M6 - Conclusion

advertisement

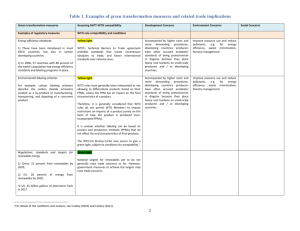

MODULE 6 Conclusion ESTIMATED TIME: 3 hours 1 CONCLUSION The WTO has established as a key requirement for achieving its objectives the elimination of discriminatory practices in international trade relations among its Members. However, the WTO does recognise that Members may need to take measures which derogate from the principles of non-discrimination in order to counteract the effect that certain trade practices of other Members may have on their interests. Those derogations are subject to limits and disciplines to ensure that they are applied in a fair manner. The Course on Trade Remedies in the WTO has taken participants through the pertinent multilateral rules and this module wraps up the core WTO principles and disciplines discussed therein. This conclusion provides an overview of the course content: MODULE 1: INTRODUCTION TO THE WTO This module introduced the WTO as an organization and explained its historical background, objectives, functions and organizational structure. MODULE 2: INTRODUCTION TO WTO BASIC PRINCIPLES AND RULES This module introduced the key principles which are present in all WTO Agreements and the specific exceptions thereto. MODULE 3: ANTI-DUMPING This module presented the rules and disciplines that the WTO imposes on Members' actions to counteract certain harmful effects to their domestic industries caused by dumped imports. MODULE 4: SUBSIDIES AND COUNTERVAILING MEASURES This module presented the rules and disciplines of the Agreement on Subsidies and Countervailing Measures, on Members' subsidies, as well as on Members' actions to counter certain harmful effects to their interests caused by other Members' subsidies. MODULE 5: SAFEGUARD MEASURES This module presented the rules in Article XIX of GATT 1994 and the Agreement on Safeguards regarding safeguard measures, i.e., temporary measures to address certain harmful effects caused to Members' domestic industries by import surges. 2 I. MODULE 1 - INTRODUCTION TO THE WTO HISTORICAL BACKGROUND ON THE WTO The WTO was established by the Marrakesh Agreement, which resulted from the Uruguay Round of multilateral trade negotiations and entered into force in 1995. I.A. THE OBJECTIVES OF THE WTO ARE Raising living standards; Ensuring full employment; Increasing real income and demand; Expanding production and trade; Sustainable development. I.B. THE FUNCTIONS OF THE WTO ARE Facilitating the implementation, administration and operation, and furthering the objectives, of the WTO Agreements (including the Plurilateral Agreements); Serving as a forum for trade negotiations; Administering the Dispute Settlement Understanding (DSU); Administering the Trade Policy Review Mechanism (TPRM); and Cooperating with the IMF and the IBRD (World Bank) to achieve coherence in global economic policy/making 3 I.C. ORGANIZATIONAL STRUCTURE OF THE WTO Figure 1: 4 WTO Organizational Structure II. MODULE 2 - BASIC PRINCIPLES AND SPECIFIC EXCEPTIONS GENERAL GATT OBLIGATIONS AND RELEVANT PROVISIONS Most-Favoured-Nation (MFN) principle: prohibits discrimination between imports irrespective of their origin or destination; National Treatment principle: prohibits discrimination between imported and locally produced products; Binding Principle: advocates adherence to the bound rates in Member's Schedules of Tariff Concessions; Quantitative Restriction Principle: prohibits the introduction or maintenance of quantitative restrictions. MFN – Art. I National Treatment – Art. III Bindings – Art. II and XXVIII, XXVIIIbis + Understanding on Art. XXVIII Quantitative restrictions – Art. XI and XIII Exceptions and derogations to these basic obligations are included in the Articles containing the principles and other provisions 5 III. MODULE 3 - ANTI-DUMPING Anti-dumping refers to measures taken to offset injurious dumping. Dumping is a practice whereby a company exports a product to a foreign market at a price lower than the normal value of the product, generally, the price charged for the product in the exporter's own home market. WTO rules do not pass judgement on the practice of dumping; they do however impose disciplines on antidumping measures through GATT Art. VI and in the Anti-Dumping Agreement, which implements GATT Article VI. Accordingly, a Member can impose a specific anti-dumping duty on imports from a particular source, in addition to its normal customs tariffs, when the necessary conditions are present, and the importing Member fulfils the requisite substantive and procedural requirements. On the substantive side, the following three elements must be demonstrated: dumping is occurring; the domestic industry producing the like product in the importing country is suffering material injury or threat thereof, or establishment of an industry is being materially retarded; and there is a causal link between the two. The demonstration of these elements must be done through an investigation. The investigation also needs to determine the margin or amount of dumping, which is necessary for setting the permissible level of the eventual anti-dumping duty. The AD Agreement contains detailed procedural requirements on a number of issues, applicable at different stages of the anti-dumping proceeding. These procedural rules are aimed at ensuring transparency and fairness in the conduct of investigations and application of measures. The AD Agreement also requires a range of notifications relative to anti-dumping legislation and actions. 6 IV. MODULE 4 - SUBSIDIES AND COUNTERVAILING MEASURES The SCM Agreement does not prohibit the use of all or even most subsidies by WTO Members. Rather, in general it establishes rules to regulate the provision of subsidies, and the actions that Members can take in respect of harmful effects caused other Members' subsidies. The SCM Agreement is, in fact, "two agreements in one". First is the multilateral track, which provides for the right to challenge certain subsidies under the Dispute Settlement Understanding of the WTO. Second is the national or unilateral track, governing the use by Members of countervailing measures in respect of subsidized imports into their territories. For a measure to be considered a subsidy for the purposes of the SCM Agreement, it must comprise three elements: A Financial Contribution; By a Government or public body; Conferring a Benefit. However, only subsidies that are "specific" are subject to the disciplines set out in the SCM Agreement. The SCM Agreement establishes two categories of specific subsidies: Prohibited ("red light") contingent upon export performance or use of domestic goods. (prohibited because they are presumed to distort international trade). Actionable ("yellow or amber light") Can be countervailed or subject to dispute settlement where causing certain harmful trade effects. The non-actionable ("green light") category expired at the end of 1999. The measures referred to in the non-actionable subsidy provisions reverted to actionable status at that time. The SCM Agreement provides for three kinds of countervailing measures: Provisional countervailing duties; Definitive countervailing duties Voluntary undertakings; The imposition of any countervailing measure must fulfil the substantive and procedural requirements set forth in the SCM Agreement. Many of these requirements are similar to those applicable to anti-dumping measures. The SCM Agreement recognizes that subsidies may play an important role in economic development programmes of developing countries. Therefore, the SCM Agreement includes special and differential treatment 7 provisions for developing Members, which are less strict than the general rules on subsidies and countervailing measures. The SCM Agreement requires Members to provide a variety of notifications. Except where a notifying Member has specifically requested otherwise, all notifications are issued as unrestricted documents and are fully accessible to the public. 8 V. MODULE 5 - SAFEGUARD MEASURES A safeguard measure is the temporary suspension of a multilateral concession or other obligation on a product where imports of that product are increasing to such an extent and in such competitive conditions that they are causing serious injury (or threat) to the domestic industry in the importing Member. The increase in imports must have been unforeseen at the time the concession or obligation was negotiated. The existence of increased imports, serious injury and causation are to be established on the basis of an investigation conducted by the authorities of the importing Member, in accordance with the rules set forth in the SG Agreement. A safeguard measure can take the form of tariff increase above the bound rate, a quota, or other forms. Subject to limited exceptions including in respect of exports from developing Members with small trade shares, safeguard measures must be applied on an MFN basis, that is, to all imports regardless of their source. To encourage the domestic industry to adjust to the new competitive conditions in its market, safeguard measures are of limited duration and must be progressively liberalized during the period of application, and no new safeguard can immediately be applied on a product following the termination of a measure on that same product. As a general matter, a Member imposing a safeguard measure must pay trade compensation to affected exporting Members, or face trade retaliation by them. Under certain circumstances, the right to retaliation cannot be exercised for the first three years of application of a measure, however. The SG Agreement requires a range of notifications relative to safeguard legislation and actions. 9