Call for Evidence

advertisement

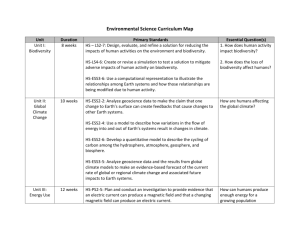

B@B Workstream 3: Access to Finance and Innovative Financing Mechanisms – Call for Evidence The Finance Workstream Workstream 3 of the B@B Platform seeks to demonstrate the benefits to business of biodiversityrelated investment. The workstream provides opportunities for businesses, including SMEs, to showcase financing schemes for biodiversity and champions in the finance sector who are funding biodiversity related projects or who are using nature-related criteria for financing decisions. The objectives of the Workstream are to: Identify and profile biodiversity investment opportunities (e.g. pro-biodiversity business/certified products; biodiversity offsetting and habitat banking, PES schemes and biocarbon markets, financial services); Identify funds and financial instruments providing investment in biodiversity in the EU and worldwide. Identify key actors in the financial sector championing integration of biodiversity into investment decisions. B@B Members, Observers and Representatives are all invited to participate in the work. Full Members are welcome to showcase examples of products, services and initiatives that they are involved in. Representatives are encouraged to provide evidence of initiatives they are aware of on behalf of other organisations with their consent. Observers are also welcome to contribute and companies that provide evidence of action on their own organisation will be automatically eligible to become Full Members of this Workstream. Other interested parties are also invited to contribute evidence in response to this call, and to Join the Platform. This Call for Evidence introduces some of the topics that we are exploring, and sets out some of the questions that we would like you to help us address. Biodiversity Investment Opportunities Addressing the loss of biodiversity will generate a range of opportunities for business and finance. These opportunities include: ■ Certified goods and services - Goods and services certified as having minimal or positive impacts on biodiversity command premium prices and represent a major growth opportunity in the EU. Biodiversity is being increasingly incorporated within standards and certification systems for a range of sectors, particularly sustainable agricultural products. ■ Biodiversity offsetting and habitat banking schemes - Compensating for development impacts on biodiversity can accelerate regulatory approval, enhance reputational value and secure additional finance for conservation. Voluntary offsets projects are in place in a number of countries, and national or regional governments are increasingly putting regulatory requirements or guidance in place to incentivise market growth. Offsets have high potential to mobilize private sector funds for new investment in ecological networks and species protection. Companies such as CDC-Biodiversité in France and the Environment Bank in the UK are actively involved in offsets and habitat banking. ■ Green Infrastructure projects offer a cost-effective alternative to engineered solutions whilst having positive benefits for biodiversity, offering significant potential to tap into new and diverse financing and revenue streams. Projects that link GI to existing ‘grey’ infrastructure - such as Gaz de France’s creation of ecological networks linked to its gas pipeline infrastructure - can provide tangible benefits and overcome scepticism amongst decision-makers. Green Business Improvement Districts – such as that in London - involve companies working together to secure finance for green infrastructure. ■ Payments for Ecosystem Services and bio-carbon markets are expanding and are expected to have a global market value of $7bn by 2020. For example, the World Bank’s BioCarbon Fund 1 recently announced a dedicated $280m Initiative for Sustainable Forest Landscapes, building on its broad portfolio of investments in forest and agro-ecological carbon stocks, and support from corporate partners such as Unilever, Mondelez and Bunge. ■ Other business opportunities related to biodiversity include environmental technologies, green financial services and sustainable tourism. ■ Innovative financing offers opportunities to support these investments in biodiversity. For example, the EU is supporting the financing of biodiversity related investments through the new Natural Capital Financing Facility, which will provide capital to support investments in privatesector projects focusing on natural capital in four broad categories: Payments for Ecosystem Services (PES), Green Infrastructure, Offsets (including land and habitat banks) and Innovative Pro Biodiversity and Adaptation Businesses. The Workstream will explore these opportunities and examine the implications for finance. Questions to be addressed include: What business opportunities in the EU are linked to biodiversity action? What is the size of the market and the market trends for these different opportunities? What are the implications of these opportunities for the financial sector? How can new and innovative financing mechanisms support biodiversity related business opportunities? Members, Observers and Representatives of the B@B Platform, and other interested parties, are invited to provide examples of biodiversity related business activities in which they are involved, and to highlight the financing structure, any financing needs, challenges and opportunities. Biodiversity Funding Mechanisms A growing range of financial instruments and services are supporting biodiversity related investments. These include: ■ Venture capital funds and debt finance initiatives providing finance for small businesses involved in biodiversity related activities. For example, the EcoEnterprises Fund II is a venture capital fund with support from a range of international institutions, and supports organic agriculture, apiculture, aquaculture, community-based energy, ecotourism and forest products. Other venture capital investors involved in biodiversity related activities include Root Capital, Triodos, Merkos, CreSud and Rabobank; ■ Retail investment funds that invest in companies actively working to protect biodiversity. An example is Sumitomo Mitsui Trust Bank, Japan, which in 2010 began selling the world’s first Biodiversity-responsible Investment Fund; ■ Banking services which support biodiversity investments. The Netherlands provides tax incentives for the use of savings to fund green projects such as biodiversity offsets: ING Group has established a dedicated bank, ‘Postbank Groen’ for ecological savings and investments, including nature conservation. The bank invested 550m Euros in the first 3 years of its existence, around 17m of which was directed to nature protection projects. Other banks involved in biodiversity related investments in the EU include Rabobank, Deutsche Bank, ASN Bank, ABN AMRO, Fortis, Triodos, Banco Espírito Santo (BES), HSBC and SocGen, ■ Specialist funds and investment vehicles. Green bonds and forest bonds are being actively promoted by a number of governments, with Ireland recently becoming the first country to provide tax incentives for forest bonds. Markets for combined carbon sequestration and conservation services also look set to grow with the emergence of instruments such as the UN REDD+ programme. Forest Finance provides investment products related to reforestation and sustainable forest management. 2 ■ Civil Society Organisations involved in financing biodiversity projects. The International Union for the Conservation of Nature (IUCN) has developed several funds that provide support for conservation priorities. One of these, the European Conservation Farming Initiative provides debt, equity and guarantees in collaboration with existing financial institutions to support development of organic farming projects, with a focus mostly on Central and Eastern Europe. Rural Investment Support for Europe (RISE) also provides support to innovative pilot projects, including PES projects with a watershed focus. Fauna & Flora International is developing a small fund to provide loans to small projects relating to biodiversity conservation. ■ Partnerships between the private, public and NGO sectors to invest in biodiversity projects. For example the Fundació Caixa Catalunya, created by the Caixa Catalunya Savings Bank, has established a network of protected areas, which are managed by the fund together with NGOs and local authorities. ■ EU grants and financial instruments. The LIFE+ fund provides grants for natural capital projects and plays an important role for catalysing and levering in funding from a range of public and private sector sources. The newly established Natural Capital Financing Facility (NCFF), jointly administered by the European Investment Bank and European Commission, will support debt and equity investments in natural capital projects across the EU, particularly in the fields of PES, biodiversity offsets, green infrastructure and a range of pro-biodiversity businesses. The workstream will explore the growing range of financing mechanisms for biodiversity and highlight examples of good practice, as well as opportunities for future growth. It will consider how the private, public and NGO sectors can work together to increase biodiversity finance. Questions to be addressed include: How are new sources of finance helping to support investment in biodiversity action in the EU? Where are the opportunities for future growth in biodiversity finance? What barriers and challenges need to be overcome to increase biodiversity finance? How can the private, public and voluntary sectors work together to maximise the available opportunities? Members, Observers and Representatives of the B@B Platform, and other interested parties, are invited to provide examples of biodiversity financing initiatives, mechanisms and services in which they are involved, and to highlight future needs, challenges and opportunities. Finance Sector Champions As well as providing direct finance for biodiversity investment, champions in the finance sector are involved in a range of activities that help to integrate biodiversity considerations into wider financial decisions. Examples of these activities include: ■ Standards - Financial sector standards are playing an increasingly influential role in biodiversity protection. Banks and commercial lenders such as ABN AMRO have developed biodiversityrelated lending and investment criteria, in many cases through partnership with civil society. As regulatory, physical and reputational risks relating to biodiversity increase, adoption of such criteria looks set to grow. Sector-wide initiatives such as the UNEP Finance Initiative are rapidly expanding and provide assurance to consumers and investors. Standards set by the Business and Biodiversity Offset Program (BBOP) and others are increasingly important as institutions such as the International Finance Corporation and European Investment Bank adopt mandatory offset requirements. The European Centre for Nature Conservation’s European Biodiversity Standard is an example of effective public-private partnership that certifies companies according to biodiversity criteria. ■ Advisory services - Financial institutions are actively building advisory capacities in areas relating to biodiversity protection. In recognition of the need for specialist knowledge in investments relating to biodiversity, many financial institutions are developing internal or external advisory services in cooperation with civil society groups. For example, Biodiversity for Banks (B4B) is a 3 capacity-building initiative administered by the World Wildlife Fund, the Equator Principles Association and the Business and Biodiversity Offsets Program, designed to help financial institutions overcome the challenges of incorporating biodiversity and ecosystem services into lending decisions and to raise greater awareness of these issues. The B4B program includes a web-based resource centre, a training course delivered during regional workshops and a series of case studies addressing different sectors and geographies, and has attracted a range of international banks such as Citi Group. ■ Reporting - Established reporting systems such as the Global Reporting Initiative are increasingly complemented by indicators providing specific information relating to organisational impacts on biodiversity and ecosystems such as the Ecosystem Services Benchmark. Environmental Profit and Loss Accounts, as recently calculated for Puma by TRUCOST, are attracting significant interest as a means to maximise internal and external transparency. ■ Stock market indices – Market indices are increasingly incorporating biodiversity criteria. Examples include the FTSE4Good index, Global Compact 100 and SGI Global Environment Index. ■ Associations of sustainable investors – Investors are increasingly grouping together to exert influence on the companies they invest in. Examples include VBDO (the Dutch Association of Sustainable Investors) and UKSIF (UK Sustainable Investment and Finance Association). The workstream will showcase champions in the financial sector that are helping to integrate biodiversity considerations into investment decisions, and will examine the benefits for businesses and for biodiversity. Questions to be addressed include: What initiatives are championing biodiversity within the EU’s finance sector? What are the benefits for biodiversity, and for business? What are the opportunities to champion biodiversity in the finance sector further, and what are the challenges to realising these opportunities? Members, Observers and Representatives of the B@B Platform, and other interested parties, are invited to provide examples of finance sector champions for biodiversity, drawing on their own experience, and to highlight future needs, challenges and opportunities. Call for evidence We would like to invite you to provide information on the three topic areas above in whatever form you have it – documents, case studies or web links – and/ or to participate in a telephone interview. You are also invited to complete the template attached. Please feel free to invite contributions from other contacts who might also be interested in contributing. For further information or to discuss this workstream further, please contact Matt Rayment, Consulting Director at ICF GHK, matt.rayment@ghkint.com 4 Template for Submission of Evidence You are invited to complete the following template, and/or to provide evidence in the form of documents, web links and contacts. Your name and contact details BIODIVERSITY INVESTMENT OPPORTUNITIES 1. Description of opportunity/opportunities identified 2. Assessment of market size and trends 3. Benefits for biodiversity 4. Financing needs and implications 5. Potential for innovative financing mechanisms 6. Challenges and barriers to finance, and how they are being/ can be addressed 7. Other comments/ ideas 8. Contacts, web links and sources of further information BIODIVERSITY FUNDING MECHANISMS 1. Description of financing mechanism/instrument/service 5 2. Companies and stakeholders involved 3. Benefits for biodiversity/ role in supporting biodiversity investment 4. Market trends and growth opportunities 5. Barriers and challenges to extending biodiversity related finance, and ways of addressing them 6. Potential for private/public/ NGO partnerships to stimulate biodiversity finance 7. Other comments/ ideas 8. Contacts, web links and sources of further information FINANCE SECTOR CHAMPIONS 1. Description of initiative/ activity 2. Companies and stakeholders involved 3. Benefits for biodiversity 4. Benefits for business and finance 5. Opportunities for growth 6 6. Challenges to be overcome, and ways of addressing them 7. Other comments/ ideas 8. Contacts, web links and sources of further information 7