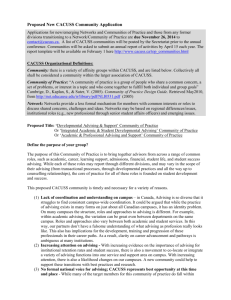

Terms of Reference

advertisement

FINANCE COMMITTEE Terms of Reference Approved by the CACUSS Board on April 25, 2012. Proposed updates, January 2015 Established by the CACUSS Board on April 25, 2012, the CACUSS Finance Committee is a sub-committee of the Board of Directors. It’s mandate is to provide strategic recommendations, advice and guidance on the finances of the organization, to ensure equitable and accountable financial planning to support the success of CACUSS communities,, and to support the development and implementation of strategies to ensure long-term financial strength and health of the organization. The CACUSS Board of Directors has overall responsibility for ensuring that the organization is fiscally accountable. Principles: The CACUSS Finance Committee will: Make responsible and sustainable financial recommendations to the CACUSS Board in keeping with CACUSS By-laws and policies, Ensure that funds for agreed upon organization-wide priorities are adequately budgeted for, and where necessary prioritize the expenditures, Endeavour to ensure that funds are allocated fairly and appropriately to support the activities of CACUSS communities, Identify where administrative expenditures might be more efficient , Ensure that organizational funds are invested soundly and that strategic investment plans are put in place for contingency and longer term needs of the organization, Review financial performance quarterly and annually to ensure that the organization is meeting its financial goals and raise issues that require action to the Board of Directors, Composition/Membership Voting Members (7 members) CACUSS Finance Director (Chairperson) 3-4 representatives from CACUSS Communities of Practice. The recruitment and application process should ensure that applications come forward representing a broad range of members from various CACUSS communities and also representative of various regions and institutions 1-2 members at-large, not currently sitting on the CACUSS Board of Directors-- Competencies should include: experience managing large budgets and or experience with large non-profit budgets and accounting and finance background Non-voting CACUSS Executive Director Membership shall be set on June 1 annually in keeping with Elections/Annual General Meetings. . Members will be recruited from the general membership via the Elections/Nominations process each winter. The Nominations/Elections/Leadership Development Committee will review applications and recommend the Committee membership to the CACUSS Board of Directors. Terms will be staggered for 2 years. An annual orientation will be held to ensure new committee members are prepared to actively participate in the Committee. Decision Making: Official proceedings of the Finance Committee require a quorum of at least 4 voting members, including the Finance Director.. The Committee will operate on a consensus model. Consensus shall be defined as: Consensus in decision making means that all members generally agree that the decision is acceptable. Consensus does not require that everyone be in complete agreement, but only that all be willing to accept—consent to—a decision. The Chair will endeavour to bring the Committee to consensus when making a recommendation to the CACUSS Board. Where voting is necessary, a minimum of 4 votes will be required for a motion to go forward to the CACUSS Board of Directors for consideration. Accountability: The Finance Committee is a sub-committee of the CACUSS Board. Recommendations from the Finance Committee move forward to the CACUSS Board of Directors for approval in accordance with the CACUSS bylaws. The CACUSS Finance Director will submit a quarterly written report to the CACUSS Board of Directors on the activities of the Finance Committee. Minutes of the Finance Committee can serve in place of a written report if appropriate. Accountability to the CACUSS membership will be facilitated by an annual presentation of the Finance Director’s report to the membership. The CACUSS Finance Director’s report will include the organization’s budget, as well as a Statement of Revenue, Expenditures and Investments. The Finance Director will present his/her report to the Finance Committee and the CACUSS Board of Directors for review before presentation at the Annual General Meeting. An annual review of the Association’s Finances will be conducted by a certified accountant. This “Engagement Review” will be accepted by the Finance Committee and then the CACUSS Board before being made available to the membership. The engagement review timeline is outlined in the by-laws. Finance Committee Role: The role of the Finance Committee is to make recommendations to the CACUSS Board on the following: An annual operating budget of the organization (with input from CACUSS committees, CACUSS staff, and the CACUSS Board), Financial policies of the organization, Organizational investments and allocation of assets including advising (where necessary) about potential large contracts in relation to the priorities and financial sustainability of the organization, Other financial matters at the request of the Board of Directors and/or the Executive Committee. Review of Terms: These terms will be reviewed every two years. Meetings: The Finance Committee will meet a minimum of four times per year. Typical meeting schedule will be bimonthly, September, November, January, March, May, and July. Additional meetings may be scheduled at the request of the Board of Directors or Finance Director.