Tax Credit Donation Letter

advertisement

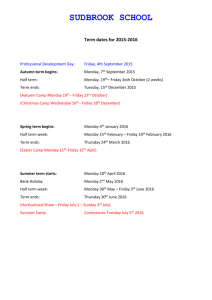

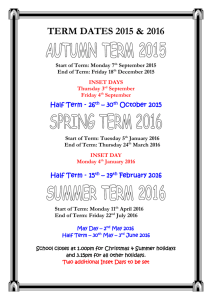

Jenny Robles, Principal Phone- 602-449-2900 Fax- 602-449-2905 15815 N 29th Street Phoenix, AZ 85032 We would like to remind you that winter break is Monday, December 18th - Friday January 1st, with classes resuming on Monday, January 4th. We look forward to seeing students back in the New Year on Monday, January 4th. We would also like to remind you that there is still time to make your tax credit donation to our school. Making a contribution to receive an Arizona public education tax credit is simple. You can get a tax credit up to $200 for an individual or $400 per married couple. Beginning in 2016, credit eligible fees paid and contributions made to a public school from January 1 through April 15 of the calendar year may be used as a tax credit on the prior year's tax return. For example, qualifying contributions made to a public school January 1, 2016 to April 15, 2016 may be used as a tax credit on either your 2015 or 2016 Arizona income tax return. (Pub 707 AZDOR). For additional information, call (602) 449-2049. Arizona tax law allows taxpayers a credit for contributions made or fees paid to a public school for support of extracurricular activities or character education (as defined in ARS 15-719. If married taxpayers file separate returns, each spouse may claim one-half of the credit that would have been allowed on a joint return. Extracurricular activities such as sports, band, speech and debate or overnight field trips are generally not fully funded by school districts, so your donation directly supports students. Thank you so much for your continued support of our programs! The Palomino Intermediate staff would like to wish all of our families a happy holiday and a wonderful New Year!