life-insurance_confidential

advertisement

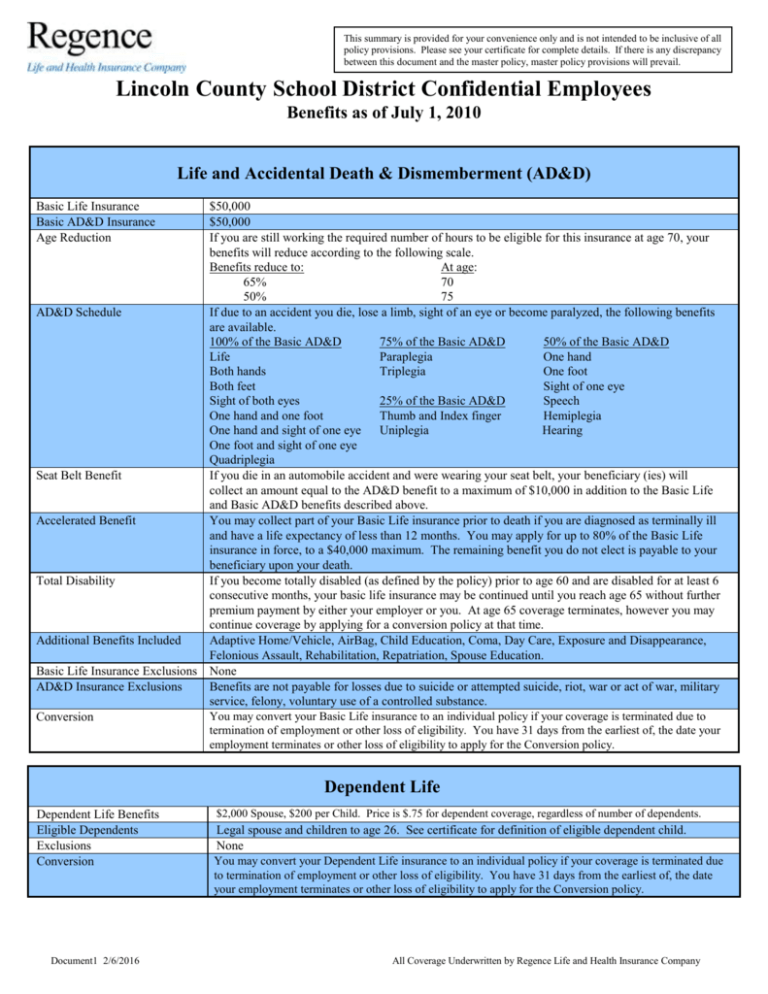

This summary is provided for your convenience only and is not intended to be inclusive of all policy provisions. Please see your certificate for complete details. If there is any discrepancy between this document and the master policy, master policy provisions will prevail. Lincoln County School District Confidential Employees Benefits as of July 1, 2010 Life and Accidental Death & Dismemberment (AD&D) Basic Life Insurance Basic AD&D Insurance Age Reduction $50,000 $50,000 If you are still working the required number of hours to be eligible for this insurance at age 70, your benefits will reduce according to the following scale. Benefits reduce to: At age: 65% 70 50% 75 AD&D Schedule If due to an accident you die, lose a limb, sight of an eye or become paralyzed, the following benefits are available. 100% of the Basic AD&D 75% of the Basic AD&D 50% of the Basic AD&D Life Paraplegia One hand Both hands Triplegia One foot Both feet Sight of one eye Sight of both eyes 25% of the Basic AD&D Speech One hand and one foot Thumb and Index finger Hemiplegia One hand and sight of one eye Uniplegia Hearing One foot and sight of one eye Quadriplegia Seat Belt Benefit If you die in an automobile accident and were wearing your seat belt, your beneficiary (ies) will collect an amount equal to the AD&D benefit to a maximum of $10,000 in addition to the Basic Life and Basic AD&D benefits described above. Accelerated Benefit You may collect part of your Basic Life insurance prior to death if you are diagnosed as terminally ill and have a life expectancy of less than 12 months. You may apply for up to 80% of the Basic Life insurance in force, to a $40,000 maximum. The remaining benefit you do not elect is payable to your beneficiary upon your death. Total Disability If you become totally disabled (as defined by the policy) prior to age 60 and are disabled for at least 6 consecutive months, your basic life insurance may be continued until you reach age 65 without further premium payment by either your employer or you. At age 65 coverage terminates, however you may continue coverage by applying for a conversion policy at that time. Additional Benefits Included Adaptive Home/Vehicle, AirBag, Child Education, Coma, Day Care, Exposure and Disappearance, Felonious Assault, Rehabilitation, Repatriation, Spouse Education. Basic Life Insurance Exclusions None AD&D Insurance Exclusions Benefits are not payable for losses due to suicide or attempted suicide, riot, war or act of war, military service, felony, voluntary use of a controlled substance. You may convert your Basic Life insurance to an individual policy if your coverage is terminated due to Conversion termination of employment or other loss of eligibility. You have 31 days from the earliest of, the date your employment terminates or other loss of eligibility to apply for the Conversion policy. Dependent Life Dependent Life Benefits Eligible Dependents Exclusions Conversion Document1 2/6/2016 $2,000 Spouse, $200 per Child. Price is $.75 for dependent coverage, regardless of number of dependents. Legal spouse and children to age 26. See certificate for definition of eligible dependent child. None You may convert your Dependent Life insurance to an individual policy if your coverage is terminated due to termination of employment or other loss of eligibility. You have 31 days from the earliest of, the date your employment terminates or other loss of eligibility to apply for the Conversion policy. All Coverage Underwritten by Regence Life and Health Insurance Company This summary is provided for your convenience only and is not intended to be inclusive of all policy provisions. Please see your certificate for complete details. If there is any discrepancy between this document and the master policy, master policy provisions will prevail. Lincoln County School District Confidential Employees Benefits as of July 1, 2010 Long Term Disability Benefits Benefits Begin: Benefit Replacement Percentage Maximum Monthly Benefit Maximum Benefit Period Minimum Monthly Benefit Definition of Total Disability Partial Disability Qualification Pre-existing Condition Exclusion Exclusions & Limitations Taxability Document1 2/6/2016 Benefits begin after 60 days of disability or end of accumulated sick leave, whichever is longer. Benefits are paid monthly. Waiting period may be served with total or partial disability or a combination of both. 66.67% of your basic monthly earnings (Does not include bonuses or overtime) $2,000 If you become disabled, as defined by the policy prior to age 61, benefits are generally payable to normal retirement age as currently defined by Social Security. Please see your certificate for complete details. $100 You are considered totally disabled if you are unable to do the material duties of your own occupation during the first 24 months of disability, thereafter you must be disabled from any occupation that you are fitted for by reason of training, experience or education. If you are working and because of a disability are earning less than 80% of what you were earning before you became disabled, you may qualify for a partial disability benefit. A pre-existing condition is one that exists 3 months prior to your effective date of LTD coverage. LTD benefits are not payable for any disability caused by a pre-existing condition, if the disability begins during the first 12 months of your coverage. However, if during the first 12 months of coverage you can be treatment free for the pre-existing condition for 6 consecutive months, you will have coverage for such condition upon completion of the 6 month treatment free period. Benefits are not payable for losses due to intentional self inflicted injuries, war or any act of war, active participation in a riot, and committing or attempting to commit a felony. There is a 24 month mental/nervous benefit limitation. All benefits received are taxable. All Coverage Underwritten by Regence Life and Health Insurance Company This summary is provided for your convenience only and is not intended to be inclusive of all policy provisions. Please see your certificate for complete details. If there is any discrepancy between this document and the master policy, master policy provisions will prevail. Lincoln County School District Confidential Employees Benefits as of July 1, 2010 Voluntary Life Insurance (Payroll Deduction) Eligibility Amounts Available Employees enrolled in the Basic Life plan, their spouses and eligible dependent children. Employees may select from a minimum of $10,000 to $500,000 in $10,000 increments. Spouses may select from a minimum of $10,000 to $250,000 in $10,000 increments, not to exceed 100% of the employee’s elected amount. Spouses may enroll in the Voluntary Life plan even if the employee does not enroll. Dependent Child(ren) coverage may be selected if the employee or spouse is approved for coverage. Coverage may be elected from a minimum of $2,000 to $10,000 in $2,000 increments. Dependent children are eligible from birth to age 26. Age Reduction If you are still working the required number of hours to be eligible for this insurance at age 70, your benefits will reduce according to the following scale. Benefits reduce to: At age: 65% 70 50% 75 Accelerated Benefit You may collect part of your Voluntary Life insurance prior to death if you are diagnosed as terminally ill and have a life expectancy of less than 12 months. You may apply for up to 80% of the Voluntary Life insurance in force, to a $150,000 maximum. The remaining benefit you do not elect is payable to your beneficiary upon your death. Employees and Spouses – For new employees, the first $50,000 of Employee Voluntary Life coverage will be offered on a guarantee issue basis (no health statement required) if applied for within 31 days of initial eligibility. For new spouses, the first $10,000 will be offered on a guarantee issue basis (no health statement required) if applied for within 31 days of initial eligibility. Child(ren) – All amounts of coverage are guarantee issue (no health statement required) if coverage is elected within 31 days of initial eligibility. All amounts of coverage applied for after the initial 31 day eligibility period require a health statement to be submitted and approved by Regence Life and Health. Underwriting and Effective Date Any coverage requiring approval of a health statement is not effective until approved in writing by Regence Life and Health. The effective date of approved coverage will be assigned by Regence Life and Health. Total Disability Cost - Rates Exclusions Conversion Portability Document1 2/6/2016 In some cases, we may request a Paramed Exam. If requested, the Paramed Exam will be at Regence Life and Health’s expense. If you become totally disabled (as defined by the policy) prior to age 60 and are disabled for at least 6 consecutive months, your Voluntary Life insurance may be continued until you reach age 65 without further premium payment by either your employer or you. Employee and Spouse premiums are based on their individual ages and are paid through the employee’s payroll deduction. Employee and Spouse Monthly Rate per $1,000 of Coverage Age Rate Age Rate Age Rate Under age 25 $.057 45-49 .207 70-74 $1.668 25-29 .061 50-54 .353 75+ 2.550 30-34 .070 55-59 .554 Child(ren) - $.14 per $2,000 increment regardless of 35-39 .085 60-64 .753 the number of covered children. 40-44 .125 65-69 1.078 Benefits are not payable for losses due to suicide or attempted suicide during the first two years of coverage. You may convert your Voluntary Life insurance to an individual policy if your coverage is terminated due to termination of employment or other loss of eligibility. You have 31 days from the earliest of, the date your employment terminates or other loss of eligibility to apply for the Conversion policy. Portability allows you and your covered dependents to continue your Voluntary Life insurance if your coverage ends, provided you are under age 65, not retiring and are not disabled. The rates charged will be the current rates plus a billing fee. To elect coverage, please complete the Portability Application and return it with your premium check to Regence Life and Health within 31 days from the date your group coverage ends. If elected, Portability coverage will end the earliest of when you reach age 65 or when this master policy terminates. All Coverage Underwritten by Regence Life and Health Insurance Company