Example 1 Suppose a person is paid #1 for rolling a 1

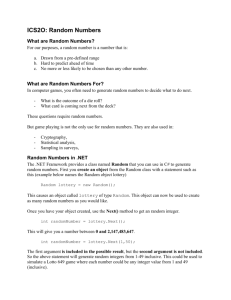

H Statistics: Practice Expected Value Problems

I will discuss any question you have prior to the quiz. I am providing basic concepts and answers only. If you expect to receive credit for doing the work, you need to show work and NOT just the answers.

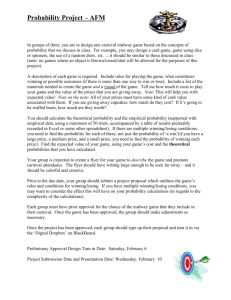

Example 1: Suppose a person is paid $1 for rolling a 1 on a die, $2 for rolling a 2, $3 for rolling 3 and $4 for rolling a 4. The person must pay $5 for rolling a 5 and must pay $6 for rolling a 6. What is the expected value for a person playing this game?

Hint: Set up a chart containing all payoffs and their respective probabilities.

You should expect to lose –$.16 per roll.

Example 2: A carnival game costs $.25 to throw 3 darts at balloons fastened to a board, and the player is given a prize worth $1.00 for breaking two balloons and a prize worth $10.00 for breaking three. The observed probability that a player will break a balloon on the throw of one dart is 0.2. What is the carnival’s expected gain on each play of this game?

Remember 1 turn is 3 darts. You need to think about the different scenarios that can occur for each turn and how often each one can occur. Then, from the carnival’s perspective, think about the $ paid or received in each scenario.

The carnival is expected to make $.074 on each play of the game

Example 3: The probability that Mr. Adams will sell his house at a profit of $2000 is 3/20, the probability that he will sell it at a profit of $1000 is 8/20, the probability that he will break even is 7/20, and the probability that he will lose $1000 is 2/20. What is his expected profit?

Mr. Adams expected profit is $600.

Example 4: A roulette wheel contains 38 numbers: 18 are red, 18 are black, two are green.

You bet $1 on a number. If right, you gain $35. If wrong, you lose $1

Is this a fair game?

The game is not fair because the player is expected to lose $.05 over many bets

H Statistics: Practice Expected Value Problems

Example 5: A dairy farmer estimates for the next year the farm’s cows will produce about

25,000 gallons of milk. Because of variation in the market price of milk and cost of feeding the cows, the profit per gallon may vary with the probabilities given in the table below.

Estimate the profit on the 25,000 gallons.

Gain per gallon $1.10

Probability 0.30

$0.90

0.38

$0.70

0.20

$0.40

0.06

$0.00

0.04

-$0.10

0.02

You expect to make $.834 per gallon so for 25,000 you’d expect a profit of $20,850

Example 6: A construction company wants to submit a bid for remodeling a school. The research and planning needed to make the bid cost $4000. If the bid were accepted, the company would make $26,000. Would you advise the company to spend the $4000 if the bid has only 20% probability of being accepted? Explain your reasoning.

Yes, the expected return is still positive

Example 7: Suppose the warranty period on your family’s new television is about to expire and you are debating about whether to buy a one-year maintenance contract for $35. If you buy the contract, all repairs for one year are free. Consumer information shows that 12% of the televisions like yours require an annual repair that costs $140 on the average. Would you advise buying the maintenance contract? Explain your reasoning.

No, the expected payout for repair is $16.80, which is less than the price of the warranty.

H Statistics: Practice Expected Value Problems

$1

Example 8: In a particular game, a fair die is tossed. If the number of spots showing is either 4 or 5 you win $1; if the number of spots showing is 6 you win $4; and if the number of spots showing is 1, 2, or 3 you win nothing. a.

How much should you expect to win? b.

What should you pay to play if the game is fair?

$1

Example 9: The following is a chart representing a number of employees in each position at a company and their salaries.

Position

Number

Manager

2

Asst Mgr

2

Supervisor

5

Technician

25

Salary $65,000 $40,000

What is the average salary for this company?

$26,875

$30,000 $20,000

Example 10: A lottery, which costs $1.00 to enter, has a first prize of $1,000, a second prize of $500 and two third prizes of $100. If there are 5,000 tickets sold, what is the expected profit for each lottery participant?

Each lottery ticket is expected to lose –$.66.