Annex 1- Explanatory note on the budget

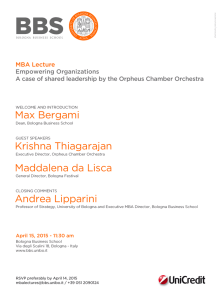

advertisement

Lifelong Learning Programme Lifelong Learning Programme Application Form – Annex 1 National Teams of Bologna Experts Period 2011 – 2013 Lifelong Learning Programme - National Teams of Bologna Experts 2011 – 2013 Application Form – Annex 1 Page 1 of 9 Annex 1: Explanatory note on the budget A. Introduction This note provides information to applicants concerning the financial procedure and the rules for eligibility of costs and guidance on how to complete the project Budget using the Excel tables. B. Financial procedure 1. Presentation of financial data by the Applicant For the presentation of the budget, a distinction is made between the following main headings of expenditure (see section D below for details): 1. National Agency staff costs1 2. National Agency travel and subsistence costs 3. Bologna Experts: daily rates, travel and subsistence for participating in national and international seminars 4. Bologna Experts/ECTS label holders: daily rates, travel and subsistence for the ECTS – DS label and the promotion of Category II activities 5. Equipment and materials 6. Sub-contacting, consultancy and other external services 7. Conferences and seminars 8. Other direct costs 2. Financial analysis of proposals The budget proposed by the LLP National Agency is analysed by the Executive Agency in order to: a) b) c) d) e) assess whether it is consistent with the proposed project and sufficiently clear and detailed; assess whether the proposed budget is appropriate for achieving the concrete objectives / results of the project; eliminate any item of expenditure which cannot be accepted according to the rules on eligible expenditure; propose, if necessary, a downward revision of some items of expenditure, where these are considered excessive compared to the nature of the project and/or to the volume of work to be implemented in order to achieve the planned results; recommend, if necessary, a reallocation of some items of expenditure, where these are considered not appropriate under a given budget heading. At the end of this analysis, an approved budget for the project is drawn up by the Executive Agency. If the proposed budget is realistic and acceptable in relation to EU rules on grants, the proposed budget and the approved budget will be identical, and the EU grant may be the same as the amount requested by the applicant. In most cases, however, the analysis is likely to result in reductions. 1 Daily rates for Bologna Experts should be based on Staff category 2 ("Researcher, Teacher, Trainer"), as indicated in Appendix A Lifelong Learning Programme - National Teams of Bologna Experts 2011 – 2013 Application Form – Annex 1 Page 2 of 9 3. Calculation of the Bologna Experts grant Once the approved project budget has been defined, the grant to be awarded is calculated on the following basis: the total grant may not exceed the amount requested by the applicant; the total grant may not exceed 90% of total eligible costs of the overall project budget; the policy for awarding grants in the invitation to submit; the available budget for the action. C. Rules on eligibility of costs 1. Eligible costs The general context, nature and amount of expenditure will be considered when assessing eligibility. To be considered as eligible project costs, costs must satisfy the following general criteria: – they must be connected with the project (i.e. relevant for the action and be directly connected with execution of the project in accordance with the activity plan) and included in the estimated project budget; – they must be necessary for the performance of the project ; – they must be reasonable and justified and they must accord with the principles of sound financial management, in particular in terms of value for money and cost-effectiveness; – they must be incurred during the lifetime of the project as defined in the agreement; – they must actually be incurred by the beneficiary and be recorded in the National Agency’s accounts in accordance with the applicable accounting principles and be declared in accordance with the requirements of the applicable tax and social legislation; – they must be identifiable and verifiable and be backed up by original supporting documents; – they must relate to activities involving the eligible countries in the Lifelong Learning Programme. Any costs relating to activities undertaken outside these countries or by organisations that are not registered in an eligible country are not eligible unless they are necessary for the completion of the action and duly justified in the application form and in the report, and/or agreed in advance with the Agency through an exchange of letters. The applicant's internal accounting and auditing procedures must permit direct reconciliation of the costs and revenue declared in respect of the project with the corresponding accounting statements and supporting documents. For scales of unit costs, this implies that the "number of units" must be recorded in appropriate documents (i.e. time sheets, presence lists, etc.). Where national taxation and accounting rules do not require an invoice, an accounting document of equivalent value means any document produced in order to prove that the accounting entry is accurate and complies with the applicable accounting law. Lifelong Learning Programme - National Teams of Bologna Experts 2011 – 2013 Application Form – Annex 1 Page 3 of 9 2. Non-eligible costs The following items of costs are not eligible and should therefore not be included under any headings in the Budget: - contributions in kind; - return on capital; - debt and debt service charges; - provisions for losses or potential future liabilities (provisions for contractual and moral obligations, fines, financial penalties and legal costs); - interest owed; - doubtful debts; - exchange losses; - VAT, unless the applicant can show that he is unable to recover it; - costs declared by the applicant and covered by another action or work programme receiving an EU grant; - excessive or reckless expenditure; - purchase of capital assets; - in the case of rental or leasing of equipment, the cost of any buy-out option at the end of the lease or rental period; - costs associated with the preparation of the application for the Lifelong Learning Programme; - costs of opening and operating bank accounts (costs of transferring funds are eligible)); - costs incurred in relation to any document required to be submitted with the application (audit reports, etc.); - indirect costs (overheads). In particular, the National Agency will take care to avoid dual funding, i.e. both as an activity supported under the Operating grant of the National Agency concerned, and as an activity supported under the present invitation. Similarly, there may be no duplicate funding of staff costs already covered by the Operating grant. D. Principles applied to the different categories of expenditure 1. Staff costs Staff costs refer to any payment made to a person attached to the contracting organisation or working on a regular or recurrent basis for the project (regardless of his or her status). Unit costs may not exceed the normal costs for the staff category in question in the country concerned. Staff costs that are already included in the Operating grant or in any other EU funding are not eligible. Staff costs will be calculated on the basis of the actual daily salary/fees of the employee/interim staff, multiplied by the number of days to be spent on the project. This calculation may include, if necessary, all the normal charges paid by the employer, such as social security contributions and related costs, but must exclude any bonus, incentive and profitsharing arrangements or running costs. Staff costs must be broken down into four categories: Staff Staff Staff Staff category category category category 1 2 3 4 Manager Researcher, Teacher, Trainer Technical Administrative The amounts in Appendix A are maximum ceilings. The applicant is requested to take into account the real staff costs in his/her country, as well as the non profit making principle which applies to EU grants and use the table in Appendix A to calculate the maximum amounts in the country concerned. If it is planned to employ or hire the services of persons, whose costs exceed the maximum amounts expressed herein, the necessary explanations, as well as evidences should be provided when submitting the application. Lifelong Learning Programme - National Teams of Bologna Experts 2011 – 2013 Application Form – Annex 1 Page 4 of 9 Daily rates for Bologna Experts should be based on Staff category 2 ("Researcher, Teacher, Trainer") as indicated in Appendix A and in the excel tables. The National Agencies can budget their staff costs up to a maximum of 15% of the total eligible project budget or 10.000 € whichever is the larger. 2. Travel and subsistence costs 2.1. Travel costs (1) (2) (3) (4) (5) Travel costs for staff and Bologna Experts (and ECTS label holders) taking part in the action are considered, provided that they are in line with the National Agency usual practices on travel costs; Costs may be claimed only for journeys directly connected to specific and clearly identifiable project-related activities. For information on charging Travel Costs for non-staff members please refer to Section ‘Other direct costs’ and ‘Costs of subcontracting, consultancy and other external services’; Reimbursement is based on real costs, independent of the means of travel chosen (rail, bus, taxi, plane, private car). The beneficiaries are required to use the cheapest means of travel (e.g. use Apex tickets for air travel and take advantage of reduced fares, where this is not the case then a full explanation should be provided); The travel cost for a journey should include all costs and all means for travel from the point of origin to the point of destination (and vice versa) and may include visa fees, travel insurance and cancellation costs; Expenses for car travel, where substantiated and where the price is not excessive, will be refunded as follows: for private vehicles (personal or company cars): on the basis of the corresponding first class rail (or economy air2) fare - the price (see point (3) above) of only one ticket shall be reimbursed, even where several people are travelling in the same vehicle; for hire cars (maximum category B or equivalent) or taxis: the actual cost where this is not excessive compared with other means of travel (also taking account of any influencing factors i.e. time, excessive luggage). Reimbursement takes place independently of the number of people travelling in the same vehicle; only in exceptional and duly substantiated cases, where the above can not to be applied, a ‘rate per mile/km’ up to a max of € 0.22, in accordance with the internal rules of the National Agency, will be considered. Travel costs incurred outside the countries participating in the LLP programme are not eligible, unless explicit prior authorisation is granted by the Executive Agency. 2.2. Subsistence costs (1) (2) (3) (4) 2 Subsistence costs for staff and Bologna Experts (and ECTS label holders) taking part in the action are considered. The budget should be based on real daily subsistence rates, which cannot exceed the maximum rate indicated in Appendix B. Any surplus will be considered as ineligible. The rate to be applied is the one from the destination country, i.e. where accommodation costs are incurred; Costs may be claimed only for journeys directly connected to specific and clearly identifiable project-related activities. For information on charging Subsistence Costs for non-staff members please refer to Section ‘Other direct costs’ and ‘Costs of subcontracting, consultancy and other external services’; Reimbursement is based on the existing internal rules of the National Agency, which may be on an actual cost (reimbursement of receipts) or daily allowance basis; Subsistence rates cover accommodation, meals and all local travel costs (but not local travel costs incurred to travel from point of origin to point of destination, see point 2.1. point (4)). In calculating the number of days for which to apply the Daily Subsistence Rate it should be noted that a FULL day normally includes an overnight stay. In duly substantiated cases, a full day’s allowance without an Only in situations where a train journey cannot be priced (i.e. no appropriate route or service exists). Lifelong Learning Programme - National Teams of Bologna Experts 2011 – 2013 Application Form – Annex 1 Page 5 of 9 (5) overnight stay may be allowed with a pro rata reduction for accommodation (maximum costs limited to 50% of the ceiling); A pro rata reduction must be applied if accommodation, meals and local travel costs are provided for by a third party. Within these limits, subsistence expenses may be reimbursed on an actual or daily allowance basis. However, if the internal regulations of the National Agency making the journey impose a lower limit than the amounts in the above table, this lower amount must be used. 3. Costs related to equipment and materials (1) (2) (3) (4) Purchase, rent or lease of equipment (new or second-hand), including the installation, maintenance and insurance costs, is considered, only when specific and necessary for achieving the goals of the project/action. Proposed equipment costs must always be duly justified. The rules for procurement apply (see point 4 below); The purchase cost of equipment and materials is considered, provided that it is written off in accordance with the tax and accounting rules applicable to the National Agency and generally accepted for items of the same kind. Only the portion of the equipment's depreciation corresponding to the duration of the action and the rate of actual use for the purposes of the action may be taken into account. If the nature and/or the context of its use justify different treatment, this should be duly justified; All equipment and materials related to the administration of the project (i.e. PCs, laptops, etc.) are not eligible; The total cost for equipment and materials may not be more than 10% of the total eligible cost of the project. 4. Cost of subcontracting, consultancy and other external services Any amount paid to an outside body, organisation or individual3 which carries out specific and limited work for the project through procurement contracts, shall be charged to the heading “Subcontracting, consultancy and other external services". Work such as translation, interpretation and printing, is considered as subcontracting costs. Such expenditure may only be allowed if the staffs of the contracting organisation do not have the skills required for the performance of the work concerned. The applicant shall award the contract to the tender offering best value for money, that is to say, to the tender offering the best price-quality ratio, in compliance with the principles of transparency and equal treatment for potential contractors, care being taken to avoid any conflict of interests. The following specific rules with regard to procurement apply: Contracts with a value up to €12.500 can be paid simply on presentation of an invoice; Contracts with a value between more than €12.500 and €25.000 are subject to a procedure involving at least three tenderers; Contracts between more than €25.000 and €60.000 are subject to a procedure involving at least five tenderers; For contracts of a value over €60.000, national rules with regard to procurement apply. None of the basic activities of the project may be subcontracted. For this reason, the beneficiary may not subcontract the management and general administration of the project. 3 This refers to individuals who may be self-employed i.e. who are responsible for their own social security or social contributions, pensions and taxes. National legislation on the definition of these individuals can vary and should always be considered. Lifelong Learning Programme - National Teams of Bologna Experts 2011 – 2013 Application Form – Annex 1 Page 6 of 9 If the beneficiary calls on the services of an outside expert (i.e. a person not on the payroll of the contracting organisation) as a consultant, the costs will be eligible subject to the conditions mentioned above and provided that they are strictly necessary for the performance of the project and are reasonable in amount. . All the costs directly connected with sub-contracting must be declared under the subcontracting budget heading whatever the nature of the costs concerned (e.g. staff costs plus travel costs, etc.). The total amount devoted to subcontracting, consultancy and other external services may not exceed 30% of the total eligible cost of the project. For translations, only expenditure directly related to translations from and into the official languages of the countries formally participating in the Lifelong Learning programme will be accepted, unless explicit prior authorisation is granted by the Executive Agency. Translation costs may not be higher than the market prices in the country where the translation is done. 5. Other direct costs Other direct costs, not covered by those indicated above, may be allowed, provided they are: necessary for the performance of the project; reasonable in amount; fully documented and clearly itemised in the application; not indicated under another heading or item of expenditure. Other direct costs are reimbursed on the basis of real costs. Specific items of expenditure eligible under this heading include: bank transfer and exchange costs (but excluding exchange losses) relating to receipts and payments for eligible expenditure under the project. costs incurred in producing, translating and publishing documents, when those activities are performed by the contracting organisation; communication costs (e.g. connection to the Internet) in duly justified cases for projects where activities require very intensive use of communications. Lifelong Learning Programme - National Teams of Bologna Experts 2011 – 2013 Application Form – Annex 1 Page 7 of 9 APPENDIX A Maximum eligible daily rates (in EUR) for Staff costs (As presented in the Lifelong Learning Programme call for proposals 2011 Guide - Part I – General Provisions, Table 5a) STAFF costs ceilings Country Description Country Code Manager Researcher Teacher Trainer Technical Administrative Belgique/Belgie - BE BE 380 325 263 205 Bulgaria- BG BG 84 75 58 39 Ceska Republika - CZ CZ 138 138 100 72 Danmark - DK DK 497 425 346 271 Deutschland - DE DE 356 309 248 191 Eesti - EE EE 102 94 66 46 Ellas - EL EL 280 239 196 152 Espana -ES ES 287 258 198 139 France - FR FR 423 358 234 179 Ireland - IE IE 386 336 280 205 Italia - IT IT 568 332 225 187 Kypros - CY CY 335 294 182 124 Latvija - LV LV 101 82 65 44 Lithuania - LT LT 90 77 59 41 Luxembourg - LU LU 508 436 353 275 Magyarorszag - HU HU 123 108 81 46 Malta - MT MT 136 123 96 68 Nederland - NL NL 388 339 269 211 Oesterreich - AT AT 420 324 241 199 Polska - PL PL 130 107 83 61 Portugal - PT PT 182 160 118 78 Rumania- RO RO 155 119 93 59 Slovenija -SI SI 252 227 183 115 Slovensko -SK SK 151 122 108 88 Suomi - FI FI 374 268 221 185 Sverige - SE SE 443 379 312 240 United Kingdom - UK GB 412 389 273 197 Island - IS IS 460 419 361 232 Liechtenstein - LI LI 414 339 263 208 Norge - NO NO 529 459 375 283 Turkey - TR TR 176 112 74 47 Croatia - HR HR 266 240 193 121 CH 392 322 249 198 Switzerland - CH Lifelong Learning Programme - National Teams of Bologna Experts 2011 – 2013 Application Form – Annex 1 Page 8 of 9 APPENDIX B Maximum eligible daily rates (in EUR) for Subsistence costs (As presented in the Lifelong Learning Programme call for proposals 2011 Guide - Part I – General Provisions, Table 5b) SUBSISTENCE ceilings Country Description Country Code Belgique/Belgie - BE BE 232 Bulgaria- BG BG 227 Ceska Republika - CZ CZ 230 Danmark - DK DK 270 Deutschland - DE DE 208 Eesti - EE EE 181 Ellas - EL EL 222 Espana -ES ES 212 France - FR FR 245 Ireland - IE IE 254 Italia - IT IT 230 Kypros - CY CY 238 Latvija - LV LV 211 Lithuania - LT LT 183 Luxembourg - LU LU 237 Magyarorszag - HU HU 222 Malta - MT MT 205 Nederland - NL NL 263 Oesterreich - AT AT 225 Polska - PL PL 217 Portugal - PT PT 204 Rumania- RO RO 222 Slovenija -SI SI 180 Slovensko -SK SK 205 Suomi - FI FI 244 Sverige - SE SE 257 United Kingdom - UK GB 276 Island - IS IS 245 Liechtenstein - LI LI 175 Norge - NO NO 220 Turkey - TR TR 220 Croatia - HR HR 222 Switzerland - CH CH 254 Daily rate Lifelong Learning Programme - National Teams of Bologna Experts 2011 – 2013 Application Form – Annex 1 Page 9 of 9