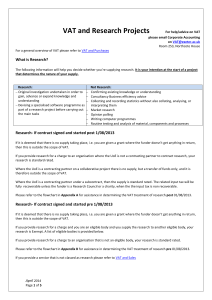

Frequently Asked Questions - VAT zero

advertisement

Please note that this information is intended for use by University departments. Whilst every effort is made to ensure that the information is correct, the University does not accept liability for actions taken by external persons/bodies which is based upon this advice. External organisations are advised to seek advice from their local Customs & Excise Office. Frequently Asked Questions VAT zerorating The following is a brief summary of eligibility. Further information on specific areas can be found in the relevant sections of the VAT advice area of our website. Check our guidelines on eligibility via: http://www.cf.ac.uk/purch/customsvat/vat/charfund/index.html The following have been listed by HM Customs and Excise as eligible items when used in medical research, diagnosis, treatment or training by an eligible institution The following do not quality for VAT zerorating, Furniture General office furniture, e.g. desks/wire-managed desking, seating , cupboards, lockers etc Ordinary cupboards, lockers seats and other furniture are not classed as laboratory equipment even if supplied for use in a laboratory Laboratory furniture benching/stools/fittings etc. Specially designed computer desks Office Equipment Photocopiers Computers purchased by the Fax machines Pagers Dictating machines University for an eligible purpose. Fax/modem built into a computer Multi-function printer/scanner/fax used in as an accessory to an eligible computer MAY be zerorated Office Consumables Stationery etc. Ribbons, ink & toner cartridges Custom made or bespoke computer software purchased for use in medical training. Computer disks (including CDs) for use in eligible computers. Normal or “off the shelf” computer software for use in medical research, training, diagnosis or treatment. Audio-Visual Equipment Televisions Standard cameras and films Overhead projectors (see note on LCD computerlinked projectors) Slide projectors & screens etc. Video cameras recorders/players & tapes Video monitors (not capable of receiving TV signals) LCD OHP which must be linked to a computer Cameras fitted to scientific equipment, e.g. specially designed camera for use with microscope Camera which cannot be used independently of an (eligible) computer X-ray equipment Specialised photographic film (e.g. x-ray film & film cut to size for EM work) Equipment/Consumables used in Laboratory (Goods designed for use in laboratory) Kettles, microwaves etc. Cleaning materials & equipment Sterilising solutions e.g. Chloros, Stericol and Hycolin. Waste disposal bags and Substances used directly for synthesis or testing in the course of medical research. These cannot be zero rated if bought for teaching or training. equipment Gloves (non-surgical) Security & Environmental Monitoring Equipment Air Conditioning Security/smoke alarms, Security locks etc. Closed-circuit television systems Refrigerators and freezers for storing reagents, samples etc. used in medical research Maintenance and repair of eligible equipment is VAT zero-rated. Parts and accessories to eligible equipment are also eligible for zero-rating. Carriage is not VAT zero-rated even when the items transported are eligible.