Detailed Summary of Changes

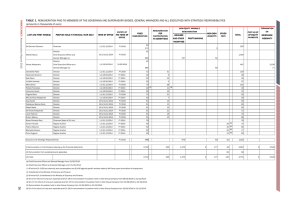

advertisement

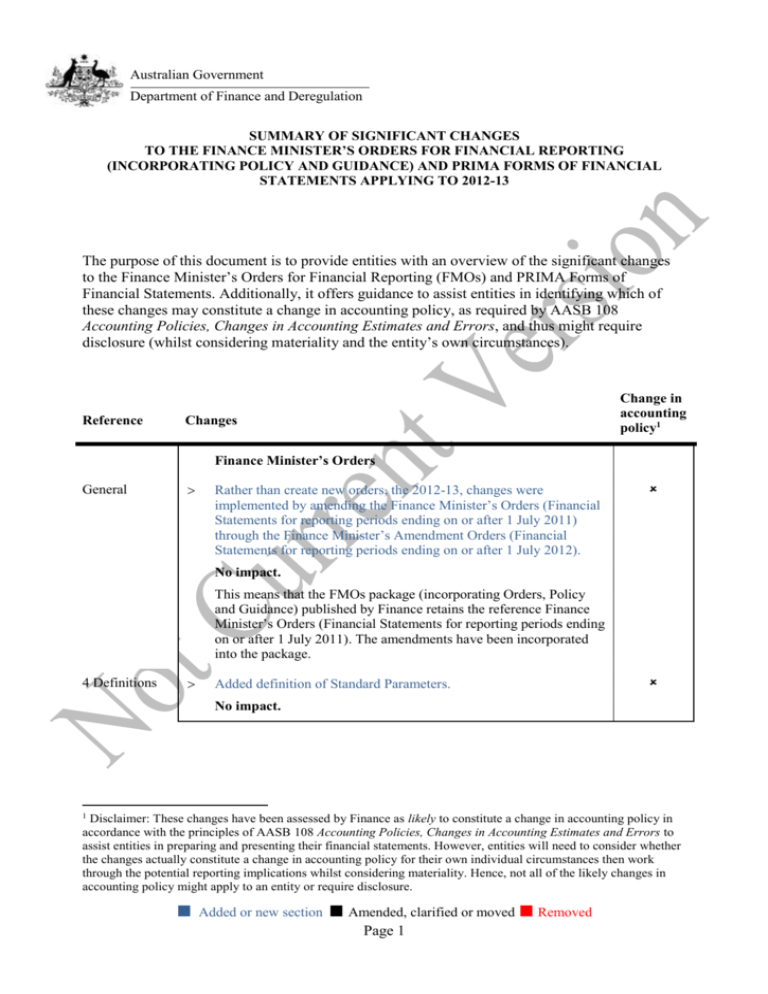

Australian Government Department of Finance and Deregulation SUMMARY OF SIGNIFICANT CHANGES TO THE FINANCE MINISTER’S ORDERS FOR FINANCIAL REPORTING (INCORPORATING POLICY AND GUIDANCE) AND PRIMA FORMS OF FINANCIAL STATEMENTS APPLYING TO 2012-13 The purpose of this document is to provide entities with an overview of the significant changes to the Finance Minister’s Orders for Financial Reporting (FMOs) and PRIMA Forms of Financial Statements. Additionally, it offers guidance to assist entities in identifying which of these changes may constitute a change in accounting policy, as required by AASB 108 Accounting Policies, Changes in Accounting Estimates and Errors, and thus might require disclosure (whilst considering materiality and the entity’s own circumstances). Reference Change in accounting policy1 Changes Finance Minister’s Orders General Rather than create new orders, the 2012-13, changes were implemented by amending the Finance Minister’s Orders (Financial Statements for reporting periods ending on or after 1 July 2011) through the Finance Minister’s Amendment Orders (Financial Statements for reporting periods ending on or after 1 July 2012). No impact. This means that the FMOs package (incorporating Orders, Policy and Guidance) published by Finance retains the reference Finance Minister’s Orders (Financial Statements for reporting periods ending on or after 1 July 2011). The amendments have been incorporated into the package. 4 Definitions Added definition of Standard Parameters. No impact. 1 Disclaimer: These changes have been assessed by Finance as likely to constitute a change in accounting policy in accordance with the principles of AASB 108 Accounting Policies, Changes in Accounting Estimates and Errors to assist entities in preparing and presenting their financial statements. However, entities will need to consider whether the changes actually constitute a change in accounting policy for their own individual circumstances then work through the potential reporting implications whilst considering materiality. Hence, not all of the likely changes in accounting policy might apply to an entity or require disclosure. ■ Added or new section ■ Amended, clarified or moved ■ Removed Page 1 8 Authoritative Requirements Added specific reference to Standard Parameters in section 8.2(b)(iv), being the list of documents an entity must “have regard to” in preparation of their financial statements. No impact. 17 Approved Exemptions Amended Department of Defence exemption (section 17.14) to replace specific executive remuneration thresholds with a cross reference to the Standard Parameters document. This is consistent with the approach taken in Division 23 Director/Senior Executive Remuneration. No impact. 23 Director/ Senior Executive Remuneration General edits: Replaced specific descriptions of requirements for Tables A, B and C, as well as director disclosures, with explicit references to Part K of the FMOs. Replaced specific references to the executive remuneration thresholds for Tables A, B and C, now located in Standard Parameters, with cross references to this document. Amended definitions of Reportable Allowances, Reportable Remuneration and Reportable Salary and the subheading for Table C to ensure consistent use of terminology. Amended the definition of Executive Remuneration to reference AASB 119 Employee Benefits rather than AGN 2007/2 (Revised) Identification of Executive Remuneration. No impact. Amended the definition of Contributed Superannuation regarding the requirements for defined benefit schemes and defined contribution schemes and to remove the need to separate salary sacrificed superannuation from total amounts salary sacrificed, with consequential amendments to the definitions of Reportable Remuneration and Reportable Salary. Impact: Entities are required to prepare Tables B and C on this basis. This has no impact on Total Reportable Remuneration for individuals disclosed (and hence the band within which they are captured), it is simply a change to how this figure is disaggregated. PRIMA Forms of Financial Statements Statement of Comprehensive Income Added subheadings to other comprehensive income as required by AASB 101 Presentation of Financial Statements. Impact: Entities are now required to split the presentation of other comprehensive income into two categories, being those items subject to, or not subject to, subsequent reclassification to net cost of services. ■ Added or new section ■ Amended, clarified or moved ■ Removed Page 2 Note 17 Senior Executive Remuneration The executive remuneration threshold is to be increased from $150,000 to $180,000. This change will be formalised by the amount shown in the Standard Parameters document (to be published early July). Impact: Entities will be required to prepare Tables A, B and C of the Senior Executive Remuneration note on this basis (noting it is only a minimum disclosure threshold for the purposes of Table C). ■ Added or new section ■ Amended, clarified or moved ■ Removed Page 3