bond

advertisement

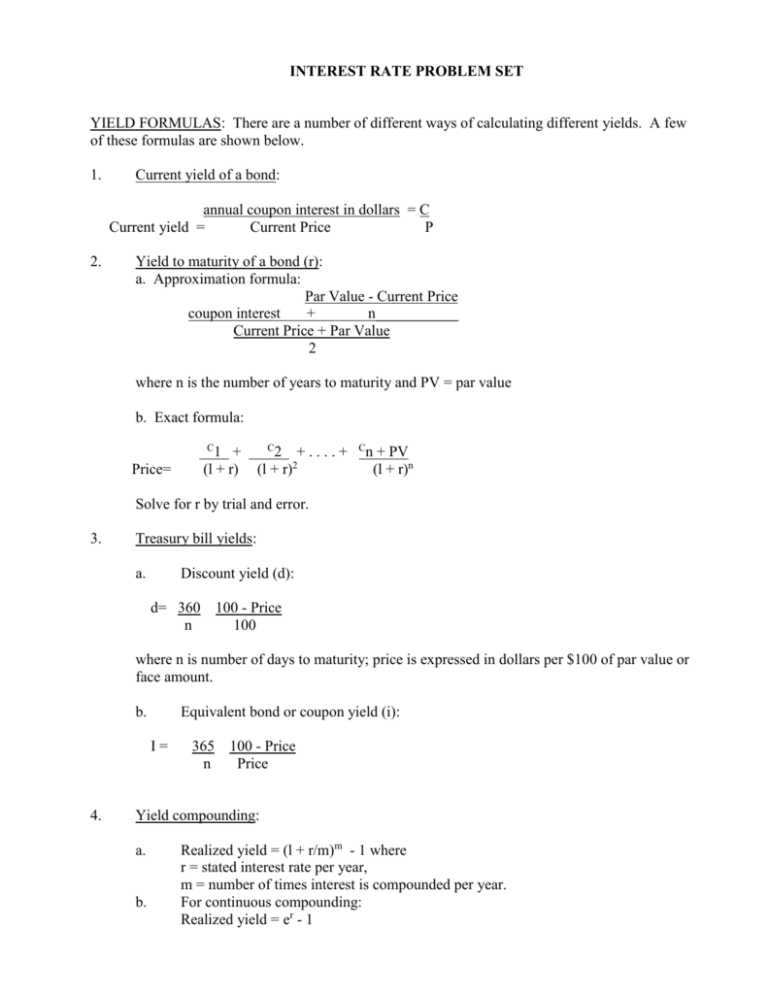

INTEREST RATE PROBLEM SET YIELD FORMULAS: There are a number of different ways of calculating different yields. A few of these formulas are shown below. 1. Current yield of a bond: annual coupon interest in dollars = C Current yield = Current Price P 2. Yield to maturity of a bond (r): a. Approximation formula: Par Value - Current Price coupon interest + n___________ Current Price + Par Value 2 where n is the number of years to maturity and PV = par value b. Exact formula: C 1 + (l + r) Price= C 2 +....+ (l + r)2 C n + PV (l + r)n Solve for r by trial and error. 3. Treasury bill yields: a. Discount yield (d): d= 360 n 100 - Price 100 where n is number of days to maturity; price is expressed in dollars per $100 of par value or face amount. b. Equivalent bond or coupon yield (i): I= 4. 365 n 100 - Price Price Yield compounding: a. b. Realized yield = (l + r/m)m - 1 where r = stated interest rate per year, m = number of times interest is compounded per year. For continuous compounding: Realized yield = er - 1 5. Stock: a. Constant Growth Model Po = D1 Ke - g b. ∞ General Dividend Model Po = Dt t=1 (1 + K)t m c. 2 Period Growth Model ∑ Do(1 + g1)t t = 1 (1 + Ke)t + ﴾ 1 (1 + Ke)m Dm+1 Ke - g2 ﴿ 3 ASSIGNMENT: INTEREST RATES This assignment explores several aspects of interest rates including (1) yield calculations, (2) yield differentials, and (3) the term structure of yields. Show all calculations. 1. Find, in the (Date to be Announced), Wall Street Journal, the close price for the American Telephone and Telegraph (ATT) bond listed as the "ATT 7 3/4 07." The prices can be found in the "US Bonds" section of the paper. Assume that the bond matures in exactly 5 years. a. What is the dollar amount of interest paid on this bond each year? b. What is the bond's current yield? c. What is the yield to maturity of the bond using the short cut formula? d. What is the yield to maturity using the exact formula, assuming interest is paid once a year? 4 2. e. Let's say you buy the bond at the current "close" price and hold it for 2 years, and then sell it. If bonds of this type are yielding 6% (yield to maturity) and has a current yield of 7.4% when you sell it, what price will you receive for the bond? (Use the exact formula). f. Using the exact formula what will have been your compound annual yield for the TWO year period during which you held this bond? For a Treasury Note listed, 4.75%, 2004 Feb, "what is your "bid quote?" (You have to quote the same fashion as WSJ does -- read the explanatory section of "Treasury Issues" in WSJ first.) a. If you require a YTM of 2% b. If you require a YTM of 5% (Both a, b are assuming that interest is paid annually and there are TWO years to go.) 5 3. Maria Esteves is a money market specialist for a large brokerage firm in Houston, Texas. A colleague from the corporate finance department has just asked her for help in calculating the yields on commercial paper that the firm is helping a client to issue. Commercial paper is essentially a post-dated check.Corporations use the security to raise money for short periods of time without having to put up collateral. Essentially the firm makes out the check for the amount of money borrowed plus the interest on the money for, say, a three month period of time. The check has two dates on it: the date the check is written and the date on which it can be cashed. The company then sells the check to an investor for the principal portion of the check's amount. The buyer of the check then holds the check until the maturity date, then deposits it in the buyer's local bank. For example, let's assume that a company would like to borrow one million dollars for four months. The company would write out a check for the amount of $1,030,000. The firm's treasurer would then sell the check to an investor for $1,000,000. The firm has the use of this money for four months, at which time the check will be cashed and $1,030,000 will be taken out of the firm's bank account. In the meantime, the investor has advanced $1,000,000 to the firm and earns $30,000 in interest for the effort. What if the check bounces? The investor is simply a general creditor of the firm and must sue to collect the money. There are no specific, pledged assets which serve as collateral for the loan. Therefore, it is important that the investor exercise "due diligence" in investigating the company before buying the check. But let's return to the matter at hand. The brokerage firm's client needs to raise money for it's Christmas inventory buildup over the next six months. The company wants to sell commercial paper for a face amount (amount received) of $1,000,000, but the brokerage firm has told the client that it will have to offer an implied annual interest rate of 5.2% in order to find a buyer for the check. Therefore, the face amount must be larger than the $1,000,000 proceeds received. Maria's colleague is providing advice to the client. The colleague has asked Maria for help in determining the effective interest rate as measured by commonly used methods of interest rate determination. Assuming that the company wants to use the money for 182 days, determine: 1. the amount of face value (par) of the paper that the company will need to issue inorder to receive the $1,000,000 they need. (ie use the following formula) Ycp = [Par-Price/Price] * [360/n]), 2. compute the discount yield of the security (ie. Use the discount formula), and 3. compute the coupon equivalent (ie use the Equivalent bond or coupon yield formula) of the security's yield. 6 4. Use the following information: Bonds Coleco 11s99f Con Ed 9 ½ 01 Crane zr99s S1s 44 12 13 High 211/4 101 81 Low 18 98 80 Last 20 100 ½ 80 ¾ Chg -2 +1 +1/2 A. The purchaser of 10 bonds issued by Crane Corporation will receive annual interest payments of: B. A customer buys 5 Coleco bonds at the closing price, with settlement taking place on February 1. The interest payment dates on the bonds are Jan 1 and July 1. How much accrued interest will the buyer pay to the seller? C. At what price did the Con Edison bonds close at on the preceding trading day? D. What is the current yield for the Con Edison bonds? E. How many Coleco bonds changed hands this day? 5. Use the following information to answer : A customer purchases a convertible bond at 90, convertible into the common stock at $40. The common stock is currently trading at $36. The company declares a 25% stock dividend. The bond trust indenture includes an anti-dilution clause. (When you have an “anti-dilutive” clause, the company issuing the additional shares will adjust the conversion terms. The conversion price will be reduced and the number of shares into which the security is convertible is increased in order to remain at parity with the original terms.) After the ex-date for the stock dividend, the conversion price for this bond issue will be: 7 6. Ford Motor Company has issued 8% convertible debentures, convertible at a 12.5:1 ratio. Currently the debenture is trading at 90. The stock is trading at 72. What is the conversion price of the stock? 7. In 1996, a customer buys 5 GMAC 10% debentures, Maturity 20’06, at 85. The interest payment dates are Feb 1 and Aug 1. The bonds are callable as of 1998 at 103. A. The current yield on the bonds is: B. The yield to maturity on the bonds is: C. If the bonds are called prior to maturity, which statement is true? a. The yield to call will be higher than the yield to maturity b. The yield to call will be lower than the yield to maturity c. the yield to call will be the same as the yield to maturity d. The yield to call will depend on the current market price of the bond at the time of the call D What is the yield to call if the bond is called in 2003 (exactly 3 years before maturity)? 8 8. A Treasury bill (182 days to maturity) has a price of 99:09 (or $99.2813 per $100 of par value). a. What is the annualized discount yield of this bill? b. What is the annualized equivalent bond or coupon yield? c. You hear that 6-month (actually 182 day) Treasury bills are now yielding 1.5% on a discount basis. What is the price you would pay for a $10,000 face amount Treasury bill?