ECON 306

advertisement

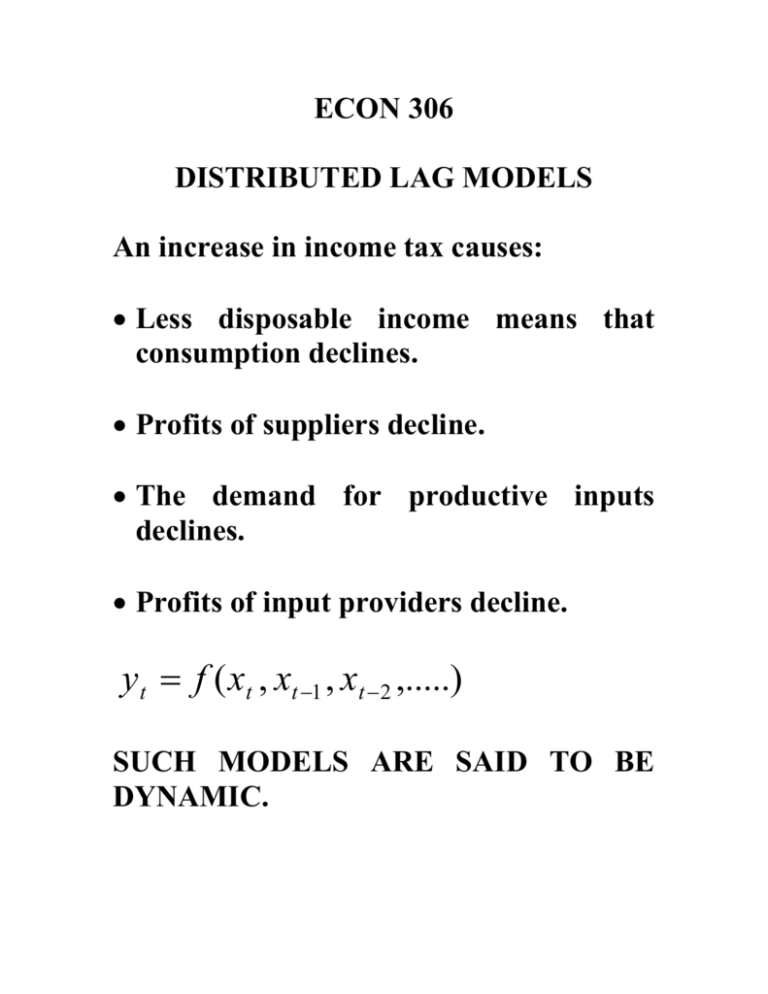

ECON 306 DISTRIBUTED LAG MODELS An increase in income tax causes: Less disposable income means that consumption declines. Profits of suppliers decline. The demand for productive inputs declines. Profits of input providers decline. y t f ( xt , xt 1 , xt 2 ,.....) SUCH MODELS ARE SAID TO BE DYNAMIC. THESE MODELS SPLIT INTO FINITE AND INFINITE LAG MODELS. FINITE LAG MODELS E.G. A FIRM'S CAPITAL EXPENDITURE DECISION 1.Investment approved. 2.Funds appropriated. 3.Actual expenditures are observed over subsequent periods as plans are finalised, labour and materials hired and construction carried out. If xt = capital appropriation and yt the amount of capital expenditure then yt will be observed over the periods t+1, t+2, … until the project is completed. We could say that xt affects yt, yt+1, yt+2, … i.e. the current period's appropriation decisions affect future capital expenditure. Alternatively we could say that current period capital expenditure decisions are affected by past capital appropriation decisions. Also we will assume that, after n quarters the effect of any appropriation decision is exhausted; hence: y t f ( xt , xt 1 , xt 2 ,...., xt n ) THIS IS A FINITE DISTRIBUTED LAG MODEL In order to convert this into a statistical model we require: A functional form. An error term. Some assumptions about the error term. We assume a linear model: y t 0 xt 1 xt 1 2 xt 2 ... n xt n et t n 1,..., T We assume: E (e t ) 0 E (e t ) t 2 2 E (et e s ) 0; t s Note loss of observations in such a model. In this model α is the intercept term and the βi are the DISTRIBUTED LAG WEIGHTS which reflects the fact that they measure the effect of changes in past appropriations Δxt-i on current expected expenditures ΔE(yi): ∂E(yt)/∂xt-i = βi This model can be estimated by OLS but multicollinearity may be a problem. An alternative is a RESTRICTED LEAST SQUARES approach which reduces the estimator variances. MODEL 1: THE ARITHMETIC LAG Proposed by Fisher in 1937, under this scheme the weights decline linearly. His restrictions were: 0 (n 1) 1 n 2 (n 1) . . n 0 βi n+1 The effect of a change in xt in the current period is β0 = (n+1) γ and the amount declines by γ in each subsequent period; in the (n+1)th period the effect has disappeared. Assume a 4 period lag model: y t 0 x t 1 xt 1 2 xt 2 3 xt 3 4 xt 4 et t 5,..., T y t (5 ) x t (4 ) xt 1 (3 ) xt 2 (2 ) x t 3 xt 4 et y t [5 xt 4 x t 1 3x t 2 2 xt 3 xt 4 ] et y t z t et z t 5 xt 4 x t 1 3x t 2 2 xt 3 xt 4 ˆ i (n 1 i )ˆ i 1,...,0 Collinearity is no longer a problem - there is only one RHS variable. But the restriction may not be true. This can be tested using an F test. MODEL 2: POLYNOMIAL DISTRIBUTED LAGS Proposed by Shirley Almon in 1965. She suggested constraining distributed lag weights to fall on a polynomial, probably of a low value. With a second order polynomial, the effect of Δxt-i on E(yt) is: E ( yt ) / xt i i 0 1i 2i 2 i 0,..., n βi i At time t the effect of the change of a policy variable is: E ( y t ) / xt 0 0 This model is commonly used to evaluate monetary and fiscal policies. With a lag of length of 4: 0 0 1 0 1 2 2 0 2 1 4 2 3 0 3 1 9 2 4 0 4 1 16 2 Substitution yields: y t 0 xt ( 0 1 2 ) xt 1 ( 0 2 1 4 2 ) xt 2 ( 0 3 1 9 2 ) xt 3 ( 0 4 1 16 2 ) xt 4 et yt 0 zt 0 1 zt1 2 zt 2 et z t 0 x t x t 1 xt 2 xt 3 x t 4 z t1 xt 1 2 xt 2 3x t 3 4 xt 4 z t 2 xt 1 4 xt 2 9 x t 3 16 xt 4 ˆi ˆ0 ˆ1i ˆ2i 2 i 0,..., n SELECTION OF THE LENGTH OF THE FINITE LAG Take the maximum length you are willing to consider. Use AIC/Schwarz - minimise - on increasingly shorter lag lengths. R squared and adjusted R squared are poor discriminators. THE INFINITE GEOMETRIC LAG yt 0 xt 1 xt 1 2 xt 2 .... et yt i 0 i xt i et i i 1 β i y t ( xt xt 1 2 xt 2 3 x t 3 ) et This is the INFINITE DISTRIBUTED LAG MODEL. It has 3 parameters: 1. The intercept, α. 2. A scale factor, β. 3. Ф which controls the rate at which the weights decline. E ( yt ) / xt i i i β is the IMPACT MULTIPLIER. If the change is sustained for 3 periods then: E ( y t 2 ) 2 If the change is sustained permanently, then the long run effect (total effect, long run multiplier) is: (1 2 3 ....) /(1 ) How can we estimate this: It has an infinite number of parameters. It is non-linear. THE KOYCK TRANSFORMATION Consider: yt yt 1 [ ( xt xt 1 2 xt 2 3 xt 3 ..... et ] [ ( xt 1 xt 2 2 xt 3 3 xt 4 ..... et 1 )] (1 ) xt (et et 1 ) yt (1 ) xt (et et 1 ) yt 1 1 2 yt 1 3 xt vt where: 1 (1 ) 2 3 v t (et et 1 ) How do we estimate this? Lagged dependent variable. vt depends on et and et-1. The OLS estimator is biased and this bias does not disappear in large samples. It is inconsistent. Two stage least squares will produce consistent estimates in large samples. yˆ t 1 a 0 a1 xt 1