Fillable e-Form () - Elder Law of East Tennessee

advertisement

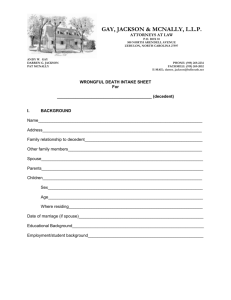

PROBATE QUESTIONNAIRE Elder Law of East Tennessee Date: For Decedent: Legal Name: Date of Birth: SSN: Residence Address: Did the Decedent have a Last Will and Testament? Was the Decedent a TennCare/Medicaid Recipient? Spouse’s Legal Name: Spouse’s Date of Birth: Legal Name: Address: Date of Birth: Date of Death: ☐ Yes ☐ Yes ☐ No ☐ No Spouse’s SSN: For Personal Representative or Proposed Personal Representative: SSN: Telephone Number: Please bring documents with you pertaining to any assets you describe herein, and in addition, bring the Last Will and death certificate if available. 1. Real Estate - Parcel 1 Address: How property is titled: Estimated fair market value as of date of death: Do you have a recent appraisal for this property? If yes, give the amount and date: Do you have the tax appraisal for this property? If yes, give the amount and date: Was there any debt on this property? If yes, for what amount? ELET – Revised 7 February 2016 ☐ Yes ☐ No ☐ Yes ☐ No ☐ Yes ☐ No Real Estate - Parcel 2 Address: How property is titled: Estimated fair market value as of date of death: Do you have a recent appraisal for this property? If yes, give the amount and date: Do you have the tax appraisal for this property? If yes, give the amount and date: Was there any debt on this property? If yes, for what amount? 2. ☐ Yes ☐ No ☐ Yes ☐ No ☐ Yes ☐ No Bank Accounts If more than one account, please indicate for each: Describe: How account is titled: Estimated fair market value: Describe: How account is titled: Estimated fair market value: Describe: How account is titled: Estimated fair market value: 3. Stock Certificates, Mutual funds, CDs, or investment accounts Describe: How account is titled: Estimated fair market value: If more than one account, please indicate for each: Describe: How account is titled: Estimated fair market value: Describe: How account is titled: Estimated fair market value: Describe: How account is titled: Estimated fair market value: 4. Vehicles Make/Model: How vehicle is titled: Estimated fair market value as of date of death: Is there any debt on this property? ☐Yes ☐No If yes, what amount is owed? Make/Model: How vehicle is titled: Estimated fair market value as of date of death: Is there any debt on this property? ☐Yes ☐No If yes, what amount is owed? 5. Life Insurance Describe: Policy owner: Named beneficiary: Total benefits: Describe: Policy owner: Named beneficiary: Total benefits: Describe: Policy owner: Named beneficiary: Total benefits: 6. Valuable Jewelry or collections (valued over $5,000) Describe: Location: Estimated fair market value: ELET – Revised 7 February 2016 7. Personal property and household goods Please provide a fair market value for this property: 8. Were there any substantial gifts of money or property (over $11,000) given by the deceased in the last three (3) years before death? ☐ Yes ☐ No If so: To whom: Date: Amount: Total gift tax paid: 9. Total cost of funeral/burial: 10. Total bills paid by his/her estate to date: 11. List the name, address, and age of all children of the decedent, including legally adopted children. If a child of the decedent is deceased, provide the name and address of all children of the deceased child. 12. List the name, address, and age of all beneficiaries under the decedent’s will. If a beneficiary of the decedent is deceased, provide the name and address of all children of the deceased beneficiary.