A Corrected Lagrange Multiplier Test

A CORRECTED LAGRANGE MULTIPLIER TEST WITH

APPLICATION TO STOCK MARKET RETURNS

DISSERTATION

Presented in Partial Fulfillment of the Requirements for

The Degree Doctor of Philosophy in the Graduate

School of The Ohio State University

By

Edward Richard Percy, Jr., B.S., M.S., M.B.A.,C.P.A.,M.A.

* * * * *

The Ohio State University

2005

Dissertation Committee:

Professor J. Huston McCulloch, Adviser

Professor Paul Evans

Professor Stephen R. Cosslett

Approved by

___________________________

Adviser

Economics Graduate Program

ABSTRACT

This paper introduces a Lagrange Multiplier goodness-of-fit test that is not biased by the presence of unknown model parameters even in finite samples. Many well-known goodness-of-fit tests rely on the empirical distribution of residuals being arbitrarily close to the “true” underlying error distribution; or, equivalently, that model parameter estimates are actually equal to the parameter’s “true,” typically unknown values. While this assumption may be approximately correct as for a very large sample size, such tests are biased towards acceptance with finite sample sizes.

The test statistic of the proposed procedure is asymptotically chi-squared. Exact finite sample sizes are calculated employing Monte Carlo simulations. Powers of the test are shown under assumptions of various underlying data generating processes. For samples of as few as 30 observations, size distortion is quite low.

Any unknown model parameters can be estimated by the maximum likelihood principle without asymptotically biasing the test. Furthermore, the test is an asymptotically, locally most powerful test in the class of unbiased tests against a general set of alternatives.

The methods suggested are a necessary complement to classical procedures, which often assume a normal error distribution, and nonparametric procedures that do ii

not rely on a particular error distribution but do require that the unknown distribution have a finite variance.

Linear, quadratic, and cubic splines are used to search for the best possible alternative to an error distribution to be tested. These classes of alternative hypotheses are shown to be members of a set which includes a variation of the classical Neyman smooth tests and the Pearson chi-squared tests. Comparisons of size and power with such tests are given.

An empirical example using stock return data is presented comparing symmetric stable error distributions with generalized student-t distributions. iii

Dedicated to my parents Marie K. and Edward R. Percy, Sr., my soul mate Georgia Ward, and my stepsons, Matt and Zach iv

ACKNOWLEDGMENTS

I want to express my deep appreciation and significantly acknowledge the vast amount of input, inspiration and number of original ideas from my dissertation supervisor, Professor J. Huston McCulloch. I wish to call especial attention to his vast knowledge of leptokurtic distributions, my use of his excellent bibliography, and his work, “A Spline Rao (LM) Test for Goodness of Fit: A Proposal,” (1999), which I have used extensively as seed and, in some cases, the substance of ideas recorded herein.

I also want to thank the other members of my Dissertation Committee,

Professors Paul Evans and Stephen R. Cosslett for substantial counsel and comments, both written and verbal during my work preceding this dissertation. Additionally, I want to thank Professor Pok-Sang Lam for his ideas at the proposal stage and for giving advice while on my Advisory Committee. Professor Nelson Mark may not remember, but the germination of my interest in error distributions of financial series came from a meeting with him. I asked him to suggest a research topic for me in his international finance class and he suggested error distributions on forward premium foreign exchange rates.

I want to thank the members of the Midwest Econometrics Group for their input when preliminary ideas from this dissertation were presented, with special thanks to v

Professor Anil Bera, who reviewed some preliminary work, offered helpful comments, and was kind enough to be an outside-the-university reference to recommend that my work receive support through a university fellowship.

For the stock market return application, I want to thank Professor G. Andrew

Karolyi for providing information and location of the financial series on Kenneth

French’s website, http://mba.tuck.dartmouth.edu/pages/faculty/ken.french/data_library.html

.

I will close by repetitiously thanking Professor J. Huston McCulloch again; it was through his contact that I met Dr. Bera and that I learned so much about leptokurtic distributions. I cannot begin to list all the ideas that he has had in helping me; additionally, I cannot imagine having a better adviser for this project.

vi

VITA

August 31, 1953……………………………. Born – Lockbourne AFB, Columbus, Ohio

June, 1975…………………………………...B.S., Statistics (Major -35 hours) and

Mathematics (45 hours), The Ohio State

University

March, 1977………………………………... M.S., Applied Statistics, The Ohio State

University

November, 1977 – May 1978……………….Society of Actuary Examinations, 1, 2, & 3

July 1986…………………………………… M.B.A., Business Administration, Dayton

University

November 1990…………………………….. Certified Public Accountant

December 1998……………………………...M.A., Economics, The Ohio State

University

1975-1977…………………………………...Graduate Teaching Associate, Department of Statistics, The Ohio State University

1978-1996…………………………………...Vice President, Actuarial and Group

Administration (most notable position among many), Central Benefits Mutual

Insurance Company (formerly Blue Cross of Central Ohio)

1997-2002………………………………….. Graduate Teaching and Research

Associate, Department of Economics, The

Ohio State University

2003-2004………………………………….. Assistant Professor, Finance and

Economics, Capital University vii

2005…………………………………………Adjunct Professor, Economics, The

Pontifical College Josephinum

2006………………………………………....Instructor, Economics, The Ohio State

University, Marion Campus, Delaware

Branch

PUBLICATIONS

The Journal of Labor Economics

, “The Long and Short of It: Maternity Leave Coverage and Women's Labor Market Outcomes” (Joint work with Masanori Hashimoto, Teresa

Schoellner, and Bruce Weinberg) – (Submitted July 2004; status: revise and resubmit

February 2005).

“Cash Flow Analysis and Capital Asset Pricing Model”, developed for Keck

Undergraduate Computational Science Education Consortium, supported by W.M.

Keck Foundation, http://www.capital.edu/acad/as/csac/Keck/modules.html

, August

2004.

“Option Pricing”, developed for Keck Undergraduate Computational Science Education

Consortium, supported by W.M. Keck Foundation, http://www.capital.edu/acad/as/csac/Keck/modules.html

, February 2005.

FIELDS OF STUDY

Major Field: Economics

Subfields: Econometrics

Finance viii

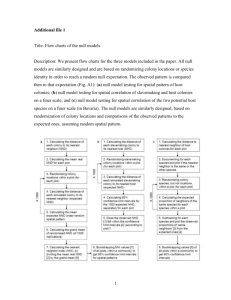

LIST OF FIGURES

Figure Page

Figure 1.1. Two sample densities compared with the uniform distribution. 9

Figure 1.2. Corresponding CDFs to densities in Figure 1.1. 10

Figure 1.3. Comparison of standard normal density to a contrived density that the Pearson test with 10 bins will be unable to detect. 13

Figure 1.4. Additional densities that the Pearson test will be unable to detect. 14

Figure 2.1. Simple cubic spline basis vectors for m=7 28

32 Figure 2.2. Cubic B-Spline basis vectors for m=7

Figure 2.3. Determinants of Fisher information matrices from first 12 simple polynomial bases

Figure 2.4. Neyman-Legendre basis with m = 7

37

39

Figure 3.1. Size distortion of Pearson test; difference between chi-square distribution and empirical distribution

Figure 3.2. Size distortion of Pearson test in tail of distribution

43

45

Figure 3.3. Size distortion of Neyman-Legendre test; difference between chi- square distribution and empirical distribution 46

Figure 3.4. Size distortion of Neyman-Legendre test in tail of distribution 47 ix

Figure

Figure 3.5. Size distortion of Cubic Spline test; difference between chi-square distribution and empirical distribution

Page

48

Figure 3.6. Size distortion of Cubic Spline test in tail of distribution (m=6) 49

Figure 3.7. Size distortion of Cubic Spline test in tail of distribution (m=12) 50

Figure 3.8. Maximum likelihood estimates under assumption of Gaussian errors.

Figure 3.10. Maximum likelihood estimates under assumption of symmetric

stable errors.

54

Figure 3.9. LM Test Statistics and p-values for Gaussian null hypothesis. 55

58

Figure 3.11. LM Test Statistics and p-values for stable null hypothesis. 59

Figure 3.12. Maximum likelihood estimates under assumption of generalized

Student-t errors. 60

Figure 3.13. LM Test Statistics and p-values for Student-t null hypothesis. 61

Figure 3.14. Comparison of inverse distribution functions of Student-t and symmetrical stable error distributions at MLE. 62

Figure 3.15. Comparison of upper tail of inverse distribution functions of

Student-t and symmetrical stable error distributions at MLE. 63

Figure 3.16. Ratio of of Student-t and symmetrical stable densities at MLE evaluated at the inverse stable distribution function.

Figure 3.17. Tests of a null of symmetric stable distribution with an underlying Student-t distribution, sample size 480.

Figure 3.18. Tests of a second null of symmetric stable distribution with an underlying Student-t distribution, sample size 480.

Figure 3.19. Tests of a null of symmetric stable distribution with an underlying Student-t distribution, sample size 10,000.

Figure 4.1. Comparison of results of 90 tests where the null hypothesis and the underlying distributions were both symmetric stable distributions.

64

66

67

68

71 x

Figure

Figure 4.2. Comparison of summary results of 90 tests where the null hypothesis and the underlying distributions were both symmetric stable distributions by type of test.

Figure 4.3 Empirical Distribution Functions of CRSP data.

Page

72

74

Figure 6.1. Estimated density using an underlying Gaussian and a perturbation function dependent on a basis of four cubic

B-splines. 96

Figure 6.2. Estimated density using an underlying uniform density and a perturbation function dependent on a basis of four cubic

B-splines.

Figure 7.1. Effect of first four basis vectors on Gaussian density.

98

102

Figure 7.2. Effect of basis vectors five through eight on Gaussian density. 103

Figure 8.1. Conditional densities of

t

given that

t-1

is at the 1 st , 25 th , and

50 th percentiles of the unconditional distribution.

Figure 8.2. Conditional densities of

t

given that

t-1

is at the 75 th and 99 th percentiles of the unconditional distribution.

113

114

Figure 8.3. Sum of 99 conditional densities to approximate the unconditional density. 115

Figure 8.4. Sum of 99 conditional cdfs to approximate the unconditional cdf. 116

Figure 8.5. Unconditional density derived from unconditional cdf. 117

Figure 8.6. Comparison of smoothness using 10,000 points rather than 99 points.

Figure 8.7. Upper tail of unconditional distribution of

.

118

119

Figure 9.1. Empirical size of 0.10 tests using the naïve and corrected Cubic

Spline and Neyman GFTs using numerical quadrature.

Figure 9.2. Power of tests to detect a GED with a stable null with 316 observations.

131

132 xi

Figure

Figure 9.3. Power of tests to detect a GED with a stable null with 1000

observations.

Figure A.1. Various GED densities. The letter “a” represents the exponent

“ .”

Figure D.1. Degrees of Freedom vs. Ratio of Moments in a Student-t

Distribution

Figure D.2. Power vs. Ratio of Moments in a GED distribution

Page

133

146

160

163

Figure F.1. Examples of quasi-random numbers and pseudo-random numbers over the unit square.

Figure G.1. Systematic portion of error function of 25 th Neyman-Legendre basis vector

173

182 xii

TABLE OF CONTENTS

Page

Abstract………………………………………………………………………………….ii

Dedication………………………………………………………………………………iv

Acknowledgments……………………………………………………………………….v

Vita……………………………………………………………………………………..vii

List of figures…………………………………………………………………………...ix

Chapters:

1. Introduction……………………………………………………………………… 1

1.1 What is the Error Distribution in Financial Series?........................................ 6

1.2 An “Ideal” Goodness-of-Fit Test…………………………………………….7

1.3 Some Well-Known Goodness-of-Fit Tests..................................................... 8

1.4 Presence of Estimated Model Parameters…................................................. 14

2. Preliminaries in the Development of an Appropriate Lagrange Multiplier Test. 18

2.1 Lagrange Multiplier (LM) Test for a Uniform Distribution………………. 18

2.2 Technical Considerations………………………………………………….. 22

2.3 Spline Lagrange Multiplier Test for a Uniform Distribution……………... 24

2.4 B-Spline Basis……………………………………………………………... 27

2.5 Neyman’s Smooth Test……………………………………………………. 33

2.6 Simple Polynomial Basis………………………………………………….. 36

2.7 Orthogonal Polynomial Basis……………………………………………... 38

The Lagrange Multiplier Test………………………………………………… 41

3.1 Lagrange Multiplier Test for a General Completely Specified Distribution 41

3.2 Finite Sample Properties with a Completely Specified Distribution…….... 42

3.3 LM Test for a General Distribution with Estimated Model Parameters....... 51 xiii

Page

3.4 First Test with Model Parameters…………………………………………. 53

3.5 Investigation of Sensitivity………………………………………………... 61

4.

Results of Other GFTs…………………………………………………………. 70

4.1

Residual Tests……………………………………………………………... 70

4.2

Empirical Distribution Function Tests…………………………………….. 72

5. Improvement in Results Due to Numerical Quadrature of Fisher Information

Matrix………………………………………………………………………...… 76

5.1

Derivation of Fisher Information Matrix…………………………...………76

5.2

Numerical Two-Sided Differentiation………………………………...……82

5.3

Numerical One-Sided Differentiation……………………………………... 88

5.4

Romberg Integration………………………………………………………. 91

6. In the Event of Multiple Rejections or Non-Rejections………………………...95

6.1 Multiple Rejections………………………………………………………... 95

6.2 Multiple Non-Rejections……………………………………………...…… 99

7.

Meaning of Basis Vectors of Perturbation Functions……………………….... 101

8.

Time Dependent Errors……………………………………………………….. 105

8.1 Examples Using Time Series Models………………………………….… 105

8.2 Estimation of

Test Recommendations for Financial Data…………………………………… 126

9.1 Size Distortion…………………………………………………………….128

9.2 Power……………………………………………………………………...129

9.3 With a Stable Null………………………………………………………... 130

9.4 With a Student-t Null...…………………………………………………... 133

9.5 With a GED Null….....…………………………………………………... 134

9.6 With a Mixture Null.....…………………………………………………... 134

9.7 Basis Size vs. Sample Size………………………………………..………134

10.

Conclusion……………………………………………………………………..140

Appendices:

A.

Densities and Distributions…………………………………………………….142 xiv

A.6 Cauchy Distribution and Its Use in Integration Over the Infinite Real

Page

A.1 Stable Distributions……………………………………………………… 142

A.2 Pareto Distributions………………………………………………………143

A.3 Generalized Error Distributions (G.E.D.)……………………………….. 145

A.4 Student-t Distributions………………………………………………...… 147

A.5 Mixture of Two Gaussians………………………………………………. 148

Line……………………………………………………………………….150

B. 1-1 Correspondence between a General Distribution and a Uniform over [0,1]151

C. Pseudo-Random Number Generator and Monte Carlo Methods……………... 152

C.1 Random Number Generator………………………………………….….. 152

C.2 Calculation of Empirical Quantiles…………………………………….... 154

C.3 Addition of 2

-33

to Pseudo-Random Numbers……………………………155

D. Starting Values for Iterative Maximum Likelihood Estimation……………… 157

D.1 Initial Estimates for Parameters For Use In Maximum Likelihood

Estimation………………………………………………….……………. 157

E. Invariance of LM Statistic with Respect to Linear Transformations or

Exponentiation………………………………………………………………... 166

F. Unconditional Calculation of

2 …………………………………………….. 171

F.1 Quasi-Random Numbers……………………………………………….... 171

F.2 Rule of Thumb for Maximal “Reasonable” Values of 2 ……………..… 177

G.

Rounding Concerns…………………………………………………………... 179

G.1 Rounding Errors in Polynomials……………………………………….... 179

G.2 Rounding with GAUSS Software……………………………………….. 182

G.3 Evaluation of Polynomials by Horner’s Rule………………………...…. 185

H. Neyman and Spline Bases…………………………………………………..… 187

I.

Size and Power with Various Null Hypotheses………………………………. 215

I.1 Stable Size………………………………………………………………... 215

I.2 Student-t Size…………………………………………………………….. 218

I.3 GED Size………………………………………………………………..... 220

I.4 Mixture Size…………………………………………………………….... 223

I.5 Stable Power……………………………………………………………... 225 xv

Page

I.6 Student-t Power………………………………………………………….. 230

I.7 GED Power……………………………………………………………..... 234

I.8 Mixture Power………………………………………………………….... 238

Bibliography……………………………………………………………………….... 243 xvi

THE LAGRANGE MULTIPLIER TEST

3.1 LAGRANGE MULTIPLIER TEST FOR A GENERAL COMPLETELY

SPECIFIED DISTRIBUTION

APPENDICES

APPENDIX

A…………………………………………………..……………………………..

who knows #

APPENDIX

B…………………………………………………..……………………………..

who knows #

Bibliography………………………………………………………………………………

…………….

Big# xvii

LIST OF FIGURES

Figure

2.1 blalahsldfkjl;skjdf…………………………………………………………

2.2 lkasjdfl;kjasdf……………………………………………………………

Page

3

4 xviii