasts for cash management purposes. Provide cashflow reconciliations by delivery partner to ensure public funds have been deployed in accordance with the terms of the programme. Analysis and Reporting Assist in the preparation and analysis of regular reporting on SUL and other programme performance, including liaison with the Bank’s Management Information team. Working with the wider Lending Solutions team, produce bespoke key lender briefing reports for use by Senior Management when meeting key lending partners. In addition and according to operational requirements, the successful applicant will be expected to undertake similar duties in respect of both existing Lending Solutions products such as the Enterprise Finance Guarantee and other new ideas under consideration. RELATIONSHIPS & CONTACTS Act as a key interface/business partner to both internal and external stakeholders responsible for delivery of SULCo and other Lending Solutions programmes. Support the Lending Solutions team with responses to Freedom of Information requests, Ministerial correspondence, Parliamentary Questions and complaints in relation to Lending solutions programmes. Work closely with colleagues within the Lending Solutions Team and more widely across BBB to contribute to achievement of wider objectives. PERSON SPECIFICATION (Qualifications, skills and competencies required for role) Practical experience of financial modelling including numerical and statistical analysis to tight deadlines. A proven ability in financial management accounting, including monitoring and analysis of partner performance against forecasts; Proven ability to work collaboratively with stakeholders in order to achieve specific objectives; Familiarity with SME lending, ideally from within a leading financial organisation. We are seeking an individual who is numerate, enthusiastic, well- organised and demonstrates a readiness for new challenges; Would suit a qualified or exceptional part- qualified individual with an accounting or banking background with the aptitude to operate in a new and very different operating environment and culture from the mainstream roles currently available in the market. Shows judgment and decisiveness while also understanding when to escalate issues; Has confidence and an ability to challenge constructively and use tact and diplomacy when working with others; Has experience working in a small collegiate team environment and is prepared to fit in. Location BBB Sheffield Qualifications Accountancy (CIMA preferred) or Banking related qualification