EC364 MS 2013

advertisement

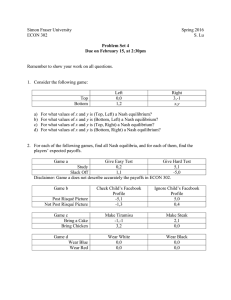

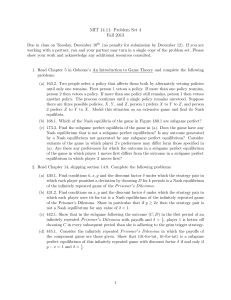

EC364: Game Theory in Economics, Finance and Business April 2013 Guide to Answers Question 1: (a) There are three Nash equilibria. A2, B1 and A1, B2 in pure strategies are straightforward. To find the equilibrium in mixed strategies, let p be the probability that player A chooses A1, 1 – p that A2 is chosen; similar let q be the probability that player B chooses B1, 1- q that B2 is chosen. Calculating the expected payoffs of A when choosing A1 and A2 and equalising the two leads to q* = 2/3. Similarly, we find p* = 5/8. The game’s expected payoffs for A and B are therefore 4/3 and 45/24 resp. (b) Backward induction for the game where A moves first gives a single subgame perfect Nash equilibrium: A1, B2. B is not able to make a credible commitment to play B1. Payoffs are therefore 4 for A and 3 for B. (c) Backward induction for the game where B moves first again gives a single subgame perfect Nash equilibrium: B1, A2. Now A is not able to make a credible commitment to play A1. Payoffs are therefore 2 for A and 5 for B. Clearly, the game offers a first mover’s advantage. Question 2: (a) Players are not able to make credible commitments (non-cooperative game). Communication may help but does not guarantee bypassing the trap (cheap talk). Both players have a dominant strategy which leads to a Pareto-inferior result; both could do better. However, the temptation built into the structure of the game makes the superior outcome unlikely. The inferior outcome is the only Nash equilibrium. (b) There are many real-world scenarios that show the structure of a PD; all examples of the ‘tragedy of the commons’ are points in case. (c) Three possible devices are: External threat (mafia), external reward, iteration of the game where internal threats (punishment) and rewards (forgiving) are operative as in ‘tit-for-tat’. Page 1 of 2 EC364 MS (May/June 2013) Question 3: (a) ‘Chicken’ is the name given to the one who surrenders in this coordination game where players want to avoid a confrontation with catastrophic consequences for all. There are two Nash equilibria in which the confrontation is avoided. However, players have opposite preferences. The result depends on who backs down, ‘blinks’ first. (b) There are many real-world scenarios that show the structure of a ‘chicken’. One of the best known is the Cuban missile crisis in 1962. But many negotiations have this kind of structure. Governments and central banks are often involved in a chicken game when it comes to the preferred ‘policy mix’. (c) To be successful in a chicken game a player must have strong nerves and must be able to make his opponents believe that he will rather risk a confrontation than back down. He may use a suitable device to back his commitment up (‘burning bridges behind oneself’). Question 4: (a) The game tree has to be drawn and the game analysed using backward induction. The only subgame perfect Nash equilibrium is a, a, which gives both a payoff of 20. (b) The game matrix shows that this equilibrium is one where the sum of profits is maximised. Firms have an incentive to collude because of the credible threat that both produce c, which leads to the worst otcome where both get 15. (c) In its strategic form, the game has a unique Cournot-Nash equilibrium where both produce b and end up with 18 each. If the competitors cannot observe the other’s move or cannot react to such an observation, this is the only stable outcome. Question 5: Brief explanations of all terms/concepts are required. Page 2 of 2 EC364 MS (May/June 2013)