AP ECONOMICS: Ch. 7,8,9 Review

advertisement

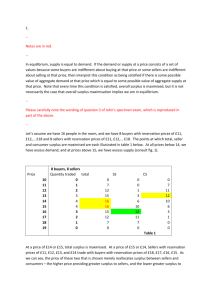

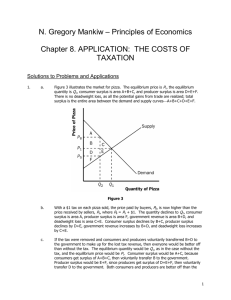

AP ECONOMICS: Ch. 7,8,9 Review MARKETS AND WELFARE Alex Kunkel Chapter 7: Consumers, Producers, and the Efficiency of Markets • The study of market allocation • Analysis using positive statements (how it is) and normative statements (how it ought to be) • Welfare economics – the study of how the allocation of resources affects economic well-being • Willingness to pay – the maximum amount that a buyer will pay for a good Example of Willingness to Pay Principle and Consumer Surplus • Say I want to sell a guitar for $1000. • I have four potential buyers at an auction; Jimi, Angus, Pete, and Tom. • Jimi has $250, Angus has $500, Pete has $900 and Tom has $1200. • Tom and I agree on $1000 as the price. • As a result Tom has a consumer surplus of $200, due to paying $1000 for a good he values at $1200. • Hypothetically, if I chose to be a bit greedier and sell the guitar for $1500, Tom would chose not to buy it because it is more than he is willing to pay. He would be an example of a marginal buyer in that case. • Consumer Surplus – the amount a buyer is willing to pay for a good minus the amount the buyer actually pays for it. Consumer Surplus (Graph) • Cost – the value of everything a seller must give up to produce a good. (For example the guitar cost me $1100 when I bought it.) • Producer Surplus – the amount a seller is paid for a good minus the seller’s cost of providing it. • Efficiency – the property of a resource allocation of maximizing the total surplus received by all members of society. • Equality – the property of distributing economic prosperity uniformly among the members of society Note: This is not an actual graph Some Equations • Consumer Surplus = Value to buyers – amount paid by buyers • Producer Surplus = amount received by sellers – cost to sellers • Total surplus = (values to buyers – amount paid by buyers) + (Amount received by sellers – cost to sellers) • Total surplus = value to buyers – cost to sellers Insights toward Market Equilibrium • • • • • • Free markets allocate the supply of goods to the buyers who value them most highly, as measured by their willingness to pay. Free markets allocate the demand for goods to the sellers who can produce them at the least cost Free markets produce the quantity of goods that maximizes the sum of consumer and producer surplus At quantities less than equilibrium the value to buyers exceeds the cost to sellers. At quantities greater than equilibrium the cost tot sellers exceeds the value to buyers. Market equilibrium maximizes the sum of producer and consumer surplus. Market Efficiency and Failure • In the analysis of welfare economics, consumer and producer surplus are shown to evaluate efficiency. In a “perfect” market, Adam Smith’s “Invisible hand” theory guides this efficiency • In certain markets a seller may be able to control prices (cough, cough monopoly) • These “certain sellers” have market power, and some side effects called externalities may occur due to inefficiency. Chapter 8: The Costs of Taxation • • “Taxes are what we pay for civilized society” – Oliver Wendell Holmes Jr. “Nothing is true but death and taxes” – Ben Franklin Effects of Taxes • Taxes place a “wedge” of deadweight loss in the market, this due to its added cost of the purchase of a good. This varies on whether the tax is on consumers or producers. Either way it creates unwanted fall in total surplus, due to extra money spent on good/raw material. That is why taxes can be considered a “market distortion” from the normal price/cost. • Tax revenue equals Tax multiplied by quantity. • Taxes cause deadweight loss because they prevent buyers and sellers from realizing some of the gains from trade. It it the lost gain from trade. Tax Revenue (graph) Tax Distortions and Elasticity • • • • • • • • What determines the size of deadweight loss from a tax that is large or small? The elasticity of supply and demand can further distort the size of tax. When supply is relatively inelastic, the deadweight loss of the tax is small. When supply is relatively elastic, the deadweight loss of a tax is large. When demand is relatively inelastic, the deadweight loss of a tax is small When demand is relatively elastic, the deadweight loss of tax is large. The graph to the right shows the distribution of tax due to price elasticity. In overview, the greater the elasticity of supply and demand, the greater the deadweight loss caused by the tax. • • • • • Deadweight Loss due to Tax Size; Laffer Curve With larger taxes, the deadweight loss caused by its application is much higher, and tax revenue is very slim. With smaller taxes the deadweight loss is quite small, but tax revenue isn’t as big as the Feds would like. A medium tax would settle this difference This is shown in the Laffer Curve, which demonstrates the trade-off caused through tax revenues and tax size. It caused the government to realize the cut in tax rates would allow an increased production. This application to taxes became known as supply-side economics. • • • Of course some transactions occur illegally through the underground economy, which is of course where taxes don’t apply and most transactions involve illegal goods. These “career criminals” that engage in this compare the opportunity cost before them; they can earn more through breaking the law rather than with a wage they could earn legitimately. Risk aversion is mostly low. A good example of a rise in the “underground economy” is during Prohibition. (Note: Al Capone, Meyer Lansky, and Arnold Rothstein; Organized Crime Kingpins during Prohibition) (Rothstein is also noted as the man that fixed the 1919 World Series) Chapter 9 No International Trade • With no given international trade, the price adjusts to balance domestic supply and demand, as shown for a random good. • With international trade the price of a good on international level will prevail the domestic price. This is called the world price. Trade • With a country that has a higher domestic price for a good, that country will import goods due to the lower world price. • With a country that has a lower domestic price for a good, that country will export goods to make profit from this international trade. • The areas represented show the consumer and producer surplus, and the imports or exports. Political Cartoons Tariffs • However, in some cases, domestic governments will impose a tax on foreign goods coming into their country. This is a tariff. • In most cases it causes domestic producers to not be completely undercut in competition by cheaper priced foreign goods. • Tariffs provide a further deadweight loss, which increases cost from world price. • The argument on tariffs and international trade is continuous. Benefits of International Trade • • • • • Increased variety of goods – free trade allows consumers a wider choice, greater variety and quality. Lower costs through economies of scale – some goods are produced at low cost only at large quantities. Free trade allows access to these world markets. Increased competition – When shielded from foreign competition, a firm has much more control over domestic markets and prices. Free trade allows the “invisible hand” to reach a much larger spectrum. Enhanced flow of ideas – Technological advances around the world are best linked to trade. Ideas flow on a bigger scale. Those who argue against free trade say there are benefits that would arise from closing off world markets as well, but isn’t widely supported. Some of these arguments include off-shoring of jobs, national security (with certain traded goods), the “infant-industry” (newer companies attempting to enter the global market) and unfair competition through undercutting prices.