Here

advertisement

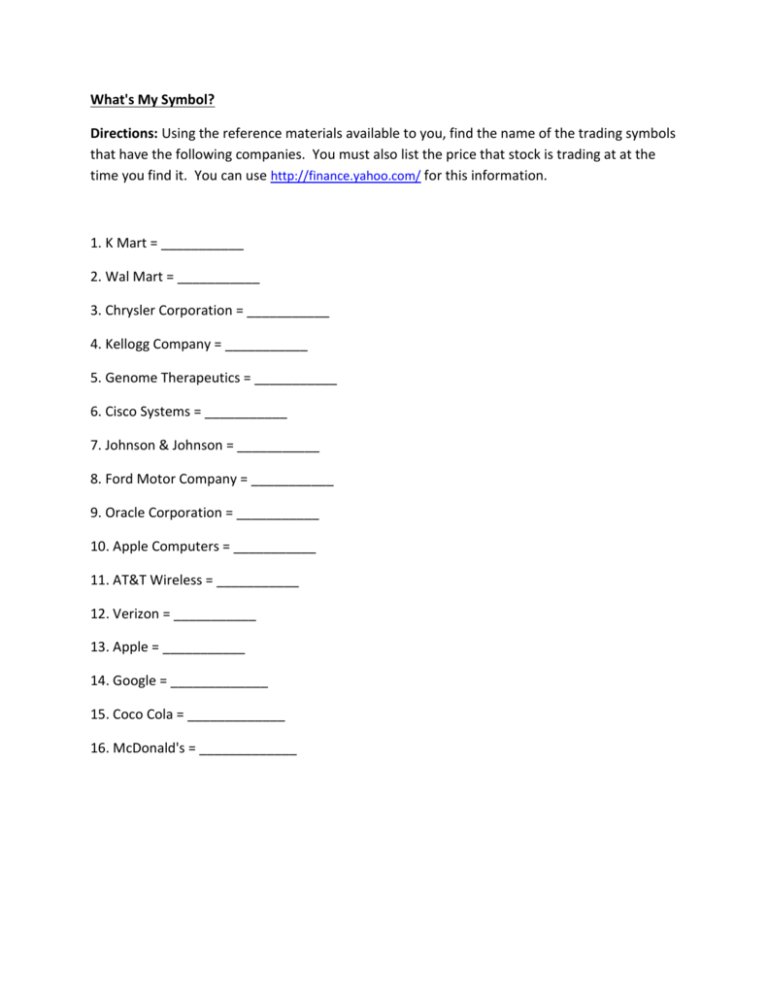

What's My Symbol? Directions: Using the reference materials available to you, find the name of the trading symbols that have the following companies. You must also list the price that stock is trading at at the time you find it. You can use http://finance.yahoo.com/ for this information. 1. K Mart = ___________ 2. Wal Mart = ___________ 3. Chrysler Corporation = ___________ 4. Kellogg Company = ___________ 5. Genome Therapeutics = ___________ 6. Cisco Systems = ___________ 7. Johnson & Johnson = ___________ 8. Ford Motor Company = ___________ 9. Oracle Corporation = ___________ 10. Apple Computers = ___________ 11. AT&T Wireless = ___________ 12. Verizon = ___________ 13. Apple = ___________ 14. Google = _____________ 15. Coco Cola = _____________ 16. McDonald's = _____________ Name ___________________________ Date ____________________ Calculating Your Return on Investment (ROI) Many times when investing money; people lose sight of why they are investing that money. The point is to make more money from your current money. It’s great to get a $100 return from an investment. Would you rather have someone give you $100 of their money for $9 of your money or $99 of your money? $9 would put you in a much better position. In this case you are risking a lot less of your own money. You can calculate the return of money on your investment using this calculation: ROI % = Gain from Investment – Money Invested x Money Invested 100 For example if Judy invests $350 in a bond fund and after one year that investment is now worth $430 her ROI can be calculated by: 430 – 350 350 x 100 = 22.86% 1. Calculate the ROI of an investment that you purchased at $5,382 and sold at $7,129. 2. What is the ROI of your mutual funds that you buy at $35,982 and sell at $41,938? 3. You purchase 12 shares of Bobby Toy Corp. stock at $31.25. You sell all the shares at $42.93, what is your ROI? Name ___________________________ Date ____________________ Reading the Language of the Street Directions: Using the data table as a reference, answer the questions below. 52 Week Stock High Low 644.00 310.50 Apple 670.25 473.02 Google 15.37 9.05 Ford Div 0 0 1.87 Yld % 7.26 10.9 -1.2 P/E 13.78 18.52 2.13 Sales High Low Last 100s 189282 578.36 565.17 581.82 24704 607.89 596.81 596.97 5327 10.87 10.63 10.67 1. How many trades of Apple were made? 2. What is the common stock dividend of each of these companies stocks? Apple _______ Ford _______ 3. Which stock is trading closest to its high of the year? 4. What was the decrease in the dollar value of Google stock today? 5. What was Ford's closing price? 6. Which company has the most attractive P/E ratio? Why? 7. If you bought 100 shares of Google at its low for the year and sold it at this day's closing price, what would be your capital gain? Chg -2.85% -2.30% -2.29%