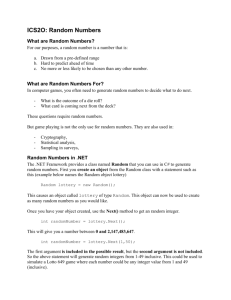

PS5 - Suffolk University

advertisement

Department of Economics, SUFFOLK UNIVERSITY

Jonathan Haughton, Fall 2014

ECONOMICS 826: Financial Economics

ASSIGNMENT 5

Answers to this assignment are due back by Wednesday, October 8, 2014.

Question 1: Measuring betas

1. A market has only the following three risky assets:

E(r) (% per month)

Risk (i.e. σi) , %

Covariance with market (σim)

Asset 1

2.03

2

1.12

Asset 2

1.79

1

0.90

Asset 3

1.49

1

0.62

Market

0.92

portfolio

The market portfolio has 4% invested in Asset 1, 76% in Asset 2, and 20% in Asset 3.

a. What is the expected return of this portfolio?

b. What are the betas of the three risky assets?

c. If the riskless rate of interest is 0.8% (per month), are these three securities priced correctly?

Question 2: Allais Paradox

Assume that we are in the world of cumulative prospect theory (CPT), and that the value function is as

follows:

𝑥𝛼

,𝑥 ≥ 0

𝑣(𝑥) ≔ {

𝛽

−𝜆(−𝑥)

,𝑥 < 0

Assume too that the probability weighting function is given by:

𝑤(𝑝) ≔

𝑝𝛾

(𝑝𝛾 +(1−𝑝)𝛾 )1/𝛾

.

If λ=2.25, α=β=0.8, and γ=0.7, show that the Allais Paradox is resolved. You will remember that the four

lotteries in the Allais Paradox are as follows:

Lottery A

Lottery B

Lottery C

Lottery D

State

Outcome

State

Outcome

State

Outcome

State

Outcome

1-33

2500

1-100

2400

1-33

2500

1-33

2400

34-99

2400

100

0

34-100

0

34-90

0

100

2400

Allais found that most people prefer B to A, and C to D, even though this behavior is not rational (in the

sense of being consistent with expected utility theory).

[Time needed: 5 hours]

1|Page

Question 3: CPT

Here is exercise 2.10 from the Hens and Rieger book, along with their answer to the question. After

working through this, answer the subsequent questions, which are variants on this theme:

“Let us assume that a value function v is given by v(x):=x and a weighting function w is w(F)=√F. A

lottery is described by the probability measure p:=a(x)dx where the probability density a is given by

𝑥

, 𝑖𝑓 0 ≤ 𝑥 < 1

𝑎(𝑥): = {2 − 𝑥 , 𝑖𝑓 1 ≤ 𝑥 < 2

0

, 𝑜𝑡ℎ𝑒𝑟𝑤𝑖𝑠𝑒.

Compute the Cumulative Prospect Theory (CPT) value of this lottery. Use this to compute the certainty

equivalent. Explain the difference between the certainty equivalent and the expected value.”

[Time needed: 5 hours]

2|Page

Now try the following.

a. Let us assume that a value function v is given by v(x):=x and a weighting function w is w(F)=√F. A

lottery is described by the probability measure p:=a(x)dx where the probability density a is given

by

𝑥

, 𝑖𝑓 0 ≤ 𝑥 < 0.5

, 𝑖𝑓 0.5 ≤ 𝑥 < 2

0.5

𝑎(𝑥): = {

2.5 − 𝑥 , 𝑖𝑓 2 ≤ 𝑥 < 2.5

0

,

𝑜𝑡ℎ𝑒𝑟𝑤𝑖𝑠𝑒

Graph this probability density and verify that it integrates to 1.

b. Compute the CPT value of this lottery (or at least set up an expression, like the last equation in

the sample answer).

c. Find the expected value of this lottery. [Should not be too hard!]

[Time needed: 5 hours]

3|Page