Major campaign launches to end gross over taxation of savings

advertisement

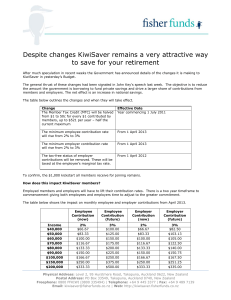

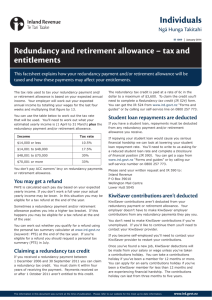

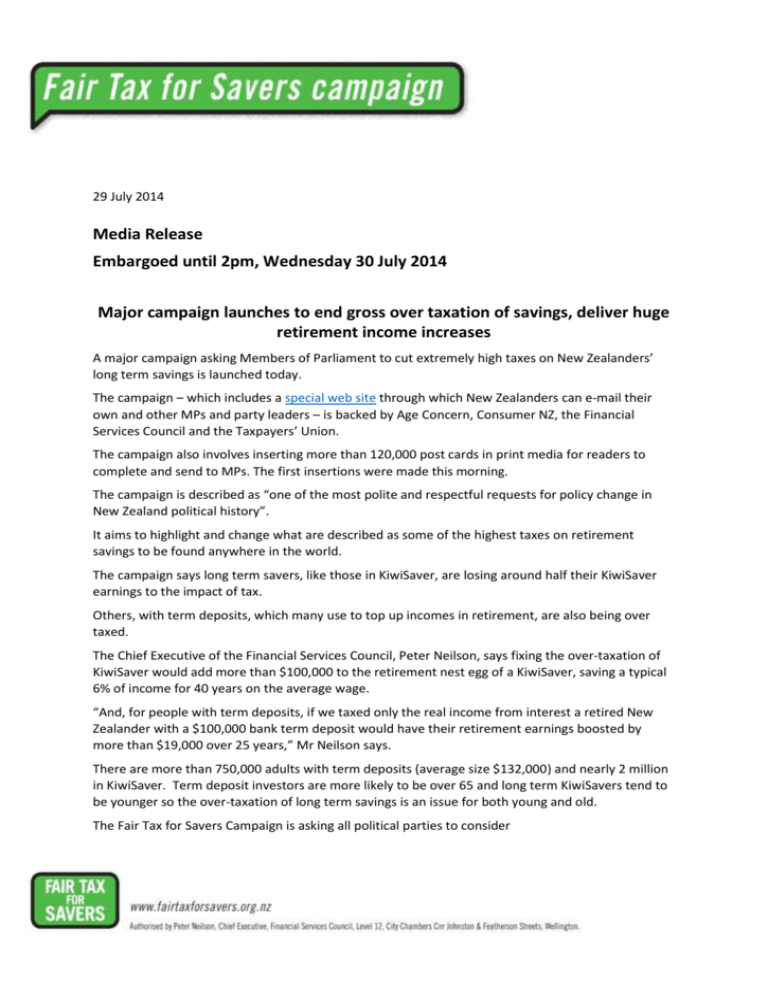

29 July 2014 Media Release Embargoed until 2pm, Wednesday 30 July 2014 Major campaign launches to end gross over taxation of savings, deliver huge retirement income increases A major campaign asking Members of Parliament to cut extremely high taxes on New Zealanders’ long term savings is launched today. The campaign – which includes a special web site through which New Zealanders can e-mail their own and other MPs and party leaders – is backed by Age Concern, Consumer NZ, the Financial Services Council and the Taxpayers’ Union. The campaign also involves inserting more than 120,000 post cards in print media for readers to complete and send to MPs. The first insertions were made this morning. The campaign is described as “one of the most polite and respectful requests for policy change in New Zealand political history”. It aims to highlight and change what are described as some of the highest taxes on retirement savings to be found anywhere in the world. The campaign says long term savers, like those in KiwiSaver, are losing around half their KiwiSaver earnings to the impact of tax. Others, with term deposits, which many use to top up incomes in retirement, are also being over taxed. The Chief Executive of the Financial Services Council, Peter Neilson, says fixing the over-taxation of KiwiSaver would add more than $100,000 to the retirement nest egg of a KiwiSaver, saving a typical 6% of income for 40 years on the average wage. “And, for people with term deposits, if we taxed only the real income from interest a retired New Zealander with a $100,000 bank term deposit would have their retirement earnings boosted by more than $19,000 over 25 years,” Mr Neilson says. There are more than 750,000 adults with term deposits (average size $132,000) and nearly 2 million in KiwiSaver. Term deposit investors are more likely to be over 65 and long term KiwiSavers tend to be younger so the over-taxation of long term savings is an issue for both young and old. The Fair Tax for Savers Campaign is asking all political parties to consider Making the effective tax rates paid on KiwiSaver funds the same as the marginal income tax rates KiwiSavers would pay on their other income, and Taxing term deposits only on the real interest rate (actual interest rate less the rate of inflation) rather than the nominal interest rate (the actual interest rate you receive) as the compensation for inflation is not really economic income. The Savings Working Group recommended in 2011 that both these issues should be addressed. Last year the Retirement Commissioner in her report recommended that only the real part of interest be taxed. Mr Neilson says the FSC is joined by campaign partners Age Concern, Consumer NZ and the Taxpayers’ Union. Age Concern is a campaign partner with a particular interest in the issues involved in the over-taxation of term deposits, a preferred investment vehicle for many New Zealand seniors. New Zealanders in KiwiSaver or holding term deposits are being invited to sign online petitions at www.fairtaxforsavers.org.nz or send a postcard or email to their MP or the Party Leader or Finance spokesperson of the party they support. As the Savings Working Group observed, the current tax system discourages saving and incentivises indebtedness and investment in real estate rather than more productive investment. The Fair Tax for Savers proposals would change that and improve the economic future for New Zealand and New Zealanders by redirecting investment for higher incomes and more jobs. “We are asking all parties to address these issues in the most polite, non-partisan, evidenced based request for policy change in New Zealand political history,” Mr Neilson says. “As improvement in the government’s books allow for tax reductions, we suggest savings taxes are reduced. We expect MPs and party leaders and financial spokespeople will get the message loud and clear in the next week. The e-mail message being sent to MPs also asks them to advise the sender of their position on savings tax cuts,” Mr Neilson says. Those sending e-mails are also being asked to add their names to an online petition which will be presented to MPs in the new Parliament. For further information contact: Peter Neilson CEO, Financial Services Council Tel 021 395 891 or 09 579 9244 Email: peter@fsc.org.nz Addendum Fair Tax for Savers Campaign We would like all parties to acknowledge the over-taxation of long term savings needs to be addressed as fiscal conditions allow. Both the Prime Minister and the Opposition Finance Spokesperson have raised the prospect of future tax cuts. Removing the over-taxation of the long term savings products favoured by most New Zealanders should be a priority for action. The proposed KiwiSaver fund tax rates are not a concession, they represent what savers would pay on any income earned outside of their KiwiSaver fund. KiwiSaver funds are locked away until a scheme member reaches 65, apart from withdrawals to buy a first home. So each year savers reinvests interest earned on interest for 40 years. Because of the way the taxation of interest on interest reduces your KiwiSaver earnings over 40 years you can lose nearly half of your KiwiSaver earnings to the impact of tax, if you are on the average wage. Someone in the 33% tax bracket loses 54.7% of their KiwiSaver earnings to the impact of tax over 40 years. The same person investing in rental property, 80% funded by borrowing over 40 years, would face an effective tax rate of only 7.9%. Economists have long argued that the part of interest that compensates you for inflation while your money is lent out is not economic income and should not be taxed. Think about this example, you lend $10,000 to the bank for 5 years at an interest rate of 5.75% a year. Over 5 years inflation is 2% a year so when you get your $10,000 back it only buys what would have cost you $9,000 when you lent the money. So about $1,000 of the interest you will receive over 5 years is simply to compensate you the loss purchasing power of your original $10,000 invested. If you apply your marginal tax rate say 33%, you have paid about $389 too much tax over 5 years. If only the real part of interest is taxable then to be even handed only the real component of interest should be a tax deductible expense as well. At the moment we overtax interest income from compound interest products like KiwiSaver and term deposits, and tax subsidise, debt financed businesses and property investment.