Class 14. Nonlinear Models and Nonlinear Optimization

advertisement

Part 14: Nonlinear Models [ 1/84]

Econometric Analysis of Panel Data

William Greene

Department of Economics

Stern School of Business

Part 14: Nonlinear Models [ 2/84]

Nonlinear Models

Nonlinear Models

Estimation Theory for Nonlinear Models

Estimators

Properties

M Estimation

GMM Estimation

Minimum Distance Estimation

Minimum Chi-square Estimation

Computation – Nonlinear Optimization

Nonlinear Least Squares

Maximum Likelihood Estimation

Nonlinear Least Squares

Newton-like Algorithms; Gradient Methods

(Background: JW, Chapters 12-14, Greene, Chapters 12-14)

Part 14: Nonlinear Models [ 3/84]

What is a ‘Model?’

Unconditional ‘characteristics’ of a population

Conditional moments: E[g(y)|x]: median, mean,

variance, quantile, correlations, probabilities…

Conditional probabilities and densities

Conditional means and regressions

Fully parametric and semiparametric specifications

Parametric specification: Known up to parameter θ

Parameter spaces

Conditional means: E[y|x] = m(x, θ)

Part 14: Nonlinear Models [ 4/84]

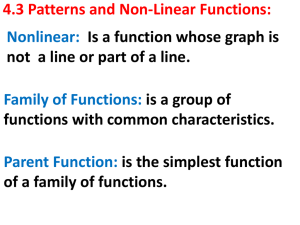

What is a Nonlinear Model?

Model: E[g(y)|x] = m(x,θ)

Objective:

Learn about θ from y, X

Usually “estimate” θ

Linear Model: Closed form; θˆ = h(y, X)

Nonlinear Model

Not wrt m(x,θ). E.g., y=exp(θ’x + ε)

ˆ )=0,

Wrt estimator: Implicitly defined. h(y, X, θ

E.g., E[y|x]= exp(θ’x)

Part 14: Nonlinear Models [ 5/84]

What is an Estimator?

Point and Interval

ˆ

f(data | mod el)

I(ˆ

) ˆ

sampling variability

Classical and Bayesian

ˆ

E[ | data,prior f()] expectation from posterior

I(ˆ

) narrowest interval from posterior density

containing the specified probability (mass)

Part 14: Nonlinear Models [ 6/84]

Parameters

Model parameters

The parameter space

The true parameter(s)

exp( y i / i )

Example : f(y i | x i )

, i exp(βx i )

i

Model parameters : β

Conditional Mean: E(y i | x i ) i exp(βx i )

Part 14: Nonlinear Models [ 7/84]

The Conditional Mean Function

m( x , 0 ) E[y | x] for some 0 in .

A property of the conditional mean:

E y,x (y m( x , ))2 is minimized by E[y | x]

(Proof, pp. 343-344, JW)

Part 14: Nonlinear Models [ 8/84]

M Estimation

Classical estimation method

1 n

ˆ

arg min i=1 q(datai ,)

n

Example : Nonlinear Least squares

1 n

ˆ

arg min i=1 [y i -E(y i | x i , )]2

n

Part 14: Nonlinear Models [ 9/84]

An Analogy Principle for M Estimation

1 n

ˆ

The estimator minimizes q= i1 q(datai , )

n

The true parameter 0 minimizes q*=E[q(data, )]

The weak law of large numbers:

1 n

P

q= i1 q(datai , )

q*=E[q(data, )]

n

Part 14: Nonlinear Models [ 10/84]

Estimation

1 n

P

q= i1 q(datai , )

q*=E[q(data, )]

n

Estimator ˆ

minimizes q

True parameter 0 minimizes q*

P

q q*

P

Does this imply ˆ

0 ?

Yes, if ...

Part 14: Nonlinear Models [ 11/84]

Identification

Uniqueness :

If 1 0 , then m(x ,1 ) m( x , 0 ) for some x

Examples when this does not occur

(1) Multicollinearity generally

(2) Need for normalization E[y|x] = m(x /)

(3) Indeterminacy m(x ,)=1 2 x 3 x 4 when 3 = 0

Part 14: Nonlinear Models [ 12/84]

Continuity

q(datai , ) is

(a) Continuous in for all datai and all

(b) Continuously differentiable. First derivatives

are also continuous

(c) Twice differentiable. Second derivatives

must be nonzero, though they need not

be continuous functions of . (E.g. Linear LS)

Part 14: Nonlinear Models [ 13/84]

Consistency

1 n

P

q= i1 q(datai , )

q*=E[q(data, )]

n

Estimator ˆ

minimizes q

True parameter 0 minimizes q*

P

q

q*

P

Does this imply ˆ

0 ?

Yes. Consistency follows from identification

and continuity with the other assumptions

Part 14: Nonlinear Models [ 14/84]

Asymptotic Normality of M

Estimators

First order conditions:

(1/n)Ni=1q(datai , ˆ

)

0

ˆ

)

1 N q(datai , ˆ

i=1

n

ˆ

1

Ni=1g(datai , ˆ

) g(data, ˆ

)

n

For any ˆ

, this is the mean of a random

sample. We apply Lindberg-Feller CLT to assert

the limiting normal distribution of n g(data, ˆ

).

Part 14: Nonlinear Models [ 15/84]

Asymptotic Normality

A Taylor series expansion of the derivative

= some point between ˆ

and 0

g(data, ˆ

) g(data, 0 ) H()(ˆ

0 ) 0

1 n 2 q(datai , )

H() i1

n

Then, (ˆ

0 ) [H()]1 g(data, 0 ) and

n (ˆ

0 ) [H()]1

n g(data, 0 )

Part 14: Nonlinear Models [ 16/84]

Asymptotic Normality

n (ˆ

0 ) [H()]1

n g(data, 0 )

[H()]1 converges to its expectation (a matrix)

n g(data, 0 ) converges to a normally distributed

vector (Lindberg-Feller)

Implies limiting normal distribution of

n (ˆ

0 ).

Limiting mean is 0.

Limiting variance to be obtained.

Asymptotic distribution obtained by the usual means.

Part 14: Nonlinear Models [ 17/84]

Asymptotic Variance

a

ˆ

0 [H()]1 g(data, 0 )

Asymptotically normal

Mean 0

Asy.Var[ˆ

] [H(0 )]1 Var[g(data, 0 )] [H(0 )]1

(A sandwich estimator, as usual)

What is Var[g(data, 0 )]?

1

E[g(datai , 0 )g(datai , 0 ) ']

n

Not known what it is, but it is easy to estimate.

1 1 n

i1g(datai , ˆ

)g(datai , ˆ

) '

n n

Part 14: Nonlinear Models [ 18/84]

Estimating the Variance

Asy.Var[ˆ

] [H(0 )]1 Var[g(data, 0 )] [H(0 )]1

1

Estimate [H(0 )]

1 n 2m(datai , ˆ

)

with i1

ˆ

ˆ

n

) m(datai , ˆ

)

1 1 n m(datai , ˆ

Estimate Var[g(data, 0 )] with

ˆ

n n i1

ˆ

E.g., if this is linear least squares, (1/2)ni=1 (y i -x i)2

m(datai , ˆ

) (1 / 2)(y i x ib)2

1 n 2m(datai , ˆ

)

1

i1

( X X / n)

ˆ ˆ

n

) m(datai , ˆ

)

1 1 n m(datai , ˆ

2

N

2

(1

/

n

)

e

x i x i

i

1

i

i1

ˆ

ˆ

nn

Part 14: Nonlinear Models [ 19/84]

Nonlinear Least Squares

Gauss-Marquardt Algorithm

qi the conditional mean function

= m(x i , )

m(xi , )

gi

xi0 'pseudo regressors '

x i0 is one row of pseudo-regressor matrix X 0

Algorithm - iteration

ˆ

(k+1) ˆ

(k) [X 0'X 0 ]1 X 0'e0

Part 14: Nonlinear Models [ 20/84]

Application - Income

German Health Care Usage Data, 7,293 Individuals, Varying Numbers of Periods

Variables in the file are

Data downloaded from Journal of Applied Econometrics Archive. This is an unbalanced

panel with 7,293 individuals. They can be used for regression, count models, binary

choice, ordered choice, and bivariate binary choice. This is a large data set. There are

altogether 27,326 observations. The number of observations ranges from 1 to

7. (Frequencies are: 1=1525, 2=2158, 3=825, 4=926, 5=1051, 6=1000, 7=987). Note,

the variable NUMOBS below tells how many observations there are for each

person. This variable is repeated in each row of the data for the person.

HHNINC = household nominal monthly net income in German marks / 10000.

(4 observations with income=0 were dropped)

HHKIDS = children under age 16 in the household = 1; otherwise = 0

EDUC = years of schooling

AGE = age in years

Part 14: Nonlinear Models [ 21/84]

Income Data

2. 74

2. 19

Densi t y

1. 64

1. 09

. 55

. 00

. 00

1. 00

2. 00

3. 00

4. 00

I NCO M E

Ker nel

densi t y est i m at e f or

I NCO M E

5. 00

Part 14: Nonlinear Models [ 22/84]

Exponential Model

f(Income | Age,Educ,Married)

HHNINCi

1

exp

i

i

i exp(a0 a1Educ a2Married a3 Age)

E[HHNINC | Age,Educ,Married] i

Starting values for the iterations:

E[y i | nothing else]=exp(a0 )

Start a0 = logHHNINC, a1 a2 a3 0

Part 14: Nonlinear Models [ 23/84]

Conventional Variance Estimator

2

ˆ

[yi m(xi , )]

0 0 1

(X X )

n #parameters

n

i1

Sometimes omitted.

Part 14: Nonlinear Models [ 24/84]

Variance Estimator

for the M Estimator

qi (1 / 2)[y i exp( x i)]2 (1 / 2)(y i i )2

gi eii x i

Hi y i i x i x i

Estimator is

[Ni=1Hi ]-1 [Ni=1 gi gi ][Ni=1Hi ]-1

= [Ni=1 y i i x i x i]-1 [Ni=1 ei2 i2 x i x i][Ni=1 y i i x i x i]-1

This is the White estimator. See JW, p. 359.

Part 14: Nonlinear Models [ 25/84]

Computing NLS

Reject;

Calc ;

Nlsq ;

;

;

;

Name ;

Create;

;

Matrix;

Matrix;

hhninc=0$

b0=log(xbr(hhninc))$

lhs = hhninc

fcn = exp(a0+a1*educ+a2*married+a3*age)

start = b0, 0, 0, 0

labels = a0,a1,a2,a3$

x = one,educ,married,age$

thetai = exp(x'b); ei = hhninc*thetai

gi=ei*thetai

; hi = hhninc*thetai$

varM = <x'[hi] x> * x'[gi^2]x * <x'[hi] x> $

stat(b,varm,x)$

Part 14: Nonlinear Models [ 26/84]

Iterations

' gradient ' e0X 0 (X 0 ' X 0 )-1X 0 ' e0

Part 14: Nonlinear Models [ 27/84]

NLS Estimates with Different

Variance Estimators

Part 14: Nonlinear Models [ 28/84]

Hypothesis Tests for M Estimation

Null hypothesis: c()=0 for some set of J functions

(1) continuous

c()

(2) differentiable;

R (), J K Jacobian

(3) functionally independent: Rank R() = J

ˆ =Est.Asy.Var[ˆ

Wald: given ˆ

, V

],

W=Wald distance

=[c(ˆ

)-c()]{R() V()R()'} -1[c(ˆ

)-c()]

chi-squared[J]

Part 14: Nonlinear Models [ 29/84]

Change in the Criterion Function

1 n

P

q= i1 q(datai , )

q*=E[q(data, )]

n

Estimator ˆ

minimizes q

Estimator ˆ

0 minimizes q subject to

restrictions c()=0

q

0

q.

D

2n(q0 q)

chi squared[J]

Part 14: Nonlinear Models [ 30/84]

Score Test

LM Statistic

Derivative of the objective function

(1 / n)ni=1q(datai , )

Score vector =

g(data, )

Without restrictions g(data, ˆ

) 0

With null hypothesis, c(ˆ

) imposed

g(data, ˆ

0 ) generally not equal to 0. Is it close?

(Within sampling variability?)

Wald distance = [g(data, ˆ

0 )]'{Var[g(data, ˆ

0 )]} 1 [g(data, ˆ

0 )]

D

LM

chi squared[J]

Part 14: Nonlinear Models [ 31/84]

Exponential Model

f(Income | Age,Educ,Married)

HHNINCi

1

exp

i

i

i exp(a0 a1Educ a2Married a3 Age)

Test H0: a1 a2 a3 0

Part 14: Nonlinear Models [ 32/84]

Wald Test

Matrix ; List ; R = [0,1,0,0 / 0,0,1,0 / 0,0,0,1]

; c = R*b ; Vc = R*Varb*r'

; Wald = c’ <VC> c $

Matrix R

has

.0000000D+00

.0000000D+00

.0000000D+00

Matrix C

has

.05472

.23756

.00081

Matrix VC

has

.1053686D-05

.4530603D-06

.3649631D-07

Matrix WALD

has

3627.17514

3 rows and 4 columns.

1.00000

.0000000D+00 .0000000D+00

.0000000D+00

1.00000

.0000000D+00

.0000000D+00 .0000000D+00

1.00000

3 rows and 1 columns.

3 rows and 3 columns.

.4530603D-06 .3649631D-07

.5859546D-04 -.3565863D-06

-.3565863D-06 .6940296D-07

1 rows and 1 columns.

Part 14: Nonlinear Models [ 33/84]

Change in Function

Calc ; b0 = log(xbr(hhninc)) $

Nlsq ; lhs

= hhninc ; labels = a0,a1,a2,a3

; start = b0,0,0,0

; fcn

= exp(a0+a1*educ+a2*married+a3*age)$

Calc ; qbar = sumsqdev/n $

Nlsq ; lhs

= hhninc ; labels = a0,a1,a2,a3

; start = b0,0,0,0 ; fix

= a1,a2,a3

; fcn

= exp(a0+a1*educ+a2*married+a3*age)$

Calc ; cm = 2*n*(Sumsqdev/n – qbar) $

(Sumsqdev = 763.767; Sumsqdev_0 = 854.682)

Part 14: Nonlinear Models [ 34/84]

Constrained Estimation

Part 14: Nonlinear Models [ 35/84]

LM Test

2

Function : qi (1 / 2)[y i exp(a0 a1Educ...)]

Derivative : gi eii x i

LM statistic

1

n

LM=( gi )[ gigi ] (i1gi )

n

i1

n

i1

All evaluated at ˆ

a0 log(y), 0, 0, 0

Part 14: Nonlinear Models [ 36/84]

LM Test

Name

Create

Create

Create

Matrix

;

;

;

;

;

;

Matrix LM

x = one,educ,married,age$

thetai = exp(x'b)

ei = hhninc - thetai$

gi = ei*thetai $

list

LM = x’gi * <x'[gi2]x> * gi’x

has

1 rows and

1

+-------------1| 1915.03286

$

1 columns.

Part 14: Nonlinear Models [ 37/84]

Maximum Likelihood Estimation

Fully parametric estimation

Density of yi is fully specified

The likelihood function = the joint density of

the observed random variable.

Example: density for the exponential model

yi

1

f(y i | x i ) exp , i exp( xiβ)

i

i

E[y i | x i ]=i , Var[y i | x i ]=i2

NLS (M) estimator examined earlier

operated only on E[y i | x i ]=i.

Part 14: Nonlinear Models [ 38/84]

The Likelihood Function

yi

1

f(y i | x i ) exp , i exp( x iβ)

i

i

Likelihood f(y1 ,..., y n | x1 ,..., x n )

by independence,

yi

1

L(β|data)= i=1 exp , i exp( x iβ)

i

i

ˆ , maximizes the likelihood function

The MLE ,β

n

MLE

Part 14: Nonlinear Models [ 39/84]

Log Likelihood Function

yi

1

f(y i | x i ) exp , i exp( x iβ)

i

i

yi

n 1

L(β|data)= i=1 exp , i exp( x iβ)

i

i

ˆ , maximizes the likelihood function

The MLE ,β

MLE

logL(β|data) is a monotonic function. Therefore

ˆ , maximizes the log likelihood function

The MLE ,β

MLE

yi

logL(β|data)= i=1 -logi

i

n

Part 14: Nonlinear Models [ 40/84]

Conditional and Unconditional

Likelihood

Unconditional joint density f(y i , x i | , )

our parameters of interest

= parameters of the marginal density of x i

Unconditional likelihood function

L(, |y,X )= i=1 f(y i , x i | , )

n

f(y i , x i | , ) f(y i |x i , , )g(x i | , )

L(, |y,X )= i=1 f(y i |x i , , )g(x i | , )

n

Assuming the parameter space partitions

logL(, |y,X )= i=1 logf(y i |x i , ) i=1 logg(x i | )

n

n

conditional log likelihood + marginal log likelihood

Part 14: Nonlinear Models [ 41/84]

Concentrated Log Likelihood

ˆ

MLE maximizes logL(|data)

Consider a partition, =(,) two parts.

logL

Maximum occurs where

0

Joint solution equates both derivatives to 0.

If logL/=0 admits an implicit solution for

ˆ), then write

in terms of ,=

ˆ MLE

ˆ (

logL c (,())=a function only of .

Concentrated log likelihood can be maximized

for , then the solution computed for .

ˆ) , so restrict

The solution must occur where

ˆ MLE

ˆ (

the search to this subspace of the parameter space.

Part 14: Nonlinear Models [ 42/84]

Concentrated Log Likelihood

Fixed effects exponential regression: it exp(i x it )

logL i1 t 1 ( log it y it / it )

n

T

i1 t 1 ( (i x it ) y it exp(i x it ))

n

T

T

logL

t 1 1 y it exp(i x it )(1)

i

T t 1 y it exp(i x it )

T

T exp(i ) t 1 y it exp( x it ) 0

T

tT1 y it / exp( x it )

Solve this for i log

i ()

T

T

c

t 1 y it / exp( x it )

Concentrated log likelihood has it

exp( x it )

T

Part 14: Nonlinear Models [ 43/84]

ML and M Estimation

logL() i1 log f(y i | x i , )

n

ˆ

MLE argmax i1 log f(y i | x i , )

n

1 n

argmin - i1 log f(y i | x i , )

n

The MLE is an M estimator. We can use all

of the previous results for M estimation.

Part 14: Nonlinear Models [ 44/84]

‘Regularity’ Conditions

Conditions for the MLE to be consistent, etc.

Augment the continuity and identification

conditions for M estimation

Regularity:

Three times continuous differentiability of the log

density

Finite third moments of log density

Conditions needed to obtain expected values of

derivatives of log density are met.

(See Greene (Chapter 14))

Part 14: Nonlinear Models [ 45/84]

Consistency and Asymptotic

Normality of the MLE

Conditions are identical to those for M estimation

Terms in proofs are log density and its derivatives

Nothing new is needed.

Law of large numbers

Lindberg-Feller central limit theorem applies to

derivatives of the log likelihood.

Part 14: Nonlinear Models [ 46/84]

Asymptotic Variance of the MLE

Based on results for M estimation

Asy.Var[ˆ

MLE ]

={-E[Hessian]}-1 {Var[first derivative]}{-E[Hessian]} -1

1

logL

logL logL

= -E

Var

-E

2

2

1

Part 14: Nonlinear Models [ 47/84]

The Information Matrix Equality

Fundamental Result for MLE

The variance of the first derivative equals the negative

of the expected second derivative.

2 logL

-E

The Information Matrix

Asy.Var[ˆ

MLE ]

logL

= -E

2

1

logL

= -E

2

logL logL

-E

-E

1

2

2

1

Part 14: Nonlinear Models [ 48/84]

Three Variance Estimators

Negative inverse of expected second derivatives

matrix. (Usually not known)

Negative inverse of actual second derivatives

matrix.

Inverse of variance of first derivatives

Part 14: Nonlinear Models [ 49/84]

Asymptotic Efficiency

M estimator based on the conditional mean is

semiparametric. Not necessarily efficient.

MLE is fully parametric. It is efficient among all

consistent and asymptotically normal estimators

when the density is as specified.

This is the Cramer-Rao bound.

Note the implied comparison to nonlinear least

squares for the exponential regression model.

Part 14: Nonlinear Models [ 50/84]

Invariance

Useful property of MLE

If =g() is a continuous function of ,

the MLE of is g(ˆ

MLE )

E.g., in the exponential FE model, the

MLE of i = exp(-i ) is exp(-

ˆ i,MLE )

Part 14: Nonlinear Models [ 51/84]

Application: Exponential

Regression – MLE and NLS

MLE assumes E[y|x] = exp(β′x) – Note sign reversal.

Part 14: Nonlinear Models [ 52/84]

Variance Estimators

LogL i1 log i y i / i , i exp( x iβ)

n

g

logL

n

n

i1 x i (y i / i )x i i1 [(y i / i ) 1]x i

Note, E[y i | x i ] i , so E[g]=0

2 logL

n

H=

i1 (y i / i )x i x i

E[H] i1 x i x i = -X'X (known for this particular model)

n

Part 14: Nonlinear Models [ 53/84]

Three Variance Estimators

Berndt-Hall-Hall-Hausman (BHHH)

1

i1 [(y i / ˆ

i ) 1] x i x i

Based on actual second derivatives

g g

i=1 i i

n

2

n

1

1

1

H (y / ˆ

)

x

x

i

i

i

i

i

i=1

i1

Based on expected second derivatives

n

n

E i=1 Hi

n

1

i1 x i x i

n

1

( X'X )1

Part 14: Nonlinear Models [ 54/84]

Variance Estimators

Loglinear ; Lhs=hhninc;Rhs=x ; Model = Exponential

create;thetai=exp(x'b);hi=hhninc*thetai;gi2=(hi-1)^2$

matr;he=<x'x>;ha=<x'[hi]x>;bhhh=<x'[gi2]x>$

matr;stat(b,ha);stat(b,he);stat(b,bhhh)$

Part 14: Nonlinear Models [ 55/84]

Hypothesis Tests

Trinity of tests for nested hypotheses

Wald

Likelihood ratio

Lagrange multiplier

All as defined for the M estimators

Part 14: Nonlinear Models [ 56/84]

Example Exponential vs. Gamma

exp(yi / i )yPi 1

Gamma Distribution: f(yi | xi , ,P)

Pi (P)

Exponential: P = 1

P>1

Part 14: Nonlinear Models [ 57/84]

Log Likelihood

logL ni1 P log i log (P) y i / i (P 1) log y i

(1) 0! 1

logL ni1 log i y i / i

(P 1) log y i (P 1) log i log (P)

ni1 log i y i / i (P 1) log(y i / i ) log (P)

Exponential logL + part due to P 1

Part 14: Nonlinear Models [ 58/84]

Estimated Gamma Model

Part 14: Nonlinear Models [ 59/84]

Testing P = 1

Wald: W = (5.10591-1)2/.042332

= 9408.5

Likelihood Ratio:

logL|(P=1)=1539.31

logL|P = 14240.74

LR = 2(14240.74 - 1539.31)=25402.86

Lagrange Multiplier…

Part 14: Nonlinear Models [ 60/84]

Derivatives for the LM Test

logL ni1 log i y i / i (P 1) log(y i / i ) log (P)

logL

ni1 (y i / i P) x i in1gx ,i x i

logL

ni1 log(y i / i ) (P) in1gP,i

P

(1)=-.5772156649

For the LM test, we compute these at the exponential

MLE and P = 1.

Part 14: Nonlinear Models [ 61/84]

Psi Function

Ps i (p ) = L o g De ri v a ti v e o f Ga m m a F u n c ti o n

5

0

P si Funct i on

-5

- 10

- 15

- 20

- 25

. 00

. 50

1. 00

1. 50

2. 00

PV

2. 50

3. 00

3. 50

Part 14: Nonlinear Models [ 62/84]

Score Test

Test the hypothesis that the derivative vector equals

zero when evaluated for the larger model with the

restricted coefficient vector.

1 n

Estimator of zero is g = i=1 g i

n

Statistic = chi squared = g[Var g]-1 g

1 1 n

Use i=1 g i gi (the n's will cancel).

n n

-1

n

n

n

chi squared = i=1 g i i=1 g i gi

g

i=1 i

Part 14: Nonlinear Models [ 63/84]

Calculated LM Statistic

Loglinear ; Lhs = hhninc ; Rhs = x ; Model = Exponential $

Create;thetai=exp(x’b) ; gi=(hhninc*thetai – 1) $

Create;gpi=log(hhninc*thetai)-psi(1)$

Create;g1i=gi;g2i=gi*educ;g3i=gi*married;g4i=gi*age;g5i=gpi$

Namelist;ggi=g1i,g2i,g3i,g4i,g5i$

Matrix;list ; lm = 1'ggi * <ggi'ggi> * ggi'1 $

Matrix LM

has 1 rows and

1

+-------------1| 23468.7

1 columns.

? Use built-in procedure.

? LM is computed with actual Hessian instead of BHHH

Loglinear ; Lhs = hhninc ; Rhs = x ; Model = Exponential $

logl;lhs=hhninc;rhs=x;model=gamma;start=b,1;maxit=0 $

| LM Stat. at start values

9604.33

|

Part 14: Nonlinear Models [ 64/84]

Clustered Data and Partial Likelihood

Panel Data: y it | x it , t 1,..., Ti

Some connection across observations within a group

Assume marginal density for y it | x it f(y it | x it , )

Joint density for individual i is

f(y i1 ,..., y i,Ti | X i ) t i 1 f(y it | x it , )

T

"Pseudo logLikelihood" i1 log t i 1 f(y it | x it , )

T

n

=

n

T

i1

t 1

log f(y it | x it , )

Just the pooled log likelihood, ignoring the panel

aspect of the data.

Not the correct log likelihood. Does maximizing wrt

work? Yes, if the marginal density is correctly specified.

Part 14: Nonlinear Models [ 65/84]

Inference with ‘Clustering’

(1) Estimator is consistent

(2) Asymptotic Covariance matrix needs adjustment

Asy.Var[]=[Hessian]-1 Var[gradient][Hessian]-1

H i1 t i 1 Hit

n

T

g i1 gi , where gi t i 1 git

n

T

Terms in gi are not independent, so estimation of the

variance cannot be done with

n

Ti

i1

t 1

git git

But, terms across i are independent, so we estimate

Var[g] with

]

Est.Var[ˆ

PMLE

n

i1

g '

Hˆ

t 1 git

Ti

n

i1

Ti

t 1

1

Ti

t 1

it

it

n

Ti

i1

t 1

ˆ it

g

t 1 gˆit ' i1 t 1 Hˆ it

Ti

(Stata inserts a term n/(n-1) before the middle term.)

n

Ti

1

Part 14: Nonlinear Models [ 66/84]

Cluster Estimation

Part 14: Nonlinear Models [ 67/84]

On Clustering

The theory is very loose.

That the marginals would be correctly specified

while there is ‘correlation’ across observations is

ambiguous

It seems to work pretty well in practice

(anyway)

BUT… It does not imply that one can safely

just pool the observations in a panel and ignore

unobserved common effects.

Part 14: Nonlinear Models [ 68/84]

‘Robust’ Estimation

If the model is misspecified in some way, then

the information matrix equality does not hold.

Assuming the estimator remains consistent, the

appropriate asymptotic covariance matrix would

be the ‘robust’ matrix, actually, the original one,

Asy.Var[ˆ

MLE ] [E[Hessian]]1 Var[gradient][E[Hessian]]1

(Software can be coerced into computing this by telling it

that clusters all have one observation in them.)

Part 14: Nonlinear Models [ 69/84]

Two Step Estimation and

Murphy/Topel

Likelihood function defined over two parameter vectors

logL= i=1 logf(y i | x i , zi , , )

n

(1) Maximize the whole thing. (FIML)

(2) Typical Situation: Two steps

y

1

exp i ,

i

i

i exp(0 1Educ 2Married 3 Age 4 Pr[IfKids])

E.g., f(HHNINC|educ,married,age,Ifkids)=

If[Kids | age,bluec] Logistic Regression

Pr[IfKids]=exp(0 1 Age 2Bluec) /[1 exp(0 1 Age 2Bluec)]

(3) Two step strategy: Fit the stage one model () by MLE

) and estimate .

first, insert the results in logL(, ˆ

Part 14: Nonlinear Models [ 70/84]

Two Step Estimation

(1) Does it work? Yes, with the usual identification conditions,

continuity, etc. The first step estimator is assumed to be consistent

and asymptotically normally distributed.

(2) The asymptotic covariance matrix at the second step that takes

ˆ

as if it were known it too small.

(3) Repair to the covariance matrix by the Murphy Topel Result

(the one published verbatim twice by JBES).

Part 14: Nonlinear Models [ 71/84]

Murphy-Topel - 1

logL1 () defines the first step estimator. Let

ˆ1 Estimated asymptotic covariance matrix for ˆ

V

gi,1

log fi,1 (..., )

n

ˆ1 might = [i=1

ˆ i,1g

ˆi,1 ]1 )

. (V

g

logL(, ˆ

) defines the second step estimator using

the estimated value of .

ˆ2 Estimated asymptotic covariance matrix for ˆ

V

|ˆ

gi,2

log fi,2 (..., , ˆ

)

ˆ2 is too small

V

n

ˆ2 might = [i=1

ˆ i,2 g

ˆi,2 ]1 )

. (V

g

Part 14: Nonlinear Models [ 72/84]

Murphy-Topel - 2

ˆ1 Estimated asymptotic covariance matrix for ˆ

V

n

ˆ1 might = [i=1

ˆi,1g

ˆi,1 ]1 )

gi,1 log fi,1 (..., ) / . ( V

g

ˆ2 Estimated asymptotic covariance matrix for ˆ

V

|ˆ

ˆ2 might = [ni=1g

ˆ i,2 g

ˆi,2 ]1 )

gi,2 log fi,2 (..., , ˆ

) / . ( V

ˆ

hi,2 log fi,2 (..., , ˆ

) /

C

ˆ (the off diagonal block in the Hessian)

ˆ i,2h

ni=1g

i,2

R

ˆ i,2 g

ˆ i,1 (cross products of derivatives for two logL's)

ni=1g

ˆ2 V

ˆ2 V

ˆ2 [CV

ˆ1C' - CV

ˆ1R' - RV

ˆ1C']V

ˆ2

M&T: Corrected V

Part 14: Nonlinear Models [ 73/84]

Application of M&T

Reject

;

Logit

;

Matrix

;

Names

;

Create

;

Loglinear;

Matrix

;

Names

;

Create

;

Create

;

Create

;

Matrix

;

Matrix

;

;

hhninc = 0 $

lhs=hhkids ; rhs=one,age,bluec ; prob=prifkids $

v1=varb$

z1=one,age,bluec$

gi1=hhkids-prifkids$

lhs=hhninc;rhs=one,educ,married,age,prifkids;model=e$

v2=varb$

z2=one,educ,married,age,prifkids$

gi2=hhninc*exp(z2'b)-1$

hi2=gi2*b(5)*prifkids*(1-prifkids)$

varc=gi1*gi2 ; varr=gi1*hi2$

c=z2'[varc]z1 ; r=z2'[varr]z1$

q=c*v1*c'-c*v1*r'-r*v1*c'

mt=v2+v2*q*v2;stat(b,mt)$

Part 14: Nonlinear Models [ 74/84]

M&T Application

+---------------------------------------------+

| Multinomial Logit Model

|

| Dependent variable

HHKIDS

|

+---------+--------------+----------------+--------+---------+----------+

|Variable | Coefficient | Standard Error |b/St.Er.|P[|Z|>z] | Mean of X|

+---------+--------------+----------------+--------+---------+----------+

Characteristics in numerator of Prob[Y = 1]

Constant

2.61232320

.05529365

47.245

.0000

AGE

-.07036132

.00125773

-55.943

.0000

43.5271942

BLUEC

-.02474434

.03052219

-.811

.4175

.24379621

+---------------------------------------------+

| Exponential (Loglinear) Regression Model

|

| Dependent variable

HHNINC

|

+---------+--------------+----------------+--------+---------+----------+

|Variable | Coefficient | Standard Error |b/St.Er.|P[|Z|>z] | Mean of X|

+---------+--------------+----------------+--------+---------+----------+

Parameters in conditional mean function

Constant

-3.79588863

.44440782

-8.541

.0000

EDUC

-.05580594

.00267736

-20.844

.0000

11.3201838

MARRIED

-.20232648

.01487166

-13.605

.0000

.75869263

AGE

.08112565

.00633014

12.816

.0000

43.5271942

PRIFKIDS

5.23741034

.41248916

12.697

.0000

.40271576

+---------+--------------+----------------+--------+---------+

B_1

-3.79588863

.44425516

-8.544

.0000

B_2

-.05580594

.00267540

-20.859

.0000

B_3

-.20232648

.01486667

-13.609

.0000

B_4

.08112565

.00632766

12.821

.0000

B_5

5.23741034

.41229755

12.703

.0000

Why so little change? N = 27,000+. No new variation.

Part 14: Nonlinear Models [ 75/84]

GMM Estimation

1

g(β)= Ni1mi (y i , x i , β)

N

1 1 N

Asy.Var[g(β)] estimated with W= i1mi (y i , x i , β)mi (y i , x i , β)

NN

The GMM estimator of β then minimizes

1 N

1 1 N

q i1mi (y i , x i , β) 'W i1mi (y i , x i , β) .

N

N

g(β)

-1

1

ˆ

Est.Asy.Var[β

]

[

G'W

G

]

,

G

=

GMM

β

Part 14: Nonlinear Models [ 76/84]

GMM Estimation-1

GMM is broader than M estimation and ML

estimation

Both M and ML are GMM estimators.

1 n log f(y i | x i , β)

g(β) i1

for MLE

n

β

E(y i | x i , β)

1 n

g(β) i1 ei

for NLSQ

n

β

Part 14: Nonlinear Models [ 77/84]

GMM Estimation - 2

Exactly identified GMM problems

1

When g(β) = Ni1mi (y i , x i , β) 0 is K equations in

N

K unknown parameters (the exactly identified case),

the weighting matrix in

1

1

q Ni1mi (y i , x i , β) 'W 1 Ni1mi (y i , x i , β)

N

N

is irrelevant to the solution, since we can set exactly

g(β) 0 so q = 0. And, the asymptotic covariance matrix

(estimator) is the product of 3 square matrices and becomes

[G'W -1G]1 G-1 WG'-1

Part 14: Nonlinear Models [ 78/84]

Optimization - Algorithms

Maximize or minimize (optimize) a function F()

Algorithm = rule for searching for the optimizer

Iterative algorithm: (k 1) (k ) Update (k )

Derivative (gradient) based algorithm

(k 1) (k ) Update(g(k ) )

Update is a function of the gradient.

Compare to 'derivative free' methods

(Discontinuous criterion functions)

Part 14: Nonlinear Models [ 79/84]

Optimization

Algorithms

Iteration (k+1) (k) Update(k )

General structure: (k+1) (k) (k ) W (k ) g(k )

g(k) derivative vector, points to a better

value than (k)

= direction vector

(k ) = 'step size'

W (k) = a weighting matrix

Algorithms are defined by the choices of (k) and W (k)

Part 14: Nonlinear Models [ 80/84]

Algorithms

Steepest Ascent:

(k)

-g(k)'g(k)

(k) (k) (k) , W (k) I

g 'H g

g(k) first derivative vector

H(k) second derivatives matrix

Newton's Method: (k) -1, W (k) [H(k) ]1

(Sometimes called Newton-Raphson.

Method of Scoring: (k) -1, W (k) [E[H(k) ]]1

(Scoring uses the expected Hessian. Usually inferior to

Newton's method. Takes more iterations.)

(k)

(k)

BHHH Method (for MLE): (k) -1, W (k) [in1gi gi ']1

Part 14: Nonlinear Models [ 81/84]

Line Search Methods

Squeezing: Essentially trial and error

(k) 1, 1/2, 1/4, 1/8, ...

Until the function improves

Golden Section: Interpolate between (k) and (k-1)

Others : Many different methods have been suggested

Part 14: Nonlinear Models [ 82/84]

Quasi-Newton Methods

How to construct the weighting matrix:

Variable metric methods:

W (k) W (k 1) E(k 1) , W (1) I

Rank one updates: W (k) W (k 1) a(k 1) a(k 1)'

(Davidon Fletcher Powell)

There are rank two updates (Broyden) and higher.

Part 14: Nonlinear Models [ 83/84]

Stopping Rule

When to stop iterating: 'Convergence'

(1) Derivatives are small? Not good.

Maximizer of F() is the same as that of .0000001F(),

but the derivatives are small right away.

(2) Small absolute change in parameters from one

iteration to the next? Problematic because it is a

function of the stepsize which may be small.

(3) Commonly accepted 'scale free' measure

= g(k)[H(k ) ]1 g(k )

Part 14: Nonlinear Models [ 84/84]

For Example

Nonlinear Estimation of Model Parameters

Method=BFGS ; Maximum iterations= 4

Convergence criteria:gtHg

.1000D-05 chg.F

.0000D+00 max|dB|

.0000D+00

Start values: -.10437D+01

.00000D+00

.00000D+00

.00000D+00

.10000D+01

1st derivs.

-.23934D+05 -.26990D+06 -.18037D+05 -.10419D+07

.44370D+05

Parameters:

-.10437D+01

.00000D+00

.00000D+00

.00000D+00

.10000D+01

Itr 1 F= .3190D+05 gtHg= .1078D+07 chg.F= .3190D+05 max|db|= .1042D+13

Try = 0 F= .3190D+05 Step= .0000D+00 Slope= -.1078D+07

Try = 1 F= .4118D+06 Step= .1000D+00 Slope= .2632D+08

Try = 2 F= .5425D+04 Step= .5214D-01 Slope= .8389D+06

Try = 3 F= .1683D+04 Step= .4039D-01 Slope= -.1039D+06

1st derivs.

-.45100D+04 -.45909D+05 -.18517D+04 -.95703D+05 -.53142D+04

Parameters:

-.10428D+01

.10116D-01

.67604D-03

.39052D-01

.99834D+00

Itr 2 F= .1683D+04 gtHg= .1064D+06 chg.F= .3022D+05 max|db|= .4538D+07

Try = 0 F= .1683D+04 Step= .0000D+00 Slope= -.1064D+06

Try = 1 F= .1006D+06 Step= .4039D-01 Slope= .7546D+07

Try = 2 F= .1839D+04 Step= .4702D-02 Slope= .1847D+06

Try = 3 F= .1582D+04 Step= .1855D-02 Slope= .7570D+02

...

1st derivs.

-.32179D-05 -.29845D-04 -.28288D-05 -.16951D-03

.73923D-06

Itr 20 F= .1424D+05 gt<H>g= .13893D-07 chg.F= .1155D-08 max|db|= .1706D-08

* Converged

Normal exit from iterations. Exit status=0.

Function= .31904974915D+05, at entry, -.14237328819D+05 at exit