Finance

advertisement

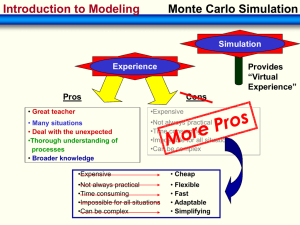

Monte Carlo Simulation and Personal Finance Jacob Foley Background on myself I work at Stephens Financial Partners as a Financial Advisor Monte Carlo simulations are the most popular simulations used by advisors These simulations failed after the 2008 market collapse Where did it come from? John von Neumann and Stanislaw Ulam Los Alamos Scientific Laboratory Studying radiation shielding Why call it Monte Carlo? Neuman and Ulam’s work had to be kept a secret because it was part of the Manhattan Project Von Neuman chose the name "Monte Carlo". What is it? Class of computational algorithms Used to solve large systems Used when it is unfeasible or impossible to compute an exact result Basic Principle of the Monte Carlo Method. The Task: Calculate a number I (one number only. Not an entire functional dependence) Example: Calculate pi Numerically: look for an appropriate convergent series and evaluate this approximately Monte Carlo: look for a stochastic model: probability space with random variable What makes a method a Monte Carlo Method? Define a domain of possible inputs. Generate inputs randomly from the domain using a certain specified probability distribution. Perform a deterministic computation using the inputs. Aggregate the results of the individual computations into the final result Random Numbers Uniform Distribution The random variable X is uniformly distributed on the interval [a, b] How many of you have played battleship? Dull Monte Carlo “hit or miss” Take a sample point The point has two outcomes True (“hit”) False (“miss”) Total number of hits and divide it by the total trials Hit or Miss f(x) x2 uniform I: unknown area known area miss hit I = ∫ f(x) dx X x1, uniform Crude Monte Carlo Write the integral such that I becomes the mean value of a random variable. Purposes we generate B numbers Uniformly distributed from (0,1) Then take their average Take Numerical Analysis Professor Robert Lewis Math 413 and 414 Applications in the Real World Physical sciences Design and visuals Telecommunications Games Finance and business Monte Carlo in Finance First Introduced in 1964 “Risk Analysis in Capital Investment” David B Hertz Harvard Business Review Article So how does Monte Carlo apply to Finance? Used to value and analyze Instruments Options Portfolios Investments How does it predict values? For each Simulation The behavior of the factors impacting the component instrument is simulated over time The values of the instrument are calculated The value is then observed The various values are then combined in a histogram (i.e. the probability distribution) The statistical characteristics are then observed How is it used in financial planning? Simulates the overall market Predicts the probability of reaching a target number Changes are made to reach the target number An Example http://www.flexibleretirementplanner.com / What works with Monte Carlo? Forecasting Earnings Modeling portfolio losses Provides flexibility What is wrong with Monte Carlo? Assumes normal return distributions We know from history that extreme returns occur more frequently than expected Can’t predict every outcome Most clients see the simulation run through thousands of iterations and believe that they have seen all possible outcomes What is wrong with Monte Carlo? Does not measure bear markets well Does not include the human factor What is wrong with Monte Carlo? Does not recognize that portfolio performance depends at least as much on the sequence of the rate of return that it does on the average of those returns What can we do better? Let’s look at an example Assumptions 20 year period Individual that has just retired in 1988 Has $1,000,000 invested in DJIA Withdraws $50,000 each year that increases by 3% to compensate for inflation 1988 11.80% $1,118,000.00 $1,068,000.00 $50,000.00 1989 27.00% $1,356,360.00 $1,304,860.00 $51,500.00 1990 -4.30% $1,248,751.02 $1,195,706.02 $53,045.00 1991 20.30% $1,438,434.34 $1,383,797.99 $54,636.35 1992 4.20% $1,441,917.51 $1,385,642.07 $56,275.44 1993 13.70% $1,575,475.03 $1,517,511.33 $57,963.70 1994 2.10% $1,549,379.06 $1,489,676.45 $59,702.61 1995 33.50% $1,988,718.06 $1,927,224.37 $61,493.69 1996 26.00% $2,428,302.70 $2,364,964.20 $63,338.50 1997 22.60% $2,899,446.11 $2,834,207.45 $65,238.66 1998 16.10% $3,290,514.85 $3,223,319.03 $67,195.82 1999 25.20% $4,035,595.42 $3,966,383.73 $69,211.69 2000 -6.20% $3,720,467.94 $3,649,179.89 $71,288.04 2001 -7.10% $3,390,088.12 $3,316,661.44 $73,426.69 2002 -16.80% $2,759,462.31 $2,683,832.83 $75,629.49 2003 25.30% $3,362,842.53 $3,284,944.16 $77,898.37 2004 3.10% $3,386,777.43 $3,306,542.11 $80,235.32 2005 -0.60% $3,286,702.86 $3,204,060.48 $82,642.38 2006 16.30% $3,726,322.33 $3,641,200.68 $85,121.65 2007 6.80% $3,888,802.33 $3,801,127.02 $87,675.30 2008 -49.80% $1,908,165.77 $1,817,860.20 $90,305.56 1988 -49.80% $502,000.00 $452,000.00 $50,000.00 1989 6.80% $482,736.00 $431,236.00 $51,500.00 1990 16.30% $501,527.47 $448,482.47 $53,045.00 1991 -0.60% $445,791.57 $391,155.22 $54,636.35 1992 3.10% $403,281.04 $347,005.59 $56,275.44 1993 25.30% $434,798.01 $376,834.31 $57,963.70 1994 -16.80% $313,526.14 $253,823.53 $59,702.61 1995 -7.10% $235,802.06 $174,308.36 $61,493.69 1996 -6.20% $163,501.25 $100,162.74 $63,338.50 1997 25.20% $125,403.75 $60,165.09 $65,238.66 1998 16.10% $69,851.67 $2,655.85 $67,195.82 1999 22.60% $3,256.08 $65,955.62 $69,211.69 2000 26.00% $83,104.08 $154,392.12 $71,288.04 2001 33.50% $206,113.48 $279,540.17 $73,426.69 2002 2.10% $285,410.51 $361,040.00 $75,629.49 2003 13.70% $410,502.48 $488,400.85 $77,898.37 2004 4.20% $508,913.68 $589,149.00 $80,235.32 2005 20.30% $708,746.25 $791,388.63 $82,642.38 2006 -4.30% $757,358.92 $842,480.58 $85,121.65 2007 27.00% $1,069,950.33 $1,157,625.63 $87,675.30 2008 11.80% $1,294,225.46 $1,384,531.02 $90,305.56 1988 11.80% $1,118,000.00 $1,068,000.00 $50,000.00 1989 27.00% $1,356,360.00 $1,304,860.00 $51,500.00 1990 -4.30% $1,248,751.02 $1,195,706.02 $53,045.00 1991 20.30% $1,438,434.34 $1,438,434.34 $0.00 1992 4.20% $1,498,848.58 $1,423,219.09 $75,629.49 1993 13.70% $1,618,200.11 $1,540,301.74 $77,898.37 1994 2.10% $1,572,648.07 $1,492,412.75 $80,235.33 1995 33.50% $1,992,371.02 $1,909,728.63 $82,642.39 1996 26.00% $2,406,258.07 $2,321,136.42 $85,121.66 1997 22.60% $2,845,713.25 $2,758,037.94 $87,675.31 1998 16.10% $3,202,082.05 $3,111,776.48 $90,305.57 1999 25.20% $3,895,944.16 $3,802,929.42 $93,014.73 2000 -6.20% $3,567,147.80 $3,471,342.62 $95,805.18 2001 -7.10% $3,224,877.30 $3,224,877.30 $0.00 2002 -16.80% $2,683,097.91 $2,683,097.91 $0.00 2003 25.30% $3,361,921.68 $3,361,921.68 $0.00 2004 3.10% $3,466,141.25 $3,358,311.65 $107,829.60 2005 -0.60% $3,338,161.78 $3,227,097.30 $111,064.49 2006 16.30% $3,753,114.16 $3,753,114.16 $0.00 2007 6.80% $4,008,325.92 $3,890,497.62 $117,828.30 2008 -49.80% $1,953,029.80 $1,831,666.66 $121,363.15 1988 -49.80% $502,000.00 $452,000.00 $50,000.00 1989 6.80% $482,736.00 $482,736.00 $0.00 1990 16.30% $561,421.97 $508,376.97 $53,045.00 1991 -0.60% $505,326.71 $450,690.36 $54,636.35 1992 3.10% $464,661.76 $464,661.76 $0.00 1993 25.30% $582,221.18 $524,257.48 $57,963.70 1994 -16.80% $436,182.22 $376,479.61 $59,702.61 1995 -7.10% $349,749.56 $349,749.56 $0.00 1996 -6.20% $328,065.08 $328,065.08 $0.00 1997 25.20% $410,737.48 $410,737.48 $0.00 1998 16.10% $476,866.22 $386,851.49 $90,014.73 1999 22.60% $474,279.93 $381,564.75 $92,715.17 2000 26.00% $480,771.59 $385,274.96 $95,496.63 2001 33.50% $514,342.08 $415,980.55 $98,361.53 2002 2.10% $424,716.14 $349,086.65 $75,629.49 2003 13.70% $396,911.52 $319,013.15 $77,898.37 2004 4.20% $332,411.70 $252,176.37 $80,235.33 2005 20.30% $303,368.18 $220,725.79 $82,642.39 2006 -4.30% $211,234.58 $126,112.93 $85,121.66 2007 27.00% $160,163.42 $160,163.42 $0.00 2008 11.80% $179,062.70 $57,699.55 $121,363.15 Have multiple buckets of money Don’t just have your money in the stock market Have money growing outside of the stock market Homework Estimate Pi using Monte Carlo Thank You! Any Questions?