Doran`s Section- Accounting 284- Spring 96

advertisement

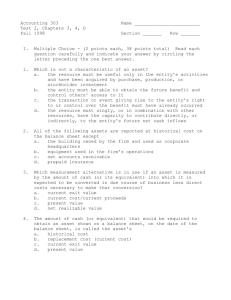

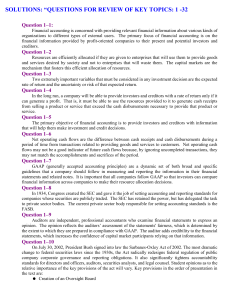

Sample Quiz Questions Chap. 1 and 2 True/False (Circle the Correct Response) T F A balance sheet should be dated for a period (such as “For the year ended December 31, 20A”), whereas an income statement should be dated at a point in time (such as “December 31, 20A”). T F Accounting is a system that collects and processes financial information about an organization and reports that information to decision makers. T F The Financial Accounting Standards Board (FASB) is an agency of the federal government that establishes generally accepted accounting principles for businesses. T F A decision maker who wants to understand a company's financial statements must carefully read the notes to the financial statements because the notes provide useful supplemental information. Transactions have a dual economic effect on the fundamental accounting model. An "account" is a standardized format used to accumulate the effects of transactions on each financial statement item. T F T F Multiple Choice (Circle the Correct Response) 1. Mark Corporation reported the following for 20B; total assets, $65,000; total liabilities, $20,000; contributed capital, $30,000. Therefore, retained earnings was A) B) C D) E) $45,000. $35,000. $25,000. $10,000. None of the above the correct answer is___________________. 2. A business’s balance sheet cannot be used to accurately predict what the business might be sold for because A) B) C) D) it identifies all the revenues and expenses of the business. assets are generally listed on the balance sheet at their historical cost, not their current value. it gives the results of operations for the current period. some of the assets and liabilities on the balance sheet may actually be those of another entity. 3. The operating activities section is often believed to be the most important part of a statement of cash flows because A) B) C) D) it gives the most information about how operations have been financed. it shows the dividends that have been paid to shareholders. it indicates a company’s ability to generate cash from sales to meet current cash needs. it shows the net increase or decrease in cash during the period. -Continued on Back Side- 4. Liabilities are defined as A) B) C) D) E) Possible debts or obligations of an entity as a result of future transactions which will be paid with assets or services. Possible debts or obligations of an entity as a result of past transactions which will be paid with assets or services. Probable debts or obligations of an entity as a result of future transactions which will be paid with assets or services. Probable debts or obligations of an entity as a result of past transactions which will be paid with assets or services. None of the above is correct. 5. An example of an external exchange would be A) B) C) D) E) the purchase of inventory on credit from a supplier cash received from a credit customer cash dividend paid to stockholders A and B only are external exchanges All of the above are external exchanges 6. Which of the following direct effects on the fundamental accounting model is not possible as a result of transaction analysis? A) B) C) D) E) Increase a liability and increase an asset. Decrease stockholders' equity and increase an asset. Increase an asset and decrease an asset. Decrease stockholders' equity and decrease an asset. None of the above is correct. 7. The assumption that a business can continue to remain in operation into the future is the A) B) C) D) Cost principle. Unit-of-measure assumption. Continuity assumption. Separate-entity assumption. 8. Assume a company's January 1, 20A, financial position was: Assets, $40,000 and Liabilities, $15,000. During January 20A, the company completed the following transactions: (a) paid on a note payable, $4,000 (no interest); (b) collected accounts receivable, $4,000; (c) paid accounts payable, $2,000; and (d) purchased a truck, $1,000 cash, and $8,000 notes payable. The company's January 31, 20A, financial position is A) B) C) D) E) Assets Liabilities $42,000 $17,000 $44,000 $17,000 $43,000 $18,000 $42,000 $ 9,000 None of the above is correct. Stockholders'Equity $25,000 $27,000 $25,000 $33,000