Practice Problems: Chapter 12, Inventory Management

advertisement

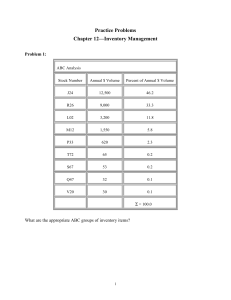

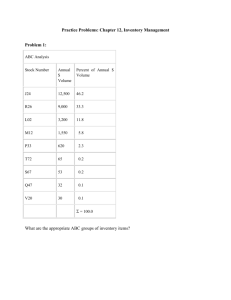

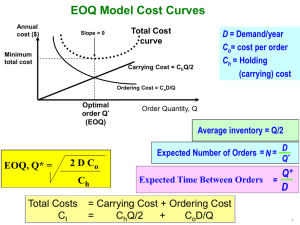

Practice Problems: Chapter 12, Inventory Management Problem 1: ABC Analysis Stock Number Annual $ Volume Percent of Annual $ Volume J24 12,500 46.2 R26 9,000 33.3 L02 3,200 11.8 M12 1,550 5.8 P33 620 2.3 T72 65 0.2 S67 53 0.2 Q47 32 0.1 V20 30 0.1 = 100.0 What are the appropriate ABC groups of inventory items? Problem 2: A firm has 1,000 “A” items (which it counts every week, i.e., 5 days), 4,000 “B” items (counted every 40 days), and 8,000 “C” items (counted every 100 days). How many items should be counted per day? Problem 3: Assume you have a product with the following parameters: Annual Demand = 360 units Holding cost per year = $1.00 per unit Order cost = $100 per order What is the EOQ for this product? Problem 4: Given the data from Problem 3, and assuming a 300-day work year, how many orders should be processed per year? What is the expected time between orders? Problem 5: What is the total cost for the inventory policy used in Problem 3? Problem 6: Based on the material from Problems 3 – 5, what would cost be if the demand was actually higher than estimated (i.e., 500 units instead of 360 units), but the EOQ established in problem 3 above is used? What will be the actual annual total cost? Problem 7: If demand for an item is 3 units per day, and delivery lead-time is 15 days, what should we use for a simple re-order point? Problem 8: Assume that our firm produces Type C fire extinguishers. We make 30,000 of these fire extinguishers per year. Each extinguisher requires one handle (assume a 300 day work year for daily usage rate purposes). Assume an annual carrying cost of $1.50 per handle, production setup cost of $150, and a daily production rate of 300. What is the optimal production order quantity? Problem 9: We use 1,000 electric drills per year in our production process. The ordering cost for these is $100 per order and the carrying cost is assumed to be 40% of the per unit cost. In orders of less than 120, drills cost $78 per unit; for orders of 120 or more the cost drops to $50 per unit. Should we take advantage of the quantity discount? Problem 10: Litely Corp sells 1,350 of its special decorator light switch per year and places orders for 300 of these switches at a time. Assuming no safety stocks, Litely estimates a 50% chance of no shortages in each cycle and the probability of shortages of 5, 10, and 15 units as 0.2, 0.15, and 0.15 respectively. The carrying cost per unit per year is calculated as $5 and the stockout cost is estimated at $6 ($3 lost profit per switch and another $3 loss of goodwill or future sales). What level of safety stock should Litely use for this product? (Consider safety stock of 0, 5, 10, and 15 units.) Problem 11: Presume that Litely carries a modern white kitchen ceiling lamp that is quite popular. The anticipated demand during lead-time can be approximated by a normal curve having a mean of 180 units and a standard deviation of 40 units. What safety stock should Litely carry to achieve a 95% service level? ANSWERS Problem 1: ABC Groups Class Items Annual Volume Percent of $ Volume A J24, R26 21,500 79.5 B L02, M12 4,750 17.6 C P33, T72, S67, Q47, V20 800 2.9 = 100.0 Item P33 is a judgment call. It might be considered a B item by some organizations. However, the modern tendency is to move items to as low a level as possible thereby reducing inventory management costs. Problem 2: Item Class Quantity Policy Number of Items to Count Per Day A 1,000 Every 5 days 1000/5 = 200/day B 4,000 Every 40 days 4000/40=100/day C 8,000 Every 100 days 8000/100=80/day Total items to count: 380/day Problem 3: EOQ 2* Demand *Order Cost 2*360*100 72000 268.33 items Holding cost 1 The EOQ model assumes any real quantity is feasible. The actual quantity ordered may need to be an integer value and may be affected by packaging or other item characteristics. In the following Problems an EOQ of 268 is assumed. Problem 4: N Demand 360 1.34 orders per year Q 268 T Working days 300 /1.34 224 days between orders Expected number of orders Problem 5: Demand *Order Cost (Quantity of Items) *(Holding Cost) Q 2 360*100 268*1 134 134 $268 268 2 TC Notice that at the EOQ Total Holding Cost and Total Ordering Cost are equal. Problem 6: Demand *Order Cost (Quantity of Items) *(Holding Cost) Q 2 500*100 268*1 186.57 134 $320.57 268 2 TC Note that while demand was underestimated by nearly 50%, annual cost increases by only 20% (320 / 268 120 . ) an illustration of the degree to which the EOQ model is relatively insensitive to small errors in estimation of demand. Problem 7: ROP = Demand during lead-time = 3 * 15 = 45 units Problem 8: The equation used differs from the basic EOQ model by allowing for gradual replenishment, which affects the average level of inventory. Q*p 2* Demand *Order Cost (2)(30, 000)(150) 3000 units 100 Daily Usage Rate 1.50 1 Holding Cost 1 300 Daily Production Rate Problem 9: Q*p ($78) (2)(1000)(100) 80 units (0.4)(78) Q*p ($50) (2)(1000)(100) 100 units 120 to take advantage of quantity discount. (0.4)(50) Ordering 100 units at $50 per unit is not possible, the discount does not apply until 120 units are ordered. We need to compare the total costs for the two alternatives, Q($78) and Q = 120. In this situation, the Total Cost equation must include the cost of the item since this is not a constant. Total cos t Demand * Cost Demand * Order Cost (Quantity of Items) * ( Holding cos t ) Q 2 (1000)(100) (80)(0.4)(78) 80 2 $78, 000 $1, 250 $1, 248 $80, 498 Total cost($78) (1000)(78) (1000)(100) (120)(0.4)(50) 120 2 $50, 000 $833 $1, 200 $52, 033 Total cost($50) (1000)(50) Therefore, we should order 120 each time at a unit cost of $50 and a total cost of $52,033. Notice that Total Holding Cost is not equal to Total Ordering Cost at the lowest cost alternative (Q = 120) since this is not an EOQ. Problem 10: Safety stock 0 units: Carrying cost equals zero. Total Stockout Costs = (stockout costs * possible units of shortage * probability of shortage * number of orders per year) S0 6*5*0.2* 1350 1350 1350 6*10*0.15* 6*15*0.15* $128.25 300 300 300 Safety stock 5 units: Carrying cos t $5 per unit * 5 units $25 Stockout cost: S5 6*5*0.15* 1350 1350 6*10*0.15* $60.75 300 300 Total Cost = Carrying cost + Stockout cost $25 $60.75 $85.75 Safety stock 10 units: Carrying cos t 10 * 5 $50.00 . * Stockout cost: S10 6* 5* 015 1350 $20.25 300 Total Cost = Carrying cost + Stockout cost $50.00 $20.25 $70.25 Safety stock 15: Carrying cos t 15* 5 $75.00 Stockout cos ts 0 (There is no shortage if 15 units are maintained) Total Cost = Carrying cost + Stockout cost $75.00 $0 $75.00 Therefore: Minimum cost comes from carrying a 10 unit safety stock. Problem 11: To find the safety stock for a 95% service level it is necessary to calculate the 95th percentile on the normal curve. Using the standard Normal table from the text, we find the Z value for 0.95 is 1.65 standard units. The safety stock is then given by: (165 . * 40) 180 66 180 246 Ceiling Lamps