The Implications of HO and IRS Theories for Bilateral Trade Flows

advertisement

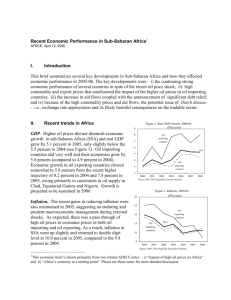

THE IMPLICATIONS OF HO AND IRS THEORIES FOR BILATERAL TRADE FLOWS WITHIN SUB-SAHARAN AFRICA Julie Lohi West Virginia University Julie.lohi@mail.wvu.edu MOTIVATION Why Bilateral trade Flows are Low within SubSaharan Africa (SSA)? LITERATURE Hanink and Owusu (1998) Used trade intensity index (TII) Find that ECOWAS has failed to promote trade Alemayehu and Haile (2008) Regional grouping has insignificant effects on bilateral trade flows in SSA. Reasons: poor private participation, compensation issue. Faezeh and Pritchett (2009) Trade flows are low within SSA Gravity prediction similar to actual trade Piet and Wheeler (2010) Transport infrastructure and border restrictions are main reasons for lower trade rate in SSA CONTRIBUTIONS Trade evaluation based on imperfect specialization in production Show that comparative advantages matter in stimulating trade SSA countries exhibit similar endowments Products are not differentiated in the region 4E+10 Trade in Differentiated Good Vs. Homogeneous Goods in SSA 3.5E+10 Trade Value 3E+10 2.5E+10 Differentiated goods 2E+10 Homogeneous goods Linear (Differentiated goods) 1.5E+10 Linear (Homogeneous goods) 1E+10 5E+09 0 1996 1998 2000 2002 2004 2006 2008 Year UNDERLYING TRADE THEORIES Heckscher-Ohlin Theory: Heckscher (1919) and Ohlin (1933) Predicts high trade for large differences in factor endowment ratios. Increasing return to scale theory: Krugman (1979, 1980) Predicts intensive trade between industries producing different varieties of a product. The love of varieties creates demand across countries. METHODOLOGIES A- Build on Evenett and Keller (2002) to estimate the gravity equation for 118 countries grouped into 5 regions (1), (2), (3), (4) Where 𝑀𝑖𝑗 ,𝑌 𝑖 , 𝑌𝑗 , 𝑌 𝑤 , 𝑎𝑛𝑑 𝑌 𝑟 are respectively imports of country i from country j, GDP of country i, j, world and region; 𝐼𝑚𝑝𝑖 is importing country’s specifics; 𝐶𝐿𝑖𝑗 , 𝑐𝑜𝑙𝑖 , 𝑐𝑜𝑛𝑡𝑖𝑔𝑖𝑗 , 𝑎𝑛𝑑 𝐿𝐿𝑖 represent respective dummies for common language, colony, contiguity, and landlocked; 𝐷 𝑖𝑗 is the log of distance between country i and j. METHODOLOGIES B- Compute the Grubel Lloyd index as: 𝑖𝑗 𝐺𝐿𝑔 = 1 − [ 𝑔 𝑖𝑗 𝑗𝑖 𝑀𝑔 − 𝑀𝑔 𝑔 𝑖𝑗 𝑗𝑖 𝑀𝑔 + 𝑀𝑔 ], 0 < 𝐺𝐿𝑖𝑗 ≤ 1, where, 𝑔 represents a commodity, 𝐺𝐿𝑖𝑗 − the Grubel Lloyd index reflects the intra industrial trade (imports and exports) of country 𝑖 from (to) country 𝑗. 𝑖𝑗 𝑀𝑔 −export value from country 𝑖 to country 𝑗 in differentiated goods 𝑗𝑖 𝑀𝑔 − imports value in good 𝑔 of country 𝑖 from 𝑗. METHODOLOGIES C- Assess capital (𝐾) to labor (𝐿 ) ratio difference within each region Compute 𝐾 𝐿 for each country and the difference between each pair of countries DATA 118 countries across the world grouped into 5 regions: Asia, Panel from 1997 to 2007 Data on bilateral imports is extracted from the IMF-DOT Europe and North America, Latin America and Caribbean, Middle East and North Africa, and Sub-Saharan Africa. Data on Real GDP, Investment Share, Real GDP per worker, and population are taken from the Penn World Tables (last version- 6.3) Data on trade factor dummies can be found at http://www.cepii.fr/anglaisgraph/bdd/distances.htm Capital stock and labor force data are from the World Bank’s World Development indicator (WDI) database The Grubel Llyod is calculated using Uncomtrade data at 3-digit. RESULTS Table 1: Testing Factor Endowments and the Comparative Advantage in SSA Country Name Angola Benin Burkina Faso Burundi Cameroon Cape Verde 1 CAF Chad Comoros 2 DRC Congo, Republic Côte d'Ivoire Equatorial Guinea Ethiopia Gabon Gambia Ghana Guinea Guinea-Bissau Kenya 1997 1998 1999 2000 2001 2002 K K K K L K L L L L L L L L L L L L L L L L L L K K K K K K K K K K K K L L L L L L L L L L L K L L L L L L L L L L L L K K K K K K K K K L L L K K . K K K L L L L L L K K K K K K L L L L L L L L L L L L L L L L L L L L L L L L L L L L L L Liberia . . . . L L Madagascar Malawi Mali Mauritius Mozambique Niger Rwanda Senegal Sierra Leone South Africa Tanzania Togo Uganda Zambia Zimbabwe L L L L L L L L L L L L L L L L K L K K K K K K L L L L L L L L L L L L L L L L L L L L L K K K L L L L L L K K K K K K L L L L L L L L L L L L L L L L L L L L L L L L K L L L L L 1 Central African Republic 2 Democratic Republic of Congo 2003 L L L L K K 2004 L L L L K K 2005 L L L L K K 2006 L K L L L L L L L L L K L K L K L L L . L L L L K K L L L K L K L L L L L L K L K L K L L L . L L L L L K L L L K L K L L L L L L K L K L K L L L . L L L L L K L L L K L K L L L K L K L L L L K L L 2007 K L . . L K L L L K L K L K L K L L L L L K L K L K L . . L L L L L L K L . L K L K L . L K L L L L L K L . L K L K L . L K L Note: The score k indicates the abundance of capital over labor in the country for a particular year, while the score L refers to the abundance of labor of capital Source: Author's calculation using WDI database. RESULTS Table 2: Regional Average Grubel Llyod Index from 1997 to 2007 East and South Asia Europe and North America Latin America and Caribbean Middle East and North Africa Sub-Saharan Africa Mean Minimum Maximum 0.12 0.00 0.28 0.24 0.00 0.43 0.06 0.00 0.16 0.06 0.00 0.17 0.02 0.00 0.11 Source: Author's calculation using UNCOMTRADE data. RESULTS Table 3: Statistics on SSA Countries' Trade in Differentiated Goods from 1997-2007 Reporter Name South Africa Kenya Zimbabwe Mozambique Nigeria Côte d'Ivoire Ghana Tanzania Burkina Faso Mali Malawi Mauritius Senegal Togo Uganda Botswana Benin Madagascar Cameroon Guinea Gabon Niger Namibia Rwanda Ethiopia Seychelles Gambia Burundi Sierra Leone Guinea-Bissau 1 CAF Comoros Eritrea Cape Verde São Tomé and Príncipe Import Value (Million $U.S.) 42781.6 3107.8 1153.0 246.0 644.9 3090.1 609.0 475.8 309.8 73.7 366.4 906.0 1394.0 1024.2 137.8 993.6 652.1 129.3 447.1 38.9 126.5 92.2 457.8 20.9 28.2 37.1 32.5 16.2 21.7 28.8 4.5 3.5 18.2 14.3 7.6 Export Value (Million $U.S.) Regional Share (percentage) 6502.3 47.16 1650.9 4.55 3556.7 4.51 4112.8 4.17 3177.5 3.66 679.0 3.61 3034.7 3.49 2448.3 2.80 2347.3 2.54 2440.0 2.41 2073.4 2.33 1263.2 2.08 756.2 2.06 1103.5 2.04 1584.3 1.65 620.8 1.54 911.7 1.50 1249.1 1.32 819.2 1.21 745.3 0.75 640.5 0.73 504.1 0.57 58.6 0.49 470.7 0.47 416.8 0.43 380.4 0.40 383.3 0.40 306.1 0.31 239.0 0.25 173.2 0.19 145.3 119.8 41.1 38.3 10.3 0.14 0.12 0.06 0.05 0.02 2 Gli 0.027 0.023 0.031 0.027 0.029 0.027 0.027 0.025 0.026 0.026 0.027 0.023 0.023 0.029 0.021 0.033 0.027 0.021 0.025 0.022 0.022 0.024 0.031 0.025 0.024 0.022 0.022 0.023 0.024 0.022 0.020 0.021 0.024 0.022 0.026 1 Central African Republic 2 The Grubel Llyod index (Gli) takes the maximum value of 1 for intensive intra industrial trade (importvalue = expport value), the minimum value of the Gli is 0 (in case of only import or export). Lower Gli means less intra industrial trade flows. Source: Author's calculation using UNCOMTRADE data. RESULTS CONCLUDING REMARKS Bilateral trade flows are low within SSA compare to that of other regions due to: Lack of comparative advantage in production across countries in SSA Similar endowments in factors of production across countries within SSA Homogeneity of traded goods Less product differentiation SUGGESTIONS SSA countries might want to increase efforts towards accessing developed markets Gain the “know-how” from interacting with mature markets Benefit from their comparative advantage over industrialized countries Use new technologies for industrialization and differentiate their products in many varieties. THANK YOU FOR YOUR ATTENTION YOUR COMMENTS ARE VERY WELCOME!