Chapter 1

advertisement

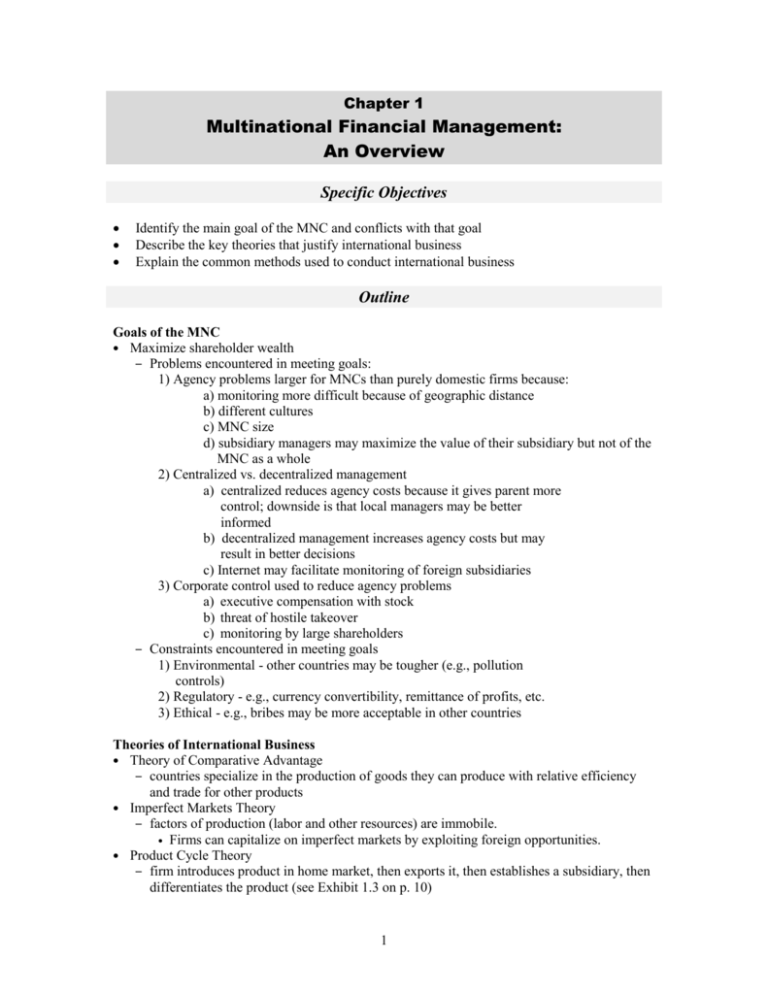

Chapter 1 Multinational Financial Management: An Overview Specific Objectives Identify the main goal of the MNC and conflicts with that goal Describe the key theories that justify international business Explain the common methods used to conduct international business Outline Goals of the MNC • Maximize shareholder wealth – Problems encountered in meeting goals: 1) Agency problems larger for MNCs than purely domestic firms because: a) monitoring more difficult because of geographic distance b) different cultures c) MNC size d) subsidiary managers may maximize the value of their subsidiary but not of the MNC as a whole 2) Centralized vs. decentralized management a) centralized reduces agency costs because it gives parent more control; downside is that local managers may be better informed b) decentralized management increases agency costs but may result in better decisions c) Internet may facilitate monitoring of foreign subsidiaries 3) Corporate control used to reduce agency problems a) executive compensation with stock b) threat of hostile takeover c) monitoring by large shareholders – Constraints encountered in meeting goals 1) Environmental - other countries may be tougher (e.g., pollution controls) 2) Regulatory - e.g., currency convertibility, remittance of profits, etc. 3) Ethical - e.g., bribes may be more acceptable in other countries Theories of International Business • Theory of Comparative Advantage – countries specialize in the production of goods they can produce with relative efficiency and trade for other products • Imperfect Markets Theory – factors of production (labor and other resources) are immobile. • Firms can capitalize on imperfect markets by exploiting foreign opportunities. • Product Cycle Theory – firm introduces product in home market, then exports it, then establishes a subsidiary, then differentiates the product (see Exhibit 1.3 on p. 10) 1 2 Chapter 1 International Business Methods • International Trade – export and import – low risk – Internet facilitates advertising and sales • Licensing – obligates firm to provide its technology in exchange for fees or other benefits (e.g., AT&T and Nynex Corp had licensing to build and operate India’s telephone system) – no major investment required – difficult to ensure quality control – Internet facilitates brand name advertising • Franchising – obligates firm to provide a specialized sales or service strategy, support assistance and possibly an initial investment in exchange for periodic fees • Joint Ventures – a venture that is jointly owned and operated by two or more firms – allow firms to apply comparative advantage (e.g., General Mills and Nestle) • Acquisitions of Existing Operations – acquire a firm in a foreign country to penetrate foreign markets – advantage: full control over foreign business – disadvantage: risky because of large investment and uncertainty – some firms make partial acquisitions, but these do not allow full control even though they are less risky • Establishing New Foreign Subsidiaries – establish new operations in foreign country to penetrate market – advantage: can tailor exactly to firm’s needs – disadvantage: must establish customer base, unfamiliarity with local customs • Methods requiring a direct investment are referred to as direct foreign investment (DFI) – includes franchising, joint ventures, acquisitions, and foreign subsidiaries International Opportunities • Opportunities – higher growth potential – larger investment opportunity set – lower borrowing costs due to more funding sources – result in lower cost of capital and higher returns for projects – limitations: • no feasible foreign opportunities • foreign projects may be riskier than domestic ones • Opportunities in Europe – Single European Act (1987) – removal of Berlin Wall – inception of the euro • Opportunities in Latin America – NAFTA – GATT – removal of investment restrictions • Opportunities in Asia – large population base Multinational Financial Management: An Overview 3 Exposure to International Risk – less exposure to domestic economy – exchange rate risk • need to convert currencies – exposure to foreign economies – political risk • actions taken by the government that affect cash flows (e.g., expropriations, buy-outs, etc.) Key Terms Matching In the following exercise, place a letter from the right column with the correct number in the left column. Key Term 1. Agency Problem____ 2. Comparative Advantage____ 3. Country Risk____ 4. Direct Foreign Investment (DFI)____ 5. Franchising____ 6. Imperfect Markets____ 7. Joint Venture____ 8. Licensing____ 9. Political Risk____ 10. Privatization____ 11. Product Cycle Theory____ Definition a. any method of increasing international business that requires a direct investment in foreign operations, including foreign acquisitions, the establishment of foreign subsidiaries, franchising, and joint ventures b. the existence of a conflict of goals in a corporation (where the shareholders differ from the managers) c. conditions under which factors of production are immobile d. the process by which a firm provides a specialized sales or service strategy, support assistance, and possibly an initial investment in the franchise in exchange for periodic fees e. political actions taken by the host government or the public that affect an MNC’s cash flows f. firms become established in the home market as a result of some perceived advantage they have over existing competitors. Foreign demands is first met by exporting. Subsequently, the firm may establish subsidiaries in the foreign country and/or differentiate its products so that the product remains competitive g. the potentially adverse impact of a country’s environment on the MNC’s cash flows h. a venture that is jointly owned and operated by two or more firms i. the process by which national governments sell state owned operations to corporations and other investors j. the process by which a firm provides its technology (copyrights, patents, trademarks, or trade names) in exchange for fees or some other specified benefits k. an advantage a country possesses in the manufacture of goods Answers to Key Terms Matching 1. b 2. k 3. g 4. a 4 5. 6. 7. 8. Chapter 1 d c h j 9. e 10. i 11. f Definitional Problems 1. As for a purely domestic firm, the goal of a multinational corporation (MNC) is the ______________________________________. 2. One of the most prevalent factors conflicting with the realization of the goal of an MNC is the existence of _________________. 3. Among the constraints interfering with the realization of the goal of an MNC are _______________, _______________, and ______________ constraints. 4. A _______________ management style trades off reduced agency costs with potentially poor decisions by parent company managers. 5. A _______________ management style trades potentially good decisions by subsidiary managers with increased agency costs. 6. The _____________ states that countries tend to use their advantages to specialize in the production of goods that can be produced with relative efficiency, while trading for other goods. 7. The _____________ states that factors of production are somewhat immobile, allowing firms to capitalize on a foreign country’s resources. 8. The _____________ states that firms first become established in their home country and then penetrate foreign markets via geographic and/or product differentiation. 9. The least risky method of conducting international business is probably ____________________. 10. A venture jointly owned and operated by a domestic and a foreign firm is referred to as a __________________. 11. The two primary methods of conducting international business that constitute foreign direct investment are ___________________ and ______________________. 12. Due to an increased opportunity set, the marginal return on projects for an MNC is generally ___________ than that of a purely domestic firm. Analogously, due to a larger opportunity set of funding sources, the cost of capital for an MNC is generally ______________ than that of a purely domestic firm. 13. If MNCs have more projects to select from and a lower cost of capital than purely domestic firms, their size should be ______________ than that of a purely domestic firm. Multinational Financial Management: An Overview 5 14. By expanding internationally, a firm may be less exposed to fluctuations in the home country economy. Nevertheless, MNCs occur additional risks in the form of ______________, ________________, and ______________. Answers to Definitional Problems 1. 2. 3. 4. 5. 6. 7. 8. 9. maximization of shareholder wealth agency problems environmental; regulatory; ethical centralized decentralized Theory of Comparative Advantage Imperfect Markets Theory Product Cycle Theory international trade (importing and exporting) 10. joint venture 11. the acquisition of existing operations; the establishment of new foreign subsidiaries 12. higher; lower 13. greater 14. exchange rate risk; exposure to foreign economic conditions; political risk True/False Problems 1. The goal of a multinational corporation (MNC) is the maximization of shareholder wealth. 2. If a firm were composed of only one owner who was also the sole manager, the agency problem would not be completely eliminated. 3. If managers of foreign subsidiaries make decisions that maximize the values of their respective subsidiaries, they automatically maximize the value of the entire corporation. 4. A centralized management style, where major decisions about a foreign subsidiary are made by the parent company, results in an automatic increase in agency costs. 5. A decentralized management style, where subsidiary managers make the relevant decisions regarding their subsidiary, may result in better decision making, as subsidiary managers are generally better informed about their subsidiary’s operations. 6. Although MNCs may be confronted with additional pollution controls (an environmental constraint), these are irrelevant, as the MNC is fully reimbursed by the U.S. government for any additional costs upon remittance of proper receipts. 7. A given country’s government, if it chooses to, may prevent the remittance of earnings by a subsidiary to the parent company. 8. In some countries, bribes are commonplace. If a U.S.-based MNC decides to adhere to a strict code of ethics and not pay bribes, its subsidiary may be at a competitive disadvantage in the foreign country. 9. The Theory of Comparative Advantage begins by assuming that a given firm first becomes established in its home country and may subsequently penetrate foreign markets via geographic or product differentiation. 6 Chapter 1 10. Under the Imperfect Markets Theory, it is assumed that factors of production are entirely mobile, so that firms can capitalize on a foreign country’s resources. 11. Under the Theory of Comparative Advantage, trade between countries results from the nonproduction of certain goods in a given country due to inefficiency. 12. Under the Product Cycle Theory, foreign demand can be initially satisfied by exporting. 13. Franchising obligates a firm to provide its technology (such as copyrights, patents, trademarks, or trade names) in exchange for fees or some other specified benefits. 14. In a joint venture, one firm is obligated to provide another firm with a specialized sales or service strategy in exchange for periodic fees. 15. Licensing allows firms to use their technology in foreign markets without a major investment in foreign countries. 16. While allowing for the highest degree of control of foreign business, the acquisition of existing operations in a foreign country and/or the establishment of foreign subsidiaries also entail the highest degree of risk when compared to the other methods of conducting international business. 17. International trade is the most common form of direct foreign investment (DFI). 18. Purely domestic firms face a larger opportunity set than MNCs and their projects provide a lower marginal return than projects faced by MNCs. 19. Due to the larger opportunity set of funding sources around the world from which an MNC can choose, an MNC may be able to obtain capital at a lower cost than a purely domestic firm. 20. The Single European Act of 1987 made regulations more uniform among European countries. However, the cost of achieving this goal resulted in the imposition of additional taxes on goods traded between these countries. 21. The North American Free Trade Agreement (NAFTA) of 1993 eliminated trade barriers between the United States and Mexico. 22. Although MNCs may need to convert currencies occasionally, they do not face any exchange rate risk, as exchange rates are stable over time. 23. A purely domestic firm may be affected by exchange rate fluctuations if it faces at least some foreign competition. 24. Although the exposure of MNCs to fluctuations in the home country’s economy is less than that of a purely domestic firm, it is more highly exposed to economic fluctuations of the foreign country in which it operates. Multinational Financial Management: An Overview 7 Answers to True/False Problems 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. T F F F T F T T F F T T 13. 14. 15. 16. 17. 18. 19. 20. 21. 22. 23. 24. F F T T F F T F T F T T Multiple Choice Problems 1. The goal of a multinational corporation (MNC) is a. The minimization of taxes remitted from foreign subsidiaries. b. The establishment of subsidiaries in any country where operations would provide a return over and above the cost of capital, even if better projects are available domestically. c. The maximization of shareholder wealth. d. The maximization of social benefits resulting from actions such as the employment of foreign managers. 2. Agency costs faced by multinational corporations (MNCs) may be larger than those faced by purely domestic firms because a. Monitoring of managers located in foreign countries is more difficult. b. Foreign subsidiary managers raised in different cultures may not follow uniform goals. c. MNCs are relatively large. d. a and b only e. all of the above 3. Which of the following is correct regarding the monitoring of foreign subsidiary managers? a. A centralized management style results in increased agency costs but better decision making by subsidiary managers. b. A decentralized management style results in increased agency costs but poor decision making by subsidiary managers. c. It is generally easier for an MNC to monitor the decisions made by subsidiary managers than it is for a purely domestic firm. d. Some MNCs allow subsidiary managers to make the key decisions about their respective operations, but the decisions may be monitored by the parent’s management. e. Since an MNC’s foreign subsidiaries are separate legal entities, the monitoring of subsidiary managers is inconsequential. 8 Chapter 1 4. Which of the following is not mentioned in the text as a constraint interfering with an MNC’s goal? a. Legal constraints b. Environmental constraints c. Regulatory constraints d. Ethical constraints e. All of the above are mentioned in the text as constraints interfering with an MNC’s goal 5. a. b. c. d. e. Which of the following is not mentioned in the text as a theory of international business? Theory of Comparative Advantage Imperfect Markets Theory Product Cycle Theory Globalization of Business Theory All of the above are mentioned in the text as theories of international business 6. a. b. c. Which of the following events would confirm the Theory of Comparative Advantage? A U.S. firm manufacturing computers imports the needed components from Taiwan. A U.S. firm manufacturing widgets builds a plant in Mexico to reduce labor costs. A U.S. firm manufacturing computers establishes a plant in Germany in order to reduce transportation costs and to retain its advantage over its German competitors. d. All of the above e. None of the above 7. a. b. c. Which of the following events would confirm the Imperfect Markets Theory? A U.S. firm manufacturing computers imports the needed components from Taiwan. A U.S. firm manufacturing widgets builds a plant in Mexico to reduce labor costs. A U.S. firm manufacturing computers establishes a plant in Germany in order to reduce transportation costs and to retain its advantage over its German competitors. d. All of the above e. None of the above 8. a. b. c. Which of the following events would confirm the Product Cycle Theory? A U.S. firm manufacturing computers imports the needed components from Taiwan. A U.S. firm manufacturing widgets builds a plant in Mexico to reduce labor costs. A U.S. firm manufacturing computers establishes a plant in Germany in order to reduce transportation costs and to retain its advantage over its German competitors. d. All of the above e. None of the above 9. a. b. c. d. e. The most risky method(s) by which firms conduct international business is (are): Franchising The acquisitions of existing operations The establishment of new subsidiaries b and c only All of the above Multinational Financial Management: An Overview 10. a. b. c. d. e. The least risky method by which firms conduct international business is: Franchising The acquisitions of existing operations International Trade The establishment of new subsidiaries Licensing 11. a. b. c. d. e. Which of the following does not constitute a form of direct foreign investment? Franchising International trade Joint ventures Acquisitions of existing operations Establishment of new foreign subsidiaries 9 12. Which of the following is not mentioned in the text as a reason for the increased globalization of business? a. An increase in GNP of virtually all countries in recent years. b. An increase in international trade. c. Growth in direct foreign investment in recent years. d. Increased privatization in recent years. e. An increased standardization of products and services across countries in recent years. 13. Which of the following is true regarding MNCs? a. MNCs generally face a smaller opportunity set than purely domestic firms because it is more costly to establish subsidiaries in foreign countries. b. MNCs generally face a larger opportunity set than purely domestic firms due to possible cost advantages and/or revenue opportunities. c. MNCs may be able to obtain financing at a lower cost than purely domestic firms. d. a and c only e. b and c only 14. Which of the following is true regarding MNCs? a. The marginal return on projects faced by MNCs is always lower than the return on projects faced by purely domestic firms. b. The cost of capital faced by MNCs is always larger than that faced by purely domestic firms. c. The cost of capital faced by MNCs is always smaller than that faced by purely domestic firms. d. Although MNCs may have an advantage relative to purely domestic firms in terms of funding sources, its cost of capital may be higher than that of a purely domestic firm because foreign projects are riskier than domestic projects. e. There are always feasible foreign projects for an MNC. 15. a. b. c. d. e. Which of the following is not a provision or result of the Single European Act of 1987? Increased regulatory uniformity among European countries The phasing in of a common currency for all European countries by 1992 The removal of many taxes on goods traded between European countries Firms’ ability to achieve economies of scale All of the above 10 Chapter 1 16. Which of the following is not mentioned in the text as an additional risk resulting from international business? a. Exchange rate fluctuations b. Political risk c. Financial risk d. Country risk e. Exposure to foreign economies 17. a. b. c. d. e. Many U.S. firms view ___________ as the country with the highest growth potential. China Japan Germany Mexico Korea 18. Which of the following is not an example of how an MNC can be affected by exchange rate movements? a. Due to exchange rate fluctuations, the number of units of a firm’s home currency needed to purchase foreign supplies can change even if suppliers have not adjusted their prices. b. When the home currency strengthens, products denominated in that currency become more expensive to foreign customers, which may reduce foreign demand for the MNC’s products. c. When the home currency weakens, products denominated in that currency become cheaper to foreign customers, which may increase foreign demand for the MNC’s products. d. Remitted earnings from the foreign subsidiary of a U.S.-based MNC may increase due to a stronger home currency. e. Remitted earnings from the foreign subsidiary of a U.S.-based MNC may increase due to a weaker home currency. 19. Licensing obligates a firm to provide _____________, while franchising obligates a firm to provide _______________. a. A specialized sales or service strategy; its technology b. Its technology; a specialized sales or service strategy c. Its technology; its technology d. A specialized sales or service strategy; a specialized sales or service strategy e. Its technology; an initial investment 20. In general, MNCs may be expected to have a ___________ marginal return on projects than purely domestic firms and a ____________ cost of capital. a. Higher; higher b. Lower; lower c. Lower; higher d. Higher; lower e. None of the above 21. Which of the following is not a way in which agency problems can be reduced through corporate control? a. Executive compensation b. Threat of hostile takeover c. Acquisition of a foreign subsidiary d. Monitoring by large shareholders e. None of the above Multinational Financial Management: An Overview 11 Answers to Multiple Choice Problems 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. c e d a d a b c d c b 12. 13. 14. 15. 16. 17. 18. 19. 20. 21. a e d b c a d b d c