Economics 2 Spring 2014 Unit 3 Study Guide Chapters 10, 11, 16

advertisement

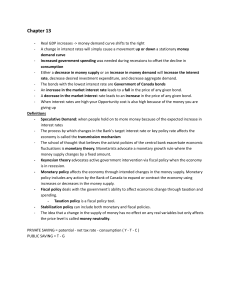

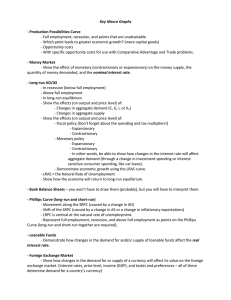

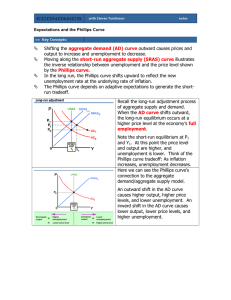

Economics 2 Spring 2014 Unit 3 Study Guide Chapters 10, 11, 16, 13, and 12 All page numbers and section headings are for the PDF download version of the textbook. Italicized sections are independent reading sections and are not covered in the lecture, but will be on the test. What I expect you to know for the test: Chapter 10 - What are Financial Markets?: Slide 3 and Introduction, page 237. - The Bond/Credit Market: Slides 1-12 and Sections 1.0,1.1, pages 238-240. - The Bond Market and Aggregate Demand: Slides 12-15 and Section 1.1, pages 238-240. - The Demand for Money: Slides 16-26 and Sections 2.0,2.1, pages 244-248. - The Supply of Money: Slide 27 and Section 2.2, pages 248-249. - Equilibrium in the Money Market: Slides 28-33 and Section 2.3, page 249. - Changes in the Money Market: Slides 34-37 and Section 2.4, pages 249-251. Chapter 11 – Introduction, page 259. - Goals of Monetary Policy: Slides 39-42 and Sections 1.0,1.1, pages 260-262. - Monetary Policy and Economic Variables: Slides 43-54 and Section 1.2, pages 262-264. - Lags: Slides 56-68 and Sections 2.0,2.1, pages 267-268. - Choosing Targets: Slides 69-76 and Section 2.2, pages 268-269. - Political Pressures: Section 2.3, pages 269-270. - The Degree of Impact on the Economy: Slides 77-86 and Section 2.4, pages 270-271. - Rational Expectations: Section 2.5, pages 271-272, explained in the next chapter. - The Equation of Exchange: Slides 87-94 and Sections 3.0,3.1, pages 274-275. - Money, Nominal GDP, and Price Level Changes: Slides 95-107 and Section 3.2, pages 275277. - Why the quantity theory is less useful in analyzing the short run: Slides 108-114 and Section 3.3, pages 277-278. - The latest new thing in macroeconomics: Market Monetarism: Slides 115-138 and not in the book. Chapter 16 – Introduction, pages 391-392. - What the Phillips Curve is: Slide 143 and Sections 1.0,1.1, pages 392-393 - How the Phillips Curve relates back to the AS/AD diagram: Slide 144 and Sections 2.0,2.1, pages 397-399. - The slope of the Phillip’s curve and SRAS based on if resources are unused or not: Slides 145147 and not in book. - How the Phillips Curve shifts in response to changes in inflation expectations: Slides 148-156 and Section 2.2,2.3, pages 399-400. - The inflation rate in the long-run: Sections 3.0, 3.1 and pages 403-406. - How there are two Phillips Curves, the short-run and the long-run PC’s: Slide 157 and Section 3.2, pages 406-409. - How the Phillips curve can be used to trace out the economic history of the United States over the last 45 years: Slide 158 and Sections 1.2,1.3,2.4, pages 393-395 and 400-401. - What Rational Expectations are: Slides 159-160 and Chapter 11, Section 2.5, pages 271-272. - How Rational Expectations fold the short-run into the long-run and make government expansionary and contractionary fiscal and monetary policy ineffective in changing output: Slides 161-170 and Chapter 11, Section 2.5, pages 271-272. - Winners and losers from inflation: Slides 171-188 and not in book. - What the real rate of interest is: Slides 175-178 and not in book. - The relationship between increases (and decreases) in the money supply and the interest rate: Slides 189-197 and not in book. - Politics, the Fed, Other Economies and Monetary Policy: Slides 198-204 and not in book. Chapter 13 – Introduction, page 313. - Meaning of Marginal Propensity to Consume (MPC): Slides 206-208 and Sections 1.0,1.1, pages 313-317. - How and why the Keynesian multiplier can cause originally small changes in investment, government, or consumer spending to result in big shifts in the aggregate demand curve (and the related importance of confidence levels in the economy): Slides 209-216 and Sections 2.0,2.1, pages 320-329. - How to construct a table showing the round by round and ultimate total change in I, C, and GDP started by a change in I: Slides 209-216 and Sections 2.0,2.1, pages 320-329. - What the numerical value of the Keynesian multiplier is: Slides 217-218 and Sections 2.0,2.1, pages 320-329. - How to translate the table into the AS/AD diagram: Slides 219-224 and Sections 3.0,3.1,3.2, pages 335-337. Chapter 12 – Introduction, pages 277-278. - What Fiscal Policy is and how the government can use it to counteract problems of recessions and inflations: Slides 225-229 and Sections 2.0,2.1,2.2,2.3,2.4,2.5,2.6, pages 297-301. - What are expansionary policies, i.e. increasing G and cutting T; and what are contractionary fiscal policies, i.e. cutting G and increasing T: Slides 225-230 and Sections 2.0,2.1,2.2,2.3,2.4,2.5,2.6, pages 297-301. - The 2 main practical problems of using fiscal policy: political problems and lag problems: Slides 231-233 and Section 3.0,3.1, page 303. - What Crowding Out is, and how crowding out destroys the usefulness of fiscal policy when it occurs: Slides 234-250 and Section 3.2, pages 303-305. Sections not covered and not on the test. Chapter 10: 1.2. Chapter 11: None. Chapter 16: None. Chapter 13: 1.2,1.3,2.2, Chapter 12: 1.0,1.1,1.2,1.3,1.4,1.5,3.3 “Greetings, my friend. We are all interested in the future, for that is where you and I are going to spend the rest of our lives. And remember my friend, future events such as these will affect you in the future.” – Criswell, opening lines in Plan 9 From Outer Space.