Chapter 9 - Cambridge University Press

advertisement

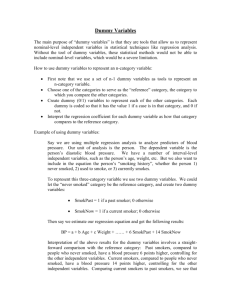

Solutions to the Review Questions at the End of Chapter 9 1. (a) This was a rather silly question since the answer is largely given away by the question in part (b)! Nonetheless, although there are several methods that could be used to determine whether there is evidence of daily seasonality in stock returns, a simple method would be to obtain a sample of daily stock returns and regress them on 5 day-of-the-week dummy variables. The coefficient estimates would then be interpreted as the average return on each day of the week, and if some of these were statistically significant but with differing signs, this could be taken as evidence of daily seasonalities. (b) The problem is one of perfect multicollinearity between the five daily dummy variables and the constant term known as the dummy variable trap. The sum of the five daily dummy variables will be one in every time period, and this will be identical to the column of ones used for the constant. The result is that the implicit assumption of the columns of the matrix of explanatory variables being independent of one another has been violated, and hence there is not enough separate information in the sample to be able to calculate the values of all of the coefficients. The (XX) matrix will be singular and therefore its inverse will not exist. The solution is simple: either use all 5 daily dummy variables but no intercept term, or drop one of the dummy variables and still include the intercept. These two methods of dealing with the problem are equivalent with identical RSS, and only the interpretation of the coefficient estimates will change. (c) The first step is to calculate the t-ratios. These are 0.232, -2.691, 0.673, 0.039, and –0.141 for the intercept, D1, D2, D3 and D4 respectively. The interpretation of the intercept coefficient is the value of the return when all of the variables (including the daily dummies) are zero, which in this case is the average Friday return. The coefficients on the daily dummies can be interpreted as the average deviation of that day’s return from the average return for all days of the week. Only one of these dummy variables is significant – the dummy for Monday, and we would thus conclude that the average return on Monday was significantly lower than the average return for the whole week, but there is no statistically significant evidence of any other daily seasonalities given these results. (d) Intercept dummy variables work by changing the regression intercept estimate if a certain set of conditions hold, while slope dummies work by changing the slope(s). For example, suppose that the regression model under study for a sample of daily returns is yt = 1 + 2x2t + 3x3t + ut . A model containing these variables but also including intercept dummy variables would be yt = 1 + 2x2t + 3x3t + 4D1t + 5D2t + 6D3t + 7D4t + ut . 1/6 “Introductory Econometrics for Finance” © Chris Brooks 2008 As before, if we include the intercept in the regression, we only want 4 dummy variables, and any 4 of the 5 daily dummies (defined as above) could be included. A model containing the explanatory variables and slope dummy variables would be yt = 1 + 2x2t + 3x3t + 4D1tx2t + 5D2tx2t + 6D3x2t + 7D4tx2t + 8D1tx3t + 9D2tx3t + 10D3tx3t + 11D4tx3t + ut . The dummy variables are defined identically as in the intercept dummy case, and again one less dummy is needed than the total number of days in the week. The dummies are now multiplied by explanatory variables so that each of the slopes on x2 and x3 are permitted to vary from one day to the next. (e) The financial year ends at approximately the end of March in the UK. So one way to test the hypothesis that stock returns are different at the end of the tax year compared with other times of the year would be to obtain a long sample of monthly returns and to regress the returns on a dummy variable taking the value one in March and zero otherwise. If, everything else equal, investors were selling to realise losses in March, we would expect the coefficient on this dummy to be negative and statistically significant due to excess selling pressure. Thus average March returns would be significantly lower than average returns over the whole year. 2. (a) A switching model is simply one where the behaviour of the series is permitted to change from one type to another under the model. For example, any regression containing seasonal dummy variables would be a simple kind of switching model, since the behaviour of the series will be different at different times. Threshold autoregressive (TAR) models are those where the variable under study is assumed to follow one autoregressive process in a given regime and other autoregressive processes in other regimes. Movements from one regime to another occur when a variable (not necessarily the variable under study) rises above or falls below a particular value. Markov switching models, in their simplest forms, assume that a variable can be drawn from one of several regimes, each regime having its own mean and variance. The key distinction between the two classes of models is that TAR models assume that the threshold variable governing the regime is known, and under the model, once this threshold is set, the variable is in one of the regimes alone. The Markov switching model, on the other hand, assumes that the state-determining or forcing variable is unobserved. The variable under study is thus never completely in one regime or another, but rather is in each regime with some probability at each point in time. The decision on which of the two model classes is more appropriate for a particular application would be made on the grounds of whether the statedetermining variable was observable or not, and what type of dynamics were of interest in the model. For example, if the financial theory does not suggest the forcing variable, then the Markov switching approach may be preferable. On the other hand, if theory suggests an obvious choice of switching variable, 2/6 “Introductory Econometrics for Finance” © Chris Brooks 2008 or if it is of interest to use an AR-type model, then the TAR would be more appropriate. There have been very few comparisons of the two approaches that I know of – authors seem to just adopt a particular approach and use it without discussing the alternatives available. (b) (i) The Markov property applies if a process is “path independent” – that is, it is only the current value of a series or the current set of probabilities that determine where the process will be during the next time period, and none of the values of the series or probabilities during previous time periods. Thus, a series that followed an AR(1) model would possess the Markov property. An algebraic expression for the Markov property is given in equation (9.10) on page 464. The implication of a process having the Markov property is that its development can be described using only a vector of current probabilities and a single transition matrix. (ii) A transition matrix, in the context of Markov switching models, is a matrix that maps a set of current probabilities to a set of future probabilities. Thus it will describe the probabilities of the process being in a particular state in the next period, conditioned upon it being in a given state during this period. (c) A SETAR model is a TAR model where the state-determining variable is the dependent variable used in the regression. The use of SETAR models rather than a more general TAR removes one item to decide on (the statedetermining variable). But there are many others – the number of regimes, the number of lags in each regime, the value(s) of the threshold(s), and the lag with which the variable will switch. The major difficulty with SETAR (and indeed all TAR) models is that it is impossible to easily and validly estimate all of these quantities at the same time. They depend on eachother, and also, the threshold causes a discontinuity in the function that would be maximised (if ML is used) or minimised (if NLS) is used. Therefore, the usually easiest way to estimate such models is to use as much knowledge as possible from financial theory and to assume values for other parameters and then to estimate as little as possible. For example, it may be the case that the number of regimes, the delay value and the threshold values can be assumed from theory. This would leave only the number of lags in each regime together with the coefficients to be estimated. This could be validly done using information criteria to determine the lag lengths for each regime and ML or NLS to estimate the coefficients. (d) Standard information criteria of the form described in Chapter 5 could be employed to determine the appropriate length of the lags in each regime. There would be one value of the criterion for each model order, and the model that order that minimised the value of the criterion would be the one selected. The problem with this approach is that, if the series under study resides in one of the regimes for a considerably shorter time than it resides in the others, a very short lag length will typically be selected for that regime. The reason is that the reduction in the overall residual sum of squares is unlikely to be big if it covers only a small number of observations. The upshot is that the use of 3/6 “Introductory Econometrics for Finance” © Chris Brooks 2008 standard information criteria applied globally to the whole model would typically be to lead to long lag lengths for all regimes that the series spends a high proportion of time in and short lag lengths for regimes that it did not enter very often. A solution is to define an information criterion that does not penalise the whole model for additional parameters in one state, i.e. a criterion that is a function of the separately calculated residual sums of squares for both of the regimes and of the number of lags and of the number of observations in each of those regimes. An algebraic example of such a criterion was given in equation (9.26) on page 476. (e) If there are transactions costs that are non-negligible, this can lead PPP not to hold since there would be deviations from PPP, which may appear to represent profitable trading opportunities since the law of one price is violated, but that in practice are unprofitable once these costs are taken into account. Thus, a threshold model may be useful for this, since it would allow PPP not to hold if the deviations from PPP were sufficiently small that transactions costs would imply that this situation could persist indefinitely, while the PPP relationship would be restored if the deviations from it became sufficiently large to warrant cross-border trading, which would restore equilibrium. In the linear case with no thresholds, the PPP relationship is can be estimated for the current example using France and Germany (before the advent of the EURO currency!) by: ln( fx F / G ,t ) 0 1 ln( p F ,t ) 2 ln( p G ,t ) u t where ln( fx F / G ,t ) is the log of the exchange rate, expressed in French francs per German mark, and ln( p F ,t ) and ln( p G ,t ) are the logs of the French and German consumer price series respectively. We could define ln( fxF / G ,t ) ln( p F ,t ) ln( p G ,t ) as the deviation from PPP (see Chapter 7). This could be generalised to allow for a different relationship between the three variables according to whether the deviation from PPP is larger than some upper threshold value r, or smaller (more negative) than a lower threshold s: 0 1 ln( p F ,t ) 2 ln( p G ,t ) u1t if ln( fx F / G ,t 1 ) ln( p F ,t 1 ) ln( p G ,t 1 ) r ln( fx F / G ,t ) 0 1 ln( p F ,t ) 2 ln( p G ,t ) u 2t if s ln( fx F / G ,t 1 ) ln( p F ,t 1 ) ln( p G ,t 1 ) r ln( p ) ln( p ) u if ln( fx F / G ,t 1 ) ln( p F ,t 1 ) ln( p G ,t 1 ) s 0 1 F ,t 2 G ,t 3t We could then consider the different values of the parameter estimates in each of the 3 regimes (although we could not validly conduct hypothesis tests in the usual way since it is very likely that the variables in the model are nonstationary!). The values of the thresholds (r and s) could be imposed on the basis of some assumed size of transactions costs, or they could be estimated. (f) The problem is essentially that the threshold no longer exists under the null hypothesis that the SETAR model collapses to a linear model with the same lag lengths as were in each part of the SETAR. This fact means that the usual basis of asymptotic theory for testing hypotheses is not applicable, so that the test statistics would not follow the distributions that we would have assumed 4/6 “Introductory Econometrics for Finance” © Chris Brooks 2008 of them. There are procedures available for testing hypotheses such as this in the context of TAR models, but these are quite complex – see Hansen (1996), for example. (g) It is tempting to think that more complex models are bound to produce more accurate forecasts than simpler models since the former should be able to capture more of the relevant features of the data. However, this is certainly not the case, for complex models may have a tendency to fit to sample-specific features of the data that are not replicated during future (out of sample) periods, and therefore lead to less accurate forecasts. This issue was discussed in Chapter 5. However, the use of SETAR models for producing out of sample prediction brings with it an additional problem, namely the possibility that the regime that the variable will reside in during the forecasted observations will be incorrectly predicted. If the SETAR model fits the data well, it is likely that the behaviour will be quite different between the two regimes, and therefore that the forecasts from each regime would also be different. This being the case, forecasting the regime wrongly could cause a big source of forecast inaccuracy for the series, and in practice it is often very difficult to forecast the regime that the series will be in with any reasonable accuracy. Thus, any improvement in forecast accuracy from accurate prediction of the variable conditional upon a correct forecast of the regime that it will be in, is likely to be more than outweighed by incorrectly forecasting the regime. Overall, therefore, regime switching models have produced surprisingly poor forecasts, even when they appear to fit the data very well – see Dacco and Satchell (1999). 3. Both of these questions concern volatility dynamics rather than dynamics in the conditional mean – therefore, in both cases the appropriate answer would be to use a model for volatility dynamics but which also allowed for varying behaviour over time. For (i), a plausible model would be a GARCH with some daily dummy variables included in the conditional variance equation, e.g. yt = + yt-1 + ut , ut N(0,t2) t2 = 0 + 1 ut21 +t-12 + 1D1t + 2D2t + 3D3t + 4D4t where D1, .., D4 are Monday, .., Thursday dummy variables. A more sophisticated model could also allow the coefficients on the lagged squared error or lagged conditional variance terms to also vary across the days of the week. If Monday volatility dynamics are different from other days of the week, we would expect to see 1 significant. For (ii), some sort of threshold model is required, and the question suggests that the threshold variable is observable (and is the value of the previous day’s volatility). Thus, an appropriate model would be a GARCH model with a threshold in the conditional variance that switches, e.g. yt = + yt-1 + ut , ut N(0,t2) t2 = 0 + 1 ut21 +t-12 + 1It 5/6 “Introductory Econometrics for Finance” © Chris Brooks 2008 where It = 1 if t-12 > 0.1, and zero otherwise. Note that the question does not specify what is “volatility”, so it is assumed in this answer that it is equated with “conditional variance”. Again, this dummy variable would only allow the intercept in the conditional variance (i.e. the unconditional variance) to vary according to the previous day’s volatility. A similar dummy variable could be applied to the lagged squared error or lagged conditional variance terms to allow them to vary with the size of the previous day’s volatility. 6/6 “Introductory Econometrics for Finance” © Chris Brooks 2008

![Understanding barriers to transition in the MLP [PPT 1.19MB]](http://s2.studylib.net/store/data/005544558_1-6334f4f216c9ca191524b6f6ed43b6e2-300x300.png)