Class 3. Models with Individual Effects

advertisement

[Part 3: Common Effects ] 1/57

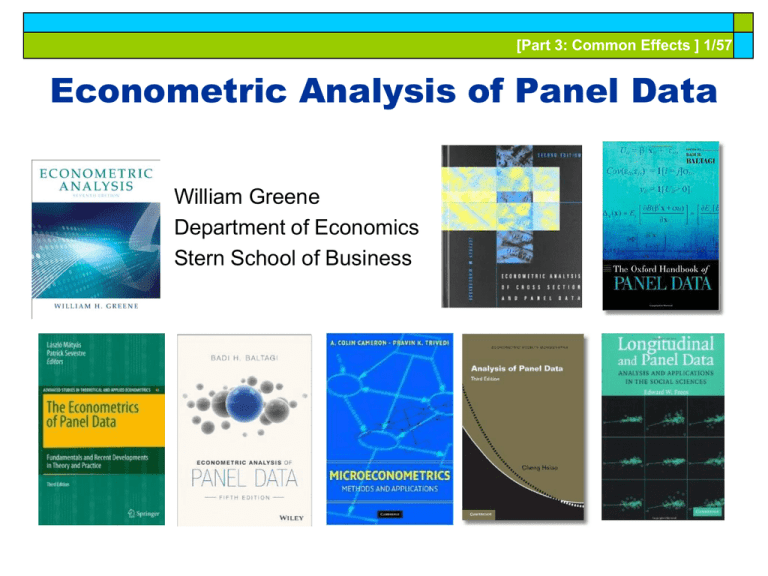

Econometric Analysis of Panel Data

William Greene

Department of Economics

Stern School of Business

[Part 3: Common Effects ] 2/57

Benefits of Panel Data

Time and individual variation in behavior unobservable

in cross sections or aggregate time series

Observable and unobservable individual heterogeneity

Rich hierarchical structures

More complicated models

Features that cannot be modeled with only cross

section or aggregate time series data alone

Dynamics in economic behavior

[Part 3: Common Effects ] 3/57

Short Term Agenda for Simple Effects Models

Models with individual effects

Extensions

Interpretation of models

Computation (practice) and estimation (theory)

Nonstandard panels: Rotating, Pseudo-, Nested

Generalizing the regression model

Alternative estimators

Methods

Least squares: OLS, GLS, FGLS

MLE and Maximum Simulated Likelihood

[Part 3: Common Effects ] 4/57

Fixed and Random Effects

Unobserved individual effects in regression: E[yit | xit, ci]

Notation:

yit =xit + ci + it

xi1

x

i2

X i Ti rows, K columns

Linear specification: x iTi

Fixed Effects: E[ci | Xi ] = g(Xi). Cov[xit,ci] ≠0

effects are correlated with included variables.

Random Effects: E[ci | Xi ] = μ; effects are uncorrelated with

included variables. If Xi contains a constant term, μ=0 WLOG.

Common: Cov[xit,ci] =0, but E[ci | Xi ] = μ is needed for the

full model

[Part 3: Common Effects ] 5/57

Convenient Notation

Fixed Effects – the ‘dummy variable model’

yit = i + xit + it

Individual specific constant terms.

Random Effects – the ‘error components model’

yit = xit + it + ui

Compound (“composed”) disturbance

[Part 3: Common Effects ] 6/57

Balanced and Unbalanced Panels

Distinction: Balanced vs. Unbalanced Panels

A notation to help with mechanics

zi,t, i = 1,…,N; t = 1,…,Ti

The role of the assumption

Mathematical and notational convenience:

Balanced, n=NT

N

Unbalanced: n i=1 Ti

Is the fixed Ti assumption ever necessary? Almost

never. (Baltagi chapter 9 is about algebra, not

different models!)

Is unbalancedness due to nonrandom attrition

from an otherwise balanced panel? This will

require special considerations.

[Part 3: Common Effects ] 7/57

An Unbalanced Panel: RWM’s

GSOEP Data on Health Care

N = 7,293 Households

Some households exited then returned

[Part 3: Common Effects ] 8/57

Exogeneity

Contemporaneous exogeneity

Strict exogeneity – the most common assumption

E[εit|xi1, xi2,…,xiT,ci]=0

Can use first difference or fixed effects

Cannot hold if xit contains lagged values of yit

Sequential exogeneity?

E[εit|xit,ci]=0 Not sufficient for regression

Doesn’t imply how to estimate β

E[εit|xi1, xi2,…,xit,ci] = 0

These assumptions are not testable. They are part of the

model.

[Part 3: Common Effects ] 9/57

Assumptions for Asymptotics

Convergence of moments involving cross section Xi.

N increasing, T or Ti assumed fixed.

“Fixed T asymptotics” (see text, p. 175)

Time series characteristics are not relevant (may be

nonstationary)

If T is also growing, need to treat as multivariate time series.

Ranks of matrices. X must have full column rank. (Xi

may not, if Ti < K.)

Strict exogeneity and dynamics. If xit contains yi,t-1 then

xit cannot be strictly exogenous. Xit will be correlated

with the unobservables in period t-1. (To be revisited

later.)

Empirical characteristics of microeconomic data

[Part 3: Common Effects ] 10/57

Estimating β

β is the partial effect of interest

Can it be estimated (consistently) in the

presence of (unmeasured) ci?

Does pooled least squares “work?”

Strategies for “controlling for ci” using the sample

data

Using a proxy variable.

[Part 3: Common Effects ] 11/57

The Pooled Regression

Presence of omitted effects

y it =x itβ+c i +εit , observation for person i at time t

y i =X iβ+cii+ε i , Ti observations in group i

=X iβ+c i +ε i , note c i (c i , c i ,...,c i )

y =Xβ+c +ε , Ni=1 Ti observations in the sample

Potential bias/inconsistency of OLS – depends

on ‘fixed’ or ‘random’

[Part 3: Common Effects ] 12/57

[Part 3: Common Effects ] 13/57

Most Helpful Customer Reviews

31 of 39 people found the following review helpful Too theoretical and poorly written

By Doktor Faustus on May 7, 2013

Format: Hardcover Econometric Analysis" by William Greene is one of the more widely use graduate-level

textbooks in econometrics. I used it in my first year PhD econometrics course. This is unfortunate for several

reasons. The book states that its first objective is to introduce students to applied econometrics, especially the basic

techniques of linear regression. When reading the book, however, what the reader notices first is that the applications

are essentially just footnotes; the meat of each chapter is dense econometric theory. An applied textbook would focus

on working with data, but Greene's book has exercises that focus on proving obscure statistical properties (i.e. prove

that the asymptotic variance of various estimators goes to zero). Useful for theorists, but not for applied work, which

is what the book advertises itself as.

Another problem with the book is its impenetrable text. Reading this book is drudgery even when not trying to make

sense of the absurdly huge matrix equations. Greene uses academic, elevated language that does not belong in a

technical textbook. Where the student needs clear explanation, he instead reads sentences like the following found in

a chapter introduction: "We first consider the consequences for the least squares estimator of the more general form

of the regression model. This will include assessing the effect of ignoring the complication of the generalized model

and of devising an appropriate estimation strategy, still based on least squares". After reading that second sentence

several times I still don't understand what Greene is trying to convey.

Finally the book is much too large and expensive for a class textbook. The book is 1200 pages long and includes

numerous asides in every chapter. If the objective of the book is to teach econometrics to graduate students (as it

says in the book), then it would be better off focusing on important topics and applications, not on topics that are

never used by the vast majority of economists. I do not recommend this book for anyone; there are better

econometrics textbooks available for undergraduates, graduate students, and professionals.

[Part 3: Common Effects ] 14/57

October 13, 2014

By Daniel Pulido

This review is from: Econometric Analysis (7th Edition) (Hardcover)

The delivery was fine. But the book itself is the worst Econometric Analysis book

I have ever come across. No examples. Only a continuous list of theorems.

I would not recommend anyone this book.

[Part 3: Common Effects ] 15/57

A Popular Misconception

If only one variable in X is correlated with , the other coefficients are

consistently estimated. False.

Suppose only the first variable is correlated with ε

1

0

Under the assumptions, plim( X'ε /n) = . Then

...

.

q11

1

21

0

q

plim b - β = plim(X'X /n)-1 1

...

...

K 1

.

q

1 times the first column of Q-1

The problem is “smeared” over the other coefficients.

[Part 3: Common Effects ] 16/57

OLS with Individual Effects

b=(X X )-1 X'y = (X X )-1 X'(Xβ+c+ε)

-1

=β + (1/N)Σ X iX i (1/N)Σ Ni=1 X ic i (part due to the omitted c i )

N

i=1

-1

+ (1/N)Σ X iX i (1/N)Σ Ni=1 X iε i (covariance of X and ε will = 0)

The third term vanishes asymptotically by assumption

N

i=1

-1

T

1

plim b = β + plim ΣNi=1 X iX i ΣNi=1 i x ic i (left out variable formula)

N

N

So, what becomes of ΣNi=1 wi x i c i ?

plim b = β if the covariance of x i and ci converges to zero.

[Part 3: Common Effects ] 17/57

Mundlak’s Estimator

Mundlak, Y., “On the Pooling of Time Series and Cross Section

Data, Econometrica, 46, 1978, pp. 69-85.

Write c i = x iδ ui , E[c i | x i1 , x i1 ,...x iTi ] = x iδ

Assume c i contains all time invariant information

y i =X iβ+c ii+ε i , Ti observations in group i

=X iβ+ix iδ+ε i + uii

Looks like random effects.

Var[ε i + uii]=Ωi +σ 2uii

May be estimable by 2 step FGLS.

[Part 3: Common Effects ] 18/57

Chamberlain’s (1982) Approach

Use a linear projection, not necessarily the conditional

mean.

P[ci | xi1 , xi1 ,...xiTi ] = xi11 + xi22 ... xiT T

ci P[ci | xi1 , xi1 ,...xiTi ] ui , cov[ui ,xit ]=0

y it =xitβ+xi11 + xi22 ... xiT T + εit ui

This “regression” can be computed T times, using one year at a time.

How would we reconcile the multiple estimators of each parameter?.

[Part 3: Common Effects ] 19/57

Chamberlain’s (1982) Approach

P[ci | xi1 , xi1 ,...xiTi ] = xi11 + xi22 ... xiT T

ci P[ci | x i1 , xi1 ,...xiTi ] ui , cov[ui ,xit ]=0

y it =xitβ+xi11 + xi22 ... xiT T + εit ui

Period 1

y i1=xi1 (β+1 ) + xi22 ... xiT T + εi1 ui

Period 2

y i2=xi11 + xi2 (β+2 ) ... xiT T + εi2 ui

and so on...

[Part 3: Common Effects ] 20/57

Proxy Variables

Proxies for unobserved effects: e.g., Test score for unobserved

ability

Interest is in δ(xit,ci)=E[yit|xit,ci]/xit

Since ci is unobserved, we seek APE = Ec[δ(xit,ci)]

Proxy has two characteristics

Ignorable in the model: E[yit|xit,zi,ci] = E[yit|xit,ci]

‘Explains’ ci in that E[ci|zi,xit] = E[ci|zi]. In the presence of zi, xit does

not further ‘explain ci.’

Then, Ec[δ(xit,ci)] = Ez{E[yit|xit,zi]/xit}

Proof: See Wooldridge, pp. 23-24.

Loose ends:

Where do you get the proxy?

What is E[yit|xit,zi]? Use the linear projection and hope for the best.

[Part 3: Common Effects ] 21/57

Estimating the Sampling Variance of b

s2(X ́X)-1?

Correlation across observations

Heteroscedasticity

A “robust” covariance matrix

Robust estimation (in general)

The White estimator

A Robust estimator for OLS.

[Part 3: Common Effects ] 22/57

A ‘Cluster’ Estimator

yit =xitβ+(ci +εit )

=xitβ+vit , Cov[vit , vis ] 0

Pseudo-log likelihood that produces OLS as the estimator

Ti

logL*=Ni=1 (-1/2)Σ t=1

(logσ 2 +log2π+v it2 /σ 2

Ti

ˆ

The solution for 2 will always be [Ni=1Σ t=1

v it2 ] / Ni=1 Ti ,

so concentrate on β. The solution will be b=(X X )-1 X y

Ti

logL*/β = Ni=1 Σ t=1

x it v it /σ 2 Ni=1gi g.

Ti

2logL*/ββ = -Ni=1Σ t=1

x it x it /σ 2 (1 / σ 2 ) X X = H and = E[H]

Var[b] = (-H-1 )Var[g](-H-1 )

Var[g] is usually H, but not here because of correlation across

observations. Approximate Var[g] with Ni=1gigi.

[Part 3: Common Effects ] 23/57

Cluster Estimator (cont.)

[Part 3: Common Effects ] 24/57

Cornwell and Rupert Data

Cornwell and Rupert Returns to Schooling Data, 595 Individuals, 7 Years

Variables in the file are

EXP

WKS

OCC

IND

SOUTH

SMSA

MS

FEM

UNION

ED

LWAGE

=

=

=

=

=

=

=

=

=

=

=

work experience

weeks worked

occupation, 1 if blue collar,

1 if manufacturing industry

1 if resides in south

1 if resides in a city (SMSA)

1 if married

1 if female

1 if wage set by union contract

years of education

log of wage = dependent variable in regressions

These data were analyzed in Cornwell, C. and Rupert, P., "Efficient Estimation with Panel

Data: An Empirical Comparison of Instrumental Variable Estimators," Journal of Applied

Econometrics, 3, 1988, pp. 149-155. See Baltagi, page 122 for further analysis. The data

were downloaded from the website for Baltagi's text.

[Part 3: Common Effects ] 25/57

Application: Cornell and Rupert

[Part 3: Common Effects ] 26/57

Bootstrapping

Some assumptions that underlie it - the sampling mechanism

Method:

1. Estimate using full sample: --> b

2. Repeat R times:

Draw n observations from the n, with replacement

Estimate with b(r).

3. Estimate variance with

V = (1/R)r [b(r) - b][b(r) - b]’

[Part 3: Common Effects ] 27/57

Bootstrap Application

matr;bboot=init(7,21,0.)$

Store results here

name;x=one,occ,…,exp$

Define X

regr;lhs=lwage;rhs=x$

Compute b

calc;i=0$

Counter

Proc

Define procedure

regr;lhs=lwage;rhs=x;quietly$

… Regression

matr;{i=i+1};bboot(*,i)=b$...

Store b(r)

Endproc

Ends procedure

exec;n=20;bootstrap=b$

20 bootstrap reps

matr;list;bboot' $

Display results

[Part 3: Common Effects ] 28/57

Results of Bootstrap Procedure

[Part 3: Common Effects ] 29/57

Bootstrap Replications

Full sample result

Bootstrapped

sample results

[Part 3: Common Effects ] 30/57

Bootstrap variance for a

panel data estimator

Panel Bootstrap =

Block Bootstrap

Data set is N groups

of size Ti

Bootstrap sample is N

groups of size Ti

drawn with

replacement.

[Part 3: Common Effects ] 31/57

[Part 3: Common Effects ] 32/57

Bootstrapping

Naïve bootstrap: Why is it naïve?

Cases when it fails

Time series

“Clustered data”

Order statistics

Parameters on the edge of the parameter space

Alternatives

Block bootstrap

“Wild” bootstrap (injects extra randomness)

[Part 3: Common Effects ] 33/57

Using First Differences

yit =xitβ+ci +εit , observation for person i at time t

Eliminating the heterogeneity

y it = y it -y i,t-1 = (x it )β+c i + εit

= (x it )β + uit

Note: Time invariant variables become zero

Time trend becomes the constant term

Time dummy variables become (0,...,1,-1,0,0...)

[Part 3: Common Effects ] 34/57

OLS with First Differences

With strict exogeneity of (Xi,ci), OLS regression of Δyit

on Δxit is unbiased and consistent but inefficient.

i,2 i,1 22

2

i,3 i,2

Var

0

i,T i,T 1 0

i

i

2

22

2

0

2

2

0

(Toeplitz form)

2

22

GLS is unpleasantly complicated. In order to

compute a first step estimator of σε2 we would use

fixed effects. We should just stop there. Or, use OLS

in first differences and use Newey-West with one lag.

[Part 3: Common Effects ] 35/57

Two Periods

With two periods and strict exogeneity,

y it = y i2 -y i,1 = 0 + (x i2 -xi1 )β + ui

Consider a "treatment, Di ," that takes place between

time 1 and time 2 for some of the individuals

y i = 0 + (x i )β + 1Di + ui

Di = the "treatment dummy"

This is a classical regression model. If there are no regressors,

ˆ

1 y | treatment - y | control

= "difference in differences" estimator.

ˆ

0 Average change in y i for the "treated"

[Part 3: Common Effects ] 36/57

Difference-in-Differences Model

With two periods and strict exogeneity of D and T,

y it = 0 1Dit 2 Tt 3 TtDit it

Dit = dummy variable for a treatment that takes place

between time 1 and time 2 for some of the individuals,

Tt = a time period dummy variable, 0 in period 1,

1 in period 2.

This is a linear regression model. If there are no regressors,

Using least squares,

b3 (y 2 y1 )D1 (y 2 y1 )D0

[Part 3: Common Effects ] 37/57

Difference in Differences

y it = 0 1Dit 2 Tt 3Dit Tt βx it it , t 1, 2

y it = 2 3Di 2 (βx it ) it

= 2 3Di 2 β(x it ) ui

y it | D 1 y it | D 0

3 β (x it | D 1) (x it | D 0)

If the same individual is observed in both states,

the second term is zero. If the effect is estimated by

averaging individuals with D = 1 and different individuals

with D=0, then part of the 'effect' is explained by change

in the covariates, not the treatment.

[Part 3: Common Effects ] 38/57

http://dera.ioe.ac.uk/14610/1/oft1416.pdf

[Part 3: Common Effects ] 39/57

Outcome is the fees charged.

Activity is collusion on fees.

[Part 3: Common Effects ] 40/57

Treatment Schools:

Treatment is an

intervention by the

Office of Fair Trading

Control Schools were

not involved in the

conspiracy

Treatment is not

voluntary

[Part 3: Common Effects ] 41/57

[Part 3: Common Effects ] 42/57

[Part 3: Common Effects ] 43/57

Treatment (Intervention)

Effect = 1 +

2 if SS school

[Part 3: Common Effects ] 44/57

In order to test robustness two versions of the fixed effects model were run. The first is

Ordinary Least Squares, and the second is heteroscedasticity and auto-correlation robust

(HAC) standard errors in order to check for heteroscedasticity and autocorrelation.

[Part 3: Common Effects ] 45/57

[Part 3: Common Effects ] 46/57

[Part 3: Common Effects ] 47/57

[Part 3: Common Effects ] 48/57

D-in-D Model: Natural Experiment

With two periods and strict exogeneity,

y it = 0 1Di 2 2 Tt 3 Tt Dit it

Di2 = dummy variable for a treatment that takes place

between time 1 and time 2 for some of the individuals,

Tt = a time period dummy variable, 0 in period 1,

1 in period 2.

This is a classical regression model. If there are no regressors,

Using least squares,

b3 (y 2 y1 )D1 (y 2 y1 )D0

[Part 3: Common Effects ] 49/57

D-i-D

Card and Krueger: “Minimum Wages and Employment: A Case

Study of the Fast Food Industry in New Jersey and Pennsylvania,”

AER, 84(4), 1994, 772-793.

Pennsylvania vs. New Jersey

1991, NJ raises minimum wage

Compare change in employment PA after the change to change in

employment in NJ after the change.

Differences cancel out other things specific to the state that would

explain change in employment.

[Part 3: Common Effects ] 50/57

A Tale of Two Cities

A sharp change in policy can constitute a natural

experiment

The Mariel boatlift from Cuba to Miami (MaySeptember, 1980) increased the Miami labor force by

7%. Did it reduce wages or employment of nonimmigrants?

Compare Miami to Los Angeles, a comparable

(assumed) city.

Card, David, “The Impact of the Mariel Boatlift on the

Miami Labor Market,” Industrial and Labor Relations

Review, 43, 1990, pp. 245-257.

[Part 3: Common Effects ] 51/57

Difference in Differences

i individual, T = 0 for no immigration, T=1 for immigration

(Yi | T) Yi,T 1 if unemployed, 0 if employed.

c = city, t = period.

Unemployment rate in city c at time t is E[Yi,0 | c,t] with no migration

Unemployment rate in city c at time t is E[Yi,1 | c,t] with migration

Assume E[Yi,0 | c,t] t c

E[Yi,1 | c,t] t c

E[Yi,0 | c,t]

the effect of the immigration on the unemployment rate.

[Part 3: Common Effects ] 52/57

Applying the Model

c = M for Miami, L for Los Angeles

Immigration occurs in Miami, not Los Angeles

T = 1979, 1981 (pre- and post-)

Sample moment equations: E[Yi|c,t,T]

E[Yi|M,79] = β79 + γM

E[Yi|M,81] = β81 + γM + δ

E[Yi|L,79] = β79 + γL

E[Yi|M,79] = β81 + γL

It is assumed that unemployment growth in the two

cities would be the same if there were no immigration.

[Part 3: Common Effects ] 53/57

Implications for Differences

Neither city exposed to migration

Both cities exposed to migration

E[Yi,0|M,81] - E[Yi,0|M,79] = [β81 + γM ] – [β79 + γM] ( Miami)

E[Yi,0|L,81] - E[Yi,0|L,79] = [β81 + γL ] – [β79 + γL] (LA)

E[Yi,1|M,81] - E[Yi,1|M,79] = [β81 + γM ] – [β79 + γM] + δ (Miami)

E[Yi,1|L,81] - E[Yi,1|L,79] = [β81 + γL ] – [β79 + γL] + δ (LA)

One city (Miami) exposed to migration: The difference

in differences is.

Miami change - Los Angeles change

{E[Yi,1|M,81] - E[Yi,1|M,79]} – {E[Yi,0|L,81] - E[Yi,0|L,79]}

= δ (Miami)

[Part 3: Common Effects ] 54/57

The Tale

1979

1980

1981

1982

1983

1984

1985

In 79, Miami unemployment is 2.0% lower

In 80, Miami unemployment is 7.1% lower

From 79 to 80, Miami gets

5.1% better

In 81, Miami unemployment is 3.0% lower

In 82, Miami unemployment is 3.3% higher

From 81 to 82, Miami gets

6.3% worse

[Part 3: Common Effects ] 55/57

Application of a Two Period Model

“Hemoglobin and Quality of Life in Cancer

Patients with Anemia,”

Finkelstein (MIT), Berndt (MIT), Greene (NYU),

Cremieux (Univ. of Quebec)

1998

With Ortho Biotech – seeking to change labeling

of already approved drug ‘erythropoetin.’

r-HuEPO

[Part 3: Common Effects ] 56/57

[Part 3: Common Effects ] 57/57

QOL Study

Quality of life study

yit = self administered quality of life survey, scale = 0,…,100

xit = hemoglobin level, other covariates

Treatment effects model (hemoglobin level)

Background – r-HuEPO treatment to affect Hg level

Important statistical issues

i = 1,… 1200+ clinically anemic cancer patients undergoing

chemotherapy, treated with transfusions and/or r-HuEPO

t = 0 at baseline, 1 at exit. (interperiod survey by some patients was

not used)

Unobservable individual effects

The placebo effect

Attrition – sample selection

FDA mistrust of “community based” – not clinical trial based statistical

evidence

Objective – when to administer treatment for maximum marginal

benefit

[Part 3: Common Effects ] 58/57

Regression-Treatment Effects Model

QOL it t + "other covariates"

+ 7Hbit7 + 8Hbit8 + 9Hbit9 + ... 15Hb15

it

+ c i + εit

Hbit hemoglobin level, grams/deciliter, range 3+ to 15

Hbit7 1(3 Hbit < 7.5) (Base case; 7 = 0)

Hbit8 1(7.5 Hbit < 8.5)

Hb15

it 1(14.5 Hbit 15)

[Part 3: Common Effects ] 59/57

Effects and Covariates

Individual effects that would impact a self reported

QOL: Depression, comorbidity factors (smoking), recent

financial setback, recent loss of spouse, etc.

Covariates

Change in tumor status

Measured progressivity of disease

Change in number of transfusions

Presence of pain and nausea

Change in number of chemotherapy cycles

Change in radiotherapy types

Elapsed days since chemotherapy treatment

Amount of time between baseline and exit

[Part 3: Common Effects ] 60/57

First Differences Model

QOL i QOL i1 QOL i0

j

j

K

= (1 0 ) 15

(Hb

Hb

)

j 8 j

i1

i0

k 1k (x ik ,1 x ik ,0 ) i1 i0

Regression to the mean (the "tendency to mediocrity")

i0 i1 ui (QOL i0 QOL 0 ) Expect 0 < 1

implies

= 1 0 QOL 0

QOL i QOL i1 QOL i0

j

j

K

= 15

(Hb

Hb

)

j 8 j

i1

i0

k 1k (x ik ,1 x ik ,0 ) QOL i0 + ui

[Part 3: Common Effects ] 61/57

Optimal treatment.

Conventional wisdom

and assumption of

policy.

Study finding

Note the implication of

the study for the

location of the optimal

point for the treatment.

Largest marginal benefit

moves from the left tail

to the center.

Finding