Income Inequality

Problem Memorandum

TO: Charles E. Schumer, United States Senator for New York

FROM: Anuradha Singh

RE: Income Inequality in the United States

DATE: September 17 th

, 2015

Wealth and income inequality has become one of the largest socio-economic issues we face in the United States and across the world. We have all heard the myth of the 1 % representation of the richest in America and the other 99 % group. Studies have shown that in 2013, the top 3% of

America’s richest, held 54 % of the nation’s wealth, whereas, the remaining 97 % of the population held 46% of the nation’s wealth. This means that the top 3% holds more than half of

America’s wealth, while the other 97% holds less than half. The disparity in this stems from the richest in America holding a majority of the wealth which establishes an uneven distribution.

Hence, there is an extremely wide gap between the richest in America and the poorest in

America.

To fully understand this problem we must understand the distinction between income and wealth.

Income represents the flow of money coming in throughout the course of year (Center on Budget and Policy Priorities). Wealth is the total stock of assets a household has, as a result of inheritance, and saving, less any liability (debt). It also important to note the difference between, market income and final income. Market income represents the income for a household before taxes and transfers. Final income represents the income for a household after taxes and transfer.

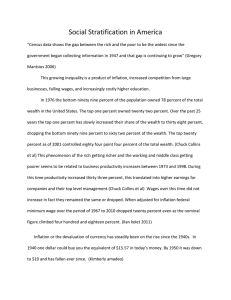

Market income represents the actual income a household receive. Final income represents their wealth. According to the Center on Budget and Policy Priorities, U.S Census data shows that income prosperity has diverged since the 1970s, causing continuously widening gap in income equality.

Causes from of this growing disparity can be attributed to multiple factors. In particular, one of the leading causes of income inequality is the stagnation of wage growth for American workers over the past generation (Economic Policy Institute). From 1973 to 2013, worker compensation has risen by merely 9 %, while productivity has risen by 74%. Therefore, workers are inputting more labor to produce more goods and products while being undercompensated for their efforts.

Moreover, the top 1% wages have grown 138% since 1979, while the wages for the bottom 90% grew 15%. A clear depiction of this disparity can be seen in an analysis of CEO pay compared to that of the average American worker. In 2013, this comparison showed that CEOs (the leaders of

American Corporations) made 300 times more than the average worker. Essentially, there have been no policy choices since 1970s which enhance the growth of wages. Had the minimum wage grown accordingly to the growth of productivity, it would be more than twice the amount that it

is today. There has also been a decline in worker participation of collective bargaining contracts.

Collective bargaining units exist to fight for the rights of workers. With little participation in collective bargaining units, workers have no outlet in which they can fight for increased wages.

A lack of collective bargaining creates a lack of employee protection regulation as well.

Along with a stagnation of wages, technology and globalization has increased the disparity in wages. Technical changes have also fueled the demand for more skilled workers and left behind those who are less educated. Today, even the simplest jobs require a sufficient amount of education than they previously did. Hence, if you are not skilled, it becomes difficult to find work. Ultimately, we see the results of increased demand for skilled workers in the unemployment rate. Workers who do not have the skills necessary to perform a job are out of work, which causes an increase in our unemployment rate. U.S Census data from 2012 reveals that 65 percent of all jobs require a post-secondary education, while 35% require a high school diploma or less. Today we have a multitude of citizens who live paycheck to paycheck. There are many who work two or more part-time jobs so that they can support their family. It does not seem

Another contributing factor to the growing income inequality stems from the debt of Americans.

Specifically, students and professionals feel this burden. In the United States, education has become a valuable key to success. Therefore, many citizens strive to educate themselves in order to be successful. Yet, after graduation, there is the burdening debt of student loans from which they borrowed in order to pay that education. It becomes hypocritical to say to the American public, we want you to become educated so you can make money. However, once you start making that money you will have to utilize it to repay your debt. It becomes even more disheartening to imagine yourself as a young person who took out loans to go to college, got good grades, and has graduated into an economy that doesn’t seem to want you. You did everything you were told to do, and it didn’t work out. That hurts, of course, but it’s a bad economy, and everybody is suffering. At least, that’s what they say (Klein).” But the truth is not everyone is suffering. Or others are suffering much more than those of the 3%. Of course with the fall of the dot com phenomenon and 2008 financial crisis, we did see the 1 % of America richest take a hit. However, the other 99 % did as well.

Social media has also brought great attention to this issue, allowing Americans to wake up and realize the disparity that is occurring. A well-known social media site which displays the effect of this income disparity is the page “We Are the 99 Percent” hosted on Tumblr. This page portrays the 99 percent who do not receive their fair share of wealth because they are burdened by the increasing costs of living (rent, food, medical care, etc.). The individuals represented on this page work long hours for little pay or some don’t work at all. This Tumblr page was created by another outlet which has crowded the social media platform, better known as the Occupy

Wall Street Movement. Occupy Wall Street movement sought to emphasize that the other 99% of Americans will “no longer tolerate the greed and corruption of the 1 %. “Occupy brought to the fore the idea that the nation is divided between a small group of haves and have-nots

(Matthews).

The last time income inequality was as high as it is now was just before the Great Depression

(Tyson). It seems as though we are moving backwards in time, when we should be learning from our past to correct the problems in our society today. Our goal should be to strive for an egalitarian society.

References

Kasperkevic, J. (2015, May 28). Class of 2015: women are still making less than men – and prospects are poor. Retrieved September 16, 2015, from http://www.theguardian.com/usnews/2015/may/28/class-of-2015-income-inequality-jobs

Klein, E. (2011, October 4). Who are the 99 percent? [Blog post]. Retrieved from http://www.washingtonpost.com/blogs/ezra-klein/post/who-are-the-99percent/2011/08/25/gIQAt87jKL_blog.html

Matthews, C. (2015, March 2). The myth of the 1% and the 99%. Retrieved September 16, 2015, from http://fortune.com/2015/03/02/economic-inequality-myth-1-percent-wealth/

Mishel, L., Gould, E., & Bivens, J. (2015, January 6). Wage Stagnation in Nine Charts.

Retrieved September 16, 2015, from Economic Policy Institute website: http://www.epi.org/publication/charting-wage-stagnation/

Stone, C., Trisi, D., & Debot, B. (2015, July 15). A guide to statistics on historical trends in income inequality. Retrieved September 16, 2015, from Center on Budget and Policy

Priotities website: http://www.cbpp.org/research/poverty-and-inequality/a-guide-tostatistics-on-historical-trends-in-income-inequality#_ftn31

Tyson, L. (2014, December 1). The rising costs of U.S. income inequality. Retrieved September

16, 2015, from http://www.huffingtonpost.com/laura-tyson/us-income-inequalitycosts_b_6249904.html