Bootstrapping with Par rate

advertisement

Bootstrapping with Par

rate

Lecturer: Jan Röman

Mälardalen University

Division of Applied Mathematics

School of Education, Culture and Communication

Mälardalen University

Box 883, SE-721 23 Västerås, Sweden

Date: 2011/12/17

Group members:

Ellen Bjarnadóttir

Koorosh Feizi

Mushegh Khalatyan

Abstract

In this report the par rates will be bootstrapped to calculate the discount factor, zero rates and the

forward rates, and draw them up in a graph to be analyzed.

Contents

Abstract ................................................................................................................................................... 2

Introduction............................................................................................................................................. 4

Methology and result .............................................................................................................................. 4

Conclusion ............................................................................................................................................... 7

Introduction

In this report discount factor, zero coupon rate and forward rates will be calculated from a given par

rate.

Par rates are the coupon rates that value an instrument to its nominal value. Typically the par rate is

the fix-receiving rate for a number of floating cash flows in the future. A typical instrument is Floating

Rate Note (FRN). FRN acts as a bond where the coupon rates are given by an Interbank rate with an

additional spread.

Zero coupon rate is the earning rate for a zero coupon bond.

Forward rates are derived from the yield curve describing the interest rates that apply between the

current date and a future date, it is possible to determine an implied forward rate, i.e. the rate that

should apply between two future dates.

The discount function describes the present value at the time t0 of a unit cash flow at time t. The

function is monotonically decreasing, which corresponds to stipulation that interest rates are always

positive. It never reaches zero since all cash flows, no matter how far in the future they are paid, are

always worth more than nothing.

Methodology and result

At the beginning a term structure of par rates are given for deposits, forward rate agreements and

swap rates.

First the discount factor for the deposits (O/N, T/N, 1W, 1M, 2M,3M) are calculated and the

corresponding zero rates with the formulas:

𝐷𝑂/𝑁 =

𝐷𝑇/𝑁 =

𝐷𝑖 =

1

and 𝑍𝑂/𝑁 = −100 ∗

𝑝𝑎𝑟 𝑑𝑂/𝑁

1+𝑟𝑂/𝑁 ∗

360

𝐷𝑂/𝑁

𝑝𝑎𝑟 𝑑𝑇/𝑁

1+𝑟𝑇/𝑁 ∗

360

𝐷𝑇/𝑁

𝑝𝑎𝑟 𝑑

1+𝑟𝑖 ∗ 𝑖

360

ln(𝐷𝑂/𝑁 )

𝑑𝑂/𝑁

(1)

365

and 𝑍𝑇/𝑁 = −100 ∗

and

ln(𝐷𝑇/𝑁 )

𝑑𝑇/𝑁

(2)

365

𝑍𝑖 = −100 ∗

ln(𝐷𝑖 )

𝑑𝑖

365

(3)

To calculate the FRA rates the discount factor and zero rates for the stub rate needs to be calculated.

The stub rate which applies to the interval between the spot settlement date and the forward IMM

start date implied in the swap future contract. The formulas for the stub rate are:

𝑍𝑠𝑡𝑢𝑏 = {(𝑍1𝑀 − 𝑍1𝑊 ) ∗

The linear interpolation formula:

Discount factor: 𝐷𝑠𝑡𝑢𝑏 = 𝑒𝑥𝑝 {−

𝑍𝑠𝑡𝑢𝑏

100

∗

𝑇𝑠𝑡𝑢𝑏

}

365

(𝑇𝑠𝑡𝑢𝑏 −𝑇1𝑀 )

}+

(𝑇1𝑀 −𝑇1𝑆 )

𝑍1𝑀

(4)

(5)

When the stub rate has been calculated the discount factor and zero rate for the FRA can be

calculated by using the following formulas:

𝑖

Discount factor: 𝐷𝐹𝑅𝐴

=

𝐼−1

𝐷𝐹𝑅𝐴

(6)

𝑖

𝐷

𝑖

1+ 𝑟𝐹𝑅𝐴

∗ 𝐹𝑅𝐴

360

𝑖

(𝑇) = −100 ∗

Zero rates: 𝑍𝐹𝑅𝐴

𝑖

ln(𝐷𝐹𝑅𝐴

)

(7)

𝑑𝑖𝐹𝑅𝐴

365

Next the swap rates must be calculated. For the the 4Y an approximation of swap rate for 1Y, 2Y, 3Y

and so forth is needed. It is calculated by using linear interpolation (formula (4)). The discount factor

is calculated by:

𝑍

𝑡

𝑖

𝐷𝑎𝑝𝑝𝑟𝑜𝑥 = 𝑒𝑥𝑝 {−(100

∗ 365)}

(8)

By doing this the discount factor and zero rate of the swap rate from 4Y to 30Y can be calculated by

the formulas:

𝑝𝑎𝑟

𝐷𝑇 =

𝐷𝑇/𝑁 −𝑟𝑇

∑𝑇−1

𝑡−1 𝑌𝑡 ∗𝐷𝑡

𝑝𝑎𝑟

1+𝑌𝑡 ∗𝑟𝑇

where 𝑌𝑡 =

360∗(𝑌𝑡 −𝑌𝑡−1 )+30∗(𝑀𝑡 −𝑀𝑡−1 )+𝐷𝑡 −𝐷𝑡−1

360

In excel the built in function Days360 is used to calculate Yt.

And the zero rate is:

𝑍𝑠𝑤𝑎𝑝 = {−100 ∗

ln(𝐷𝑖 )

𝑡

360

}

Finally the forward rate of the all the rates are calculated byt he formula:

𝑓𝑜𝑟𝑤𝑎𝑟𝑑

𝑟𝑡2 −𝑡1

= (

𝑠𝑝𝑜𝑡 𝑡2

)

2

𝑠𝑝𝑜𝑡 𝑡

(1+𝑟𝑡

)1

1

(1+𝑟𝑡

)

1

𝑡2 −𝑡1

−1

(10)

(9)

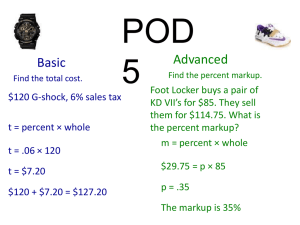

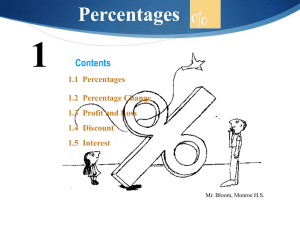

Next a graph of the discount factor is drawn up, see picture 1, and also a graph with the par rate,

zero rate and forward rate, picture 2.

Discount factor

1.2

1

0.8

0.6

0.4

0.2

0

10962

5484

3293

2196

91

91

91

91

28

35

3

Discount factor

Picture 1: Graph of discount factor

7

6

5

%

4

Par rate

3

Zero rate

2

Forward rates

1

10962

7311

4387

3293

2561

1831

91

91

91

91

91

91

28

66

11

3

0

Days to maturity

Picture 2 : Graph of Par rates, Zero rates and forward rates.

The problem was solved in an excel sheet that will be handed in with the report.

Conclusion

The discount function has a rather smooth decreasing line which reflect how they are supposed

to evolve.

The zero rates are a bit higher then the par rates in the beginning but then join them to be almost

identical in the end.

The forward rate also follow similar path but has a few jumps which is a typical problem when using

linear interpolation. The curve intends to get sharp angels at the intersection point and that gives

jumps when the forward rates are calculated. The forward rate should be above the zero rates but in

our case they are at the same path or slightly below.