Most microeconomic models assume that decision makers wish to

advertisement

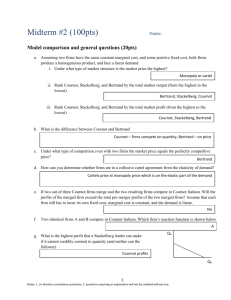

姓名: 學號: Microeconomics II Homework#3 Spring, 2008 Due day: 5/1 I. Multiple choices(40%) 1) In the Cournot model, a firm maximizes profit by selecting A) its output, assuming that other firms keep their output constant. B) its price, assuming that other firms keep their price constant. C) its output, assuming that other firms will retaliate. D) its price, assuming that other firms will retaliate. 2) Compared to a cartel firms in a Cournot Oligopoly A) make more joint profit. B) sell less output. C) make less joint profit. D) act independently. 3) The Stackelberg model is more appropriate than the Cournot model in situations where A) there are more than two firms. B) all firms enter the market simultaneously. C) one firm makes its output decision before the other. D) firms will be likely to collude. 4) In a Bertrand model with differentiated products, A) firms can set price above marginal cost. B) firms set price at marginal cost. C) price is independent of marginal cost. D) firms set price independently of one another. 5) Assuming a homogeneous product, the Bertrand duopoly equilibrium price is A) the same as the Cournot equilibrium price. B) less than the Cournot equilibrium price. C) greater than the Cournot equilibrium price. D) equal to the monopoly price. 6) The above figure shows the reaction functions for two pizza shops in a small isolated town. The Cournot equilibrium is at point A) a. B) b. C) c. D) d. 7) The above figure shows the reaction functions for two pizza shops in a small isolated down. The Stackelberg leader will produce A) 25 pizzas. B) 50 pizzas. C) 66.7 pizzas. D) 100 pizzas. 8) The above figure shows the reaction functions for two pizza shops in a small isolated town. Collusion would result in A) each firm producing 25 pizzas. B) each firm producing 40 pizzas. C) each firm producing 50 pizzas. D) firm A monopolizing the market by selling 50 pizzas. 9) If only two identical firms operate in a market, consumers prefer A) a Cournot equilibrium. B) a Stackelberg equilibrium. C) a collusive equilibrium. D) any equilibrium since they all result in the same consumer surplus. 10) Which of the following models results in the greatest deadweight loss assuming a fixed number of firms with identical costs and a given demand curve? A) B) C) D) Cournot Stackelberg Monopoly Perfect competition 1 2 3 4 5 6 7 8 9 10 A C C A B B D C B C II. Problems(60%) 1) Suppose that market demand can be represented as p = 100 - 2Q. There are 10 identical firms producing an undifferentiated product, each with the total cost function TC 50 q 2 . Compare the competitive outcome with the cartel outcome. What is the individual firm's incentive to cheat on the cartel? Answer: Each firm has MC = 2q, so that market supply is Q = 5p or joint MC = Q/5. As a cartel, they set joint MR = joint MC yielding 100 - 4Q = Q/5 or 100 = 4.2Q. Q = 23.8, and each firm will produce 2.38 units. The cartel price is 100 - 2(23.8) = $52.38. Each firm has the incentive to cheat because its marginal cost is $4.76 and the market price is $52.38. As a competitive market, supply equals demand. p = 100 - 2(5p) or 11p = 100. Price equals $9.09 and output equals 45.45 units. 2) Suppose the demand for pizza in a small isolated town is p = 10 - Q. There are only two firms,A and B, and each has a cost function TC = 2 + q. Determine the Cournot equilibrium. Answer: Firm A's profit is π = [10 - (qA + qB)] q1 - 2 - q1. Maximizing with respect to its own output yields q1 = 4.5 – qB/2. Similarly, firm B's best response is qB = 4.5 - q1/2. The equilibrium occurs when both firms produce 3 units. Price is 10 - 3 - 3 = 4. 3) Suppose the demand for Pepsi is qp = 54 – 2pp + 1 pc. The demand for Coke is qc = 54 – 2pc + 1pp. Each firm faces a constant marginal cost of zero. Determine the Bertrand equilibrium prices. What happens to the Bertrand equilibrium prices and profits if increased differentiation causes the demand for Pepsi to become qp = 104 2pp + 1pc while the demand for Coke remains unchanged? Answer: For Pepsi, profit maximization means δπ/δpp = 54 - 4pp + pc = 0. For Coke, profit maximization means δπ/δpc = 54 - 4pc + pp = 0. Both firms are at equilibrium setting a price of 18. If Pepsi's demand curve shifts, profit maximization for them implies δπ/ δpp = 104 - 4pp + pc = 0. Both firms are now at equilibrium when Pepsi charges 31.33 and Coke charges 21.33.