yxu-lehman1 - The University of Texas at Dallas

advertisement

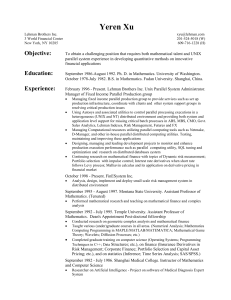

Yeren Xu Lehman Brothers Inc. 3 World Financial Center New York, NY 10285 xyu@lehman.com 201-524-5018 (W) 609-716-1228 (H) Objective: To obtain a challenging position that requires both mathematical talent and UNIX parallel system experience in developing quantitative methods on innovative financial applications Education: September 1986-August 1992. Ph. D. in Mathematics. University of Washington. October 1978-July 1982. B.S. in Mathematics. Fudan University. Shanghai, China. Experience: February 1996 - Present. Lehman Brothers Inc. Unix Parallel System Administrator. Manager of Fixed Income Parallel Production group Managing fixed income parallel production group to provide services such as set up production infrastructure, coordinate with clients and other system support groups in resolving critical production issues Using Autosys and associated utilities to control parallel processing executions in a heterogeneous (UNIX and NT) distributed environment and providing both system and application level support for missing critical batch processes in ABS, MBS, CMO, Govt. Sales Analytics, Lehman Indexes, Risk Management, Futures and FX Managing Computational resources utilizing parallel computing tools such as Netmake, D-Manager, and other in-house parallel distributed computing utilities. Testing, maintaining and improving these applications Designing, managing and leading development projects to monitor and enhance production execution performance such as parallel computing utility, SQL tuning and optimization and research on distributed databases system Continuing research on mathematical finance with topics of Dynamic risk measurement; Portfolio selection with impulse control; Interest rate derivatives when short rate follows Levy process; Malliavin calculus and its application on derivative pricing in financial market October 1998 - Present. FinESystem Inc. Analysis, design, implement and deploy small scale risk management system in distributed environment September 1995 - August 1997. Montana State University. Assistant Professor of Mathematics. (Tenured) Performed mathematical research and teaching on mathematical finance and complex analysis September 1992 - July 1995. Temple University. Assistant Professor of Mathematics. Dean's Appointment Post-doctoral fellowship Conducted research on geometric complex analysis and mathematical finance Taught various (under)graduate courses in all areas. (Numerical Analysis; Mathematica Computing Programming in MAPLE/MATLAB/MATEMATICA; Mathematical Game Theory; Wavelets; Diffusion Processes; etc.) Completed graduate training on computer science (Operating Systems; Programming Techniques in C++; Data Structures; etc.), on finance (Insurance Derivatives in Risk Management; Corporate Finance; Portfolio Selection and Capital Asset Pricing; etc.), and on statistics (Inference; Time Series Analysis; SAS/SPSS.) September 1982 - July 1986. Shanghai Medical College. Instructor of Mathematics and Computer Science Researcher on Artificial Intelligence - Project on software of Medical Diagnosis Expert System Technical Skills: Computer Technology In depth experience on Unix system and Sybase database system from daily production management and infrastructure build up Solaris/Sun OS system (System resources management; TCP/IP network protocol, NIS/NIS+/NFS/DNS/AFS); Sybase System 11 (Server setup, tuning and maintenance; SQL application execution monitoring; Performance evaluation and tuning; Sybase internal data structure; DB/CT-Library, etc.) Proficient programming skills in C++, C, Sybase SQL and shell programming Borne shell, Perl, C-shell, Kohn shell, Syperl, Unix network programming (System V Interprocess communications: semaphores, shared memory, multi-threadings); OOPdesign in distributed parallel computing w/ Netmake/PVM/MPI/Linda/Paradise/CORBA Extensive hands-on skill on Autosys, and working experience on CORBA, Window NT, FORTRAN, MAPLE, MATLAB, SAS, SPSS, Neuron network and fuzzy logic, and artificial intelligence on expert system Finance Engineering Publications: Experienced on design and implement small scale Risk Evaluation systems for (loan) portfolio management (VaR calculation on historical data and on assimilation; Correlation adjustment; Dynamical optimal components selection and hedging strategy. Application of extreme value theory.) In depth knowledge on major interest rate derivative/swaps models (CIR, Vasicek, Ho-Lee, Hull-White, Blake-Derman-Toy, HJM, Jamshidian) and derivative pricing theory in a incomplete market environment Solid knowledge on stochastic analysis and its application on pricing of ABS, MBS, exotic options, and other innovative products on financial engineering. Extensive experience on Monte Carlo simulation, stochastic/dynamic programming, genetic algorithms, neuron networks, and fuzzy logics Strong experience on numerical analyses using maple/matlab/mathematica and statistical analysis using sas/spss Made valuable contribution to fundamental mathematical research; worked independently as well as with other members of mathematical community; taught graduate and undergraduate courses; achieve outstanding evaluations. Extension of 1-dimensional varieties across rectifiable curves, Canadian Journal of Mathematics,1995 Hartogs theorem for analytic curves, Math. Zeitschrift, V.217, No. 4, 635-640, 1994 Extension of analytic varieties across manifolds with restricted CR dimension, Complex Analysis and Its Application, Pitman Research Notes in Mathematics, V. 305, 258-261, 1994 Interpolation submanifolds of unitary group, Pacific Journal of Mathematics, V. 165, No. 1, 181-205, 1994 Extension of complex varieties across C1 manifolds, Michigan Journal of Mathematics, V. 40, No.2, 399-410, 1993 Fixed point theorems for some contraction mappings, Journal of Mathematical Research and Exposition, 5(1986), No. 4, 49-52. Professional Affiliation: Member of Bachelier Mathematical Finance Society