THE SIMILARITY PARADOX IN ORGANIZATIONAL STUDIES

advertisement

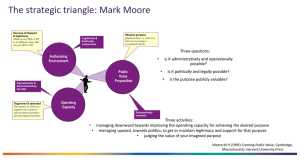

Page 1 A PARADOX AMONG STRATEGIC MANAGEMENT, INSTITUTIONAL, AND RESOURCE DEPENDENCE THEORIES DAVID L. DEEPHOUSE Rucks Department of Management, Louisiana State University R. CARTER HILL Department of Economics, Louisiana State University ERIC A. WALDEN Department of Information Systems and Decision Sciences, University of Minnesota Address correspondence to first author at: E. J. Ourso College of Business Administration Louisiana State University Baton Rouge, LA 70803-6312 225-388-6249; 225-388-6140 (FAX) mgdeep@lsu.edu November 16, 1998 Under review at Academy of Management Journal. Please do not cite without authors’ permission. We wish to thank Suzanne Carter, Peter Foreman, Bryant Hudson, Paul Jarley, Kai Lamertz, Michael Sturman, Andrew Van de Ven, and James Westphal for their comments on prior drafts of this manuscript. The final version benefited significantly from the suggestions of the editor and the anonymous reviewers of this journal. Page 2 (74 words) A PARADOX AMONG STRATEGIC MANAGEMENT, INSTITUTIONAL, AND RESOURCE DEPENDENCE THEORIES ABSTRACT Strategic management and institutional theories offer contradictory prescriptions about how similar a firm's strategy should be to others. The former proposes differentiation increases performance. The latter proposes conformity increases legitimacy. Moreover, institutional and resource dependence theories propose a virtuous circle between performance and legitimacy. This paper coalesces these propositions into a paradox and develops a model to test it. Results support hypotheses derived from institutional theory. The paper concludes with suggestions for future research. Page 3 In order to prosper, strategic managers must select strategies that increase economic performance and social legitimacy (DiMaggio & Powell, 1983; Pfeffer & Salancik, 1978). Theory offers conflicting advice on the choice of strategies, however. Strategic management recommends that a firm differentiate itself from its competitors to achieve superior performance (Barney, 1991; Henderson, 1981; Porter, 1991; Wernerfelt, 1984). In contrast, new institutional theory recommends that a firm should be isomorphic to its competitors to achieve legitimacy (DiMaggio & Powell, 1983; Fligstein, 1991; Haveman, 1993; Meyer & Rowan, 1977). Given that research is beginning to integrate strategic management and institutional theories (Dacin, 1997; Oliver, 1991, 1997; Powell, 1991; Roberts & Greenwood, 1997; Scott, 1994), the question of strategic similarity is an important one for this integration (Chen & Hambrick, 1995). Complicating this conflict is the relationship between performance and legitimacy. Resource dependence theory suggests that legitimacy increases performance because of its effect on the flow of resources to the firm (Pfeffer & Salancik, 1978). Institutional theory suggests that performance increases legitimacy because it indicates how well a firm is fulfilling its roles in society (Meyer & Rowan, 1977; Suchman, 1995). Together, these theories imply there is a virtuous circle between performance and legitimacy. Combining the conflicting prescriptions for how similar a firm's strategies should be to others with the virtuous circle produces what we call the similarity paradox, depicted in Figure 1. Hypothesis 1 states that greater strategic similarity reduces performance. Hypothesis 2 states that greater strategic similarity increases legitimacy. Hypothesis 3 states that legitimacy increases performance. Hypothesis 4 states that performance increases legitimacy. -----Insert Figure 1 About Here----Empirical work has begun to examine these relationships. Three studies supported the negative relationship between strategic similarity and performance predicted by strategic Page 4 management (Hypothesis 1): Geletkanycz and Hambrick (1997); Gimeno and Woo (1996) and Westphal, Gulati, and Shortell (1997). Two studies supported the positive relationship between strategic similarity and legitimacy predicted by institutional theory (Hypothesis 2): Deephouse (1996) and Westphal et al. (1997). Geletkanycz and Hambrick (1997) proposed and supported a positive relationship between strategic similarity and performance, contrary to Hypothesis 1, by combining the institutional and resource dependence arguments of Hypotheses 2 and 3. They did not measure legitimacy, however. We are unaware of studies that formally tested either the effect of performance on legitimacy, as predicted by institutional theory, or the effect of legitimacy on performance, as predicted by resource dependence theory and recommended by Rao (1994: 40). Consequently, no research examined the paradox in toto. To address these gaps, this paper formally develops the similarity paradox and devises a method to test it. The similarity paradox is a social paradox, consisting of thought-provoking contradictions about social phenomena (Poole & Van de Ven, 1989). Social paradoxes provide opportunities for building, testing, and refining theories (Poole & Van de Ven, 1989; Sutton & Staw, 1995). Examination of the similarity paradox is important in the integration of strategic management and organizational theories. The similarity paradox should be most applicable to firms in strong competitive and institutional environments where performance and legitimacy are important, such as pharmaceutical manufacturers, hospitals, and banks (Scott & Meyer, 1991). We structure the paper as follows. First, we formally develop hypotheses for each part of the paradox. Second, we describe how we tested the hypotheses in a sample of commercial banks using a simultaneous equations model. Third, we present the results. We conclude with several implications for future research. THE SIMILARITY PARADOX We define strategy as the realized position of a firm in its product-market space Page 5 (Mintzberg, 1987; Porter, 1980). Representing resource allocations resulting from management decisions and emergent patterns of action (Chandler, 1962; Mintzberg, 1978), strategy denotes the markets a firm serves and how it positions itself to serve them. Underlying a firm’s strategic position are its resources (Wernerfelt, 1984). Strategy is a fundamental concept in strategic management (Rumelt, Schendel, & Teece, 1994), and it is becoming more important in institutional research (e.g., Fligstein, 1991; Haveman, 1993; Powell, 1991; Scott 1994, 1995). Following Gimeno and Woo (1996), we define strategic similarity as the extent to which a firm's resource allocations resemble those of its competitors. In this paper, strategic similarity is a firmlevel concept, although it has also been applied at the strategic group level (e.g., Cool & Dierickx, 1993; Farjoun & Lai, 1997). Strategic Similarity and Performance The first hypothesis of the paradox rests on the idea that a firm with different strategies faces less competition for resources and thus has higher performance.1 Firms compete for resources in both product and factor markets (Chen, 1996). These resources are divided among competitors to the extent their realized strategic positions tap the same niches (Hotelling, 1929). A firm conforming to the strategies of others has many similar competitors for customers and factors of production that limit its performance (Chen, 1996; Henderson, 1981). This situation approaches perfect competition in microeconomics in which economic profit for all competitors equals zero. Chen and Hambrick (1995) proposed these firms might be "stuck in the middle" (Porter, 1980). Similarly, Miles, Snow, and Sharfman (1993) suggested a lack of strategic variety in an industry increases head-to-head competition and reduces performance. A firm that rationally differentiates into an under exploited niche faces less competition. Porter (1991: 102) proposed: "The firm must stake out a distinct position from its rivals. Imitation almost ensures a lack of competitive advantage and hence mediocre performance." A Page 6 distinct position enables the firm to earn higher rents because it faces less competition and may even establish a local monopoly (Chamberlin, 1933; Henderson, 1981). Underlying this position are resources that are rare, inimitable, valuable, and non-substitutable (Barney, 1991; Wernerfelt, 1984). A firm attempting to establish a position in a niche that turns out to be unviable will either fail or change to a viable niche. Over time, most firms with different strategic positions will have higher performance because they build barriers to imitation (Barney, 1991) or stay ahead of the competition in exploiting market niches (D’Aveni, 1994). Hypothesis 1: Less strategic similarity increases performance. Support for this hypothesis has been reported by Gimeno and Woo (1996), Geletkanycz and Hambrick (1997), and Westphal et al. (1997). Strategic Similarity and Legitimacy The second hypothesis of the paradox is based on the argument in new institutional theory that a firm must be isomorphic to others to maintain legitimacy (DiMaggio & Powell, 83; Meyer & Rowan, 1977). Following Suchman (1995: 574), we define legitimacy as the generalized perception that the firm's actions are congruent with the social system's values, cultural theories, goals, and expectations for action (cf. Meyer & Scott, 1983; Parsons, 1960). For most for-profit firms, ambiguity and uncertainty make the choice of strategies for dealing with the environment unclear, leading to what DiMaggio and Powell (1983) called mimetic isomorphism. Strategic norms emerge in an iterative process among firms and external actors (Scott, 1995). The process contains at least three components: (1) imitation in the face of uncertainty (Cyert & March, 1963; Haveman, 1993); (2) communication through trade associations, social networks, or the media (Davis, Diekmann, & Tinsley, 1994; Haunschild, 1993); and (3) approval by regulatory, judicial, or legislative arms of the state (Edelman, 1992). A firm conforming to strategic norms appears rational, prudent, and acceptable to its Page 7 social system (Fligstein, 1991; Meyer & Rowan, 1977). The social system endorses the firm's legitimacy or at least does not actively challenge it (Ashforth & Gibbs, 1990; Pfeffer & Salancik, 1978). On the other hand, a firm that deviates from the norm becomes subject to legitimacy challenges and may be deemed unacceptable by society (Hirsch & Andrews, 1984; Meyer & Rowan, 1977). Thus: Hypothesis 2: Greater strategic similarity increases legitimacy. Statistical support for this was reported by Deephouse (1996) and Westphal et al. (1997). Several studies argued that maintaining legitimacy was important when imitating the strategies of others (Dacin, 1997; Davis et al., 1994; Fligstein, 1991; Geletkanycz & Hambrick, 1997; Haveman, 1993). Finally, cognitive strategy researchers found that managers develop a cognitive consensus about the appropriate strategies to use (Porac, Thomas, & Baden-Fuller, 1989; Reger & Huff, 1993). Porac et al. (1989) also reported criticism of those violating the norms. The Virtuous Circle between Performance and Legitimacy The last two hypotheses of the paradox consist of the virtuous circle between legitimacy and performance. These two hypotheses have been suggested by past research but not formally developed and tested. We first examine the effect of legitimacy on performance. From a resource-dependence perspective, a major benefit of legitimacy is that it facilitates the flow of resources from exchange partners to the firm (Hybels, 1995; Pfeffer & Salancik, 1978; Rao, 1994; Suchman, 1995: 574). Such resources include customer purchases, quality employees, and supplier inputs. In general, a legitimate firm acquires better quality resources at better contract terms than a firm that lacks social endorsements. Having higher quality resources and better contract terms should increase a firm’s performance. There are at least three ways that legitimacy enhances resource acquisition and improves performance. First, some exchange partners will do business only with a firm endorsed by Page 8 society. They wish to avoid the stigma of being associated with an illegitimate firm (Ashforth & Gibbs, 1990). This restricts resource supply, increasing costs to a firm whose legitimacy is challenged. Second, a legitimate firm can offer contract terms to exchange partners that are more favorable to itself. Potential exchange partners prefer to contract with a legitimate firm because this contract is itself an endorsement enhancing the legitimacy of the exchange partner (Galaskiewicz, 1985; Pfeffer & Salancik, 1978: 145). Moreover, because legitimate firms are less likely to fail (Baum & Oliver, 1991; Singh, Tucker, & House, 1986), exchange partners do not need higher premiums in contracts to compensate for the risk of failure (Cornell & Shapiro, 1987). Third, because a legitimate firm is less likely to fail, it attracts higher quality managers and employees who improve the quality of firm decisions (Hambrick & D’Aveni, 1992). Thus, Hypothesis 3: Greater legitimacy increases performance. Past research suggested informally that performance increases legitimacy (e.g., Parsons, 1960; Pfeffer & Salancik, 1978). Recent work in institutional theory provides a formal rationale for this relationship. Since the Protestant reformation, success in the market has become an increasingly important value in Western capitalist societies (Friedland & Alford, 1991; Weber, 1958). Firms that efficiently convert inputs into goods and services are likely to be more acceptable to their social system (Dowling & Pfeffer, 1975; Parsons, 1960). Performance can be viewed as a symbolic or substantive indicator of how much a firm contributes to society (Ashforth & Gibbs, 1990; Meyer & Rowan, 1977). A firm with higher performance has more of what Suchman (1995) called consequential legitimacy, the ability to deliver valued outcomes to the social system. Thus, the firm should be endorsed by the social system. In contrast, a firm with lower performance is more likely to face what Hirsch and Andrews (1984) called performance challenges. The firm is criticized because of its failures to achieve its stated goals and to fulfill its claimed domains in society (Ashforth & Gibbs, 1990; Levine & White, 1961). Thus: Page 9 Hypothesis 4: Greater performance increases legitimacy. METHOD Sample The paradox was tested in the entire population of commercial banks in the MinneapolisSt. Paul, Minnesota, area (Twin Cities, hereafter) from 1985 to 1992. A commercial bank is chartered by government regulators. It differs from a bank holding company that can own several bank and non-bank subsidiaries. Commercial banks are in strong competitive and institutional environments (Scott & Meyer, 1991). During the sample period, a banking market was defined as a metropolitan area or a rural county by regulators (e.g., Federal Reserve Bulletin, 1991), financial economists (e.g., Berger, 1995; Hannan, 1991), and management researchers (e.g., Barnett, Greve, & Park, 1994). Thus, Twin Cities banks compete with each for similar customers and similar inputs (Chen, 1996). Studying one industry in one market controls for the confounding influences of competitive conditions, social values, and institutional forces that vary across geographic locations and industries. We chose 1985 as the initial year because regulators changed reporting requirements in 1984. There were 159 banks in business in the period. The unit of analysis was the bank-year. The sample of banks was identified from the Call Reports database, which consists of balance sheet and income statement data that regulators require banks to file. Measures Strategic similarity. We measure strategic similarity using strategic distance (Chen & Hambrick, 1995; Cool & Dierickx, 1993; Fiegenbaum & Thomas, 1995; Gimeno & Woo, 1996; Miles et al., 1993). As applied in this research, strategic distance measures the Euclidean distance between the strategies of the individual bank and average strategies of all banks in the Twin Cities. Average strategies represent reference points for managers in positioning decisions Page 10 (Fiegenbaum & Thomas, 1988; Huff, 1982; Mintzberg & Waters, 1985). The strategy variables used to measure strategic similarity in this study were bank asset strategies (Santomero, 1984). An asset strategy is the allocation of resources to certain revenueproducing activities (cf. Chandler, 1962). It is expressed here as a proportion of total assets. Financial economists (e.g., Swamy, Barth, Chou, & Jahera, 1996) and management researchers (e.g., Reger, Duhaime, & Stimpert, 1992; Haveman, 1993) used asset allocation models to measure strategy. Data from the Call Reports were used to measure eleven asset strategy variables: commercial loans, real estate loans, loans to individuals, agriculture loans, other loans and leases, cash, overnight money, securities, trading accounts, fixed assets, and all other assets. The following equation was used to calculate SDit, the Euclidean strategic distance from industry average for bank i in time t, where Pait is the proportion of the assets in strategy a for bank i in time t, and M(Pat) is the mean proportion of strategy a for the industry in time t. 11 SDit Pait M Pat a 1 1/ 2 2 The range of SDit is non-negative, and it decreases as strategic similarity increases. Performance. Although there are many ways to measure performance, in commercial banking return on assets (ROA) was the most commonly used and well-regarded measure during our sample period (e.g., Barnett et al, 1994; Berger, 1995; Gilbert, 1984; Swamy et al., 1996). Reger et al. (1992: 195) stated: "Return on assets is the most meaningful financial indicator in the banking industry and is the indicator most closely watched by bank analysts and the bankers themselves." ROA measures the effectiveness of management’s utilization of its assets and allows comparison between banks with different capital structures (Kidwell & Peterson, 1990). ROA is especially appropriate for our sample because most banks were privately held. We computed ROA as the ratio of net income to average assets. Total average assets was the Page 11 denominator, consistent with bank regulatory practice, because banks undertake "window dressing" of their balance sheets at year-end and assets change over time. For clarity in our regression tables, we multiplied ROA (and its lagged value) by 10. Legitimacy. Reflecting on the multidimensional nature of legitimacy, Ruef and Scott (in press) suggested that empirical researchers limit the scope of their studies to certain components. They examined the legitimacy of hospitals from the perspective of professional organizations. We follow their lead and measure two types of socio-political legitimacy, regulative and normative (Scott, 1995). Socio-political legitimacy is usually measured from endorsements made by constituents who have the authority to confer legitimacy (Meyer & Scott, 1983; Stinchcombe, 1968). Constituents endorse a firm when it satisfies the norms and rules of society. They also issue legitimacy challenges or “anti-endorsements” when a firm is not congruent with these norms and rules (Ashforth & Gibbs, 1990; Dowling & Pfeffer, 1975; Hirsch & Andrews, 1984). Legitimacy challenges may be more visible than endorsements. Pfeffer and Salancik (1978: 194) stated: "Legitimacy is known more readily when it is absent than when it is present." Researchers examined endorsements by regulatory agencies, religious organizations, finance intellectuals, professional associations, etc. (Baum & Oliver, 1991; Davis et al., 1994; Singh et al., 1986; Westphal et al., 1997). Regulative legitimacy focuses on adherence to legal and regulatory rules (Scott, 1995) that often embody deeper social values and expectations (Edelman & Suchman, 1997). An important publicly available endorsement was the regulators’ evaluation of a bank's capital position, which reflect its ability to safeguard customer deposits. Regulators classified banks into three categories. Banks in lower categories were not endorsed by the regulators. Instead, they were subject to increased levels of regulatory supervision that varied by category. Banks Page 12 persisting in the lowest category would be closed. We measured regulative legitimacy using the regulators’ three ordered categories (Spong, 1985, 1990). These categories were numbered 0, 1, and 2, with 2 representing adequate capital. This variable was called regulatory endorsement. Normative legitimacy focuses on adherence to social norms and values (Parsons, 1960; Scott, 1995). The general public has values that it expects banks to share and expectations for the actions that banks undertake. Normative legitimacy is the extent to which a bank adheres to these values and fulfills these expectations for action. We measured normative legitimacy by content analyzing media reports. Communication and management research pointed out the media influence and reflect societal norms and values (Dowling & Pfeffer, 1975; Gamson, Croteau, Hoynes, & Sasson, 1992; Gans, 1979). When firm actions are illegitimate, comments and attacks occur, and the media report such comments (Dowling & Pfeffer, 1975; Pfeffer & Salancik, 1978: 194). Although the media may be biased towards bad news, we assume this bias does not vary across banks. Moreover, endorsements of a bank and reports of its legitimate actions appear in the media. A firm that was not challenged in the media would be legitimate because no question was raised about its role and role performance (Meyer & Scott, 1983). The media was used to assess the legitimacy of President Reagan’s Task Force on Food Assistance (Coombs, 1992), ACT UP and Earth First! (Elsbach & Sutton, 1992), the unrelated diversification strategy (Davis et al., 1994), the population of biotechnology firms (Hybels, Ryan, & Barley, 1994), and downsizing (Lamertz & Baum, 1998). We measured normative legitimacy using a variable called media endorsement reported by Deephouse (1996) who content analyzed Twin Cities' newspapers. Following Janis and Fadner (1965), it measures the relative proportions of endorsing and challenging recording units for a bank in a year. Its range is (-1, 1). It equals 0 when the number of challenging articles equals the number of endorsing articles. Page 13 Control Variables. We included several variables to improve model specification. The first was for bank size. Most economic research suggests that larger banks should be more profitable than smaller banks. Two reasons for this are the market power and the efficient structure hypotheses (Berger, 1995). The former argues that large companies can set higher prices because of their size (Gale, 1972). The latter argues that larger firms have lower costs resulting from scale economies or superior management (Demsetz, 1973). Size also controls for the possibility that there are strategic groups of banks based on size, as suggested by Porter (1979) and Reger and Huff (1993). Size may also increase legitimacy. Larger firms have more contractual and social ties with actors in the external environment which should lead to more endorsements (Baum & Oliver, 1991; Galaskiewicz, 1985; Pfeffer & Salancik, 1978; Singh et al., 1986;). We measured size with market share of deposits, consistent with prior bank studies (e.g., Berger, 1995; Smirlock, 1985). Market share was correlated in excess of 0.93 with total average assets and number of employees, two other measures of size common in organizational research. The asset strategies measuring strategic similarity primarily address the revenue side of banking, not the cost side. Banks which emphasized low costs should have higher performance (Dos Santos & Peffers, 1995). Following Dos Santos and Peffers (1995), we controlled for costs using the total expense ratio, the ratio of total expenses to total average assets. Age may increase legitimacy. Singh et al. (1986) stated that older firms were more likely to develop stronger exchange relationships, to become part of a power hierarchy, and to have their actions endorsed by powerful collective actors. Older firms are more also reliable (Hannan & Freeman, 1984). We obtained the founding year for each bank from Polk's Bank Directory, a semi-annual reference of banks. Lagged dependent variables also were included as controls. These reflect the possibility that the effects of changes in the independent variables, such as the effect of strategic similarity Page 14 on performance, are distributed over multiple time periods (Fomby, Hill, & Johnson, 1984). Annual dummy variables were added to each equation. We excluded the dummy variable for the first year to avoid perfect collinearity with the intercept (Greene, 1993). Annual dummies reflect overall trends occurring in the competitive market or the institutional environment, such as changes in the resource environment and the structure of the industry. We attempted to control for these directly using annual measures of market growth and concentration. Inclusion of these annual constants created serious collinearity problems (Belsley, Kuh, & Welsch, 1980). Statistical model and analysis techniques The following two equations comprise our basic statistical model. The first equation tests performance; the second, legitimacy. The legitimacy term represents regulatory endorsement and media endorsement. All variables are from time t except the lagged dependent variables. ROAit 0 1Strategic Distance it + 2 Legitimacy it 3 Market Share it M 4 Total Expense Ratio it 5 ROAi ,t 1 m 4 Year Dummy m2 Legitimacy it m e1t (1) 0 1Strategic Distance it + 2 ROAit 3 Market Share it 4 Age it 5 Legitimacy M i ,t 1 m 4 Year Dummy m2 m e2t (2) Taken as individual equations, a least squares estimator would be appropriate for the ROA equation, a probit estimator would be appropriate for the ordinal regulatory endorsement legitimacy variable, and a tobit estimator would be appropriate for the censored media endorsement legitimacy variable (Greene, 1993; Judge, Hill, Griffiths, Lüktepohl, & Lee, 1985). However, the mutual relationship between legitimacy and performance creates simultaneity bias which makes these estimators biased and inconsistent (Greene, 1993; Judge et al., 1985; Kennedy, 1985). The usual solution for simultaneity bias is to replace ROA and the legitimacy measures on the right hand side of the equations with instrumental variables, but the typical twostage least squares procedures in most statistical packages are inappropriate because the Page 15 legitimacy measures are not continuous. To address this, we applied the two-step estimator introduced by Heckman (1978) and Amemiya (1978, 1979) for non-continuous variables. Identification is a precondition for estimating a simultaneous equations model. The two equations are identified by the rank condition (Judge et al., 1985; Greene, 1993). In small samples, the asymptotic covariance matrices derived by Amemiya (1979) and Hill and Waters (1995) for censored and ordinal dependent variables usually understate the true standard errors (Freedman & Peters, 1984). This increases the chance of Type I error. To mitigate this, we employed empirically derived standard errors based on a bootstrap procedure (Jeong & Maddala, 1993). We implemented our estimation procedure using IML, the matrix programming procedure in SAS (SAS Institute, 1990). After collecting our media data, we discovered that not all the banks received media coverage each year. Because media endorsement is measured only for banks covered by the media, there may be sample selection bias (Heckman, 1979). Estimates for the sample may not apply to all the banks in the period, thus raising generalizability concerns. To correct for this, we applied the two-step procedure presented by Heckman (1979). The first step estimated a probit model predicting whether a bank received media coverage. We used these estimates to create a variable called the "inverse Mills ratio" that corrects for sample selection bias when included in both equations of the model. We also modified the statistical model slightly. To reduce collinearity in the ROA equation, we eliminated the theoretically unimportant dummy variable for 1989 (Belsley, Kuh, & Welsch, 1980). In the legitimacy equation, we eliminated the lagged dependent variable because its inclusion would cut the sample size from 265 to 155. RESULTS We examined our data in the two periods associated with our measures of regulative and normative legitimacy. After collecting and classifying the regulatory data, we discovered that all Page 16 banks were in the highest regulatory category during 1989-1992, so we analyzed this variable only in 1986-1988. Table 1 presents the means, standard deviations, and correlations among the variables during the period 1986-1988 when regulatory endorsement was the legitimacy measure. The sample size was 400. Table 2 presents these statistics from 1988-1992, when media endorsement was the legitimacy measure. The sample size was 265. -----Insert Tables 1 and 2 About Here----Table 3 presents the results of the two-step estimates. Hypothesis 1, based on strategic management theory, predicted that less strategic similarity increases performance. In columns 1 and 3, the coefficients for strategic distance were not statistically significant, providing no support for Hypothesis 1. The collusion hypothesis of oligopoly theory was not supported either, given that the coefficients were greater than zero. Hypothesis 2, based on institutional theory, predicted that greater strategic similarity increases legitimacy. In columns 2 and 4, the coefficients for strategic distance were negative and significant at the p<.05 and p<.01 level, respectively, supporting hypothesis 2. Hypothesis 3, based on resource dependence theory, predicted that legitimacy increases performance. Neither the coefficient for regulatory endorsement in column 1 nor the coefficient for media endorsement in column 3 was statistically significant, providing no support to hypothesis 3. Hypothesis 4, based on institutional theory, predicted that performance increases legitimacy. The coefficient for ROA was positive and significant at the p<.05 level in column 2. It was not significant in column 4. Thus, there is mixed support for Hypothesis 4. -----Insert Table 3 About Here----Turning to the control variables, market share did not have a significant effect on any of the dependent variables. The total expense ratio had a significantly negative effect on ROA in both columns 1 and 3, as expected. Age did not have a positive effect on regulatory endorsement, Page 17 but it had a significantly negative effect on media endorsement. The lagged dependent variables were positive and significant, as expected. The inverse Mills ratio was positive and significant at the p<.001 level in column 4, implying that controlling for selectivity was very important when estimating media endorsement. DISCUSSION AND CONCLUSION The relationships among firm-level similarity, performance, and legitimacy have attracted increased research attention recently (e.g., Chen & Hambrick, 1995; Deephouse, 1996; Geletkanycz & Hambrick, 1997; Gimeno & Woo, 1996; Westphal et al., 1997). This paper coalesced strategic management, institutional, and resource dependence theories to create the similarity paradox. The paradox highlights the challenges managers face in strong competitive and institutional environments. It also advances our understanding of theory (Poole & Van de Ven, 1989; Sutton & Staw, 1995). We tested the paradox in a population of commercial banks using a simultaneous equations model. Although the paradox as a whole was not supported, our results lent support to the predictions of institutional theory. Our study has several implications for future research on the paradox and its components. The first hypothesis stated that less strategic similarity increases performance, based on strategic management theory (e.g., Porter, 1991). We did not find statistical support for this. Past results in different industries have been mixed (Geletkanycz & Hambrick, 1997; Gimeno & Woo, 1996; Westphal et al., 1997). One explanation may be the level of uncertainty in the banking industry. Geletkanycz and Hambrick (1997) found the relationship was positive in the more certain branded foods industry and negative in the more uncertain computer industry. At some level of uncertainty, the relationship between conformity and performance switches from positive to negative. It is plausible that the level of uncertainty in the banking industry is between the levels in computers and branded foods such that the relationship between similarity and ROA is Page 18 near zero. A second explanation for these results is that we examined similarity across all competitors in the market, consistent with strategy (e.g., Geletkanycz & Hambrick, 1997) and financial economics research (e.g., Berger, 1995). Future research could examine if competition is more localized around strategic groups (e.g., Cool & Dierickx, 1993) or firm-specific niches like geography (e.g., Gimeno & Woo, 1996). Our second hypothesis stated that greater strategic similarity increases legitimacy, based on new institutional theory (e.g., DiMaggio & Powell, 1983; Meyer & Rowan, 1977). We found strong support for this. Because our estimation controlled for the virtuous circle between performance and legitimacy, we provide more conclusive evidence for the positive effect of conformity on legitimacy shown in past research (e.g., Deephouse, 1996; Westphal et al., 1997). Taken together, the results for hypotheses 1 and 2 suggest the set of firms important for determining performance in the competitive environment can differ from the set important for determining legitimacy in the institutional environment. Having two different groups complicates the strategic choices made by managers and could be an important topic for future research. Past research implied there may be a virtuous circle between performance and legitimacy, but neither relationship has been formally tested in past research . Hypothesis 3 stated legitimacy should increase performance, based on resource dependence theory (Pfeffer & Salancik, 1978). Although least squares estimates (available on request) show that regulative legitimacy had a positive effect on ROA, our final analysis did not support this hypothesis. Thus, controlling for simultaneity bias is important when testing performance and legitimacy. A theoretical explanation for our results is that other institutions may diminish the benefits of legitimacy. In banking, government deposit insurance and the regulators’ practice of merging troubled banks may have curtailed the need for potential exchange partners to rely on the regulatory and media endorsements in their decisions. Page 19 Hypothesis 4 stated that performance should increase legitimacy, based on institutional theory (e.g., Friedland & Alford, 1991; Suchman, 1995). We found different results for the two types of legitimacy. Performance had a positive effect on regulatory legitimacy. A central concern of regulators is the safety and soundness of banks (Spong, 1990), and, as our results demonstrated, performance helps alleviate this concern. The results for normative legitimacy did not support hypothesis 4, however. One explanation is the Twin Cities community did not value higher profits as much as other characteristics, such as the companies’ charitable giving that Galaskiewicz (1997) has studied extensively. Similarly, in Canada, high bank profits led to “bank bashing” (Partridge, 1996: B1). Taken together, the results for Hypotheses 3 and 4 suggest that future research could examine differences in the relationship between performance and different types of legitimacy (e.g., Ruef & Scott, in press; Scott, 1995; Suchman, 1995). This paper also makes a methodological contribution to legitimacy research. Legitimacy is often conceptualized non-continuously (Galaskiewicz, 1985; Meyer & Scott, 1983; Pfeffer & Salancik, 1978: 194) and measured using endorsements (Baum & Oliver, 1991; Singh et al., 1986). Although this complicates testing the virtuous circle between performance and legitimacy, we resolved it by developing a simultaneous equations technique. There are some limitations to this study that could be examined in future research. We examined only one type of performance, ROA, an appropriate measure in our sample of privately held banks. Future research could use market return to measure performance among publicly traded firms. A second limitation is causality. Consistent with the strategic choice view (Child, 1972), we assumed strategic choices led to differences in the similarity of competitors, which then affect performance and legitimacy. Strong causal inference from our results would be inappropriate. A third limitation is generalizability. We studied only one industry in one market. Future research could examine the similarity paradox in other samples facing strong competitive Page 20 and institutional forces. In sum, this paper integrated strategic management, institutional, and resource dependence theories to develop a paradox connecting three important concepts: similarity, legitimacy, and performance. Our empirical analysis supported hypotheses based on institutional theory. We recommend further examination of the hypotheses based on strategic management and resource dependence theories that did not receive support here. On a broader level, this paper contributes to the study of how firms interact with competitive and institutional forces and to the dialogue among the theories that address this important topic. Page 21 ENDNOTES Some research in strategic management proposes that greater strategic similarity increases performance, namely strategic groups and oligopoly theories. Similar firms may engage in tacit collusion (Caves & Porter, 1977; Stigler, 1964). Whether collusion supplants competition depends on many conditions (Cool & Dierickx, 1992), and empirical support in the banking industry is weak (Berger, 1995). Hence, we do not state this as a competing hypothesis. We do consider it in our research design and in our results. 1 Page 22 REFERENCES Amemiya, T. 1978. The Estimation of a Simultaneous Equation Generalized Probit Model. Econometrica, 46: 1193-1205. Amemiya, T. 1979. The Estimation of a Simultaneous Equation Tobit Model. International Economic Review, 20: 169-181. Ashforth, B. E., & Gibbs, B. W. 1990. The double-edge of organizational legitimation. Organization Science, 1: 177-194. Barnett, W. P., Greve, H. R., & Park, D. Y. 1994. An evolutionary model of organizational performance. Strategic Management Journal, 15 (Winter): 11-28. Barney, J. B. 1991. Firm resources and sustained competitive advantage. Journal of Management, 17: 99-120. Baum, J. A. C., & Oliver, C. 1991. Institutional linkages and organizational mortality. Administrative Science Quarterly, 36: 187-218. Belsley, D., Kuh, E., & Welsch, R. 1980. Regression diagnostics: Identifying influential data and sources of collinearity. New York: Wiley. Berger, A. N. 1995. The profit-structure relationship in banking -- Tests of market-power and efficient-structure hypotheses. Journal of Money, Credit, and Banking, 27: 404-431. Chamberlin, E. 1933. The theory of monopolistic competition. Cambridge: Harvard University Press. Chandler, A. D. 1962. Strategy and structure. Cambridge, MA: MIT Press. Chen, M-J. 1996. Competitor analysis and interfirm rivalry: Toward a theoretical integration. Academy of Management Review, 21: 100-134. Chen, M-J., & Hambrick, D. C. 1995. Speed, stealth, and selective attack: How small firms differ from large firms in competitive behavior. Academy of Management Journal, 38: 453-482. Child, J. 1972. Organizational structure, environment, and performance: The role of strategic choice. Sociology, 6: 2-21. Cool, K., & Dierickx, I. 1993. Rivalry, strategic groups, and firm profitability. Strategic Management Journal, 14: 47-59. Coombs, W. T. 1992. The failure of the task force on food assistance: A case study of the role of legitimacy in issue management. Journal of Public Relations Research, 4(2): 101-122. Cornell, B., & Shapiro, A. C. 1987. Corporate stakeholders and corporate finance. Financial Management, 16 (1): 5-14. Page 23 Cyert, R. A., & March, J. G. 1963. A behavioral theory of the firm. Englewood Cliffs, NJ: Prentice-Hall. Dacin, M. T. 1997. Isomorphism in context: The power and prescription of institutional norms. Academy of Management Journal, 40: 46-81. D’Aveni, R. A. 1994. Hypercompetition. New York: Free Press. Davis, G. F., Diekmann, K. A., & Tinsley, C. H. 1994. The decline and fall of the conglomerate form in the 1980s: The deinstitutionalization of an organizational form. American Sociological Review, 59: 547-570. Deephouse, D. L. 1996. Does isomorphism legitimate? Academy of Management Journal, 39: 1024-1039. Demsetz, H. 1973. Industry structure, market rivalry, and public policy. Journal of Law and Economics, 16: 1-10. DiMaggio, P. J., & Powell, W. W. 1983. The iron cage revisited: Institutional isomorphism and collective rationality in organizational fields. American Sociological Review, 48: 147-160. Dos Santos, B. L., & Peffers, K. 1995. Rewards to investors in innovative information technology applications: First movers and early followers in ATMs. Organization Science, 6: 241-259. Dowling, J., & Pfeffer, J., 1975. Organizational legitimacy: Social values and organizational behavior. Pacific Sociological Review, 18: 122-136. Edelman, L. 1992. Legal ambiguity and symbolic structures: Organizational mediation of civil rights law. American Journal of Sociology, 97: 1531-1576. Edelman, L. B., & Suchman, M. C. 1997. The legal environments of organizations. Annual Review of Sociology, 23: 479-515. Elsbach, K. D., & Sutton, R. I. 1992. Acquiring institutional legitimacy through illegitimate actions: A marriage of institutional and impression management theories. Academy of Management Journal, 35: 699-738. Farjoun, M. & Lai, L. 1997. Similarity judgements in strategy formulation: Role, process, and implications. Strategic Management Journal, 18: 255-273. Federal Reserve Bulletin. 1991. Legal developments: Order approving the acquisition of a bank holding company. 77: 110. Fiegenbaum, A., & Thomas, H. 1988. Attitudes towards risk and the risk-return paradox: Prospect theory explanations. Academy of Management Journal, 31: 85-106. Page 24 Fiegenbaum, A., & Thomas, H. 1995. Strategic groups as reference groups: Theory, modeling and empirical examination of industry and competitive strategy. Strategic Management Journal, 16: 461-476. Fligstein, N. 1991. The structural transformation of American industry: An institutional account of the causes of diversification in the largest firms, 1919-1979. In W. W. Powell & P. J. DiMaggio (Eds..), The new institutionalism in organizational analysis: 311-336. Chicago: U. of Chicago Press. Fomby, T. B., Hill, R. C., & Johnson, S. R. 1984. Advanced econometric methods. New York: Springer Verlag. Freedman, D. A., & Peters, S. C.. 1984. Bootstrapping an econometric model: Some empirical results. Journal of Business and Economic Statistics, 2: 150-158. Friedland, R., & Alford, R. R. 1991. Bringing society back in: Symbols, practices, and institutional contradictions. In W. W. Powell & P. J. DiMaggio (Eds.), The New Institutionalism in Organizational Analysis: 232-263. Chicago: U. of Chicago Press. Galaskiewicz, J. 1985. Interorganizational relations. Annual Review of Sociology, 11: 281-304. Galaskiewicz, J. 1997. An urban grants economy revisited: Corporate charitable contributions in the Twin Cities, 1979-81, 1987-89. Administrative Science Quarterly, 42: 445-471. Gale, B. T., 1972. Market share and rate of return. The Review of Economics and Statistics, 54: 412-423. Gamson, W. A., Croteau, D., Hoynes, W., & Sasson, T. 1992. Media images and the social construction of reality. Annual Review of Sociology, 18: 373-393. Gans, H. J. 1979. Deciding what’s news. New York: Pantheon Books. Geletkanycz, M. A., & Hambrick, D. C. 1997. The external ties of top executives: Implications for strategic choice and performance. Administrative Science Quarterly, 42: 654-681. Gilbert, R. A. 1984. Bank market structure and competition: A review and evaluation, Journal of Money, Credit, and Banking, 16: 617-44. Gimeno, J., & Woo, C. Y. 1996. Hypercompetition in a multimarket environment: The role of strategic similarity and multimarket contact in competitive de-escalation. Organization Science, 7: 322-341. Greene, W. H. 1993. Econometric analysis (2nd ed.). New York: Macmillan. Hambrick, D. C., & D’Aveni, R. A. 1992. Top management team deterioration as part of the downward spiral of large bankruptcies. Management Science, 38: 1445-1466. Page 25 Hannan, M. T., & Freeman, J. 1984. Structural inertia and organizational change. American Sociological Review, 49: 149-164. Hannan, T. H. 1991. Bank commercial loan markets and the role of market structure: Evidence from surveys of bank lending. Journal of Banking and Finance, 15: 133-149. Haunschild, P. 1993. Interorganizational imitation: The impact of interlocks on corporate acquisition activity. Administrative Science Quarterly, 38: 564-592. Haveman, H. A. 1993. Follow the leader: Mimetic isomorphism and entry into new markets. Administrative Science Quarterly, 38: 593-627. Heckman, J. J. 1978. Dummy endogenous variables in a simultaneous equation system. Econometrica, 46: 931-959. Heckman, J. J. 1979. Sample selection bias as a specification error. Econometrica, 47: 153-161. Henderson, B. D. 1981. The concept of strategy. Boston: The Boston Consulting Group. Hill, R. C., & Waters, M. 1995. Estimation of a simultaneous equations model with an ordinal endogenous variable: The extent of teacher bargaining and the state legal environment. Journal of Economics and Finance, 19: 45-63. Hirsch, P. M., & Andrews, J. A. Y. 1984. Administrators' response to performance and value challenges: Stance, symbols, and behavior. In T. J. Sergiovanni and J. E. Corbally (Eds.), Leadership and Organizational Culture: 170-185. Urbana, IL: University of Illinois Press. Hotelling, H. 1929. Stability in competition. Economic Journal, 39: 41-57. Huff, A. S. 1982. Industry influences on strategy formulation. Strategic Management Journal, 3: 119-131. Hybels, R. C. 1995. On legitimacy, legitimation, and organizations: A critical review and integrative theoretical model. In D. P. Moore (Ed.), Academy of Management Best Papers Proceedings: 241-245. Hybels, R. C., Ryan, A. R. & Barley, S. R. 1994. Alliances, legitimation, and founding rates in the U. S. biotechnology field, 1971-1989. Paper presented at the annual meeting of the Academy of Management, Dallas. Janis, I. L., & Fadner, R. 1965. The coefficient of imbalance. In H. D. Lasswell, N. Leites, & Associates (Eds.), Language of politics: 153-169. Cambridge: MIT Press. Jeong, J., & Maddala. G. S. 1993. A perspective on application of bootstrap methods in econometrics. Handbook of statistics, 11: 573-610. Judge, G. G., Hill, R. C., Griffiths, W. E., Lutkephol, H., & Lee, T-C. 1985. The theory and practice of econometrics. New York: Wiley. Page 26 Kennedy, P. 1985. A guide to econometrics (2nd ed.). Cambridge: MIT Press. Kidwell, D. S., & Peterson, R. L. 1990. Financial institutions, markets, and money (4th ed.). Chicago: Dryden Press. Lamertz, K., & Baum, J. A. C. 1998. The legitimacy of organizational downsizing in Canada: An analysis of explanatory media accounts. Canadian Journal of Administrative Sciences, 15: 93107. Levine, S., & White, P. E. 1961. Exchange as a conceptual framework for the study of interorganizational relationships. Administrative Science Quarterly, 5: 583-601. Meyer, J. W., & Rowan, B. 1977. Institutional organizations: Formal structure as myth and ceremony. American Journal of Sociology, 83: 340-363. Meyer, J. W., & Scott, W. R. 1983. Centralization and the legitimacy problems of local government. In J. W. Meyer & W. R. Scott. Organizational environments: 199-215. Newbury Park, CA: Sage. Miles, G., Snow, C. C., & Sharfman, M. P. 1993. Industry variety and performance. Strategic Management Journal, 14: 163-177. Mintzberg, H. 1978. Patterns in strategy formulation. Management Science, 24: 934-948. Mintzberg, H. 1987. The strategy concept: Five Ps for strategy. California Management Review, 30 (1): 11-24. Mintzberg, H., & Waters, J. A. 1985. Of strategies, deliberate and emergent. Strategic Management Journal, 6: 257-272. Oliver, C. 1991. Strategic responses to institutional processes. Academy of Management Review, 16: 145-179. Oliver, C. 1997. Sustainable competitive advantage: Combining institutional and resource-based views. Strategic Management Journal, 18: 697-713. Parsons, T. 1960. Structure and process in modern societies. Glencoe, IL: Free Press. Partridge, J. 1996. Royal sets profit record. The Globe and Mail, December 5: B1. Pfeffer, J., & Salancik, G. R. 1978. The external control of organizations. New York: Harper and Row. Polk, R. L. and Co. (various issues). Polk's Bank Directory. Nashville, TN: R. L. Polk and Co.. Poole, M. S., & Van de Ven, A. H. 1989. Using paradox to build management and organization theories. Academy of Management Review, 14: 562-578. Page 27 Porac, J. F., Thomas, H., & Baden-Fuller, C. 1989. Competitive groups as cognitive communities: The case of Scottish knitwear manufacturers. Journal of Management Studies, 26: 397-416. Porter, M. E. 1979. The structure within industries and companies' performance. The Review of Economics and Statistics, 61: 214-227. Porter, M. E. 1980. Competitive strategy. New York: Free Press. Porter, M. E. 1991. Towards a dynamic theory of strategy. Strategic Management Journal, 12 (Winter): 95-117. Powell, W. W. 1991. Expanding the scope of institutional analysis. In W. W. Powell & P. J. DiMaggio (Eds.) The new institutionalism in organizational analysis: 183-203. Chicago: U. of Chicago Press. Rao, H. 1994. The social construction of reputation: Certification contests, legitimation, and the survival of organizations in the American automobile industry: 1895-1912. Strategic Management Journal, 15 (Winter): 29-44. Reger, R. K., & Huff, A. S. 1993. Strategic groups: A cognitive approach. Strategic Management Journal, 103-124. Reger, R. K., Duhaime, I. M. & Stimpert, J. L. 1992. Deregulation, strategic choice, risk, and financial performance. Strategic Management Journal, 13: 189-204. Roberts, P. W., & Greenwood, R. 1997. Integrating transaction cost and institutional theories: Toward a constrained-efficiency framework for understanding organizational design adoption. Academy of Management Review, 22: 346-373. Ruef, M., & Scott, W. R. In press. A multidimensional model of organizational legitimacy: Hospital survival in changing institutional environments. Administrative Science Quarterly. Rumelt, R. P., Schendel, D. E., & Teece, D. J. 1994. Fundamental issues in strategy. In R. P. Rumelt, D. E. Schendel, &. D. J. Teece, (eds.), Fundamental issues in strategy: A research agenda: 9-47. Boston: Harvard Business School Press. SAS Institute. 1990. SAS/IML software: Usage and reference, Version 6, (1st ed.). Cary, NC: SAS Institute. Santomero, A. M. 1984. Modeling the banking firm: A survey. Journal of Money, Credit, and Banking, 16: 617-44. Scott, W. R. 1987. Organizations: Rational, natural, and open systems (2d ed.). Englewood Cliffs, NJ: Prentice-Hall. Page 28 Scott, W. R. 1994. Introduction. In W. R. Scott, & S. Christensen (Eds.), The institutional construction of organizations: xi-xxiii. Thousand Oaks, CA: Sage. Scott, W. R. 1995. Institutions and organizations. Thousand Oaks, CA: Sage. Scott, W. R., & Meyer, J. W. 1991. The organization of societal sectors. In W. W. Powell, & P. J. DiMaggio, (Eds.) The new institutionalism in organizational analysis: 108-140. Chicago: U. of Chicago Press. Singh, J. V., Tucker, D. J. & House, R. J. 1986. Organizational legitimacy and the liability of newness. Administrative Science Quarterly, 31: 171-193. Smirlock, M. 1985. Evidence on the (non) relationship between concentration and profitability in banking. Journal of Money, Credit, and Banking, 17(1): 69-83. Spong, K. 1985. Banking regulation: Its purposes, implementation, and effects (2nd ed.). Kansas City: Federal Reserve Bank of Kansas City. Spong, K. 1990. Banking regulation: Its purposes, implementation, and effects (3rd ed.). Kansas City: Federal Reserve Bank of Kansas City. Stinchcombe, A. L. 1968. Constructing social theories. New York: Harcourt, Brace & World. Suchman, M. C. 1995. Managing legitimacy: Strategic and institutional approaches. Academy of Management Review, 20: 571-610. Sutton, R. I. & Staw, B. M. 1995. What theory is not. Administrative Science Quarterly, 40: 371384. Swamy, P. A. V. B., Barth, J. R., Chou, R. Y., & Jahera, J. S., Jr. 1996. Determinants of U. S. commercial bank performance: Regulatory and econometric issues. In A. H. Chen (ed.), Research in Finance, 14: 117-156. Weber, M. 1958. The Protestant ethic and the spirit of capitalism. New York: Charles Scribner’s Sons. Wernerfelt, B.. 1984. A resource-based view of the firm. Strategic Management Journal, 5: 171180. Westphal, J. D., Gulati, R., & Shortell, S. M. 1997. Customization or conformity: An institutional and network perspective on the content and consequences of TQM adoption. Administrative Science Quarterly, 42: 366-394. Page 29 TABLE 1 Correlations for 1986-1988a Mean s.d 1. ROA (Return on Assets) 0.009 0.008 2. ROAt-1 0.010 0.008 .65** 3. Regulatory endorsement 1.805 0.461 .37** .24** 4. Regulatory endorsementt-1 1.833 0.447 .27** .30** 5. Strategic Distance 0.042 0.033 -.07 -.09 -.28** -.24** 6. Market Share 0.007 0.034 -.14** -.13** -.04 -.04 .11* 7. Total Expense Ratio 0.083 0.010 -.60** -.54** -.28** -.30** .15** 53.230 32.677 .04 .05 8. Age 1 2 3 4 5 6 .50** -.04 .02 -.08 4 5 -.07 .28** aN=400. * p < 0.05; ** p < 0.01 (two-tailed). TABLE 2 Correlations for 1988-1992a Mean s.d 1 2 1. ROA (Return on Assets) 0.008 0.008 2. ROAt-1 0.008 0.008 3. Media Endorsement 0.871 0.317 -.03 -.00 4. Strategic Distance 0.040 0.035 .04 -.00 7 3 .56** -.11 6 -.21** Page 30 5. Market Share 0.017 0.060 -.03 -.17** -.18** .17* 6. Total Expense Ratio 0.084 0.014 -.44** -.33** .10 .06 50.230 33.5995 -.00 -.03 -.10 -.10 7. Age aN=265. * p < 0.05; ** p < 0.01 (two-tailed). .01 .46** -.07 Page 31 TABLE 3 Two-Step Estimatesa Sample Period & Dependent Variables 1986-1988 1 1988-1992 ROA 2 Regulatory Endorsement ROA Intercept 0.337*** (0.075) 0.052 (0.362) 0.151 (0.255) 2.763*** (0.170) Strategic Distance 0.003 (0.004) -0.184* (0.078) 0.003 (0.008) -0.101** (0.038) Regulatory endorsement 0.001 (0.010) Independent Variables Media Endorsement 4 Media Endorsement -0.002 (0.177) ROA 3.390* (1.709) Market Share -0.280 (0.234) Total Expense Ratio -3.328*** (0.720) Age ROAt-1 3 -0.051 (3.208) -1.148 (0.746) 0.081 (0.223) -2.026 (2.146) -1.334+ (0.794) -0.000 (0.003) 0.430*** (0.087) -0.005*** (0.001) 0.502*** (0.146) Regulatory endorsementt-1 0.968*** (0.208) Ordinal Probit Threshold 1.339*** (0.229) Inverse Mills Ratio 0.016 (0.015) 0.380*** (0.080) Annual Dummy Variables Not Shown. Sample Size 400 400 265 aStandard errors based on 500 bootstrap samples are in parentheses. Significance tests are two-tailed. + p < 0.10; * p < 0.05; ** p < 0.01; *** p < 0.001. 265