Acct 100 On line links/Computer Project/Tucker Consulting QB

advertisement

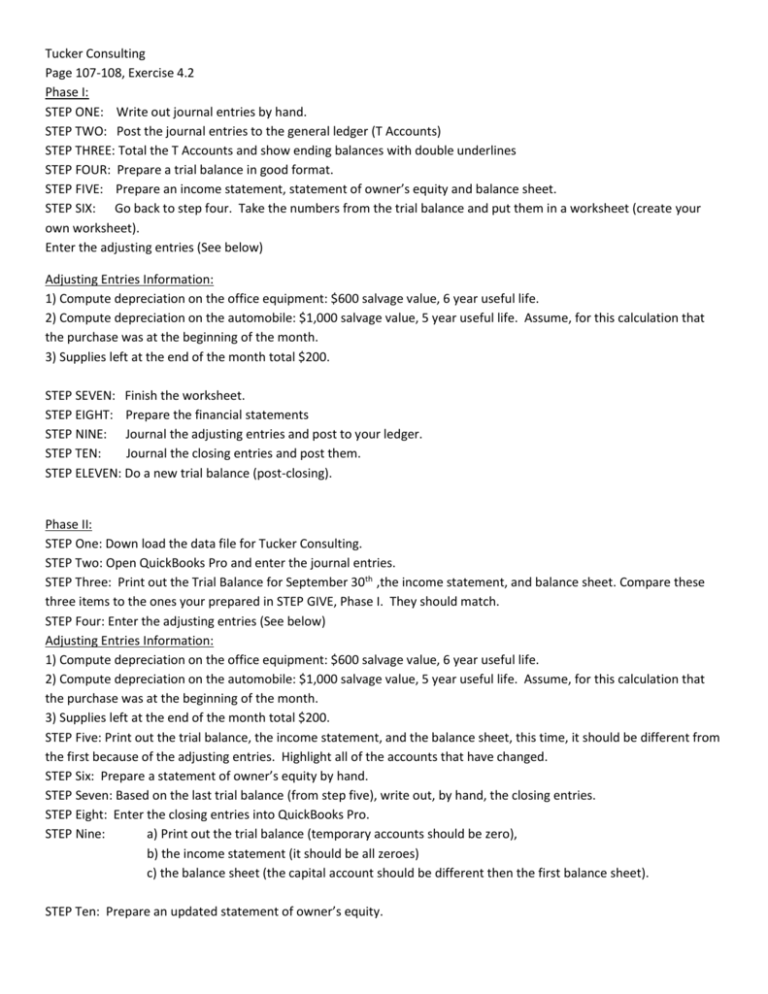

Tucker Consulting Page 107-108, Exercise 4.2 Phase I: STEP ONE: Write out journal entries by hand. STEP TWO: Post the journal entries to the general ledger (T Accounts) STEP THREE: Total the T Accounts and show ending balances with double underlines STEP FOUR: Prepare a trial balance in good format. STEP FIVE: Prepare an income statement, statement of owner’s equity and balance sheet. STEP SIX: Go back to step four. Take the numbers from the trial balance and put them in a worksheet (create your own worksheet). Enter the adjusting entries (See below) Adjusting Entries Information: 1) Compute depreciation on the office equipment: $600 salvage value, 6 year useful life. 2) Compute depreciation on the automobile: $1,000 salvage value, 5 year useful life. Assume, for this calculation that the purchase was at the beginning of the month. 3) Supplies left at the end of the month total $200. STEP SEVEN: Finish the worksheet. STEP EIGHT: Prepare the financial statements STEP NINE: Journal the adjusting entries and post to your ledger. STEP TEN: Journal the closing entries and post them. STEP ELEVEN: Do a new trial balance (post-closing). Phase II: STEP One: Down load the data file for Tucker Consulting. STEP Two: Open QuickBooks Pro and enter the journal entries. STEP Three: Print out the Trial Balance for September 30th ,the income statement, and balance sheet. Compare these three items to the ones your prepared in STEP GIVE, Phase I. They should match. STEP Four: Enter the adjusting entries (See below) Adjusting Entries Information: 1) Compute depreciation on the office equipment: $600 salvage value, 6 year useful life. 2) Compute depreciation on the automobile: $1,000 salvage value, 5 year useful life. Assume, for this calculation that the purchase was at the beginning of the month. 3) Supplies left at the end of the month total $200. STEP Five: Print out the trial balance, the income statement, and the balance sheet, this time, it should be different from the first because of the adjusting entries. Highlight all of the accounts that have changed. STEP Six: Prepare a statement of owner’s equity by hand. STEP Seven: Based on the last trial balance (from step five), write out, by hand, the closing entries. STEP Eight: Enter the closing entries into QuickBooks Pro. STEP Nine: a) Print out the trial balance (temporary accounts should be zero), b) the income statement (it should be all zeroes) c) the balance sheet (the capital account should be different then the first balance sheet). STEP Ten: Prepare an updated statement of owner’s equity.