co-authored by Ryan Trudgen, Monash University

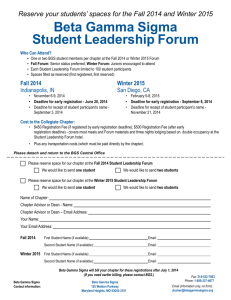

advertisement