Time-Varying Incentives in the Mutual Fund Industry

advertisement

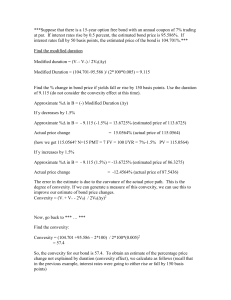

Time-Varying Incentives in the Mutual Fund Industry Jacques Olivier HEC Paris Anthony Tay Singapore Management University Motivation Existing empirical literature on mutual fund flows: Ippolito (1992), Gruber (1996), Chevalier and Ellison (1997), Sirri and Tufano (1998), Del Guercio and Tkac (2002), Lynch and Musto (2003), Barber, Odean and Zheng (2005), Gallaher, Kaniel and Starks (2006) and Huang, Wei and Yan (2007)… Because of fee structure, investor flows shape the incentives of mutual fund managers Crucial property of flows: convex function of past performance, which provides incentives for strategic risk-shifting Chevalier and Ellison (1997), Brown et al. (1996) Preview (1) Central result of this paper: Convexity of the flow-performance relationship varies with economic activity The stronger is economic activity, the more convex is the flow-performance relationship Preview (2) 5 issues: (i) Is the effect economically significant? • YES: +1% GDP growth implies (more than) twice as much convexity as on average -1% GDP growth implies no convexity whatsoever (and even some concavity) (ii) Is the effect driven by “abnormal” years? • NO: removing years with deep recessions or strong booms leaves the result unchanged Preview (3) 5 issues (continued): (iii) Through which channel does economic activity affect the nature of the flow-performance relationship? • GDP growth, NOT market returns • Aggregate flows, NOT volatility • Consistent with consumption smoothing + disposition effect (iv) Does the time variation of the flow-performance relationship affect decisions of fund managers? • YES: strategic risk-shifting occurs only when GDP growth is high • Effect of GDP growth dominates that of market returns Preview (4) 5 issues (continued): (v) Other reasons why we care about the result: • Rationalizes existing results on mutual fund performance over the business cycle • Methodological aspects • Time-varying risk premia (more tentative…) Data and Methodology (1) No-load US domestic equity mutual funds appearing in CRSP survival bias free mutual fund database between 1980 and 2006 Exclude multiple classes, index funds, funds of funds, funds closed to investors, funds that never reached 10M$ of total net assets Flow variablei,t = Dollar Flowi,t = TNAi,t – (1+ri, t) TNAi, t-1 Where TNAi,t represent Total Net Assets at the end of year t Data and Methodology (2) Rank (or relative performance): year-by-year ranking of fund managers according to their (1-factor) alpha: • Measure between 0 (worse performer) and 1 (best performer) Following Sirri and Tufano (1998), divide performance in three regions: TOP: top quintile (relative performance from 0.8 to 1) MIDDLE: middle three quintiles (from 0.2 to 0.8) BOTTOM: bottom quintile (below 0.2) Estimate piecewise linear regression of current flows on past performance Robustness checks: Rank managers by their excess returns or by their 4-factor alphas Use 1-factor alphas themselves instead of the ranking Data and Methodology (3) Standard flow-performance regression (e.g. Sirri and Tufano, 1998): Where: Data and Methodology (4) Interpretation of the standard regression: There is convexity if and only a1 – a3 is positive and significant In other words, if and only if flows react more to differences in performance of good performers than to differences in performances of lousy performers Data and Methodology (5) What we test in this paper: Does the difference a1 – a3 vary with economic activity? Our basic regression: Data and Methodology (6) Interpretation: Business cycle effects measured by deviations (in percentage) of real US GDP growth from its sample mean Year-fixed effects: take care of impact of business cycle on the intercept Slope effects: captured by interaction variable: Data and Methodology (7) Interpretation of coefficient on performance: impact of performance on flows when US GDP growth is equal to its sample mean Interpretation of coefficient on interaction variable: how does a +1% deviation of GDP growth change the (total) impact of performance on growth Data and Methodology (8) Tests of convexity Flow-performance relationship is convex on average if and only if: a1 is (significantly) larger than a3 A +1% increase of GDP growth rate increases convexity if and only if: a4 is (significantly) larger than a6 Data and Methodology (9) Unbalanced Panel Data Year fixed effects though year dummy variables Standard errors clustered by funds Methodological remark: Usual methodology used in mutual fund flows literature: FamaMac Beth regressions Assumes that slope coefficients in each annual regression drawn from the same distribution Not valid if systematic time variation at business cycle frequency in slope coefficients Comparable to point made 10 years ago in the asset pricing literature (conditional vs. unconditional CAPM) Basic Results (1) Basic Results (2) Basic Results (3) Interpretation: Flow-performance relationship convex on average Stronger reaction of flows to good performance when economic activity is strong Stronger convexity of the flow-performance relationship when economic activity is strong Order of magnitude: a +/- 1% change of GDP growth (more than) doubles / eliminates the convexity in the flow-performance relationship Robustness Checks Economic Interpretation (1) Economic Interpretation (2) Candidate 1: flow composition effect Step 1: convexity of new inflows and of portfolio rebalancing flows • Investors look for positive alpha funds • Positive alpha funds concentrated in upper tail of the distribution Step 2: outflows are a flat or concave function of performance • Concentration of portfolios + short-sale constraints • Disposition effect Step 3: more outflows when economic activity is weak • Consumption smoothing Economic Interpretation (3) Candidate 2: volatility effect Step 1: convexity driven by investors looking for positive alpha funds Step 2: volatility is countercyclical Step 3: performance is less informative about skill when volatility is high (more noise) Economic Interpretation (4) Implications (1) Tournament Hypothesis Brown et al. (1996), Chevalier and Ellison (1997): convexity of flowperformance relationship provides incentives for poor mid-year performers to take on more risk Empirical evidence on risk-shifting: very mixed depending on samples Kempf et al. (2008): cost of switching jobs imply more risk-shifting under good than under bad market conditions 2 issues: • No direct estimate of cost of switching jobs and relative magnitude compared to high-powered incentives in the industry • Could go either way (foregone bonuses) Implications (2) Conditional Tournament Hypothesis When the flow-performance relationship is convex, then poor midyear performers have incentives to increase the risk of their portfolios Thus, more risk-shifting when economic activity is strong If risk-shifting mostly driven by the flow-performance relationship then no impact of market conditions on risk-shifting once business cycle effects are accounted for Implications (3) Conditional Tournament Hypothesis (continued) Negative coefficient of interaction variable: poor performers increase their risk even more when GDP growth is high Year fixed effect and fund clustered standard errors Implications (4) Implications (6) Conclusion: Behavior of fund managers is consistent with time-series properties of the flow-performance relationship Reconciles insights of seminal papers in the field with conflicting empirical evidence Once time-varying nature of incentives are accounted for, only mild support for impact of employment risk Some evidence in favor of market timing by fund managers Other Reasons to Care About the Result Kosowski (2006): Funds have significantly larger alphas during recessions than during booms This paper provides a possible rationale for the result: more distortion of incentives of mutual fund managers during booms Mechanism supported by Huang et al. (2008): risk-shifting destroys value Asset pricing literature: Non constant discount factors This paper provides a (very) specific example where business cycle variations generate endogenously shifts to risk aversion of agents (fund managers)