Presentation slides

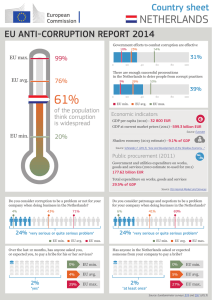

advertisement

Prepared by Jonathan Hoechst Rebecca McAtee Jonathan McBride Ulrike Nischan Overview Cost-Benefit Analysis Process Theoretical Framework Costs Benefits Monte Carlo Conclusion and Limitations Theoretical Framework ALAC Effect on Corruption Societal approach Negative Impacts of Corruption Social welfare Political Economic Costs Costs of Running an ALAC: Initial start-up costs (€95,600) Total administration costs, which include salary, equipment, rent, etc. (€131,300) Volunteer opportunity cost (€3,600) Cost to Clients: Opportunity cost (€3,360) Travel costs (€795) Benefits Societal Benefit Economic gain from reduced corruption Pervasive corruption decreases actual economic activity below level of full potential Any decrease in corruption will yield economic gains Alternative Benefit Calculation: Client Level Legal advice provided by the ALACs Cannot Use Both Measures Double counting Calculating Economic Gains derived from ALACs, Part 1 In order to calculate the economic gains from ALACs, one must first calculate an ALAC’s impact on corruption Using an adjusted Corruption Perceptions Index to measure corruption and worldwide economic data from 2003 through 2008 we were able to estimate that a single ALAC per million people reduces corruption by 0.74 on the 0-10 scale Controlling for CPI Concerns Change in Methodology 2006 2007 Controlled for with statistical model Surveys 21 different surveys used 3 required to be included in index Controlled for using survey variables The Model Change in adjusted CPI indicator was measured by holding all differences among countries and over time constant This allowed us to look only at the change within time and within countries attributable to ALAC presence Model Results One ALAC per one million inhabitants has a 0.88 reduction effect on the measure of corruption There is a diminishing return of 0.14 for each ALAC per one million inhabitants Calculating Economic Gains derived from ALACs, Part 2 Estimates indicate that for every one-point change in corruption GDP increases 0.38 percent (Pellegrini and Gerlagh, 2004) Economic benefits of ALACs are calculated using the estimate of an ALAC’s impact on corruption and the impact of corruption on GDP How to Calculate Benefits Example Country Syriana Population 2,500,000 Number of ALACs 2 currently in operation GDP €34,000,000,000 How to Calculate Benefits Change in corruption attributed to ALACs in Syriana: ∆Corrupt #ALAC /mil×# ALAC/mil+ returns|#ALAC /mil× # ALAC2 /mil (i) -0.88 (2/2.5) + 0.14 (2/2.5)2 = -0.614 Percent change in GDP attributed to ALACs in Syriana: Multiply previous equation by %∆GDP| ∆Corrupt /mil, 0.38% (ii) -0.614 -0.0038 = 0.0023 The change in GDP attributed to ALACs %∆GDP| ∆Corrupt /mil × GDPSyriana (iii) 0.0023 €34 bil. = $78.2 mil. Standing As ALACs operate at the national level, we give national standing Criminals are not given standing Cost-Benefit Analysis Timeframe – 3.5 Years Cost associated with Year 0 is include the initial six month startup period No benefits accrue during Year 0 Years 1 through 3 include administration costs, client costs, volunteer costs, and economic benefits All costs and benefits are discounted to Year 0 Three countries are used: Turkey, Hungary, and Cameroon to show the range of net benefits in a low GDP, moderate GDP, and high GDP country The calculated net benefit is an estimate of the net benefit over the 3.5 years that the country in question receives if an ALAC is founded this year The Monte Carlo Process Varying Uncertain Parameters Running Simulations Evaluating Results Monte Carlo Data Ranges Part 1 Min Value Max Value Distribution Client Hours 0.5 4.0 Uniform Yearly Caseload 154 158 Uniform Operating Costs €43,500 €48,625 Uniform Rural Travel Costs €3.00 €12.00 Uniform Urban Travel Costs €0.81 €1.81 Uniform Monte Carlo Data Ranges Part 2 Median Standard Dev. Distribution Marginal ALAC Impact -0.88 0.45 Bivariate Normal Marginal ALAC Diminishing Returns 0.14 0.08 Bivariate Normal Corruption’s Effect on GDP 0.38 0.13 Normal Monte Carlo Results (Millions of Euros) Country Average Net Benefits Low High Below Zero Turkey 63.0 -251.0 518.0 8% Hungary 97.8 -275.0 653.0 8% Cameroon 6.9 -28.9 51.9 9% Monte Carlo – Turkey •High GDP – High population •Average Net Benefit: €63.0 mil •Below Zero: 8% Monte Carlo – Hungary •High GDP – Low Population •Average Net Benefit: •€97.8 mil •Below Zero: 8% Monte Carlo – Cameroon •Low GDP – Low Population •Average Net Benefit: €6.9 mil •Below Zero: 9% Conclusions and Limitations Significant ALAC benefits Data limitations Availability of other research Relatively new strategy