File - Brion M. Williams` ePortfolio

advertisement

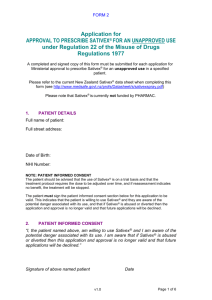

GW Pharmaceuticals Plc (NASDAQ: GWPH) Case Study Prepared for: Dr. Judith Hunt Prepared On: February 22, 2015 Brion Williams SIC/NAICS The SIC codes for GW Pharmaceuticals plc are listed below (RESEARCH; SIC): 2834 – Pharmaceuticals preparation The NAICS codes for GW Pharmaceuticals are listed below (NAICS): 325412 – Pharmaceutical Preparation Manufacturing Vision/Mission Statement Vision Statement: “Our vision is to be the global leaders in prescription cannabinoid medicines, through the rapid cost-effective development of pharmaceutical products which address clear unmet need.” (GW Pharmaceuticals plc). Mission Statement: “The group’s lead programme is the development of a product portfolio of cannabinoid prescription medicines to meet patient needs in a wide range of therapeutic indications, including Sativex Oromucosal Spray and Epidiolex for childhood epilepsy.” (GW Pharmaceuticals plc). Corporate Strategy: Attitude towards Growth GW Pharmaceuticals’ focus is to bring novel prescription medicines to market which provide patients with serious conditions with valuable medicines. Through rapid cost-effective product development, addressing market needs, and establishing commercial partnership, GW seeks to maximize the value of its products and shareholders returns. (GW pharmaceuticals) Strategic Posture GW Pharmaceuticals strategy is to maintain a world leading position in the field of cannabinoid science and in the research, development and commercialization of cannabinoid molecules as novel prescription pharmaceutical therapeutic candidates. (GW Pharmaceuticals) Strategies In use GW Pharmaceuticals is applying a cooperative strategy. GW pharm is in partnership with Otsuka, Novartis, Almirall, Bayer, Ipsen, and Neopharm. They have extended exclusive licenses with these companies where GW Pharm will supply and manufacture Sativex for the companies. In return the companies will pay the cost for these actions and has exclusive commercialization rights to Sativex within their region. (GW Pharmaceuticals) GW Pharmaceutical is also using a global strategy by using these companies. Granting the companies the right to their products guarantees their products will be marketed on a global scale. Companies such as Bayer will market Sativex in the UK and Canada. Likewise the other companies will market Sativex in their region giving GW Pharm a global presence. (GW Pharmaceuticals) Structure: Board of Directors Global Marketing Clinical Operations Director R&D Director Botanical Research GW Pharmaceuticals uses a functional structure. The board of directors has overall responsibility for the group. Its aim is to provide leadership and control in order to ensure the growth and development of a successful business. Under the Board of Directors is the company’s management team, which is comprised of 15 department heads. This setup allows each department head the ability to focus on their area and activities and leaving it to the Board of Directors to provide direction. (GW Pharmaceuticals) Business Level Strategies GW Pharmaceuticals seeks to enter into license agreements with major pharmaceutical companies with a view to those companies undertaking the sales and marketing of GW’s products. (GW Pharmaceuticals) While these companies promote GW’s products, GW will retain control over their products developments. GW Supplies finished packaged and labelled product to its pharmaceutical partners for the purposes of commercial distribution and sale. (GW Pharmaceuticals) Pricing Strategy GW Pharmaceuticals products are priced on the higher end of the product range. Compared to similar products on the market GW Pharm products such as Sativex are overpriced. Promotion Strategy GW pharmaceuticals aligns themselves with many different pharmaceutical companies such as Otsuka, Novartis, Almirall, Bayer, Ipsen, and Neopharm. These companies are in charge of promotion with in their region. Otsuka has an exclusive right to market Sativex in the US. Novartis has the rights to commercialize in Australia and New Zealand, Asia (excluding Japan, China and Honk Kong), Middle East (excluding Israel/Palestine) and Africa. Almirall is granted an exclusive license to market in the European Union (excluding the UK), EU accession countries as well as Switzerland, Norway and Turkey. Bayer has an exclusive license to market in the UK and Canada. Ipsen has the rights to promote and distribute in Latin America (excluding Mexico and the Islands of the Caribbean). Finally Neopharm has commercial rights in Israel/Palestine. (GW Pharmaceuticals) Placement Strategies GW Pharmaceuticals uses a third party to deliver their products to the public. Their headquarters is located in the United Kingdom. Their product can be found wherever prescriptions drugs can be purchased. Product Strategy Currently GW Pharmaceuticals offer Sativex, an oral mucosal spray with two principal cannabinoid components, cannabidiol (CBD) and Delta-9 Tetrahydrocannabinol (THC). This drug is used in treatments in the field of MS and pain. In 2013 GW commenced an orphan clinical program in pediatric epilepsy and was granted orphan drug designation by the FDA. The drug used it called Epidiolex and has reported significant anti-epileptiform and anticonvulsant activity. The drug is used in treatment of both Dravet Syndrome and Lennox-Gastaut Syndrome. Functional Strategies Clinical Science GW Pharmaceuticals clinical sector is a key part to their business strategy. The clinical department helps develop drugs and process them through clinical trials. GW Pharmaceuticals does a good job at hiring for this department. They hired Dr. Sommerville, a proven board-certified neurologists and has over twenty years of experience in the pharmaceutical industry. (GE Pharmaceutical) Global Marketing GW Pharmaceuticals has built a unique global marketing network. The department is led by Mr. Haynes a veteran in of the pharmaceutical industry with experience in product pre-launch, launch and lifecycle management. He also has experience in sales, market research, medical affairs, and marketing. Their marketing network covers many continents and has companies promoting for them around the world. Investor Relations In such a controversial market it is important to have a powerful team to attract investors. Investor relations fund the whole business strategy. GW Pharmaceuticals Vice president of Investor Relations has 25 years of experience in investor relations, financial communications and media relations. His expertise helps keep investors happy by providing detailed information. Industry Analysis Growth Rate Since 2009 to 2014, the growth rate of the Global Pharmaceuticals industry is 6.5% annually. (IBIS World, 2014) Competitors Companies in this industry manufacture and process pharmaceutical products. Major companies include Bristol-Myers Squibb, Eli Lilly, Johnson & Johnson, Merck & Co, and Pfizer (all based in the US), as well as AstraZeneca, Bayer, GlaxoSmithKline, Novartis, Roche Holding, and Sanofi. (Ranker) Driving Forces Demand for Pharmaceuticals is driven by the desire to cure illness and disease. The profitability of individual companies depends on their ability to discover and market new drugs. Small companies can compete effectively by specializing in drugs that target one or two specific ailments and by partnering with larger drug makers. Key Success Factors Understand the Business: It is important to have a holistic view of the business and the considerations necessary to innovate (Burger) Innovation: Companies often strive to acquire the latest tools and technologies but it these are not effectively integrated into business processes then the investment is essentially wasted (Burger) Implementation: Executing a successful implementation of tools/solutions. Think realistically, Prepare Carefully Be Flexible, Be Adaptive Secure Funding, and Provide Exposure (Burger) Future Opportunities: many disjoint products can be implemented across early R&D, but a comprehensive workbench is what is needed. (Burger) Integrate Enabling Technologies: Scientific Discovery, Genetics, Drug development (Burger) Porter’s Five Forces Model Supplier Power: the supplier power is limited as GW Pharmaceuticals grows their own crops for the development of their medicine. Buyer Power: After the legalization of marijuana in certain states the buyer power has increased. There is still a market for their Sativex but many will argue that marijuana has the same healing effects as Sativex. Competitive Rivalry: There are no competitors selling a product claiming to do the same as Sativex. Threat of Substitution: Close substitutes for Sativex are marijuana and edibles. The effects of marijuana are said to be the same a Sativex. Since the legalization of marijuana and the affordability consumers are more likely to purchase the substitutes. Threat of New Entry: Legalization of marijuana in some states in the US more companies are entering the marijuana growing field increasing the amount of substitutes on the market. SWOT Strengths: Strong expertise in the industry Partnerships with multiple companies gives them a global marketing network Expanding uses of their cannabinoids Weakness: Health issues due to use of marijuana Legal issues from cultivating Legal issues from selling marijuana Products require high quality medical marijuana Opportunity: Hospitals use their products as key medications Releasing new products (Epidiolex) Entering different divisions of Pharmaceuticals Legalization of marijuana in the US Only one drug offered to the public (Sativex) Need for more innovation Marijuana is not legal on the federal level Threats Appendix Income Statement Period Ending Total Revenue Sep 30, 2014 Sep 30, 2013 Sep 30, 2012 48,708 44,202 53,482 3,340 2,066 1,355 45,368 42,135 52,128 Research Development 70,480 52,950 44,533 Selling General and Administrative 11,894 5,757 5,846 Non Recurring - - - Others - - - Total Operating Expenses - - - Cost of Revenue Gross Profit Operating Expenses Operating Income or Loss (31,838) (16,955) 1,684 (96) 258 (16,667) 2,008 Income from Continuing Operations Total Other Income/Expenses Net Earnings Before Interest And Taxes Interest Expense Income Before Tax Income Tax Expense Minority Interest Net Income From Continuing Ops 5,379 (31,627) 99 104 2 (31,726) (16,771) 2,006 (7,962) (9,404) (2,015) - (23,765) - (7,367) - 4,021 Non-recurring Events Discontinued Operations - - - Extraordinary Items - - - Effect Of Accounting Changes - - - Other Items - - - Net Income (23,765) Preferred Stock And Other Adjustments (7,367) - Net Income Applicable To Common Shares (23,765) - (7,367) 4,021 - 4,021 Balance Sheet Period Ending Sep 30, 2014 Sep 30, 2013 Sep 30, 2012 Assets Current Assets Cash And Cash Equivalents 266,667 61,649 47,370 - - - 11,523 7,503 3,888 7,744 7,548 5,712 - - - 285,935 76,700 56,970 - - - 18,869 8,868 3,927 8,446 8,437 8,413 Intangible Assets - - - Accumulated Amortization - - - Other Assets - - - 449 1,449 - 313,699 95,454 69,311 Short Term Investments Net Receivables Inventory Other Current Assets Total Current Assets Long Term Investments Property Plant and Equipment Goodwill Deferred Long Term Asset Charges Total Assets Liabilities Current Liabilities Accounts Payable 20,064 15,287 14,717 204 162 - 7,825 5,151 3,955 Total Current Liabilities 28,093 20,600 18,672 Long Term Debt 15,738 3,085 - - - - 12,776 14,439 16,353 Minority Interest - - - Negative Goodwill - - - 56,608 38,124 35,025 Misc Stocks Options Warrants - - - Redeemable Preferred Stock - - - Preferred Stock - - - Common Stock 384 288 215 Short/Current Long Term Debt Other Current Liabilities Other Liabilities Deferred Long Term Liability Charges Total Liabilities Stockholders' Equity Retained Earnings (132,067) (111,682) (105,014) Treasury Stock - - - Capital Surplus 357,550 136,038 106,492 31,224 32,686 32,593 Total Stockholder Equity 257,091 57,330 34,286 Net Tangible Assets 248,645 48,893 25,873 Other Stockholder Equity Bibliography Standard Industrial Classification (SIC) System Search. (n.d.). Retrieved February 22, 2015, from https://www.osha.gov/pls/imis/sicsearch.html?p_sic=2834&p_search= Reference for Business. (n.d.). Retrieved February 22, 2015, from http://www.referenceforbusiness.com/industries/Chemicals-Allied/PharmaceuticalPreparations.html Porter's Five Forces of Competitive Position Analysis - CGMA. (n.d.). Retrieved February 22, 2015, from http://www.cgma.org/Resources/Tools/essential-tools/Pages/porters-fiveforces.aspx?TestCookiesEnabled=redirect Pharmaceutical Preparations Companies. (n.d.). Retrieved February 22, 2015, from http://www.ranker.com/list/pharmaceutical-preparations-companies/reference NAICS Search Results. (n.d.). Retrieved February 22, 2015, from http://www.naics.com/naicssearch-results/ Global Pharmaceuticals & Medicine Manufacturing: Market Research Report. (n.d.). Retrieved February 22, 2015, from http://www.ibisworld.com/industry/global/global-pharmaceuticalsmedicine-manufacturing.html GW Pharmaceuticals: High As A Kite And Too Close To The Sun. (n.d.). Retrieved February 22, 2015, from http://seekingalpha.com/article/2034243-gw-pharmaceuticals-high-as-a-kite-andtoo-close-to-the-sun?page=2 (n.d.). Retrieved February 22, 2015, from http://gw-pharmaltd.salisbury.amfibi.company/uk/c/88562-gw-pharma-ltd (n.d.). Retrieved February 22, 2015, from http://www.lexjansen.com/pharmasug/2004/FDACompliance/FC11.pdf