Chapter 7 Funds Analysis, Cash Flow Analysis, and Financial

advertisement

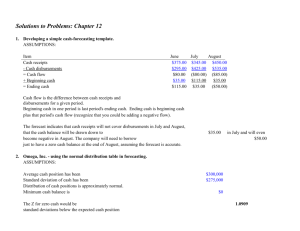

Chapter 7 Funds Analysis, Cash Flow Analysis, and Financial PlanningIntroduction: Cash flow and financial distress•In China, most ST firms get into financial distress. If they could not get financial help soon they will not stand of feet •But why does they get themselves in such a hell ? They have got much money with IPO. 草原兴发谎言致命 海市蜃楼崩塌•公司募集和借贷的 30 多亿现金,大部分不知所踪 •40 天前,因涉嫌违反有关证券法规,中国证监会调查组正式进驻了这家公司。 •事发于数月前草原兴发的一则“坦白”公告。今年 5 月 18 日,草原兴发发布了一则提示性公 告,公告表明,2005 年前三季度,公司在赊销业务发生时提前确认了销售收入 3.39 亿元, 相应虚增了银行存款,并制造了虚假的银行凭证。 •数年来,草原兴发大张旗鼓地宣布,动用 了 10 亿元收购了大批草原,但是公司一位中层却很无奈地告诉记者“我也不知道这些草地的 具体位置。”还有那 12 家食品厂,草原兴发曾花掉了 2.61 亿元真金白银,却没产生任何收 益。 •另有确凿证据表明,草原兴发在运用公司资金炒作股票,2001 年时曾有数亿资金在股市中 游走。Study Objectives•Flow of funds statement •Accounting statement of cash flows •Cash-flow forecasting •Range of cash-flow estimates •Forecasting financial statements1.Flow of funds statements•Flow of funds statement is a summary of a firm’s changes in financial position from one period to another •WHY do we need a flow of funds statement? –By arranging a company’s flow of funds in a systematic fashion, the analyst can better determine whether the decisions made for the firm resulted in a reasonable flows of funds or in questionable flows, which warrant future inspection (1)What is funds?•Funds: all of the firm’s investments and claims •We define funds as the claims and investments because many important transactions are not reported in cash (2)What does flow of funds tell us?•The sources and uses of funds during a period of time •The firm’s flow of funds is therefore comprised of the individual changes in balance sheet items between two points in time •The flow of funds statement portrays net rather than gross changes, although an analysis of the gross funds flow of a firm over time would be much more revealing than analysis of net funds flow, we are usually constrained by the financial information available What are source? Uses?•Sources of funds: any decrease in an asset item or any increase in an claim item •Uses of funds: any increase in an asset item or any decrease in a claim item •See Table 7-1 the determination of sources and uses Adjustments•In the former computation, the change in fixed assets and retained earnings is a mixed result of changes, and what we want is detailed information of changes in these items •See computation: page 175 Implications of funds of statement analysis•Imbalances in the use of funds can be detected and appropriate actions undertaken •An analysis of the major sources of funds in the past reveals what portions of the firm’s growth were financed internally and externally •We can judge whether the firm has expanded at too fast a rate and whether the firm’s financing capability is strained Accounting statement of cash flow•Statement of cash flow is a summary of a firm’s cash receipts and cash payments during a period of time •The purpose of the statement of cash flow is to report a firm’s cash inflows and outflows, during a period of time, segregated into three categories: operating, investing, and financing activities The usefulness of statement of cash flow•It helps the financial manager to assess and identify: –A company’s ability to generate future net cash inflows from operations to pay debts, interest, and dividends –A company’s need for external financing –The reasons for differences between net income and net cash flow from operating activities –The effects of cash and noncash investing and financing transactions Contents of the statement•The statement of cash flows explains changes in cash (and cash equivalents) by listing the activities that increased cash and those decreased cash •Each activity’s cash inflow or outflow is segregated according to one of three broad category types: operating, investing, or financing activity •Table 7-4 (page 178) lists the activities found most often in a typical statement of cash flows Alternative forms of the statement•The cash flow statement may be presented using either a “direct” method or an “indirect” method. The only difference between the direct and indirect methods of presentation concerns the reporting of operating activities; the investing and financing activity sections would be identical under either method Analyzing the statement of cash flow•Operating cash inflow, dividend and investment outflow •Sales revenue inflow, inventory and employee wages outflow •Analyzing of Aldine: page 180 Cash-flow forecasting(1)Cash budget: a forecast of a firm’s future cash flows arising from collections and disbursements, usually on a monthly basis –Cash flow reveals the timing and amount of expected cash inflows and outflows over the period studied. •With this information, the financial manager is better able to determine the future cash needs of the firm, plan for the financing of these needs, and exercise control over the cash and liquidity of the firm. –Without cash budget, the firm may run into financial difficulty (2) The preparation of cash budget•Sales forecast •Collections and other cash receipts •Cash disbursements •Net cash flow and cash balance •Means of meeting the cash deficits The sales forecast•Often this is done by marketing department •This forecast can be based on an internal analysis, an external one, or both. •With an internal approach, sale representatives are asked to project sales for the forthcoming period. The product sales managers screen these estimates and consolidate them into sales estimates for product lines. The estimates for the various product lines are then combined into an overall sales estimate for the firm. •The basic problem with an internal approach is that it can be too myopic. Often, significant trends in the economy and in the industry are overlooked •With an external approach, economic analysts make forecasts of the economy and of industry sales for several years to come. They may use regression analysis to estimate the association between industry sales and economy in general. The next step is to estimate market share by individual products, prices that are likely to prevail, and the expected reception of new product •From this information, an external sales forecast can be prepared •The defect of external approach is that the data used in the computation are not always very accurate, most of them are estimated by scholars or experts who are not familiar with product markets •Past experience will show which of the two forecasts is likely to be more accurate •In general, the external forecast should serve as a foundation for the final sales forecast, often modified by internal forecast Collections and other cash receipts•Collections here means to determine the cash receipts from the sales •For cash sales, cash is received at the time of the sale; for credit sales, the receipts comes later. How much later depends on the billing terms, the type of customer, and the credit and collection policies of the firm •Example: Table 7-7, page 183 Cash receipts•Cash receipts may arise from the sale of assets, as well as from external financing and investment income. These cash receipts need estimations or advanced planning Cash disbursements•Operation disbursements and other disbursements •Operation disbursements are expenses occurred to maintain operation, such as material, wages, power, interest, tax, etc. •How does the firm estimate Operation disbursements ? •Sales---production schedules---material purchasing, labor cost, and other expenses •Example: Table 7-8 page 184 Other disbursements•Capital expenditures: the expenditures involves long-term investment. They are planned in advance, so they are predictable for the short-term cash budget •Dividend payments for most companies are stable and are paid on specific date •Federal taxes can be estimated according to the firm’s sales and income Net cash flow and cash balance•After having taken all foreseeable cash inflows and outflows into account, we combine the cash receipts and disbursements, and compute the projected cash position by month •If, in a month there is a cash deficit, the financial manager should take measures to meet this deficit. The feasible measures may including borrowing from bank or delaying capital expenditures or payments for purchases Example •The cash manager of Monet Paint are preparing a cash budget for the 6 months from April through September. Their cash management model is based on the following assumptions: •Recent and forecasted sales are: Month Sales forecast 2(actual) $400000 3(actual) 4(forecast) •Twenty percent of sales are collected in the month of sale, 50% are collected in the month following the sale, and 30% are collected in the second month following the sale •Purchases are 60% of sales, and purchases are paid for 1 month prior to sale •Wages and salaries are 12% of sales and are paid in the same month as the sale •Rent of $10000 is paid each month. Additional cash operating expense of $30000 per month will be incurred for April through July. These will decrease to $25000 for August and September •Tax payments of $ 20000 and $30000 are expected in April and July, respectively. A capital expenditure of $150000 will occur in June, and the firm has a mortgage payment of $60000 due in May •The cash balance at the end of March is $150000. Managers want to maintains a minimum balance of $100000 at all times. The firm will borrow what it needs to achieve the minimum balance. Any cash above the minimum will be used to pay off any loan balance until it is eliminated. Cash receipts budget month sales Collection(current) 20% 120000 140000 160000 160000 140000 120000 Previous month 50% 250000 300000 350000 400000 400000 350000 2nd month previous 30% 120000 150000 180000 210000 240000 240000 Total cash receipts 490000 590000 690000 770000 780000 710000 purchase 420000 480000 480000 420000 360000 300000 Wages and salaries 72000 84000 96000 96000 84000 72000 Rent 10000 10000 10000 10000 10000 10000 Cash operating expense 30000 30000 30000 30000 25000 25000 Tax installments 20000 Cash disbursement budget month 30000 Capital expenditures 150000 Mortgage payment Total cash disbursement 60000 552000 664000 766000 586000 479000 407000 Cash balance and deficits meetings month Net cash flow -62000 -74000 -76000 184000 301000 303000 Beginning cash balance 150000 100000 100000 100000 122000 423000 Available balance 88000 26000 24000 284000 423000 726000 Monthly borrowing 12000 74000 76000 423000 726000 Monthly repayment 162000 Ending balance 100000 100000 100000 Cumulative loan balance 12000 86000 162000 122000 4. Range of cash flow estimates•Depending on the care devoted to preparing the budget and the volatility of cash flows resulting from the nature of the business, actual cash flows will deviate more or less widely from those that are expected. •In the face of uncertainty, we must provide information about the range of possible outcomes Deviations from expected cash flows•To take into account deviations from expected cash flows, it is desirable to work out additional cash budget –We can change assumptions of cash flow and display new cash budget. For example, different sales volume, price, etc. –See figure 7-1, distributions of ending cash balances Use of probabilistic information•The expected cash position plus the distribution of possible outcomes give us a considerable amount of information –additional funds required or the funds released under various possible outcomes –the firm’s ability to adjust to deviations from the expected outcomes •From the standpoint of internal planning, it is far better to allow for a range of possible outcomes than to rely solely on the expected outcome 5.Forecasting financial statements•Forecast financial statements are expected financial statements based on conditions that management expects to exist and actions it expects to take •A cash budget gives us information about only the prospective future cash positions of the firm, whereas forecast statements embody expected estimates of all assets and liabilities as well as of income statement items •Much of the information that goes into the preparation of the cash budget can be used to derive a forecast income statement •Sales revenue: sales forecast •Assume cost can be divided into fixed cost and variable cost •Cost of goods sold: assume variable cost •Selling, general and administrative expense: assume fixed cost •Income tax: according to tax law •Dividend: according to dividend policy •Forecast asset: assume fixed turnover ratios for receivables and inventories •Future net fixed assets are estimated by adding planned expenditures to existing net fixed assets and substracting from this sum the book value of any fixed assets sold along with depreciations during the period •Forecasting liabilities: accounts payable according to purchase and payments amounts; wages according to production schedule; shareholders’ equity according to net profit less dividend •Example: page 189-191