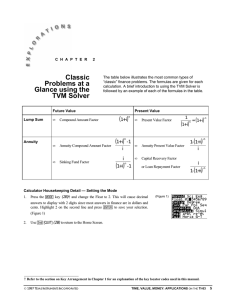

Key elements in determining the values of money

advertisement

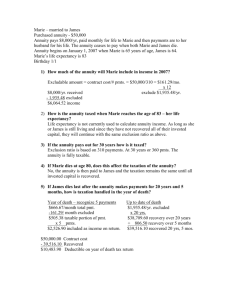

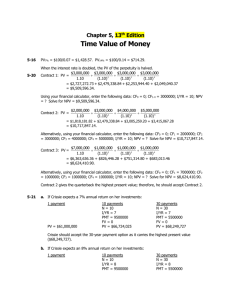

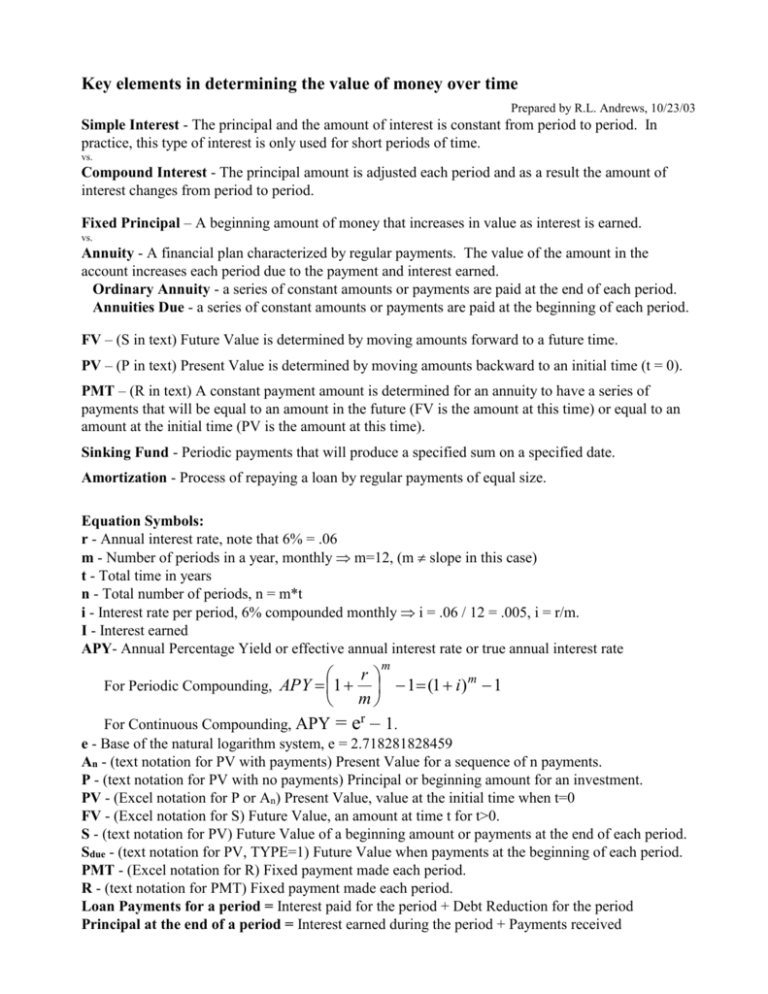

Key elements in determining the value of money over time Prepared by R.L. Andrews, 10/23/03 Simple Interest - The principal and the amount of interest is constant from period to period. In practice, this type of interest is only used for short periods of time. vs. Compound Interest - The principal amount is adjusted each period and as a result the amount of interest changes from period to period. Fixed Principal – A beginning amount of money that increases in value as interest is earned. vs. Annuity - A financial plan characterized by regular payments. The value of the amount in the account increases each period due to the payment and interest earned. Ordinary Annuity - a series of constant amounts or payments are paid at the end of each period. Annuities Due - a series of constant amounts or payments are paid at the beginning of each period. FV – (S in text) Future Value is determined by moving amounts forward to a future time. PV – (P in text) Present Value is determined by moving amounts backward to an initial time (t = 0). PMT – (R in text) A constant payment amount is determined for an annuity to have a series of payments that will be equal to an amount in the future (FV is the amount at this time) or equal to an amount at the initial time (PV is the amount at this time). Sinking Fund - Periodic payments that will produce a specified sum on a specified date. Amortization - Process of repaying a loan by regular payments of equal size. Equation Symbols: r - Annual interest rate, note that 6% = .06 m - Number of periods in a year, monthly m=12, (m slope in this case) t - Total time in years n - Total number of periods, n = m*t i - Interest rate per period, 6% compounded monthly i = .06 / 12 = .005, i = r/m. I - Interest earned APY- Annual Percentage Yield or effective annual interest rate or true annual interest rate m r m For Periodic Compounding, APY 1 1 (1 i ) 1 m For Continuous Compounding, APY = er – 1. e - Base of the natural logarithm system, e = 2.718281828459 An - (text notation for PV with payments) Present Value for a sequence of n payments. P - (text notation for PV with no payments) Principal or beginning amount for an investment. PV - (Excel notation for P or An) Present Value, value at the initial time when t=0 FV - (Excel notation for S) Future Value, an amount at time t for t>0. S - (text notation for PV) Future Value of a beginning amount or payments at the end of each period. Sdue - (text notation for PV, TYPE=1) Future Value when payments at the beginning of each period. PMT - (Excel notation for R) Fixed payment made each period. R - (text notation for PMT) Fixed payment made each period. Loan Payments for a period = Interest paid for the period + Debt Reduction for the period Principal at the end of a period = Interest earned during the period + Payments received 1. Fixed Principal a. Simple Interest I=P*r*t, S = P + I = P*(1+rt) or FV = PV*(1+rt) S = P + I = P + (number of periods)*(interest per period) = P+(t*m)*(P*i) Interest per period = Principal * i, where i is the interest rate per period. b. Compound Interest with m periods per year Interest per period = (Principal for the current period) * i FV = PV*(1+i) n or S P 1 i n r P 1 m mt c. Continuous Compounding of Interest FV = PV*ert or S = P*ert 2. Ordinary Annuity, fixed payment at the end of the period a. Future Value of an Annuity FV PMT 1 i n 1 i (1 i ) n 1 S R i b. Payment for the Future Value for an Ordinary Annuity PMT FV i 1 i n 1 … i RS n ( 1 i ) 1 c. Present Value of an Ordinary Annuity 1 1 i PV PMT i n 1 (1 i ) n An R i d. Payment for the Present Value of an Ordinary Annuity PMT PV i 1 1 i n i R An n 1 (1 i ) 3. Annuity Due, fixed payment at the beginning of the period (1 i)n 1 Sdue R (1 i) i n (1 i) 1 R Sdue (1 i) i 1 (1 i) n A( n, due) R (1 i) i n 1 (1 i) R A( n, due) (1 i) i