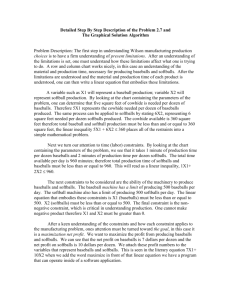

Cost coefficient analysis

A: Cost Coefficients c (j) Range Analysis: How far each coefficient of the objective functions can increase (or decrease) without having any impact on the current optimal solution?

The coefficient c (1) = 7 of Variable X1 (number of dozen baseballs to produce) has a range of optimality of 5 to 8.3333 while for Variable X2 (Number of dozen softballs to produce) coefficient c (2) = 10, has a range of optimality of 8.4 to 14. This means that as long as the profit per dozen baseballs (currently $7 per dozen) remains between $5 to $8.3333 per dozen, the optimal solution (product mix X1 = 360, X2 =

300) will remain 360 dozen baseballs and 300 dozen softballs provided all other input parameters remain constant, for example no change on c (2). Note however that the optimal value that is of the objective function will change to newc1 (X1=360) + $10(X2=300). For example, if due to competition

Wilson had to lower its price on baseballs causing the profit per dozen to decrease by $1 causing c1 is changed from $7 to $6 the current optimal (strategic) solution X1=360, X2 = 300 will be still optimal.

That is the optimal solution would remain the same, but profit would decrease to $5,160 from $5,520

(see table 2). The same holds true for decision variable X2 provided that its cost coefficient remains within its range of optimality ($8.40 to $14). See the result of raising c2 to $13 from $10 in table 3.

Table 2 – Lowered c1 to $6 from $7

Similarly, raising c2 from 10 to 13, the current optimal solution still is optimal.

Notice that this is true for one-change at a-time; we set back c1 to 7 as shown in table 3.

Table 3 – Raised c2 to $13 from $10

Conclusions: any change on c1 or c2 outside of their range will change the current optimal solution.

B: Right-hand Side (RHS) Sensitivity Range Analysis: How far each RHS of Constraint Ci can increase (or decrease) without having any impact on the value of the shadow prices if that RHS value. In other word, the solution to the dual problem (which are the shadow prices) remains optimal?

Since C1 and C2 are non-binding constraints (their respective slack is not equal to zero) as long as the

RHS values remain within their respective ranges, the shadow price and optimal solution will remain the same. For instance, if the RHS C1 = 500 were to fall to 360, the shadow price will be zero, because there is left-over of that resource (see table 4). However, if the RHS value changes for C3 or C4 which are binding constraints, but remains with the range of feasibility, the objective function value will change by the value of its Shadow Price per unit of the increase/decrease. For example, if the RHS of C3 changed to

3,700 from 3,600, the objective function value would will increases by $1 x 100 to 100 + 5520 = $5,620

(and certainly the optimal solution would change, because this constraint is a binding one, has slack = 0, it resource is fully utilized). Or if the RHS of C4 were to change from 960 to 900, the object function value would change decrease by ($2 x 60) =120 to 5520 - 120 = $5,400 (and the optimal solution would change).

Table 4 - C1 RHS value changed to 360 from 500

Table 5 – Changed RHS of C4 to 900 from 960

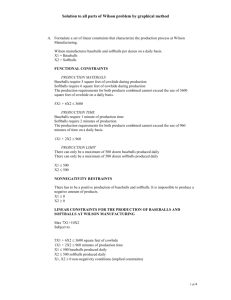

C: Construct the dual to the problem, solve it and provide economical interpretation

Primal

Maximize $7X

1

+ $10X

2

(Total daily profit)

Subject to:

C1 = X

1

≤ 500 (Production constraint)

C2 = X

2

≤ 500 (Production constraint)

C3 = 5X

1

+ 6X

2

≤ 3600 (Material constraint)

C4 = X

1

+ 2X

2

≤ 960 (Manufacturing time constraint)

C5 = X

1

≥ 0, X

2

≥ 0 (non-negativity conditions)

Dual

Minimize 500U

1

+ 500U

2

+ 3600U

3

+ 960U

4

Subject to:

U

1

+ 5U

3

+ U

4

≥ 7

U

2

+ 6U

3

+ 2U

4

≥ 10

U

1

, U

2

, U

3

, U

4

≥ 0

Dual form in WINQSB

Solution in WINQSB

The optimal solution of the dual of the original Wilson Linear Program, are the shadow prices from the primal (original) form of the Wilson problem and vice versa. The objective function value is $5,520 which is equal to that of the primal indicating that the primal and dual are in Economic Equilibrium with one another and that there is no duality gap. From the resulting output, one can determine that the value of an additional minute of manufacturing time (C4) is $2 provided that the total amount of time remains with the range of optimality in this instance for the dual of 866.67 to 1,120 minutes and that the cost of manufacturing time is a sunk cost. Also, one can infer that the additional value of an additional sq ft of cowhide (C3) is $1 provided the total amount of sq ft of cowhide remains within the range of 2,880 to 3,880 under similar assumptions. Therefore, Wilson should not pay more than $2 for an additional minute of manufacturing time and no more than $1 for additional sq ft of cowhide.

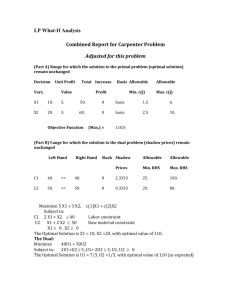

D: What-if Scenarios:

D1: Delete a constraint

An alternative supplier of cowhide is considering relocating within close proximity of Wilson. Such a move would eliminate the need for 3,600 sq ft of cowhide per day constraint (C3). Since this constraint has a slack of zero and is therefore binding, the optimal solution will change. Upon deletion of the cowhide material constraint, the maximized profit increases by $280 to $5,800 from $5,520 and the optimal solution changes to 500 dozen baseballs and 230 dozen softballs.

Linear Program Model after deletion of cowhide constraint (C3)

Optimal solution following deletion of cowhide constraint (C3)

Addition of a Variable

Wilson is considering adding baseball gloves which have a higher profit margin than softballs or baseballs to its product mix. Producing baseball gloves will take 4 minutes of manufacturing time and 2 sq ft of cowhide to manufacture and will generate a profit of $19 per glove. No more than 500 baseball gloves may be produced per day. Please note that since this production constraint is consistent with the other production constraints, it is a redundant constraint and should not affect the optimal solution.

Upon re-solving the linear programming model, it is determined that the optimal solution is 500 dozen baseballs, 174 dozen softballs, and 28 baseball gloves. The maximized profit increases by $252 dollars to

$5,772 from $5,520; thus, based solely on the profit increase alone, it is feasible to incorporate baseball gloves into Wilson’s product mix.

Wilson LP Model with Additional Decision Variable (X3) for Baseballs Gloves Included

Optimal Solution for Wilson LP Model with Additional Decision Variable (X3) for Baseballs Gloves

Included

Addition of a Constraint

Gas prices are on the rise again. As a result, Wilson can now only afford to ship orders 3 days a week rather than 5. Wilson has spare warehouse capacity, but anticipates that the higher gas prices will abate demand for its products and therefore it will temporarily reduce its daily output for baseballs and softballs combined to 600 dozen (X

1

+ X

2

<= 600). The current optimal solution X1=360, X2=300 violates this constraint (360 + 300 = 660 <= 600 = False); therefore, the solution must be resolved. Upon resolving the model, the optimal solution is found to be X1=240, X2=360 with a maximizing profit of

$5,280 down $240 dollars from the initial $5,520 maximizing profit.

Addition of Total Combined Output Constraint (C5)

Optimal Solution for Model with Addition of Total Combined Output Constraint (C5)

Deletion of a Variable

Due to the global financial crisis Wilson anticipates that it may no longer be viable to produce softballs due to weak demand and low contribution margins. As a result, decision variable X2 (number of dozen softballs), is removed from the linear model along with the redundant constraint C2=X2<=500, and the model is then resolved. The results of model without X2 indicate that the optimal solution is X1=500 with a maximizing profit of $3,500—a decrease of $2,020 from the initial situation.

Deletion of Variable X2

Optimal Solution for Model after Deletion of Variable X2