Chapter 21

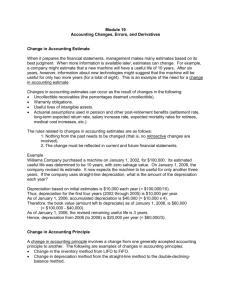

advertisement

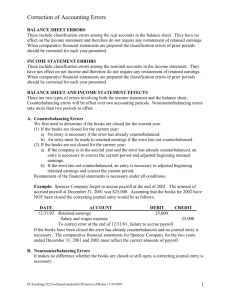

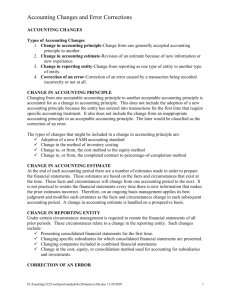

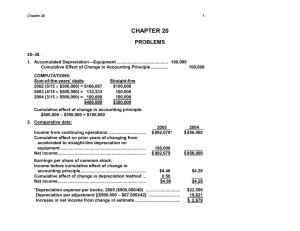

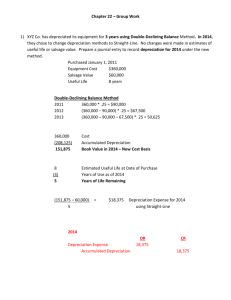

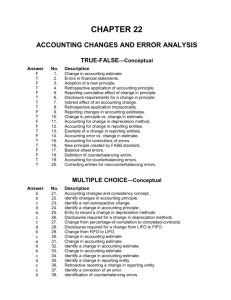

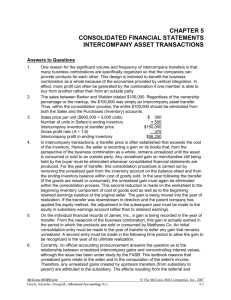

Exercise 21-1 Requirement 1 ($ in 000s) Accumulated depreciation (cumulative effect given) ........................... Deferred tax liability ($450 x 40%) ................................................ Cumulative effect of accounting change (net effect) ..................... 450 180 270 Requirement 2 The cumulative income effect (net of the tax effect) is reported as a separate item of income between extraordinary items and net income. The 2002 financial statements are not restated in their entirety under the current approach. However, the effect of the change on certain key income numbers should be disclosed for the current period and on a “pro forma” (“as if”) basis for the financial statements of all prior periods that are included for comparison with the current financial statements. So, the 2003 comparative income statements should include pro forma restatement of 2002’s (a) income before extraordinary items, (b) net income, and (c) earnings per share for both income amounts. These specific items are calculated as if the straight-line method had been in effect before the change and are reported as supplemental information. Also, the nature of and justification for the change should be described in the disclosure notes. 1 Exercise 21-3 (Skip Requirement 4) Requirement 1 ($ in millions) Construction in process (additional amount due to the new method: $7 million + 3 million) ............................................ Deferred tax liability ($10 million x 40%) ........................................ Retained earnings (difference) ........................................................ 10 4 6 Retained earnings is increased by $6 million because the net income in years prior to 2003 would have been higher by that amount. Requirement 2 Income before income taxes Income tax expense (40%) Net Income 2003 $10.0 (4.0) $ 6.0 2002 $8.0 (3.2) $4.8 Requirement 3 Besides net income, which was reported in 2002 as $3 million ($5 million less tax) and now restated to $4.8 million, other amounts that would be restated to reflect accounting by the percentage - of - completion method are: Earnings per share Income tax expense (and income before income taxes) Construction in process (and total assets) Deferred tax liability (and total liabilities) Retained earnings (and total shareholders’ equity) 2 Exercise 21-5 PC 1. Change from declining balance depreciation to straight-line. E 2. Change in the estimated useful life of office equipment. E 3. Technological advance that renders worthless a patent with an unamortized cost of $45,000. PC 4. Change from determining lower of cost or market for inventories by the individual item approach to the aggregate approach. PR 5. Change from LIFO inventory costing to weighted-average inventory costing. E 6. Settling a lawsuit for less than the amount accrued previously as a loss contingency. R 7. Including in the consolidated financial statements a subsidiary acquired several years earlier that was appropriately not included in previous years. N* 8. Change by a retail store from reporting bad debt expense on a pay-as-you-go basis to the allowance method. PC 9. A shift of certain manufacturing overhead costs to inventory that previously were expensed as incurred to more accurately measure cost of goods sold. (Either method is generally acceptable.) E 10. Pension plan assets for a defined benefit pension plan achieving a rate of return in excess of the amount anticipated. *Error correction: change from an unacceptable method to GAAP. Exercise 21-8 1. c 2. a 3. b 3 Exercise 21-13 (Exercise 11-13) Van Frank Telecommunications has a patent on a cellular transmission process. The company has amortized the patent on a straight-line basis since 1999, when it was acquired at a cost of $18 million at the beginning of that year. Due to rapid technological advances in the industry, management decided that the patent would benefit the company over a total of six years rather than the nine-year life being used to amortize its cost. The decisions was made at the end of 2003 (before adjusting and closing entries). Required: Prepare the appropriate adjusting entry for patent amortization in 2003 to reflect the revised estimate. ($ in millions) Amortization expense (determined below) ......................... Patent........................................................................... Calculation of annual amortization after the estimate change: $ in millions) $18 $2 x 4 years Cost Old annual amortization ($18 ÷ 9 years) 8 10 Amortization to date (1999-2002) Unamortized cost (balance in the patent account) ÷ 2 Estimated remaining life (6 years – 4 years) $ 5 New annual amortization 4 5 5 Exercise 21-17 (Exercise 11-14) Wardell Company purchased a minicomputer on January 1, 2001, at a cost of $40,000. The computer was depreciated using the straight-line method over an estimated fiveyear life with an estimated residual value of $4,000. On January 1, 2003, the estimate of useful life was changed to a total of 10 years, and the estimate of residual value was changed to $900. Requirement 1: Prepare the appropriate adjusting entry for depreciation in 2003 to reflect the revised estimate. Depreciation expense (determined below) .......................... Accumulated depreciation - computer ........................ 3,088 3,088 Calculation of annual depreciation after the estimate change: $40,000 $7,200 x 2 years Cost Old annual depreciation ($36,000 ÷ 5 years) 14,400 Depreciation to date (2001-2002) 25,600 Book value 900 Revised residual value 24,700 Revised depreciable base ÷ 8 Estimated remaining life (10 years - 2 years) $ 3,088 New annual depreciation Requirement 2: Repeat requirement 1 assuming that the company uses the sumof-the-years’-digits method instead of the straight-line method. Depreciation expense (determined below) .......................... Accumulated depreciation - computer ........................ 5 3,889 3,889 Exercise 21-17 (Exercise 11-14) – concluded Calculation of annual depreciation after the estimate change: $40,000 Cost Old depreciation: $12,000 2001 - ($36,000 x 5/15) 9,600 2002 - ($36,000 x 4/15) 21,600 Depreciation to date (2001-2002) 18,400 Book value 900 Revised residual value 17,500 Revised depreciable base x 8/36 Estimated remaining life - 8 years $ 3,889 2003 depreciation 6 Exercise 21-19 Requirement 1 The 2001 error caused 2001 net income to be understated, but since 2001 ending inventory is 2002 beginning inventory, 2002 net income was overstated the same amount. So, the income statement was misstated for 2001 and 2002, but the balance sheet (retained earnings) was incorrect only for 2001. After that, no account balances are incorrect due to the 2001 error. Analysis: 2001 Beginning inventory Plus: net purchases Less: ending inventory Cost of goods sold Revenues Less: cost of goods sold Less: other expenses Net income U = Understated O = Overstated 2002 Beginning inventory Plus: net purchases Less: ending inventory Cost of goods sold U O Revenues Less: cost of goods sold Less: other expenses Net income O U Retained earnings U U U O U Retained earnings 7 corrected Exercise 21-19 (concluded) However, the 2002 error has not yet self-corrected. Both retained earnings and inventory still are overstated as a result of the second error. Analysis: 2002 Beginning inventory Plus: net purchases Less: ending inventory Cost of goods sold Revenues Less: cost of goods sold Less: other expenses Net income U = Understated O = Overstated O U U O Retained earnings O Requirement 2 Retained earnings (overstatement of 2002 income) ......................... 150,000 Inventory (overstatement of 2003 beginning inventory) .............. 150,000 Requirement 3 The financial statements that were incorrect as a result of both errors (effect of one error in 2001 and effect of two errors in 2002) would be retroactively restated to report the correct inventory amounts, cost of goods sold, income, and retained earnings when those statements are reported again for comparative purposes in the current annual report. A “prior period adjustment” to retained earnings would be reported, and a disclosure note should describe the nature of the error and the impact of its correction on each year’s net income, income before extraordinary items, and earnings per share. 8 Exercise 21-22 1. Error discovered before the books are adjusted or closed in 2003. Investments ($100,000 – 80,000)........................................................ Gain on sale of investments ................................................ 20,000 20,000 2. Error not discovered until early 2004. Investments ($100,000 – 80,000)........................................................ Retained earnings ................................................................ Exercise 21-24 1. c 2. a 3. a 9 20,000 20,000