DOCX file of ANZSCO 2211-11,12,13 Accountants

advertisement

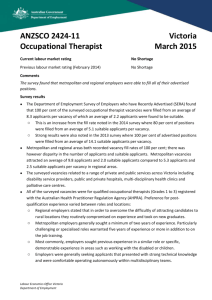

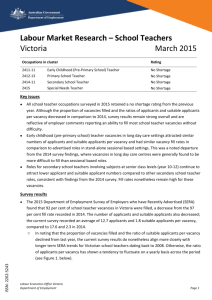

ANZSCO 2211-11,12,13 Accountants Victoria March 2015 Current labour market rating No Shortage Previous labour market rating Not previously assessed at state level Comments Employers were able to fill most advertised vacancies with qualified and experienced accountants without difficulty. Survey results The Department of Employment Survey of Employers who have Recently Advertised (SERA) for accountants found that 82 per cent of vacancies were filled within the survey period from an average of 50.3 applicants and 1.7 suitable applicants per vacancy: o Metropolitan employers filled 83 per cent of vacancies from an average of 64.7 applicants and 1.8 suitable applicants per vacancy. Regional employers filled 80 per cent of vacancies from an average of 15.8 applicants and 1.6 suitable applicants per vacancy. The surveyed vacancies were broadly distributed across the general, management, and taxation accountant classifications and related to a range of accounting roles including; corporate and business services, public practice, and insolvency, bankruptcy, taxation and auditing services. Associated industry areas included dedicated accountancy firms as well as the finance, construction, manufacturing, the health sector and non-government organisations. All vacancies required an accounting related bachelor degree as the minimum qualification level. There were a variety of desired experience ranges, starting with 1 to 2 years for a small number of junior and administrative roles. Intermediate positions required 2 to 3 years of experience with the common expectation to be also undertaking study toward a Chartered Accountant (CA) or Certified Practicing Accountant (CPA) qualification. Senior level roles generally ranged upwards from 4 to 5 years of experience to 10 years and above, and most often also required applicants to hold a CA or CPA. Significant focus was placed on the setting and nature of previous experience, with many employers noting the growing trend for the accounting profession to become increasingly specialised to individual industry sectors and related functions. Accordingly, previous experience in a related industry undertaking similar accounting duties was commonly considered to be essential. While there was a wide variety of desired accounting skills according to the conditions of individual vacancies, commonly stated requirements included a high level of proficiency with accounting software packages (in addition to well-developed general computer skills) and sound current knowledge of the Australian accounting industry and associated regulatory issues. Labour Economics Office Victoria Department of Employment Desired employability capabilities included workflow management skills, as well as strong interpersonal and communication skills which were regarded as essential given that operational stakeholder engagement is a key aspect of many accounting roles. Although employers were able to fill most advertised vacancies at the time of the survey, roles requiring CA and CPA qualified accountants at the mid to senior level experience range (i.e. 4 to 8 years) were consistently noted to be the most challenging to fill, particularly in relation to taxation, auditing, insolvency and bankruptcy roles requiring particularly specialised and detailed technical knowledge: o The survey found that these vacancies attracted lower numbers of qualified and suitable applicants, at 13 qualified and 0.75 suitable applicants per vacancy. By comparison, vacancies for general and management accounting roles both attracted more applicants, with 50.4 qualified and 2.0 suitable applicants per vacancy. Unsuitable applicants As a proportion of the 83 per cent of applicants that were qualified accountants, employers considered 96 per cent to be unsuitable. The most common reason for unsuitability was a lack of experience for the desired duration, or a lack of previous experience in a role within a related industry sector with similar accountancy functions: o A large proportion of applicants who lacked previous experience were represented by recent graduates who had failed to secure a position in a dedicated graduate development programme. Employers noted new graduates were unlikely to be considered suitable for most of the surveyed accounting vacancies without completion of a graduate development year. There were a number of vacancies which listed CAs and CPAs as preferential and in those instances where these advertisements attracted applicants who did possess this level of qualification, applicants who did not possess this level of qualification were commonly considered unsuitable. A lack of interpersonal and communication skills was identified as a common reason for unsuitability in relation to employer requirements regarding stakeholder engagement capabilities. Employers noted that limited English skills were a common barrier for some applicants from overseas backgrounds. Demand and supply trends Demand for accountants can be found across a broad variety of sectors, however the accounting services sector represents the single largest area of demand. Data from the Australian Bureau of Statistics (ABS) data shows that at the end of the 2013-14 financial year there were 8,413 accounting service businesses in Victoria; an increase of 1 per cent compared to 2013-14. Previously, the number of accounting services in Victoria had declined by 2 per cent in 2012-13.1 The Department of Employment Internet Vacancy Index (IVI) shows that online advertisements for accountants declined during the twelve months to February 2015. Online vacancies also declined during the previous five years dating from 2008-09.2 1 ABS, Cat. no. 81650, Counts of Australian Businesses, including Entries and Exits, Jun 2010 to Jun 2014, Table 1: Businesses by Main State by Industry Class by Employment Size Ranges, June 2014, 8 April 2015 2 Department of Employment, Internet Vacancy Index, February 15, 12 month moving average Labour Economics Office Victoria Department of Employment For the supply of new accountants, entry into the occupation is most commonly via completion of a bachelor degree in accounting, or via a business or commerce degree undertaking majors in accounting: o The latest available data from the Australian Government Department of Education and Training for bachelor degree courses related to accounting (including accounting degree students as well as students from other courses majoring in accountancy studies) shows there were 1,390 completions in 2013, a 3.7 per cent decrease from 2012. Completions had previously declined by an average of 5.1 per cent per annum during the 5 year period from 2008 to 2012.3 Data from the Department of Immigration and Border Control shows that 457 visas are an increasing source of supply for accountants in Victoria. Visas in this subclass were granted to 311 persons in the 2013-14 financial year; while this is down from 329 persons in 2012-13, a longer term comparison shows 457 visas for accountants had previously averaged 184 persons per annum from 2005-06 to 2011-12.4 3 4 Department of Education and Training, Higher Education Student Data Collection, 2013, customised tables Department of Immigration and Border Control, Subclass 457 visas granted, 31 March 2015 Labour Economics Office Victoria Department of Employment